FHA Gift Funds Kentucky 2025: Complete Guide to Gifts of Equity & Down Payment Assistance

Last Updated: October 2025 — FHA loans remain one of the most accessible pathways to homeownership for Kentucky first-time buyers. If you've been told you can't afford a home because of down payment requirements, think again. Understanding how FHA gift funds and gifts of equity work could open the door to your dream home with as little as 3.5% down.

Kentucky first-time homebuyers with FHA gift funds make homeownership more affordable

Kentucky first-time homebuyers with FHA gift funds make homeownership more affordable

Many Kentucky homebuyers don't realize they can receive financial help from family, friends, or even employers to cover their down payment and closing costs. This guide explains exactly how FHA gift funds work, who can provide them, and what documentation you'll need to get approved.

Who Can Give FHA Gift Funds in Kentucky?

The HUD 4000.1 Handbook outlines several acceptable sources for FHA gift funds. The key requirement: the funds must be a gift, not a loan.

FHA gift funds can come from family members, employers, charities, and government programs

FHA gift funds can come from family members, employers, charities, and government programs

Eligible donors include:

- Family members — parents, grandparents, siblings, children, spouse, or in-laws

- Employers or labor unions — who offer down payment assistance programs

- Close friends — with documented proof of relationship

- Charitable organizations — non-profits offering homebuyer assistance

- Government or public agencies — like KHC (Kentucky Housing Corporation) programs

💡 Important: Sellers, builders, and real estate agents cannot provide gift funds. FHA lenders verify this to prevent fraud and ensure true down payment assistance.

FHA Definition of "Family Member"

For FHA purposes, family includes parents, grandparents, children (including adopted or foster children), siblings, spouses, domestic partners, uncles, aunts, and all in-laws (mother-, father-, sister-, or brother-in-law). This broad definition means most relatives can provide gift funds.

FHA Gift Fund Rules for Kentucky Borrowers: What You Need to Know

| Requirement |

FHA Rule |

| Property Type |

Primary residence (1–4 family units) |

| Minimum Down Payment |

No minimum required (can be 100% gift) |

| Maximum LTV (Loan-to-Value) |

Up to 96.5% with 3.5% down |

| Gift Fund Use |

Down payment, closing costs, pre-paid expenses |

| Reserves |

Gift funds cannot count toward reserve requirements |

| Cash on Hand |

Not acceptable (funds must be traceable) |

| Repayment |

Strictly prohibited — must be a gift, not a loan |

Documentation Required for FHA Gift Funds

The most critical part of using gift funds is documentation. Lenders need proof that:

- The donor has the funds available

- The funds came from a legitimate source

- No repayment is expected

- The money actually transferred to you

Required Documents Checklist

- Signed gift letter — states the amount, relationship, and that no repayment is expected

- Donor's recent bank statements — typically last 2 months showing the gift fund withdrawal

- Your bank statements — showing the deposit of gift funds

- Wire receipt or cashier's check proof — if funds go directly to closing

- Written explanation — if any gaps appear between withdrawal and deposit

Pro Tip: Have the donor wire funds directly to your account or the title company, or use a cashier's check. This creates a clear paper trail. Lenders want to see documented proof that doesn't raise red flags.

Understanding FHA Gifts of Equity in Kentucky

A gift of equity is a unique FHA program that helps when a family member sells you their home. Instead of paying full market value, you purchase the home at a lower price, and the difference becomes your down payment credit.

Real-World Example: Gift of Equity in Kentucky

Scenario: Your parent owns a home appraised at $200,000. They agree to sell it to you for $180,000. The $20,000 difference is the "gift of equity." You can use this $20,000 as your down payment on an FHA loan. Your loan would be for $180,000 (or less with additional down payment), and the $20,000 equity gift covers the difference.

FHA Gift of Equity Requirements

- Only family members can provide a gift of equity

- Maximum LTV = 85% (loan amount ÷ appraised value) unless:

- The seller's home is their primary residence, OR

- You rented the property for at least six months before the sales contract date

- Must be documented in the purchase agreement and appraisal

Documentation for Gift of Equity

- Signed gift letter — from the seller acknowledging the equity gift

- Current appraisal — showing the true market value

- Sales contract — identifying the purchase price and equity gift amount

- Proof of relationship — birth certificate, marriage license, or family documents

FHA Gift Letter Template for Kentucky Borrowers

Your FHA gift letter must include specific language. Here's a template you can use:

Sample FHA Gift Letter:

"I, [Donor Full Name], am giving [Borrower Full Name] a gift of $[Amount] for use toward the down payment on the property located at [Property Address]. This gift represents no obligation for repayment. I expect nothing in return for this gift. [Donor Signature] [Date]"

Make sure your lender approves the exact wording before having it signed.

