Can You Buy a House After Bankruptcy in Kentucky? (Updated 2026 Guide)

Yes — you can buy a home after a bankruptcy in Kentucky. The key is understanding the timelines for each loan program, rebuilding your credit, and showing stable financial behavior after your discharge or dismissal.

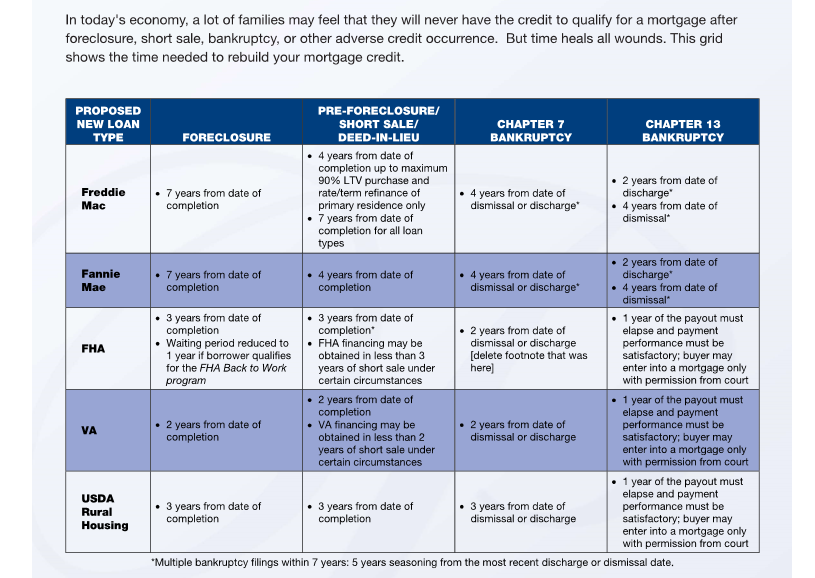

Below is the 2026 Kentucky-specific guide to FHA, VA, USDA, and Conventional loans after Chapter 7 or Chapter 13 bankruptcy.

How Soon Can You Buy a Home After Bankruptcy?

Your waiting period depends on:

- The type of bankruptcy (Chapter 7 or Chapter 13)

- The loan program (FHA, VA, USDA, Conventional)

- Whether the bankruptcy is discharged or dismissed

- Your new credit history and debt management

Most Kentucky homebuyers qualify again between 1–4 years after bankruptcy.

2025 Waiting Periods After Chapter 7 Bankruptcy

| Loan Type | Waiting Period After Chapter 7 Discharge |

|---|---|

| FHA | 2 years from the discharge date |

| VA | 2 years from the discharge date |

| USDA Rural Housing | 3 years from the discharge date |

| Conventional (Fannie Mae/Freddie Mac) | 4 years from the discharge date |

Tip: If your Chapter 7 bankruptcy included a home foreclosure, that may extend your waiting period depending on the loan program. Let me review your full history so I can tell you exactly where you stand.

2026 Waiting Periods After Chapter 13 Bankruptcy

| Loan Type | Waiting Period After Chapter 13 |

|---|---|

| FHA | 1 year of on-time plan payments with Trustee approval — OR 2 years after discharge |

| VA | 1 year of plan payments with Trustee approval — OR 2 years after discharge |

| USDA | 1 year of on-time payments with Trustee approval — OR 3 years after discharge |

| Conventional | 2 years after discharge — OR 4 years after dismissal |

Good news: Many Kentucky buyers in Chapter 13 qualify while still in repayment with a simple letter from their Trustee.

Kentucky FHA Loans After Bankruptcy

An FHA loan is often the fastest path back to homeownership after bankruptcy for Kentucky first-time buyers. FHA is flexible with credit scores, previous hardship, and higher debt-to-income ratios.

- Minimum credit score usually 580+

- Low 3.5% down payment

- Gift funds allowed

- KHC Down Payment Assistance can be used with FHA

FHA is often the best option for buyers rebuilding credit after Chapter 7 or Chapter 13.

Kentucky VA Loans After Bankruptcy

VA loans are extremely forgiving for eligible military borrowers. In 2026, the VA still allows homeownership again as early as:

- 2 years after Chapter 7 discharge

- 1 year into a Chapter 13 with Trustee approval

VA loans also require no down payment and no monthly mortgage insurance — making them a major win for recovering credit profiles.

Kentucky USDA Rural Housing Loans After Bankruptcy

USDA is stricter about credit history, but still very doable after bankruptcy:

- 3-year wait after Chapter 7

- 1 year into Chapter 13 with Trustee approval

USDA is a 0% down program designed for rural Kentucky counties. Income limits and property-eligibility maps apply.

→ Click here to check if a Kentucky property is USDA-eligible

How to Rebuild Credit After Bankruptcy (Quick Wins)

- Use a secured credit card and keep balances below 10–20%

- Pay every bill on time

- Avoid new personal loans or auto loans

- Dispute inaccurate items on your credit report

- Keep your credit usage low — this matters more than you think

Your goal is to show 12–24 months of clean, stable credit behavior.

Kentucky First-Time Homebuyer Options After Bankruptcy

You can still use:

- KHC Down Payment Assistance

- FHA Loans

- VA Loans

- USDA Rural Housing Loans

If you’re not sure which program is best, I can review your entire profile — credit, income, job history, debts — and map out your fastest path to getting approved.

Get a Free Kentucky Mortgage Assessment

If you’ve had a bankruptcy and want to buy again in Kentucky, reach out and I’ll build a personalized roadmap for you.

Call/Text: 502-905-3708

Email: kentuckyloan@gmail.com

Website: www.mylouisvillekentuckymortgage.com

I’ve helped more than 1,300 Kentucky families purchase or refinance — including hundreds rebuilding after bankruptcy.

Joel Lobb, Mortgage Broker FHA, VA, KHC, USDA

NMLS #57916 | Company NMLS #1738461

Equal Housing Lender | This is not a commitment to lend. All approvals subject to credit, income, property, and underwriting guidelines.