FHA CHANGES TO HANDLING OF COLLECTIONS

AND DISPUTED ACCOUNTS

1. Credit Analysis of Collections and Judgments. Collections and judgments may indicate a borrower's disregard for credit obligations and must be considered in the creditworthiness analysis. The guidance below applies to loans with collection accounts and all judgments. Medical collections and charge off accounts are excluded from this guidance.

- Applicable to Manually Underwritten Loans: The lender must document reasons for approving a mortgage when the borrower has collection accounts or judgments.

Regardless of the amount of outstanding collection accounts or judgments, the lender must determine if the collection account or judgment was a result of:

- The borrower's disregard for financial obligations;

- The borrower's inability to manage debt; or

- Extenuating circumstances.

The borrower must provide a letter of explanation with supporting documentation for each outstanding collection account and judgment. The explanation and supporting documentation must be consistent with other credit information in the file.

- Applicable to Loans Run Through TOTAL Mortgage Scorecard: TOTAL Mortgage Scorecard Accept/Approve - There are no documentation or letter of explanation requirements for loans with collection accounts or judgments run through TOTAL Mortgage Scorecard receiving an "Accept/Approve" despite the presence of collection accounts or judgments. These accounts have been already taken into consideration in the borrower's credit score. If TOTAL Mortgage Scorecard generates a"Refer," the lender must manually underwrite the loan in accordance with the guidance above applicable to manually underwritten loans with collection accounts and judgments.

All medical collections and charge off accounts are excluded from this guidance and do not require resolution.

Collections - FHA does not require collection accounts to be paid off as a condition of mortgage approval. However, FHA does recognize that collection efforts by the creditor for unpaid collections could affect the borrower's ability to repay the mortgage. To mitigate this risk, FHA is requiring a capacity analysis of collection accounts with an aggregate balance equal to or greater than $2,000, as described below.

If the total outstanding balance of all collection accounts for all borrowers is equal to or greater than $2,000, the lender must perform a capacity analysis as detailed below. Unless excluded under state law, collection accounts of a non-purchasing spouse in a

community property state

are included in the cumulative balance.

All medical collections and charge off accounts are excluded from this guidance and do not require resolution.

Capacity analysis includes any of the following actions:

- At the time of or prior to closing, payment in full of the collection account (verification of acceptable source of funds required).

- The borrower makes payment arrangements with the creditor. If the borrower has entered into a payment arrangement with the creditor, a credit report or letter from the creditor verifying the monthly payment is required. The monthly payment must be included in the borrower's debt-to-income ratio.

- If evidence of a payment arrangement is not available, the lender must calculate the monthly payment using 5% of the outstanding balance of each collection, and include the monthly payment in the borrower's debt-to-income ratio.

TOTAL Mortgage Scorecard Accept/Approve/Refer - Regardless of the Accept/Approve/Refer recommendation by TOTAL Mortgage Scorecard, the lender must include the payment amount in the calculation of the borrower's debt-to-income ratio.

Judgments - FHA requires judgments to be paid off before the mortgage loan is eligible for FHA insurance. An exception to the payoff of a court ordered judgment may be made if the borrower has an agreement with the creditor to make regular and timely payments. The borrower must provide a copy of the agreement and evidence that payments were made on time in accordance with the agreement, and a minimum of three months of scheduled payments have been made prior to credit approval.

Borrowers are not allowed to prepay scheduled payments in order to meet the required minimum of three months of payments. Furthermore, lenders are instructed to include the payment amount in the agreement in the calculation of the borrower's debt-to-income ratio.

FHA requires judgments of a non-purchasing spouse in a community property state to be paid in full, or meet the exception guidance for judgments above, unless excluded by state law.

3. Handling of Disputed Accounts - The existence of potentially inaccurate information on a borrower's credit report resulting in a dispute must be reviewed by an underwriter. Accounts that appear as disputed on the borrower's credit report are not considered in the credit score utilized by TOTAL Mortgage Scorecard in rating the application. Therefore, FHA requires the lender to consider them in the underwriting analysis as described below.

