Medical Collections, Credit Scores, and Getting Approved for a Mortgage in Kentucky

If you are shopping for a home loan in Kentucky and have medical collections on your credit report, you are not alone.

A recent federal court decision reversed a rule that would have kept medical debt off credit reports and out of credit

decisions. As a result, medical collections can now show up again on your credit report and may impact your credit score

and mortgage approval.

This guide explains how the new medical debt landscape affects Kentucky FHA, VA, USDA, KHC, and conventional mortgage

borrowers, and what you can do before you apply.

What Changed: Federal Medical Debt Protections Rolled Back

Earlier in 2025, the Consumer Financial Protection Bureau (CFPB) finalized a rule that would have:

- Kept medical debt off credit reports

- Excluded medical debt from credit scores

- Prevented lenders from using medical collections in credit decisions

The CFPB estimated that about 15 million Americans would have seen roughly $49 billion in medical debt removed from

their records. However, the rule was immediately challenged in court. Under the new administration, the CFPB stopped

defending the rule and agreed it should be blocked. A federal court then overturned it.

The net result is simple:

medical collections can now be reported again and can be considered when you apply for credit, including a mortgage loan.

How Medical Collections Show Up on Your Credit Report

Medical collections typically appear on your credit report as collection accounts, often reported by a third-party

collection agency rather than the original medical provider. Even if the original bill was small or related to an

insurance dispute, the collection can still show as a derogatory item.

Depending on how recent and how many medical collections you have, you may see:

- Lower FICO scores

- More conservative automated underwriting findings (AUS)

- Requests for letters of explanation and documentation

- Additional conditions during underwriting

How Medical Collections Affect Mortgage Approval in Kentucky

Medical collections are not treated exactly the same as credit card charge-offs or auto repossessions, but they can still

make a difference in whether you are approved and what terms you receive. Here is how they can impact different loan types

in Kentucky:

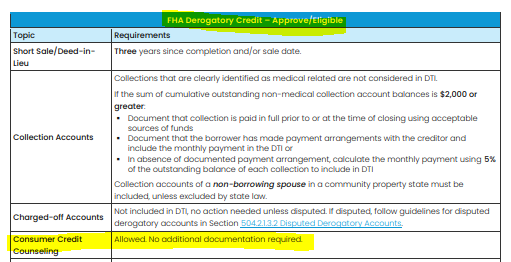

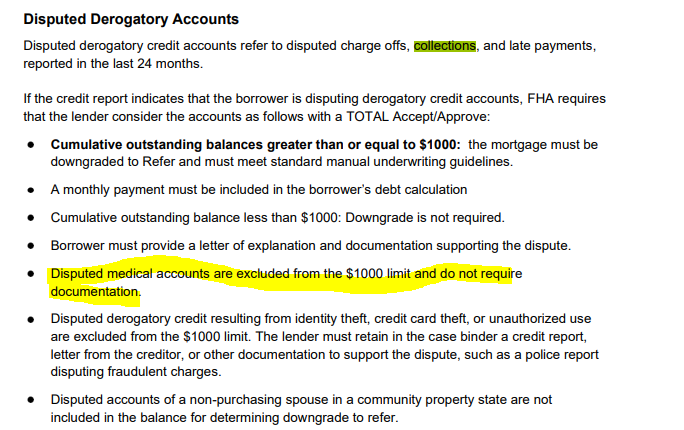

FHA Loans

FHA guidelines are often more flexible with medical collections than with other types of debt, but they still matter.

Too many recent medical collections can trigger:

- Manual underwriting instead of automated approval

- Closer review of payment history and explanations

- Requests for proof that any disputes or insurance issues have been resolved

Learn more about FHA guidelines here:

Kentucky FHA Mortgage Loans

VA Loans

VA loans look at the overall picture: residual income, payment history, and the nature of your collections.

One or two older medical collections may not be a deal breaker, but larger or recent medical collections can raise red flags

and lead to extra documentation requirements or compensating factors.