Does Kentucky's KHC Program Accept Gift Funds?

Yes. Kentucky Housing Corporation (KHC) and other down payment assistance programs often work alongside FHA gift funds. Many Kentucky first-time homebuyers combine KHC grants with family gifts to minimize out-of-pocket costs.

Learn more about KHC down payment assistance programs →

Common Questions About FHA Gift Funds in Kentucky

Can I use multiple gift sources?

Yes. You can receive gifts from multiple family members or organizations. Each gift requires its own gift letter and documentation.

Is there a limit to how much I can receive as a gift?

No. FHA has no maximum on gift amounts, but the full down payment and closing costs can be covered by gifts if properly documented.

Can a gift fund be used for closing costs?

Absolutely. FHA gift funds can cover down payment, closing costs, appraisal fees, inspection costs, and other homebuying expenses.

What if the donor and I live in different states?

That's fine. The donor's location doesn't matter — only that they have a legitimate relationship to you and the funds are properly documented.

Why Work With a Kentucky FHA Loan Expert?

Understanding FHA gift fund rules is complex, and mistakes can delay your approval or derail your loan entirely. Working with a knowledgeable Kentucky mortgage specialist ensures:

- Proper documentation — all gifts are verified and approved upfront

- No delays — we catch issues before they become problems

- Maximum benefits — we identify all programs you qualify for (FHA, KHC, VA, USDA)

- Peace of mind — you have expert guidance every step of the way

Ready to Buy Your Kentucky Home With FHA Gift Funds?

Let me help you navigate FHA gift fund requirements and get approved quickly. Whether you're receiving a family gift, a gift of equity, or KHC assistance, I'll ensure everything is documented correctly for a smooth, fast approval.

Related Kentucky Homebuying Resources

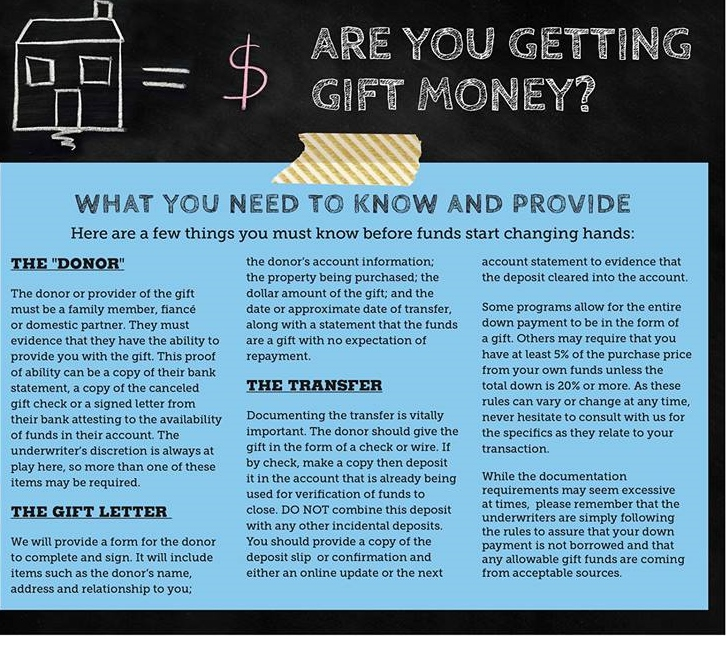

If you're fortunate enough to have a family member or any eligible entity who can give you funds towards your home’s down payment, you’ll need to confirm your relationship with the gift-giver and provide your mortgage underwriter more information about where the funds came from.

For lenders to confirm that the new money isn’t a loan, you’ll need these things:

1. A down payment gift letter - If your lender has a template letter for this purpose, you will need to send it to the funds’ donor. If there isn’t a template, you might want to ask what information should be included so you can draft your own.

The letter typically includes details about the gift-giver, such as the name, address, contact phone, relationship to the borrower, and address of the property to be purchased. The date when the gift was transferred and the amount of funds given to the borrower must also be indicated. The donor should also write a sentence explaining that the fund is a gift and that there isn’t any expectation of repayment. The letter must be signed by both the gift-giver and the borrower.

2. The gift-giver’s bank statements - This is to show they have the funds to give the buyer as much money as promised.

3. A bank slip from the buyer’s account - This is to indicate when the money was transferred, to verify that the cash is from a legitimate source and that the borrower has an appropriate relationship with the donor, and to confirm the information provided in the letter.

FHA gift funds can come from family members, employers, charities, and government programs

FHA gift funds can come from family members, employers, charities, and government programs