With this ML, FHA is revising policy on manual downgrades for applications with disputed accounts to reflect the risk associated with derogatory and non-derogatory disputed accounts for factors such as age and size of outstanding balance.

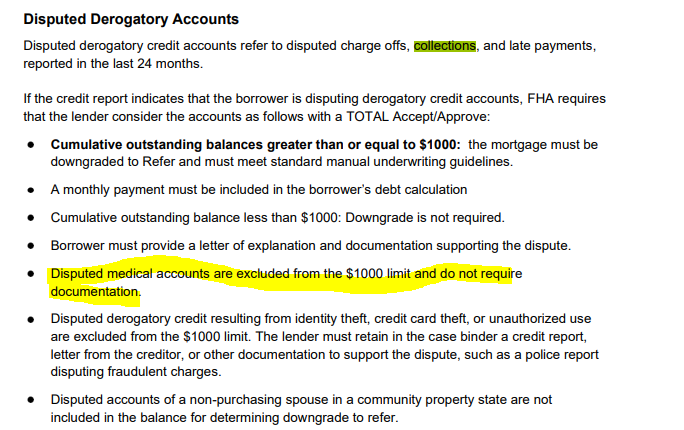

Disputed Derogatory Accounts Indicated on the Credit Report - If the credit report utilized by TOTAL Mortgage Scorecard indicates that the borrower is disputing derogatory credit accounts, the borrower must provide a letter of explanation and documentation supporting the basis of the dispute. The lender must analyze the documentation provided for consistency with other credit information in the file to determine if the derogatory credit account should be considered in the underwriting analysis.

Guidance for TOTAL Mortgage Scorecard Accept/Approve loans with disputed accounts.

Disputed Derogatory Credit Accounts greater than or equal to $1,000

|

If the cumulative outstanding balance of disputed derogatory credit accounts of all borrowers is equal to or greater than $1,000, the mortgage application must be downgraded to a"Refer" and a Direct Endorsement underwriter is required to manually underwrite the loan as described above. |

Disputed Derogatory Credit Accounts less than $1,000

|

If the cumulative outstanding balance of disputed derogatory credit accounts of all borrowers is less than $1,000, a downgrade is not required.

|

Excluded Accounts

|

- Disputed medical accounts are excluded from the $1,000 limit and do not require documentation.

- Disputed derogatory credit accounts resulting from identity theft, credit card theft, or unauthorized use are also excluded from the $1,000 limit. However, the lender must provide in the case binder a credit report, letter from the creditor, or other appropriate documentation to support the dispute, such as a police report disputing the fraudulent charges.

|

Disputed derogatory credit accounts are defined as follows:

- disputed charge-off accounts,

- disputed collection accounts, and

- disputed accounts with late payments in the last 24 months.

Disputed derogatory credit accounts of a non-purchasing spouse in a community property state are not included in the cumulative balance for determining if the mortgage application is downgraded to a "Refer".

Non-derogatory disputed accounts are excluded from the $1,000 cumulative total.

Non-Derogatory Disputed Accounts and Disputed Accounts Not Indicated on the Credit Report - Non-derogatory disputed accounts include the following types of accounts:

- disputed accounts with zero balance,

- disputed accounts with late payments aged 24 months or greater, and

- disputed accounts that are current and paid as agreed.

If a borrower is disputing non-derogatory accounts, or is disputing accounts which are not indicated on the credit report as being disputed, the lender is not required to downgrade the application to a "Refer." However, the lender must analyze the effect of the disputed accounts on the borrower's ability to repay the loan. If the dispute results in the borrower's monthly debt payments utilized in computing the debt-to-income ratio being less than the amount indicated on the credit report, the borrower must provide documentation of the lower payments.

If you have loans pending that these changes will affect, be sure to order the FHA case number prior to October 15, 2013.

--

Fill out my form for mortgage pre-approval by clicking this link!

.jpg)

.jpg)