Read more about VA loans:

Kentucky VA Home Loans

USDA Rural Housing Loans

USDA loans are strict about overall credit history and payment patterns. Medical collections can hurt your USDA approval

odds if they are recent, numerous, or combined with other negative items. Underwriters will want to see that the situation

is under control and not ongoing.

Explore USDA options here:

Kentucky USDA Rural Housing Loans

Kentucky Housing Corporation (KHC) and Down Payment Assistance

When you use KHC down payment assistance with FHA, VA, USDA, or conventional loans, both the first mortgage and the KHC

program will review your credit. Medical collections do not automatically disqualify you, but they can affect the

combination of score, DTI, and program eligibility.

Learn how KHC works with first-time buyers:

Kentucky Housing Corporation (KHC) Programs

Conventional (Fannie Mae/Freddie Mac) Loans

Conventional loans tend to be more credit-score driven. Medical collections can drag down your score and cause you to:

- Miss program or pricing cutoffs

- Need a larger down payment

- Receive less favorable interest rates

Why Medical Debt Is So Common, Even With Insurance

Millions of Americans, including Medicare beneficiaries and people with employer plans, carry unpaid medical bills. Common

causes include:

- High deductibles and co-pays

- Out-of-network charges

- Surprise emergency bills

- Insurance delays, denials, and disputes

For many families, this leads to:

- Using credit cards to cover basic expenses

- Draining savings accounts

- Falling behind on other bills

- Delaying or skipping needed medical care

What You Should Do Before Applying for a Mortgage if You Have Medical Collections

-

Pull your credit reports from all three bureaus so you can see exactly which medical collections are

reporting and for how much.

-

Verify accuracy. Make sure the balances, dates, and providers are correct. Many medical collections

come from insurance billing issues.

-

Resolve insurance disputes first. If the bill should have been paid by your insurance, work with

the insurer and provider to correct it.

-

Consider settlement on smaller or older collections when it makes sense strategically. In some cases,

paying or settling a medical collection can help your overall profile.

-

Prepare a clear letter of explanation for any major medical event or period of hardship that led to

the collections.

-

Avoid adding new debt or opening new credit lines right before or during the mortgage process.

Frequently Asked Questions about Medical Collections and Kentucky Mortgages

Do medical collections still show on credit reports after the rule was reversed?

Yes. With the federal rule blocked, medical collections can be reported again and may show up as derogatory accounts on

your credit report.

Will medical collections automatically stop me from buying a home in Kentucky?

Not necessarily. Approval depends on the number of collections, how recent they are, your overall credit profile,

income, debt-to-income ratio, and the loan program you are using. Many buyers with medical collections still qualify,

especially with FHA and VA loans.

Should I pay off all medical collections before I apply?

It depends. Paying off certain collections can help, but in other cases the impact may be limited. The best approach is

to review your full credit picture with a knowledgeable Kentucky mortgage broker and develop a strategy that matches

your goals and timeline.

What if the medical collection is due to an insurance mistake?

Document everything. Keep copies of bills, explanation of benefits (EOBs), and correspondence with your provider and

insurer. Underwriters are more understanding when you can show that the collection came from an insurance dispute rather

than from ignoring bills.

Can a local Kentucky mortgage broker help if I have medical collections?

Yes. A local, experienced mortgage broker can review your credit report, explain how specific medical collections will be

viewed under FHA, VA, USDA, KHC, and conventional guidelines, and help you choose the program and timing that gives you

the best chance of approval.

Next Steps: Talk Through Your Situation Before You Apply

Every borrower’s medical and credit story is different. If you have medical collections and want to buy a home in

Kentucky, the smartest move is to review your situation early, before you make an offer on a home.

Reach out to discuss your credit, medical debt, and homebuying goals. We can look at your credit reports, run payment

scenarios, and outline a game plan to get you mortgage-ready.

Joel Lobb, Mortgage Broker FHA, VA, KHC, USDA

NMLS 57916 • EVO Mortgage NMLS 1738461

Call/Text: 502-905-3708

Email: kentuckyloan@gmail.com

Website:

www.mylouisvillekentuckymortgage.com

Equal Housing Lender

.jpg)