FHA Gift Funds Kentucky 2025: Complete Guide to Gifts of Equity & Down Payment Assistance

Last Updated: October 2025 — FHA loans remain one of the most accessible pathways to homeownership for Kentucky first-time buyers. If you've been told you can't afford a home because of down payment requirements, think again. Understanding how FHA gift funds and gifts of equity work could open the door to your dream home with as little as 3.5% down.

Many Kentucky homebuyers don't realize they can receive financial help from family, friends, or even employers to cover their down payment and closing costs. This guide explains exactly how FHA gift funds work, who can provide them, and what documentation you'll need to get approved.

Who Can Give FHA Gift Funds in Kentucky?

The HUD 4000.1 Handbook outlines several acceptable sources for FHA gift funds. The key requirement: the funds must be a gift, not a loan.

FHA gift funds can come from family members, employers, charities, and government programs

FHA gift funds can come from family members, employers, charities, and government programs

Eligible donors include:

- Family members — parents, grandparents, siblings, children, spouse, or in-laws

- Employers or labor unions — who offer down payment assistance programs

- Close friends — with documented proof of relationship

- Charitable organizations — non-profits offering homebuyer assistance

- Government or public agencies — like KHC (Kentucky Housing Corporation) programs

FHA Definition of "Family Member"

For FHA purposes, family includes parents, grandparents, children (including adopted or foster children), siblings, spouses, domestic partners, uncles, aunts, and all in-laws (mother-, father-, sister-, or brother-in-law). This broad definition means most relatives can provide gift funds.

