Here’s a quick overview of KENTUCKY MORTGAGE USDA loans:

- No down payment - a true 100% LTV Loan

- Minimum credit score of NONE . Just investors will create overlays and institute a higher minimum credit score-Be aware of this!~!!!

- The following slides will highlight a few key credit requirements.

- • Credit requirements may vary for loans underwritten with the assistance of the GUS compared

- to those that are manually underwritten.

- • Lenders and investors may impose overlays. A common overlay is credit score requirements.

- Rural Development does not have a minimum published credit score, but many lenders do.

- • It is the lender’s responsibility to determine the creditworthiness of their applicant. In some

- cases of adverse credit, the lender’s underwriter can grant credit exceptions.

- • There are a few instances of adverse credit that a lender cannot waive which include delinquent

- non‐tax Federal debt, delinquent child support, previous USDA losses, and a CAIVRS claim

- indicating the applicant is delinquent on federal debt.

- Borrowers that do not have a credit score may be eligible with additional requirements.

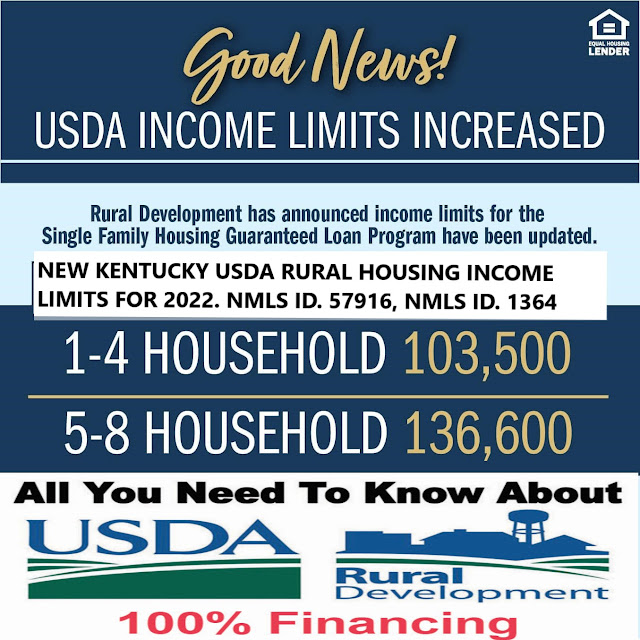

- Kentucky USDA Rural Housing has a Household income limits apply.

- The base USDA income limits are for most Kentucky counties below:

Kentucky USDA Mortgage Limits for Households with 1-4 members have different limits as households with 5-8. Similarly, applicants living in high-cost counties will have a higher income limit than those living in counties with a more average cost of living.

The base USDA income limits are formostKentucky counties below:

New Income limits for most counties (*) in Kentucky are $103,500 for a household family of four and household families of five or more can make up to $136,600 with the new changes for

2022 Kentucky USDA Income limits, the Jefferson County Louisville, KY Metro area (**) saw an increase of$103,500for a family of four and up to $136,600 for a family of five or more. The metro area surrounding counties of Jefferson County includes Oldham, Bullitt, Spencer are included in these higher income limits for USDA loans.

Remember, the entire Jefferson County and Fayette County Kentucky counties are not eligible for USDA loans. Along with parts of the following counties Daviess (Owensboro), Mccracken (Paducah), Madison County, (Richmond), Clark County (Winchester), Warren (Bowling Green), Hardin (Fort Knox and Radcliff), Bullitt(Hillview, Maryville, Zoneton, Fairdale, Brooks), Franklin, (Frankfort), Henderson (Henderson City Limits)…

- Generally easier to qualify for than a Conventional mortgage and much cheaper mortgage insurance than FHA loans in Kentucky!

- Property must be located in an eligible rural area as designated by map below

- No maximum loan amount unlike FHA and Conventional loans.

- Eligible Property Types:

- 1 unit properties only and must meet HUD FHA minimum standards

- HUD Approved Condos

- New Manufactured Homes (*There is currently a pilot program in KENTUCKY only that allows for existing homes built after Jan. 2006)

Credit Accounts and Adverse Credit

Chapter 12 or 13 Bankruptcy

Charge‐Offs

Consumer Credit Counseling Debt Management Plans

Delinquent Court Ordered Child Support

Federal Taxes

Deed‐in‐Lieu, Foreclosures, and Short Sales

Previous USDA Loss

Rent/Mortgage Payment History

Want to learn more about KENTUCKY USDA loans? Let us know, we are here to help!