I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2026

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Down Payment Assistance Kentucky Housing Corporation KHC up to $12,500

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score For Mortgage Loan Approval

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky Mortgage Loan

- Testimonials

- Mortgage Calculator

- Kentucky USDA Rural Development Housing Loan

- Legal / Privacy Policy / Accessibility Statements

- About Me and this website

- Kentucky FHA/VA Approved Condos

Top No-Money-Down Loan Programs for Kentucky First-Time Buyers (2026 Guide)

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky Welcome Home Grant

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Your Credit Score Matters for a Kentucky Mortgage | FHA, VA, USDA, K...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville offers down payment assistance for homebuyers

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky USDA Rural Housing Mortgage Lender: KENTUCKY USDA RURAL HOUSING ELIGIBILITY MAP FOR 2026

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Ultimate Guide for Kentucky First-Time Homebuyers: Steps, Loan Programs & How to Apply

Introduction: How to Buy Your First Home in Kentucky

Are you a first-time homebuyer in Kentucky looking to purchase your dream home? Buying a house is one of the biggest financial decisions you'll ever make. Understanding the steps involved can help you feel confident throughout the process.

- In this guide, we'll cover:

- How much house you can afford

- Loan programs for first-time homebuyers in Kentucky

- Credit score requirements

- Down payment & closing costs

- Mortgage pre-approval process

- Required documents & how to apply

By the end of this article, you'll have a clear roadway to homeownership in Kentucky!

Step 1: Determine How Much House You Can Afford

One of the first steps to buying a home is understanding your budget. Mortgage lenders suggest you should consider a price range. It is recommended not to buy a home that exceeds 30% to 45% of your gross monthly income. For instance, if you earn $3000 gross a month, your maximum house payment should be about $1350 a month. This includes PITI.

Step 2: Check Your Credit Score

Your credit score plays a crucial role in determining your mortgage eligibility and interest rate. The mortgage scores used by lenders are different than the ones usually seen for borrowers. Be aware of this.

Here’s how you can improve your score before applying

Step 2: Check Your Credit Score

Your credit score plays a crucial role in determining your mortgage eligibility and interest rate. Here’s how you can improve your score before applying:

✔️ Pay down credit card balances

✔️ Make all payments on time

✔️ Avoid applying for new credit cards or loans

✔️ Don’t make big purchases before getting approved

✔️ If possible, avoid changing jobs before closing on your home

Pull your own credit report from www.annualcreditreport.com to see what is on your credit report from Experian, Equifax, and Transunion. You will not be able to get your mortgage fico scores but you can see what creditors are reporting before you apply to correct any errors

The credit scores used by mortgage lenders are different than what the consumers see, so be aware of that.

We can pull your fico mortgage scores for free, no costs to you, as far as the application process. If you want to obtain your own mortgage fico scores

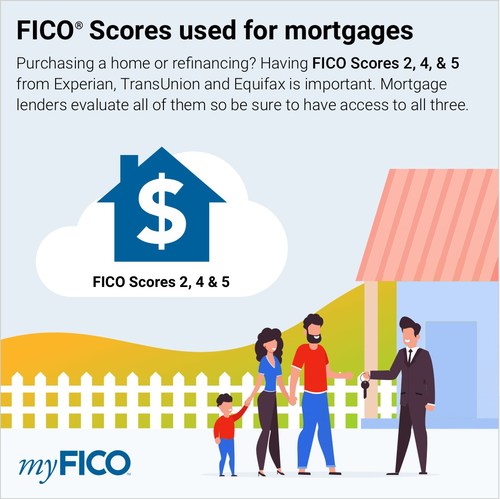

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

- FICO® Score 2 (Experian)

- FICO® Score 5 (Equifax)

- FICO® Score 4 (TransUnion)

Credit Score Requirements for Kentucky First-Time Homebuyers

Step 3: Save for a Down Payment & Closing Costs

How Much Do You Need for a Down Payment?

💰 FHA Loan: 3.5% of the purchase price

💰 Conventional Loan: 3-20% (Varies)

💰 VA & USDA Loans and KHC Down payment Assistance Loans : No down payment required

Other Expenses to Consider

- Earnest Money Deposit: Shows sellers you’re serious. This is known as a good faith deposit. Typically, it's $500 at the minimum. However, more serious buyers show a bigger commitment by putting down $1000 or more.

