How to get approved for a Kentucky FHA Mortgage Loan with Bad Credit in 2023.

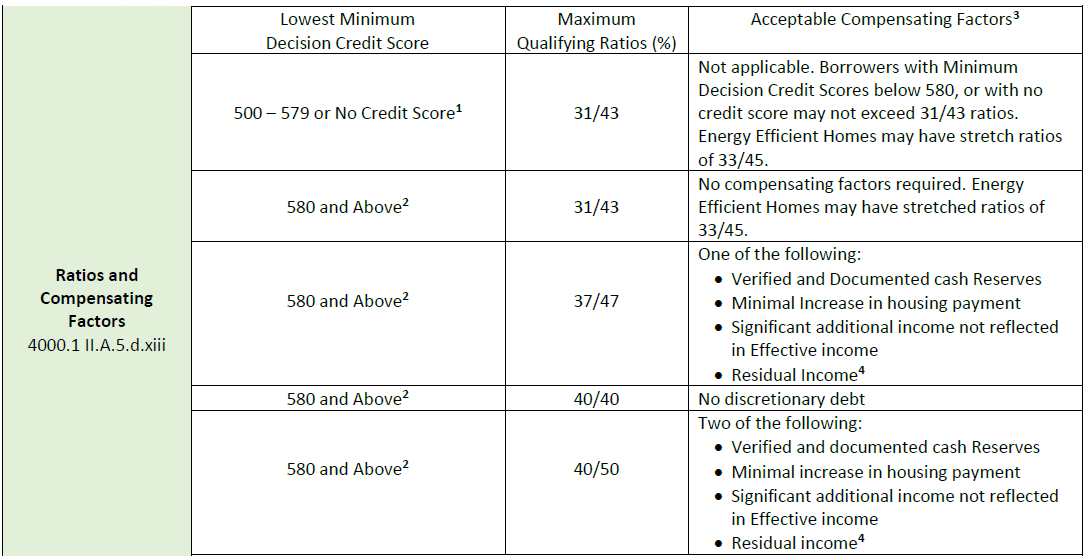

Below details the DTI requirements The maximum Front and Back ratios applicable to manually underwritten Kentucky FHA Mortgages are detailed below.

Maximum DTI allowed for Manual UW is 40/50

**IMPORTANT – any loan where ALL borrowers have No Fico Score, the Maximum DTI is 31/43 per HUD DTI and Compensating Factor Requirements:

560 FICO and Above – DTI up to 31/43.Comp Factors Required - NONE.

560 FICO and Above - DTI up to 37/47Comp Factors Required– 1 Required

560 FICO and Above – DTI up to 40/50Comp Factors Required– 2 Required

ACCEPTABLE COMPENSATING FACTORS:

RESERVES – 3 mo (1-2 Unit) 6 Mo (3-4 Unit)

HOUSING DECREASE – new PITI is no more than $100 or 5%, the lesser of the two

RESIDUAL – Meet VA residual requirements

ADDITIONAL INCOME – Income not reflected in DTI (this comp factor is only permitted when DTI is over 37/47 and if income were used, it would decrease DTI under 37/47)

MANUAL UNDERWRITE REQUIREMENTS ON ALL LOANS

12 Months verified housing history OR rent free letter,

Reserves, AND

1 month reserves for 1-2 Unit

3 month reserves for 3-4 Unit

NOTE: If you use reserves as a compensating factor, then you do not need these reserves in addition

Letter of explanation for all derogatory credit, including any NSFs and/or overdrafts in bank accountIf applicable, 2 months for all bank statements in the file (60 days activity)

Maximum DTI 40/50 (HUD guideline, no exceptions

Instructions for Residual Income as Compensating Factor

Residual income may be used as compensating factor when it meets or exceeds the stated amounts in

the table below. Note that all household members must be counted for ‘family size’ except for individuals

who are fully supported from a verified source of income not included in the effective income of the loan.

Residual Income Calculation When Needed as a Compensating Factor

Gross Monthly Income1 2

- (State income taxes3)

- (Federal income taxes3)

- (Municipal or other taxes3)

- (Retirement deductions and/or Social Security deductions)

- (Total monthly housing payment)

- (Estimated maintenance and utilities4)

- (Job related expenses (e.g., childcare)5)

= Monthly Residual Income for Family Support.

[When using Residual Income as a compensating factor, the “Monthly Residual Income for Family Support” must

meet or exceed the dollar amount in the “Residual Income Table” above.

1 Income from occupying borrowers only

2 Non-taxable income may not be grossed up

3 Federal and state taxes must be used to determine appropriate deductions or paystub if taxes are not available

4 Multiply total living area (sq ft) x 14

5 Childcare letter is not required (as it is for VA) and should not be requested

Exceptions to the Required Residual Income

You may reduce the residual income figure from the above tables by 5% if:

1. The borrower(s) is an active duty or retired serviceperson, OR

2. There is a clear indication that a borrower will receive the benefits resulting from use of military-based

facilities located near the property.

Examples of military service for reduced residual income are:

Guard and Reserve military retirees, 100% disabled Veterans and their family members, or Medal of Honor

recipient.

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS ID# 57916, (www.nmlsconsumeraccess.org).