Thinking about buying or refinancing a home in Kentucky and wondering what credit score you need? Your credit score is one of the key factors lenders look at when deciding whether to approve your mortgage and what interest rate to offer.

As a Kentucky mortgage loan officer who has helped over 1,300 families across the state, I work every day with first-time homebuyers, repeat buyers and homeowners looking to refinance using programs like FHA, VA, USDA Rural Housing, Conventional (Fannie Mae) and Kentucky Housing Corporation (KHC) down payment assistance.

This guide breaks down typical credit score benchmarks for Kentucky mortgage approvals and explains what you can do if your scores are not quite where you want them yet.

Why Your Credit Score Matters for a Kentucky Mortgage

When you apply for a mortgage in Kentucky, the lender pulls your credit from the three major bureaus and uses your middle score (or the lower middle score if there is more than one borrower).

Your credit score helps the lender evaluate:

- How likely you are to pay on time

- Your history of managing credit cards, auto loans and other accounts

- How much total debt you are carrying compared to your limits

- Past issues like collections, charge-offs, bankruptcies or foreclosures

Important: There is no single “magic number” that approves or denies every Kentucky mortgage. Each program has its own guidelines, and many lenders add their own internal rules, called “overlays.” Your income, debt-to-income ratio (DTI), job stability and property type all matter too.

Typical Credit Score Minimums by Loan Type in Kentucky

Below are common credit score benchmarks used by many lenders for Kentucky borrowers. These are general guidelines and can change based on lender, market conditions and your overall profile.

| Loan Type |

Typical Minimum Credit Score |

Notes for Kentucky Borrowers |

| FHA (Federal Housing Administration) |

580+ for 3.5% down

500–579 possible with 10% down (lender approval required) |

Very popular with first-time homebuyers and buyers with limited down payment or past credit issues. |

| VA (Department of Veterans Affairs) |

No official VA minimum; many lenders look for 580–620+ |

For eligible Veterans, Active Duty, Reservists and some surviving spouses. No monthly PMI and flexible guidelines. |

| USDA (Rural Housing) |

Often 620–640+ for automated approval |

$0 down for eligible rural areas in Kentucky. Lower scores may require more documentation and manual underwriting. |

| Conventional (Fannie Mae/Freddie Mac) |

Generally 620+ minimum |

Stronger scores (680–740+) can mean better interest rates and easier approval, especially with lower down payments. |

| Kentucky Housing Corporation (KHC) |

Varies by program; many options start around 620+ |

Often paired with FHA, VA, USDA or Conventional loans for down payment and closing cost assistance for Kentucky homebuyers. |

Note: These are typical ranges only. Final approval depends on full underwriting and your complete financial profile.

How Your “Qualifying” Mortgage Credit Score Is Calculated

When you apply, your lender orders a tri-merge mortgage credit report from:

- Experian

- Equifax

- TransUnion

For most Kentucky mortgages, the lender uses the middle score of the three bureaus as the “qualifying” score. If there are two borrowers, the lender usually uses the lower of the two middle scores.

Example:

- Borrower A: 598, 625, 604 → Qualifying score = 604

- Borrower B: 640, 659, 652 → Qualifying score = 652

If both apply together, the lender may qualify the file off the lower middle score, in this example 604.

Also keep in mind: mortgage lenders often use older FICO models (not the same as many “free” credit score apps), so your lender’s scores can look different from what you see on a credit monitoring website.

