I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2026

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Down Payment Assistance Kentucky Housing Corporation KHC up to $12,500

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score For Mortgage Loan Approval

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky Mortgage Loan

- Testimonials

- Mortgage Calculator

- Kentucky USDA Rural Development Housing Loan

- Legal / Privacy Policy / Accessibility Statements

- About Me and this website

- Kentucky FHA/VA Approved Condos

Louisville Down Payment Assistance 2026 | Up to $25,000 Metro Housing fo...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

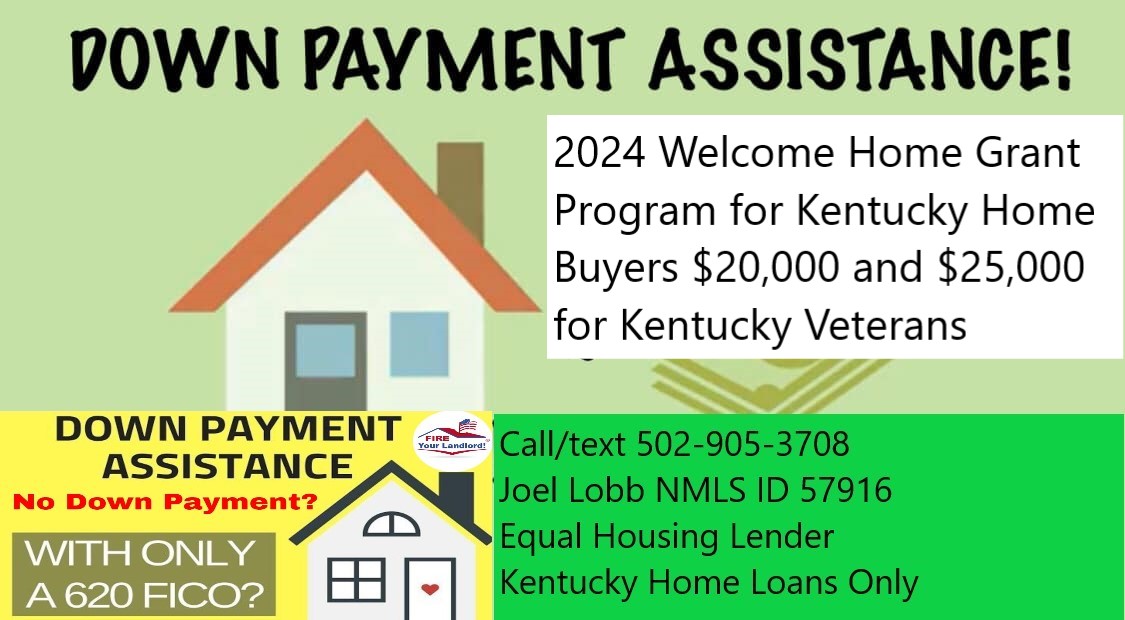

Kentucky Down payment assistance loans are available up to $20,000 for Mortgage with Welcome Home Grant 2024

Information for Kentucky Homebuyers

Welcome Home Program Grant Program for Kentucky Home buyers in 2024

A fully executed (signed by buyer and seller) purchase contract on an eligible property is in hand;

The homebuyer has at least $500 of their own funds to contribute towards down payment and/or closing costs; and,

If a first-time homebuyer (typically anyone who has not owned a home in the last three years), a satisfactory homebuyer counseling course is completed prior to the loan closing. Note: Applicants do not have to be first-time homebuyers.

The property is a single family, townhome, condominium, duplex, multi-unit (up to four family units) or a qualified manufactured home. (Manufactured homes may be eligible if they are taxed as real estate and affixed to a permanent foundation); and,

The property is subject to a legally enforceable five-year retention mechanism, included in the Deed or as a Declaration of Restrictive Covenants to the Deed, requiring the FHLB Cincinnati be given notice of any refinancing, sale, foreclosure, deed in-lieu of foreclosure, or change in ownership during the five year retention period.

|

Kentucky First Time Home Buyer Common Questions and Answers:

∘ WHAT KIND OF CREDIT SCORE DO I NEED TO QUALIFY FOR DIFFERENT FIRST TIME HOME BUYER LOANS IN KENTUCKY?

∘ DOES IT COSTS ANYTHING TO GET PRE-APPROVED FOR A MORTGAGE LOAN?

∘ HOW LONG DOES IT TAKE TO GET APPROVED FOR A MORTGAGE LOAN IN KENTUCKY?

∘ ARE THERE ANY SPECIAL PROGRAMS IN KENTUCKY THAT HELP WITH DOWN PAYMENT OR NO MONEY DOWN LOANS FOR KY FIRST TIME HOME BUYERS?

- HUD Community Development Block Grants (CDBG) — Kentucky contacts: HUD provides grant money to communities and those funds may be used to assist home buyers

- HUD HOME Program — Kentucky contacts: HUD provides grant money to communities designated as participating jurisdictions for assisting home buyers, rental assistance, and other housing initiatives

- Community Ventures Corporation Kentucky Home Financing

- The Kentucky Housing Corporation offers:

- Habitat for Humanity: Through volunteer labor and donations of money and materials, Habitat builds and rehabilitates simple, decent houses with the help of the homeowner (partner) families

- Federal Home Loan Bank of Cincinnati: Serves Kentucky residents by offering various home buying assistance programs, including Welcome Home grants. For more information, you may call 1 (888) 345-2246

- Kentucky Area Development Districts (ADDs): Contact your local ADD to find out more about local home buying assistance programs

- Kentucky Association for Community Action: Helps to fund housing programs for low-income residents

- Federal Appalachian Housing Enterprise (FAHE): Provides housing assistance in rural, low-income, Appalachian communities

- Housing Partnership, Inc.: Provides affordable housing services for residents of Jefferson County

- Secondary financing/down payment assistance programs are listed by state

- USDA Rural Development: Home buying loan programs that reduce the cost of homeownership for low and moderate-income families

@mortgage.ky #firsrtimehomebuyer #badcredit #creditscore #usdaloan #zerodownhomeloan #zerodownhomeloan #zerodownhomeloan #kentuckyrealestate #mortgagebroker #mortgage #homelender #valoans #badcredit #firsrtimehomebuyer #mortgagetips #homelender #grants #downpaymentassistance #welcomehomegrant #20kgrant ♬ Positive Vibes - Soundbeaver

∘ WHEN CAN I LOCK IN MY INTEREST RATE TO PROTECT IT FROM GOING UP WHEN I BUY MY FIRST HOME?

∘ HOW MUCH MONEY DO I NEED TO PAY TO CLOSE THE LOAN?

HOW LONG IS MY PRE-APPROVAL GOOD FOR ON A KENTUCKY MORTGAGE LOAN?

HOW MUCH MONEY DO I HAVE TO MAKE TO QUALIFY FOR A MORTGAGE LOAN IN KENTUCKY?

If you want a personalized answer for your unique situation call, text, or email me or visit my website below:

Text/call: 502-905-3708

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.