- Closing Costs: Typically 2-5% of the loan amount

- Home Inspection Costs: $300-$500

- Appraisal Costs: $550 to $700 range

Step 4: Get Pre-Approved for a Mortgage in Kentucky

🔹 What is Mortgage Pre-Approval?

Being pre-approved means a lender has reviewed your financial information and determined how much you can borrow. This makes you a stronger buyer in the eyes of sellers.

✅ To Get Pre-Approved, You’ll Need the following documents plus more:

- W2’s from the past 2 years for 2023 and 2024

- Last months of pay stubs

- Bank statements (Last 2 months)

- 2 years of tax returns and all schedules

- Divorce decree (if applicable)

- Additional income documents for other income possible

- Looking for stability in the income. Waited over the last two years and the next 3 years.

- Two forms of ID> Driver's License and card

Step 5: Choose the Right Mortgage Loan in Kentucky

Types of Mortgage Loans Available

| Loan Type | Who Qualifies? | Down Payment | Upfront Mortgage Insurance | Monthly Mortgage Insurance | Min. Credit Score |

|---|---|---|---|---|---|

| VA Loan | Veterans & eligible service members | None | None | None | 580 |

| USDA Loan | Rural homebuyers | None | 2% of loan amount (can roll in) | Required | 640 |

| FHA Loan | Buyers meeting income/credit limits | 3.5% | 1.75% of loan amount | Required | 580-640 |

| 203K Loan | Buyers renovating a home | 3.5% | 1.75% of loan amount | Required | 580-640 |

| Conventional 97 | First-time homebuyers | 3% | None | Required | 620 |

| Select Smart Plus | Buyers meeting lender’s requirements | 3-20% | None | Required | 620 |

Step 6: Submit Your Mortgage Application

- Once you’ve chosen the right loan and been pre-approved, you’ll submit a formal mortgage application with your lender.

- The Lender Will Verify:

✅ Your credit score and credit bureau-Three scores are pulled from Experian, Equifax and Experian

✅ Income & employment history for last two years

✅ Bank statements for last two months & tax returns for last two years

✅ Property appraisal - Title search

Step 7: Close on Your New Home! 🎉

Your loan is approved. All final paperwork is completed. You’ll attend the closing meeting to sign documents and get the keys to your new home!

🏡 Congratulations! You’re now a Kentucky homeowner!

Ready to Buy a Home in Kentucky? Get Expert Help Today!

Buying your first home is a big step, but you don’t have to do it alone. Work with a trusted mortgage broker like Joel Lobb to get expert guidance, personalized loan options, and fast approvals.

📩 Contact Joel Lobb Today for a Free Consultation!

📞 Call or Text: (502) 905-3708

📧 Email: kentuckyloan@gmail.com

🔹 Get Pre-Approved Now & Start House Hunting!

Final Thoughts

If you're a first-time homebuyer in Kentucky, understanding the steps involved is crucial. Being aware of the loan programs available will help you make a smart financial decision.

1 - Email - kentuckyloan@gmail.com 2. Call/Text - 502-905-3708

Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Kentucky Local Home Loan Lender Services

First-Time Home Buyers Welcome

First-Time Home Buyers Welcome FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans

FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans Conventional Loan Options Available

Conventional Loan Options Available Fast Local Decision-Making

Fast Local Decision-Making Experienced Guidance Through the Home Buying Process

Experienced Guidance Through the Home Buying Process

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

4 Things Every Borrower Needs to Know to Get Approved for a Mortgage Loan In Kentucky

Thank you for visiting. I hope you find this website both informative and empowering as you explore your Kentucky mortgage options. My goal is to help you feel confident in selecting the right home loan for your unique situation.

I proudly serve all 120 counties in Kentucky, offering a full range of mortgage loan programs, including:

With over 20 years of lending experience, I’ve had the privilege of helping more than 1,300 Kentucky families achieve their homeownership goals. Whether you're a first-time homebuyer or seeking a second opinion, I’m here to offer honest, no-pressure advice—always free of charge.

I am dedicated to:

-

Attending as many closings as possible

-

Providing responsive, personalized service

-

Ensuring quick, efficient, and accurate loan processing

-

Making myself accessible every step of the way

I've been consistently recognized as a top mortgage loan officer in Kentucky for VA, FHA, USDA, and KHC programs. I take pride in being thorough, transparent, and attentive with each and every client.

Please take a moment to read my reviews below. If you have questions or need guidance, feel free to call or text me directly.