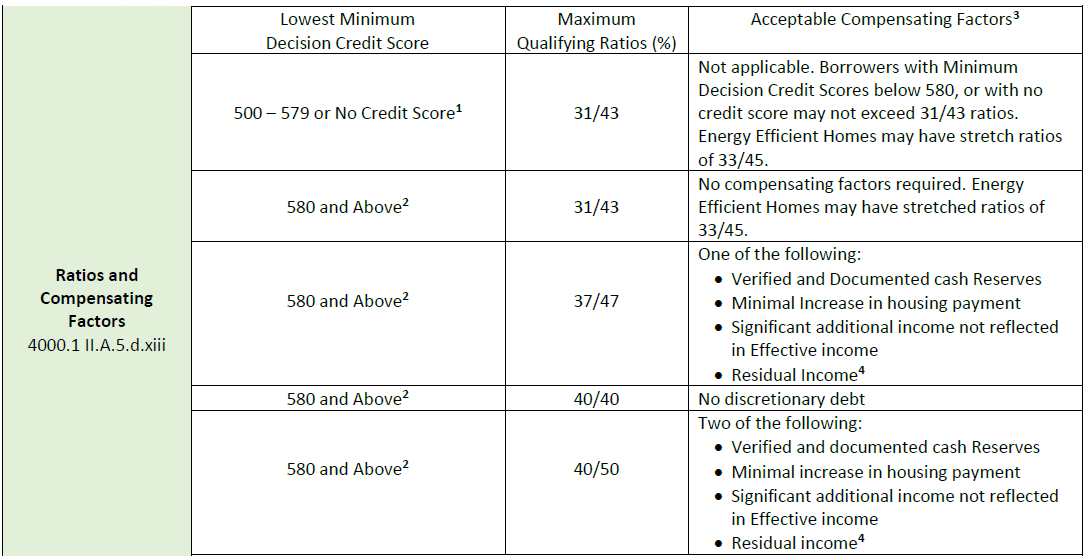

FHA Credit Score Requirements in Kentucky

FHA loans are a go-to option for many Kentucky first-time home buyers because they allow for lower down payments and more flexible credit guidelines than many conventional loans.

- 580+ credit score: You may qualify for the minimum 3.5% down payment, subject to full underwriting.

- 500–579 credit score: FHA will technically allow financing with at least 10% down, but many lenders set higher internal minimums. Expect a case-by-case review and stricter conditions.

- Below 500: Usually not eligible for FHA financing. Work on credit repair first, then re-apply.

FHA also looks closely at your recent 12–24 month payment history, especially for any mortgage or rent, auto loans and major revolving accounts.

For more in-depth FHA information, you can also review my Louisville FHA guide here:

Louisville Kentucky First-Time Home Buyer FHA & KHC Programs

VA Credit Score Guidelines for Kentucky Veterans

The VA itself does not publish a strict minimum credit score. Instead, lenders set their own tolerances based on risk, experience and market conditions.

In practice for Kentucky VA home loans:

- Many lenders look for 580–620+ as a baseline.

- Stronger income, solid recent payment history and low DTI can help offset borderline scores.

- Past credit events (bankruptcy, foreclosure, short sale) may require seasoning time and compensating factors.

VA loans can be extremely powerful tools for eligible buyers: no down payment in most cases, no monthly PMI, and flexible guidelines when structured properly.

USDA Rural Housing Credit Score Expectations in Kentucky

USDA Rural Development (Rural Housing) loans offer true $0 down financing in many areas of Kentucky. Because there is no down payment, lenders pay close attention to credit history and income stability.

Typical USDA score expectations:

- 640+: Often qualifies for automated underwriting approval (GUS Accept), assuming the rest of the file is strong.

- 620–639: May still be possible, but more documentation or a manual underwrite could be required.

- Below 620: Case-by-case basis. Expect more scrutiny and a need for strong compensating factors like low DTI and reserves.

If you want to check whether a property might be USDA-eligible, you can start with my Kentucky USDA map and eligibility tools here:

Check if a Kentucky Property Is in a USDA Eligible Area

Conventional (Fannie Mae/Freddie Mac) Credit Score Benchmarks

Conventional loans backed by Fannie Mae or Freddie Mac usually require a stronger credit profile than FHA, VA or USDA.

- 620+: Common minimum score for many lenders.

- 660–679: Often required for certain products, lower down payments or riskier profiles.

- 680–740+: Typically qualifies for more favorable pricing, especially with smaller down payments.

If you are trying to refinance out of FHA into a Conventional loan to remove mortgage insurance, or you want to pair a Conventional loan with KHC down payment assistance, your credit score can make a noticeable difference in interest rate and closing cost options.

How KHC (Kentucky Housing Corporation) Looks at Credit

Kentucky Housing Corporation (KHC) does not lend money directly to consumers, but it partners with approved lenders (like us) to provide down payment assistance and special programs.