FHA Gift Fund Rules for Kentucky Borrowers: What You Need to Know

| Requirement | FHA Rule |

|---|---|

| Property Type | Primary residence (1–4 family units) |

| Minimum Down Payment | No minimum required (can be 100% gift) |

| Maximum LTV (Loan-to-Value) | Up to 96.5% with 3.5% down |

| Gift Fund Use | Down payment, closing costs, pre-paid expenses |

| Reserves | Gift funds cannot count toward reserve requirements |

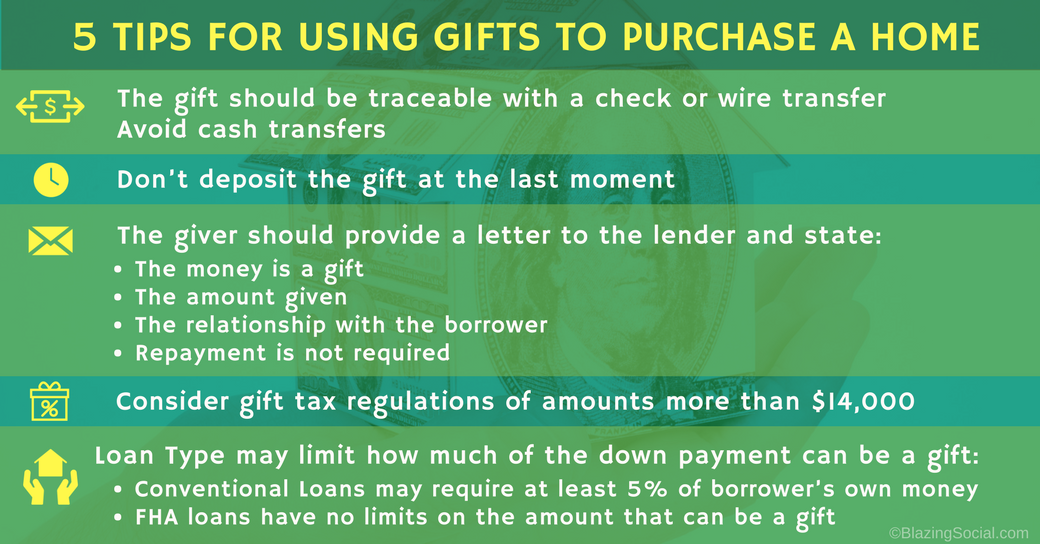

| Cash on Hand | Not acceptable (funds must be traceable) |

| Repayment | Strictly prohibited — must be a gift, not a loan |

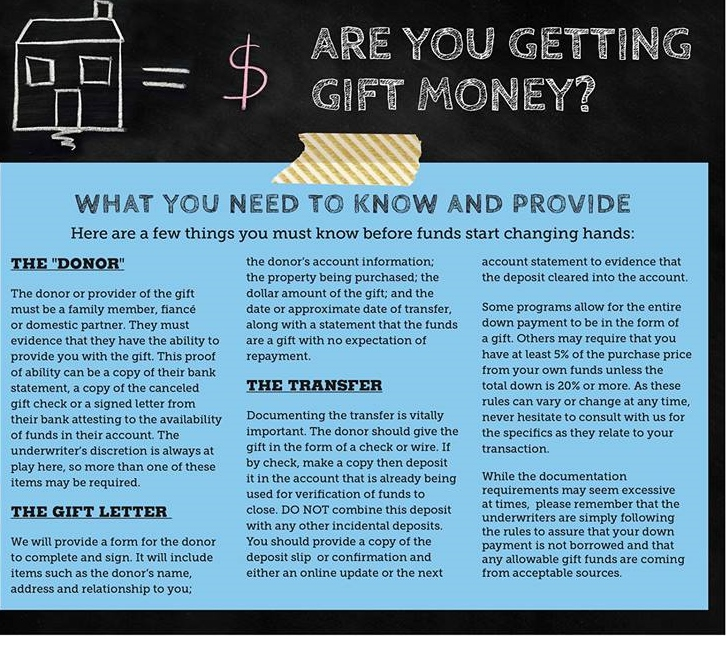

Documentation Required for FHA Gift Funds

The most critical part of using gift funds is documentation. Lenders need proof that:

- The donor has the funds available

- The funds came from a legitimate source

- No repayment is expected

- The money actually transferred to you

Required Documents Checklist

- Signed gift letter — states the amount, relationship, and that no repayment is expected

- Donor's recent bank statements — typically last 2 months showing the gift fund withdrawal

- Your bank statements — showing the deposit of gift funds

- Wire receipt or cashier's check proof — if funds go directly to closing

- Written explanation — if any gaps appear between withdrawal and deposit

Understanding FHA Gifts of Equity in Kentucky

A gift of equity is a unique FHA program that helps when a family member sells you their home. Instead of paying full market value, you purchase the home at a lower price, and the difference becomes your down payment credit.

Real-World Example: Gift of Equity in Kentucky

FHA Gift of Equity Requirements

- Only family members can provide a gift of equity

- Maximum LTV = 85% (loan amount ÷ appraised value) unless:

- The seller's home is their primary residence, OR

- You rented the property for at least six months before the sales contract date

- Must be documented in the purchase agreement and appraisal

Documentation for Gift of Equity

- Signed gift letter — from the seller acknowledging the equity gift

- Current appraisal — showing the true market value

- Sales contract — identifying the purchase price and equity gift amount

- Proof of relationship — birth certificate, marriage license, or family documents

FHA Gift Letter Template for Kentucky Borrowers

Your FHA gift letter must include specific language. Here's a template you can use:

"I, [Donor Full Name], am giving [Borrower Full Name] a gift of $[Amount] for use toward the down payment on the property located at [Property Address]. This gift represents no obligation for repayment. I expect nothing in return for this gift. [Donor Signature] [Date]"

Make sure your lender approves the exact wording before having it signed.

Does Kentucky's KHC Program Accept Gift Funds?

Yes. Kentucky Housing Corporation (KHC) and other down payment assistance programs often work alongside FHA gift funds. Many Kentucky first-time homebuyers combine KHC grants with family gifts to minimize out-of-pocket costs.

Learn more about KHC down payment assistance programs →

Common Questions About FHA Gift Funds in Kentucky

Can I use multiple gift sources?

Yes. You can receive gifts from multiple family members or organizations. Each gift requires its own gift letter and documentation.

Is there a limit to how much I can receive as a gift?

No. FHA has no maximum on gift amounts, but the full down payment and closing costs can be covered by gifts if properly documented.

Can a gift fund be used for closing costs?

Absolutely. FHA gift funds can cover down payment, closing costs, appraisal fees, inspection costs, and other homebuying expenses.

What if the donor and I live in different states?

That's fine. The donor's location doesn't matter — only that they have a legitimate relationship to you and the funds are properly documented.

Why Work With a Kentucky FHA Loan Expert?

Understanding FHA gift fund rules is complex, and mistakes can delay your approval or derail your loan entirely. Working with a knowledgeable Kentucky mortgage specialist ensures:

- Proper documentation — all gifts are verified and approved upfront

- No delays — we catch issues before they become problems

- Maximum benefits — we identify all programs you qualify for (FHA, KHC, VA, USDA)

- Peace of mind — you have expert guidance every step of the way

Ready to Buy Your Kentucky Home With FHA Gift Funds?

Let me help you navigate FHA gift fund requirements and get approved quickly. Whether you're receiving a family gift, a gift of equity, or KHC assistance, I'll ensure everything is documented correctly for a smooth, fast approval.

Joel Lobb — Kentucky FHA Mortgage Specialist

NMLS #57916 | EVO Mortgage NMLS #1738461

📞 (502) 905-3708 |

📧 Joel Lobb Expert on Gift Funds for Kentucky Mortgage Laons

Services: FHA • VA • USDA • KHC • Conventional Loans

Serving: All of Kentucky | Same-Day Pre-Approvals Available

Related Kentucky Homebuying Resources

This is why it's possible to get a little help in the form of a down payment gift from a family member or relative, close friend, or even a charitable organization. And it’s actually becoming more popular, especially among millennials. In the National Association of REALTORS® 2020 Generational Trends Report, 13 percent of home buyers (and 27 percent for ages 22 to 29) indicated their source of down payment to be a gift from their relative or friend.