2 reviews

We were afraid we wouldn’t get approved for a loan because we didn’t have the best credit scores. But with Joel’s help he got us approved for a FHA. We closed on our home about 2 weeks ago! Joel was quick at responding to any of our questions and concerns. He was polite and professional when it came to our needs. We couldn’t have done this without Joel! THANKS AGAIN

3 reviews

The 4 things below underwriters review for a Mortgage Loan Approval

⬇️

1. Income

You need income. You need to be able to afford the home. But what is acceptable income? Let’s just say that there are two ratios mortgage underwriters look at to qualify you for mortgage payment:

First Ratio – The first ratio, top ratio or housing ratio. Basically, that means out of all the gross monthly income you make, that no more that X percent of it can go to your housing payment. The housing payment consists of Principle, Interest, Taxes and Insurance.

Whether you escrow or not every one of these items are factored into your ratio. There are a lot of exceptions to how high you can go, but let’s just say that if your ratio is 33% or less, generally, across the board, you’re safe.

Second Ratio- The second ratio, bottom ratio or debt ratio includes the housing payment, but also adds all of the monthly debts that the borrower has. So, it includes housing payment as well as every other debt that a borrower may have.

This would include, Auto loans, credit cards, student loans, personal loans, child support, alimony…. basically any consistent outgoing debt that you’re paying on. Again, if you’re paying less than 45% of your gross monthly income to all of the debts, plus your proposed housing payment, then……generally, you’re safe. You can go a lot higher in this area, but there are a lot of caveats when increasing your back ratio.

What qualifies as income?

Basically, it’s income that has at least a proven, two-year history of being received and pretty high assurances that the income is likely to continue for at least three years. What’s not acceptable? Unverifiable cash income, short term income and income that’s not likely to continue like unemployment income, student loan aid, VA education benefits, or short-term disability are not allowed for a mortgage loan.

2. Assets

What the mortgage underwriter is looking for here is how much can you put down and secondly, how much will you have in reserves after the loan is made to help offset any financial emergencies in the future.

Do you have enough assets to put the money forth to qualify for the down payment that the particular program asks for?

FHA loans currently requires a 3.5% down payment and Fannie Mae, or Conventional loans require a 3% to 5% down payment. The more you put down, the better your rate and terms usually and your chances of qualifying.

Kentucky Home buyers that have access to putting down at least 5% or more, will usually turn to Fannie Mae or Freddie Mac mortgage programs so they can get better pricing when it comes to mortgage insurance.

These assets need to be validated through bank accounts, 401k or retirements account and sometimes gifts from relatives or employer. Can you borrow the down payment? Sometimes.

Generally, if you’re borrowing a secured loan against a secured asset you can use that. But rarely can cash be used as an asset.

FHA will allow for gifts from relatives for down payments with little as 3.5% down but Fannie Mae will require a 20% down payment when a gift is being used for the down payment on the home.

The down payment scenarios listed above are for Kentucky Primary Residences only. There are stricter down payment requirements for investment homes made in Kentucky.

3. Credit

580 to 620 is the bottom score (again with few exceptions) that lenders will permit. Below a 620, then you have to look at doing a FHA loan or VA loan if you are a veteran. Even at 620, people consider you a higher risk that other folks and are going to penalize you or your borrower with a more expensive loan. 720 is when you really start to get in the “as a lender we love you” credit score. 760 is even better.

Watch your credit scores carefully. You have three credit scores, and the lender will take your middle score. For example, let's say you have a 590 on Transunion, 679 on Experian, and a 618 on Equifax. Then your middle qualifying credit score will be 618 credits score.

If you absolutely cannot get your credit scores up to 620, then FHA will be a good option for you. FHA states that if your fico credit score is 580 or above, they will allow for a 3.5% down payment, and if below 580, you will need 10% down payment.

There are a lot of mortgage lenders that will not go below 580 to 620 range, so keep that in mind when you are shopping for a mortgage lender, because they create credit overlays.

Kentucky FHA Mortgage Loans currently requires 3 years removal from a foreclosure or short sale and 2 years on a bankruptcy with good reestablished credit.

Kentucky Fannie Mae Mortgage Loans currently requires 4 years removal from a bankruptcy, and 7 years on a foreclosure.

Kentucky VA Mortgage Loans currently requires 2 years removal from a bankruptcy or foreclosure with good, reestablished credit.