In general:

- Many KHC programs start around 620+ credit scores, depending on the specific product and loan type (FHA, VA, USDA, Conventional).

- KHC overlays may be stricter than the underlying FHA/VA/USDA/Conventional guidelines in some areas.

- Higher scores help with pricing, underwriting approval and access to more assistance options.

If you are a first-time homebuyer in Kentucky and need help with down payment or closing costs, we can review which KHC options fit your credit profile and income.

Refinancing vs. Purchasing: Does the Credit Score Requirement Change?

For most programs, the credit score ranges are similar whether you are purchasing or refinancing. However, the purpose of the refinance can matter:

- Rate-and-term refinance: Often similar credit score and DTI guidelines as a purchase.

- Cash-out refinance: Usually requires higher scores and more equity, especially for Conventional and VA cash-out.

- Streamline refinances (FHA, VA IRRRL, etc.): May have more flexible credit documentation but still require a review of payment history and risk.

If you already own a home in Kentucky and want to lower your payment, shorten your term, or remove mortgage insurance, we can run side-by-side refinance scenarios based on your current scores.

5 Practical Ways to Improve Your Credit Before Applying

If your credit score is close to the cutoff, even a small improvement can open up better loan options and interest rates. Here are five practical steps:

- Pull and review your credit reports. Check Experian, Equifax and TransUnion for errors, duplicates or old derogatory items that should have fallen off.

- Lower your credit card balances. Try to keep utilization under 30% of your limits on each revolving account – lower is better.

- Avoid new loans or major purchases. Hold off on buying vehicles, furniture or opening new credit cards right before applying for a mortgage.

- Make every payment on time. A single 30-day late payment can drop scores and trigger underwriting issues.

- Talk to a Kentucky loan officer early. A customized credit review can show you which actions will give you the biggest boost toward mortgage approval.

Next Steps: Talk Through Your Kentucky Mortgage Credit Plan

Every borrower’s story is different. Two people can have the same credit score but very different credit histories and approval paths.

If you are:

- A first-time homebuyer in Kentucky

- Looking to refinance your current home loan

- A Veteran or active-duty service member considering a VA loan

- Buying in a rural area and exploring USDA Rural Housing

- Interested in KHC down payment assistance

…I can help you review your credit, run loan scenarios and design a practical plan to get you approved.

Call or text: 502-905-3708

Email: kentuckyloan@gmail.com

Serving homebuyers and homeowners across all 120 counties in Kentucky.

Frequently Asked Questions About Kentucky Mortgage Credit Scores

What is the minimum credit score for an FHA loan in Kentucky?

Many lenders in Kentucky look for a 580+ credit score to qualify for the 3.5% minimum down payment on an FHA loan. Scores between 500 and 579 may be considered with at least 10% down, but approval is more difficult and not all lenders will allow it.

Can I get a Kentucky mortgage with a credit score below 580?

It can be possible, but options are limited. Some FHA and VA lenders may consider scores in the 500–579 range with stronger down payment, low debt-to-income ratio and clean recent payment history. In many cases, it is more effective to spend a few months improving your credit and then apply.

What credit score do I need for a VA loan in Kentucky?

The VA does not publish a hard minimum score, but many Kentucky lenders prefer 580–620+. Stronger scores can mean better terms, especially if you have prior credit challenges.

What credit score is required for a USDA Rural Housing loan in Kentucky?

USDA loans often work best with scores of 640 or higher for automated approval. Lower scores may still be considered, but expect more documentation, a manual underwrite and tighter qualification standards.

How can I improve my score quickly before applying for a Kentucky mortgage?

Common fast-impact steps include paying down credit card balances, bringing any past-due accounts current, avoiding new inquiries and disputing any obvious errors on your report. A targeted review with a Kentucky loan officer can help you focus on the items that will move your score the most.

Disclaimer: This information is for educational purposes only and does not constitute a commitment to lend. Program guidelines, credit score requirements and underwriting standards are subject to change without notice. All loans are subject to credit approval, income verification, acceptable collateral and program availability.

NMLS #57916 | Company NMLS #1738461 | Equal Housing Lender

.png)

Call/Text -

Call/Text -