Kentucky VA Loan Guidelines: Collections, Charge-Offs, Judgments and Liens

Many Kentucky veterans are worried that old collections or charge-offs will automatically stop a VA home loan approval. In most cases, that is not true. The VA underwriter looks at the whole credit picture, not just one negative item, and wants to know whether you are a satisfactory long-term credit risk.

This guide explains how Kentucky VA lenders typically treat collection accounts, charge-offs, judgments and liens when you apply for a VA mortgage.

How VA Views Collection Accounts

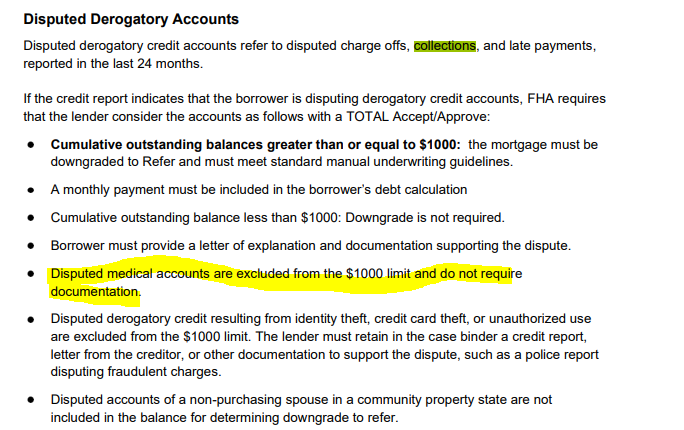

VA does not automatically require every collection to be paid before you can close on a home. Instead, the underwriter reviews the type, age, size and pattern of the collection accounts and whether you have re-established good credit since those events.

Key points about collection accounts

- Isolated or low-impact collections (especially older medical collections) generally do not have to be paid as a condition of approval.

- All collections are still treated as part of your overall credit history, even if payment is not required.

- If the credit report shows a minimum monthly payment on a collection, that payment may need to be counted in your debt-to-income ratio (DTI).

- Borrowers with prior collections are expected to show re-established, on-time credit afterward.

- The underwriter documents the handling of collections on VA Form 26-6393, Loan Analysis, to explain why the negative history does not make the loan unacceptable.

When a Letter of Explanation is needed for collections

For many Kentucky VA loans, especially manual underwrites, the lender will ask for a short written Letter of Explanation (LOE) that covers:

- What happened that led to the collection

- What you did to resolve or address it

- What you are doing now to avoid the same situation in the future

- Whether you plan to pay it, settle it or leave it as is

The goal is to show that the collection is tied to a specific, understandable event and that your current behavior reflects responsible money management.

How VA Views Charge-Off Accounts

Charge-offs are accounts the creditor has written off and is no longer actively trying to collect. VA generally treats them differently than active collections.

Key points about charge-offs

- Charge-offs usually are not required to be paid for a VA loan approval.

- They are often ignored for DTI purposes since there is no active minimum monthly payment.

- The underwriter still looks at the circumstances and timing of the charge-offs to decide whether you have since re-established good credit.

Even when a charge-off does not need to be paid, it still contributes to the overall picture of how you have used credit in the past.

Debts That Must Be Paid Before a Kentucky VA Closing

Some items cannot simply be left unpaid because they affect title and the legal ability to record the new mortgage. These almost always must be paid or released prior to closing.

Judgments

- Civil judgments reported on credit or discovered in public records generally must be paid in full or have a documented, satisfactory repayment agreement in place.

- Judgments can attach to the property and impact title, so they must be resolved before recording the VA mortgage.

Liens

- Tax liens, child support liens and other recorded liens must be paid, released or otherwise cleared before closing.

- Federal debt issues are treated very seriously. Delinquent federal debt will usually stop a VA loan until it is resolved.

When VA Credit Issues Lead to Manual Underwriting

Not every VA file receives an Approve/Eligible recommendation through automated underwriting. When there are multiple collections, recent late payments or other risk factors, your loan may be manually underwritten.

On a manual underwrite, the underwriter will focus heavily on:

- Pattern of on-time payments over the last 12–24 months

- Stability of income and employment

- Overall DTI ratio and residual income

- Strength of the LOE around prior collections or charge-offs

Good, recent payment history can often outweigh older negative items if the rest of the file is strong.

Key Takeaways for Kentucky VA Homebuyers

- Most standard collections do not automatically have to be paid to qualify for a VA loan.

- Charge-offs are often ignored for DTI, but still reviewed as part of credit history.

- Judgments, tax liens and many federal debts must be cleared or resolved before closing.

- A clear, honest Letter of Explanation helps the underwriter understand what happened and why your situation is now stable.

- The best approach is a full credit review by a Kentucky VA lender who knows how to work within VA guidelines.

If you have collections or charge-offs and you are not sure how they will affect your VA home loan, I can review your credit report and give you a clear plan. Many veterans are closer to qualifying than they think once the file is structured correctly.

Senior Loan Officer

Cell/Text: 502-905-3708

Email: kentuckyloan@gmail.com

Website: www.mylouisvillekentuckymortgage.com

More Kentucky VA Loan Resources

- Kentucky VA loan requirements and updates

- All VA loan articles for Kentucky veterans

- Start a Kentucky VA loan application

NMLS ID #57916 (www.nmlsconsumeraccess.org)

502-905-3708

502-905-3708

911 Barret Ave., Louisville, KY 40204

911 Barret Ave., Louisville, KY 40204.jpg)