Kentucky USDA loans require 3 years removal from bankruptcy and foreclosure with good re established credit.

Which credit score is used to qualify for a Mortgage loan in Kentucky?

4. Appraisal

Generally, there’s nothing you can do to affect this. Bottom line here is…..”is the value of the house at least the value of what you’re paying for it?” If not, then not good things start to happen. Generally you’ll find less issues with values on purchase transactions, because, in theory, the realtor has done an accurate job of valuing the house prior to taking the listing. The big issue comes in refinancing. In purchase transactions, the value is determined as the

Lower of the value or the contract price!!!

That means that if you buy a $1,000,000 home for $100,000, the value is established at $100,000. Conversely, if you buy a $200,000 home and the value comes in at $180,000 during the appraisal, then the value is established at $180,000. Big issues….Talk to your loan officer.

For each one of these boxes, there are over 1,000 things that can effect if a borrower has reached the threshold to complete that box. Soo…..talk to a great loan officer. There are so many loan officers that don’t know what they’re doing. But, conversely, there’s a lot of great ones as well. Your loan is so important! Get a great lender so that you know, for sure, that the loan you want, can be closed on!

5 Most Popular Kentucky Home Loan Programs below:⬇️

Conventional Loan

• At least 3%-5% down• Closing costs will vary on which rate you choose and the lender. Typically the higher the rate, the lesser closing costs due to the lender giving you a lender credit back at closing for over par pricing. Also, called a no-closing costs option. You have to weigh the pros and cons to see if it makes sense to forgo the lower rate and lower monthly payment for the higher rate and less closing costs.

Fico scores needed start at 620, but most conventional lenders will want a higher score to qualify for the 3-5% minimum down payment requirements Most buyers using this loan have high credit scores (over 720) and at least 5% down.

The rates are a little higher compared to FHA, VA, or USDA loan but the mortgage insurance is not for life of loan and can be rolled off when you reach 80% equity position in home.

KENTUCKY FANNIE MAE LOAN LIMITS IN 2026 FOR CONVENTIONAL MORTGAGE LOANS

href="https://www.fhfa.gov/data/conforming-loan-limit-cll-values">Kentucky 2026 Conforming Loan Limits

Area Type

2026 1-Unit Loan Limit

Notes

Most U.S. Areas (Baseline)

$832,750

Increased from $806,500 in 2025

High-Cost Areas (Ceiling)

$1,249,125

150% of baseline conforming limit

Alaska, Hawaii, Guam, U.S. Virgin Islands

$1,249,125 – $1,873,675

Higher statutory limits apply in these areas

Source: Federal Housing Finance Agency (FHFA). Loan limits shown apply to 1-unit properties for 2026.

| Area Type | 2026 1-Unit Loan Limit | Notes |

|---|---|---|

| Most U.S. Areas (Baseline) | $832,750 | Increased from $806,500 in 2025 |

| High-Cost Areas (Ceiling) | $1,249,125 | 150% of baseline conforming limit |

| Alaska, Hawaii, Guam, U.S. Virgin Islands | $1,249,125 – $1,873,675 | Higher statutory limits apply in these areas |

Source: Federal Housing Finance Agency (FHFA). Loan limits shown apply to 1-unit properties for 2026.

These new limits allow Kentucky homebuyers to finance larger homes while still qualifying for conforming loans, avoiding the stricter requirements and higher rates of jumbo loans.

The FHFA determines the conforming loan limit each year, basing it on the average U.S. home value over the past four quarters.

Kentucky USDA Rural Housing Program

If you meet income eligibility requirements and are looking to settle in a rural area, you might qualify for the KY USDA Rural Housing program. The program guarantees qualifying loans, reducing lenders’ risk and encouraging them to offer buyers 100% loans. That means Kentucky home buyers don’t have to put any money down, and even the “upfront fee” (a closing cost for this type of loan) can be rolled into the financing.

Fico scores ****.usually wanted for this program center around 620 range, with most lenders wanting a 640 score so they can obtain an automated approval through GUS. GUS stands for the Guaranteed Underwriting system, and it will dictate your max loan pre-approval based on your income, credit scores, debt to income ratio and assets.

They also allow for a manual underwrite, which states that the max house payment ratios are set at 29% and 41% respectively of your income.

They loan requires no down payment, and the current mortgage insurance is 1% upfront, called a funding fee, and .35% annually for the monthly mi payment. Since they recently reduced their mi requirements, USDA is one of the best options out there for home buyers looking to buy in an rural area.