So if you’re lucky enough to find down payment fund as one of your gifts under the Christmas tree this year (or maybe you’re the one who wants to give it), it may not be as simple as opening your cash gift (or handing someone a wad of cash) and going straight to the lender to use it to buy a home.

Down payment gift funds, whether you’re giving or receiving it, are closely regulated by lenders and must meet certain requirements. Here are certain rules that the gift giver and recipient should know to avoid trouble down the road.

While we may automatically consider a family member, like parents or siblings, when thinking about who can give a mortgage down payment gift, there are other entities who could also be eligible gift sources. But because cash can come with strings attached, and lenders want to make sure that the gift money is nothing but a gift (which will be discussed later on), there are restrictions on who can give money (or who you can give money to) to help purchase a home.

For conventional loans

If you are getting a loan through Fannie Mae or Freddie Mac, gifts can only be from a family member or relative. This may be your spouse, child, siblings, parents, grandparents, or anyone related by blood, marriage, adoption, or legal guardianship. Soon-to-be family members such as your domestic partner, fiancé, or even future in-laws are also eligible to give funds for a down payment.

For FHA loans

The Federal Housing Administration (FHA) has its own set of rules when it comes to giving or receiving down payment gifts, although they offer a broader eligibility range. If you are getting an FHA loan, you can receive down payment funds from family members, friends who have a clearly defined and documented interest in your life, employers, labor unions, government agencies, and even charitable organizations.

For USDA and VA home loans

VA loans (backed by the U.S. Department of Veterans Affairs) and USDA mortgages (given by the U.S. Department of Agriculture)may have fewer restrictions, but the down payment gift funds cannot come from anyone who would benefit from the proceeds of the purchase, such as the seller, developer, builder, your real estate agent, and some other entity.

There are no limits on the amount of money someone can give you for a down payment or to cover closing costs. However, rules still apply depending on the type of loan and property you're purchasing. Some types of loans may need you to contribute a certain amount of the down. The key is to check with your lender for the latest regulations on how much you can really use.

Likewise, there can be tax implications on the person giving the gift funds. They may be liable if the amount exceeds the gift tax exclusion limit. As of 2020, for instance, any individual can give funds up to $15,000 without a tax penalty. On the other hand, parents who are married and are filing jointly can give up to $30,000 per child for a mortgage down payment (or any other purpose), without incurring the gift tax. For a down payment gift that exceeds the said amounts, the donor must file a gift tax return to disclose the gift.

You need to confirm the relationship between you and the giver and provide the right paperwork.

If you're fortunate enough to have a family member or any eligible entity who can give you funds towards your home’s down payment, you’ll need to confirm your relationship with the gift-giver and provide your mortgage underwriter more information about where the funds came from.

For lenders to confirm that the new money isn’t a loan, you’ll need these things:

1. A down payment gift letter - If your lender has a template letter for this purpose, you will need to send it to the funds’ donor. If there isn’t a template, you might want to ask what information should be included so you can draft your own.

The letter typically includes details about the gift-giver, such as the name, address, contact phone, relationship to the borrower, and address of the property to be purchased. The date when the gift was transferred and the amount of funds given to the borrower must also be indicated. The donor should also write a sentence explaining that the fund is a gift and that there isn’t any expectation of repayment. The letter must be signed by both the gift-giver and the borrower.

2. The gift-giver’s bank statements - This is to show they have the funds to give the buyer as much money as promised.

3. A bank slip from the buyer’s account - This is to indicate when the money was transferred, to verify that the cash is from a legitimate source and that the borrower has an appropriate relationship with the donor, and to confirm the information provided in the letter.

Remember: you can't pay back the gift.

Down payment gift funds need to be just like that—a gift and not a loan that is expected to be paid. You need to make it clear with your mortgage lender that the money you received was entirely gifted and not something that you need to pay back eventually, because by then it will be considered mortgage or loan fraud. Besides, it can also put your loan qualification at risk since your debt-to-income ratio will be factored when you get a mortgage.

Try to make it a “seasoned” gift money.

It might make more sense to try and make your gift money “seasoned”, especially if you know that someone is going to help you buy a home (often in the case of parents or other relatives). Lenders refer to it as seasoned money when it has been sitting in your bank account for some time, at least for two months. When the gifted money is given in advance, you often don't have to worry about writing gift letter documentation.

Bottom Line

Down payment gift funds make it easier for first-time home buyers to afford a home. If you anticipate accepting help, remember to consider the rules above so you can accept such a gift in a proper manner. Be upfront with your mortgage lender if you plan on using gift funds for the down payment. Don't forget to also talk to the individual or entities who are planning to give you money about the tax implications and other considerations.

--