- Applicable to Manually Underwritten Loans: The lender must document reasons for approving a mortgage when the borrower has collection accounts or judgments.

- The borrower's disregard for financial obligations;

- The borrower's inability to manage debt; or

- Extenuating circumstances.

- Applicable to Loans Run Through TOTAL Mortgage Scorecard: TOTAL Mortgage Scorecard Accept/Approve - There are no documentation or letter of explanation requirements for loans with collection accounts or judgments run through TOTAL Mortgage Scorecard receiving an "Accept/Approve" despite the presence of collection accounts or judgments. These accounts have been already taken into consideration in the borrower's credit score. If TOTAL Mortgage Scorecard generates a"Refer," the lender must manually underwrite the loan in accordance with the guidance above applicable to manually underwritten loans with collection accounts and judgments.

- At the time of or prior to closing, payment in full of the collection account (verification of acceptable source of funds required).

- The borrower makes payment arrangements with the creditor. If the borrower has entered into a payment arrangement with the creditor, a credit report or letter from the creditor verifying the monthly payment is required. The monthly payment must be included in the borrower's debt-to-income ratio.

- If evidence of a payment arrangement is not available, the lender must calculate the monthly payment using 5% of the outstanding balance of each collection, and include the monthly payment in the borrower's debt-to-income ratio.

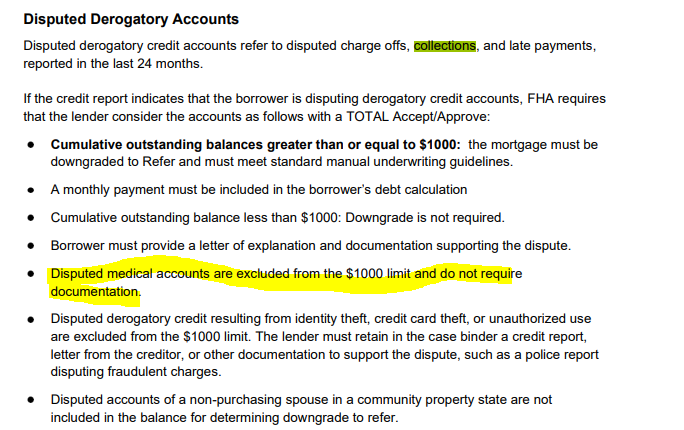

Disputed Derogatory Credit Accounts greater than or equal to $1,000

|

If the cumulative outstanding balance of disputed derogatory credit accounts of all borrowers is equal to or greater than $1,000, the mortgage application must be downgraded to a"Refer" and a Direct Endorsement underwriter is required to manually underwrite the loan as described above.

|

Disputed Derogatory Credit Accounts less than $1,000

|

If the cumulative outstanding balance of disputed derogatory credit accounts of all borrowers is less than $1,000, a downgrade is not required.

|

Excluded Accounts

|

|

- disputed charge-off accounts,

- disputed collection accounts, and

- disputed accounts with late payments in the last 24 months.

- disputed accounts with zero balance,

- disputed accounts with late payments aged 24 months or greater, and

- disputed accounts that are current and paid as agreed.

--

Fill out my form for mortgage pre-approval by clicking this link!