A rural area typically will be any area outside the major cities of Louisville, Lexington, Paducah, Bowling Green, Richmond, Frankfort, and parts of Northern Kentucky .

There is a map link below to see the qualifying areas.

2025 Kentucky USDA Rural Housing Income Limits by County Type

USDA requires 3 years removed from bankruptcy and foreclosure.

There is no max USDA loan limit.

|

| Add caption |

Kentucky FHA Loan

FHA loans are good for home buyers with lower credit scores and no much down, or with down payment assistance grants. FHA will allow for grants, gifts, for their 3.5% minimum investment and will go down to a 580 credit score.

The current mortgage insurance requirements are kind of steep when compared to USDA, VA , but the rates are usually good so it can counteracts the high mi premiums.

As I tell borrowers, you will not have the loan for 30 years, so don’t worry too much about the mi premiums.

The mi premiums are for life of loan like USDA.

FHA requires 2 years removed from bankruptcy and 3 years removed from foreclosure.

The new Kentucky FHA Mortgage Loan Limits for for FHA case numbers assigned on or after January 1, 2026:

- Floor (Low-Cost Areas):

- 1-Unit: $541,287

- 2-Units: $693,050 / $693,063

- 3-Units: $837,700 / $837,720

- 4-Units: $1,041,138 / $1,041,125

Kentucky VA Loan

VA loans can be made anywhere, unlike the USDA restrictions, and there is no income household limit.

Most VA lenders I work with will want a 580 credit score even though on paper, VA says they don't have a minimum credit score.

VA requires 2 years removed from bankruptcy or foreclosure.

VA Loan Limits for 2025 in Kentucky

As announced previously by VA in Circular 26-19-30 (which provides interim guidance on implementing "The Blue Water Navy Vietnam Veterans Act of 2019") the conforming loan limit cap on guarantees was removed for Veterans with full entitlement. For Veterans who have previously used entitlement and the entitlement has not been restored, the maximum amount of guaranty entitlement available to the Veteran (for a loan above $144,000) is 25 percent of the conforming loan limit reduced by the amount of entitlement previously used (not restored) by the Veteran.

As a reminder, Veterans are able to use their VA Home Loan Guaranty benefit regardless of loan amount, but in order to purchase homes with loan amounts above the conforming loan limits, Veterans with partial entitlement may be required to make a down payment on amounts in excess of the conforming loan limit. Regardless of full or partial entitlement, the VA guaranty plus any required down payment must total 25% of the loan amount.

Kentucky Down Payment Assistance

KHC Loan (Kentucky Housing Loan with Down Payment Assistance)

The first no money-down home loan program offered by Kentucky Housing and other lenders in the state of Kentucky currently offers up to $10,000 in down payment assistance (DAP)

- Informational Flyer

- First-time homebuyers statewide in non-targeted areas

- First-time and repeat homebuyers statewide in targeted areas

- 30-year fixed interest rate

- Principal residence ONLY

- Purchase Price Limit: $544,232

- Borrower must meet KHC's MRB Income Limits

Secondary Market Funding Source

- First-time and repeat homebuyers statewide

- 30-year fixed interest rate

- Principal residence ONLY

- Purchase Price Limit: $544,232

- Borrower must meet KHC's Secondary Market Income Limits

Need to be 2 years removed from a Chapter 7 Bankruptcy and 3 years removed from a foreclosure.

Kentucky First Time Home Buyer Common Questions and Answers below:👇

∘ What kind of credit score do I need to qualify for different first time home buyer loans in Kentucky?

Answer. Most lenders will wants a middle credit score of 620 to 640 for KY First Time Home Buyers looking to go no money down. The two most used no money down home loans in Kentucky being USDA Rural Housing and KHC with their down payment assistance will want a 620 to 640 middle score on their programs.

If you have access to 3.5% down payment, you can go FHA and secure a 30 year fixed rate mortgage with some lenders with a 580 credit score. Even though FHA on paper says they will go down to 500 credit score with at least 10% down payment, you will find it hard to get the loan approved because lenders will create overlays to protect their interest and maintain a good standing with FHA and HUD.

Another popular no money down loan is VA. Most VA lenders will want a 620 middle credit score but like FHA, VA on paper says they will go down to a 500 score, but good luck finding a lender for that scenario.

