Louisville Kentucky VA Residual Income Guidelines

Residual Income

VA residual income is one of the major underwriting guidelines required to qualify for a Louisville Ky VA mortgage. Residual income is calculated by determining the gross monthly income of the veteran and spouse. Then, ... deduct from that total gross monthly income the following monthly expenses:

0

State Taxes

Social Security

Federal Taxes

Proposed new monthly house payment (PITI: principle, interest, taxes and insurance)

Estimated Maintenance and Utilities

Monthly Child Care Expense

Alimony or Child Support

Monthly consumer debt payments: installment and revolving credit cards

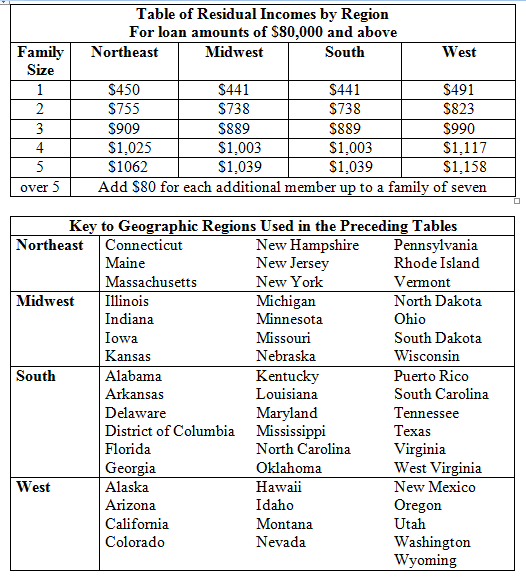

The balance remaining is "residual income" and will determine whether the borrower qualifies based on the table below.

Louisville Ky VA's minimum residual incomes (balance available for family support) are a guide. They should not automatically trigger approval or rejection of a loan. Instead consider residual income in conjunction with all other credit factors.

An obviously inadequate residual income alone can be a basis for disapproving a loan.

If residual income is marginal, look to other indicators such as the applicant's credit history, and in particular, whether and how the applicant has previously handled similar housing expense.

Consider whether the purchase price of the property may affect family expense levels. For example: A family purchasing in a higher priced neighborhood may feel a need to incur higher-than-average expenses to support a lifestyle comparable to that in their environment. Whereas a substantially lower priced home purchase may not compel such expenditures.

Also consider the ages of the applicant's dependents in determining the adequacy of residual income. Count all members of the household (without regard to the nature of the relationship) when determining "family size," including:

An applicant's spouse who is not joining in title or on the note, and

Any other individuals who depend on the applicant for support. For example, children from a spouse's prior marriage who are not the applicant's legal dependents.

Exception: The lender may omit any individuals from "family size" who are fully supported from a source of verified income which, for whatever reason, is not included in effective income in the loan analysis.

For example: A spouse not obligated on the note who has stable and reliable income sufficient to support his or her living expenses, or a child for whom sufficient foster care payments or child support is received regularly.

Reduce the residual income figure (from the following tables) by a minimum of 5% if the applicant or spouse is an active-duty or retired serviceperson, and there is a clear indication that he or she will continue to receive the benefits resulting from use of military-based facilities located near the property.

Use 5% unless the Louisville Ky VA office of jurisdiction has established a higher percentage, in which case, apply the specified percentage for that jurisdiction.