A lot of times if your scores are in the high 500’s or low 600’s range, we can do a rapid rescore and get your scores improved within 30 days.

∘ Does it costs anything to get pre-approved for a mortgage loan?

Answer: Most lenders will not charge you a fee to get pre-approved, but some lenders may want you to pay for the credit report fee upfront. Typically costs for a tri-merge credit report for a single borrower runs about $50 or less. Maybe higher if more borrowers are included on the loan application.

∘ How long does it take to get approved for a mortgage loan in Kentucky?

Answer: Typically if you have all your income and asset documents together and submit to the lender, they typically can get you a pre-approval through the Automated Underwriting Systems within 24 hours. They will review credit, income and assets and run it through the different AUS (Automated Underwriting Systems) for the template for your loan pre-approval. Fannie Mae uses DU, or Desktop Underwriting, FHA and VA also use DU, and USDA uses a automated system called GUS. GUS stands for the Guaranteed Underwriting System.

If you get an Automated Approval, loan officers will use this for your pre-approval. If you have a bad credit history, high debt to income ratios, or lack of down payment, the AUS will sometimes refer the loan to a manual underwrite, which could result in a longer turn time for your loan pre-approval answer

∘ Are there any special programs in Kentucky that help with down payment or no money down loans for KY First Time Home Buyers?

Answer: There are some programs available to KY First Time Home Buyers that offer zero down financing: KHC, USDA, VA, Fannie Mae Home Possible and HomePath, HUD $100 down and City Grants are all available to Kentucky First Time Home buyers if you qualify for them. Ask your loan officer about these programs

∘ When can I lock in my interest rate to protect it from going up when I buy my first home?

Answer: You typically can lock in your mortgage rate and protect it from going up once you have a home picked-out and under contract. You can usually lock in your mortgage rate for free for 90 days, and if you need more time, you can extend the lock in rate for a fee to the lender in case the home buying process is taking a longer time. The longer the term you lock the rate in the future, the higher the costs because the lender is taking a risk on rates in the future.

Interest rates are kind of like gas prices, they change daily

∘ How much money do I need to pay to close the loan?

Answer: Depending on which loan program you choose, the outlay to close the loan can vary. Typically you will need to budget for the following to buy a home: Good faith deposit, usually less than $500 which holds the home for you while you close the loan. You get this back at closing; Appraisal fee is required to be paid to lender before closing.

There are also lender costs for title insurance, title exam, closing fee, and underwriting fees that will be incurred at closing too. You can negotiated the seller to pay for these fees in the contract, or sometimes the lender can pay for this with a lender credit. The lender has to issue a breakdown of the fees you will incur on your loan pre-approval.

How long is my pre-approval good for on a Kentucky Mortgage Loan?

Answer: Most lenders will honor your loan pre-approval for 120 days. After that, they will have to re-run your credit report and ask for updated pay stubs, bank statements, to make sure your credit quality and income and assets has not changed from the initial loan pre-approval.

How much money do I have to make to qualify for a mortgage loan in Kentucky?

Answer: The general rule for most FHA, VA, KHC, USDA and Fannie Mae loans is that we run your loan application through the Automated Underwriting systems, and it will tell us your max loan qualifying ratios.

There are two ratios that matter when you qualify for a mortgage loan. The front-end ratio, is the new house payment divided by your gross monthly income. The back-end ratio, is the new house payment added to your current monthly bills on the credit report, to include child support obligations and 401k loans.

Car insurance, cell phone bills, utilities bills does not factor into your qualifying rations.

If the loan gets a refer on the initial desktop underwriting findings, then most programs will default to a front end ratio of 31% and a back-end ratio of 43% for most government agency loans that get a refer. You then take the lowest payment to qualify based on the front-end and back-end ratio.

So for example, let’s say you make $3000 a month and you have $400 in monthly bills you pay on the credit report. What would be your maximum qualifying house payment for a new loan?

Take the $3000 x .43%= $1290 maximum back-end ratio house payment. So take the $1290-$400= $890 max house payment you qualify for on the back-end ratio.

Then take the $3000 x .31%=$930 maximum qualifying house payment on front-end ratio.

So now you know! The max house payment you would qualify would be the $890, because it is the lowest payment of the two ratios.

10 mortgage facts will give you an advantage when shopping for a home loan in KY!👇

1. Mortgage Rates Change

Just like the stock market, mortgage rates change throughout the day. Mortgage rates you see today may not be available tomorrow. If you are in the market for a mortgage loan, be sure to check the current rates being offered by lenders. If you have already done your research and have found your dream home consider locking in your rate as soon as possible.

2. Different Lenders Charge Different Fees

Don’t expect every lender to charge the same fees for a mortgage loan. Every lender structures their fees differently, which is why it is important to shop with at least 3 lenders to compare. Next time you apply for a mortgage loan pay attention to the rates, points being charged and closing costs.

3. Lenders Can Sell Your Loan to Another Bank

Many borrowers have experience getting a mortgage loan with a certain lender only to find out that the loan has been sold to another bank. This occurs because lenders need to free up their liabilities in order to make room to give out more loans. This does not affect your mortgage whatsoever, but it’s important to pay close attention to your mortgage statement and any correspondence you receive in the mail to make sure you do not make payments to the wrong bank.

4. Your Middle Credit Score Matters

When you apply for a mortgage loan, the lender will pull your credit scores from three credit bureaus (Transunion, Equifax and Experian) to help them determined if you are credit worthy. Your middle score of the three is what lenders will use for loan qualification. However, the underwriter will review all three scores as part of the loan underwriting process. If you pull your own credit score through a website online, the credit scores displayed to you may be different than what lenders use because they use different reporting systems.

5. You Can Refinance Your Home Loan Anytime

You can refinance your mortgage anytime, but it doesn’t necessarily mean you should. Think about why you want to refinance. Is because you want to lower your monthly payments, to change the type of loan you are in or to take cash out from your equity? Whatever the reason is, make sure that it makes financial sense.

6. You Can Get a Mortgage Loan After a Foreclosure

Many homeowners have experienced a foreclosure after the recent mortgage crisis. There is good news for these borrowers because they can get a mortgage loan after foreclosure. There are waiting periods involved, for example, to apply for an FHA loan you must wait three years after foreclosure to apply. If you want to get a conventional loan the waiting period is seven years from foreclosure. For those seeking a VA loan, the waiting period is two-years.

There are exceptions to the waiting periods, but you have to show the lender that your foreclosure was caused by an event outside your control, such as losing your job or being seriously ill.

8. Good Credit Allows you to Get Better Mortgage Rates

Good credit scores mean a better rate in any type of loan, especially a mortgage loan. Your credit heavily impacts the type mortgage loan you will qualify for. To maintain a good credit report, make sure you monitored it closely. One of the advantages to good credit is that more banks will want to compete for your business, therefore giving you leverage to negotiate the closing costs.

9. Know Your Annual Percentage Rate (APR)

Knowing your APR will allow you see the true cost of your loan. While the interest rate shows the annual cost of your loan, the APR includes other fees such as origination points, admin fees, loan processing fees, underwriting fees, documentation fees, private mortgage insurance and escrow fees.

There may be more or less fees included in the ARP from what we mentioned. To be sure what fees are included in the APR, ask your lender to give you a breakdown of the closing costs included.

10. You Can Always Reduce Closing Costs

One way to reduce closing costs is to have the sellers contribute towards the closing costs when purchasing your home. This can be negotiated between the buyer and the sellers in the purchase contract. The amount the seller can contribute will depend on the type of loan. Another way to save on closing costs is to have the lender give you a credit to cover out of pocket loan costs.

For Kentucky first-time homebuyers, we still have down payment assistance available through KHC programs. These funds can make a huge difference in reducing upfront costs and making homeownership more accessible.

- Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

- Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

- Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

- Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

- Step-by-step guides for first-time homebuyers.

- Information on loan programs like FHA, VA, USDA, and KHC.

- Tools to help you calculate potential payments and affordability.

- Blog posts with tips and updates on the Kentucky housing market.

- A secure portal to start your loan application and upload documents.

Call/Text - 502-905-3708

Call/Text - 502-905-3708Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

- NMLS Personal ID: 57916

(www.nmlsconsumeraccess.org).

PITI Mortgage Calculator

Estimated Payments

Total Estimated Monthly Payment (PITI)

-

Principal & Interest (P&I)

-

Monthly PMI

-

Monthly Property Tax

-

Monthly Home Insurance

-

Loan Summary

Total P&I Paid (Loan Term)

-

Total Interest Paid (Loan Term)

-

*Estimates are for informational purposes and don't constitute financial advice. PMI is calculated on the initial loan amount for the term specified; actual PMI may vary and might be cancellable. Property taxes and home insurance can change over time.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.