2-1 buydown Kentucky Mortgage Loans for FHA, VA, USDA, and Fannie Mae.

Temporary buydown of interest rate for Kentucky Mortgage Loans

We are excited to announce our new Temporary Buydown Programs:

Lower Rates & Payments = More Purchase Referrals for you!

We’re here to help strengthen your professional relationships and increase your purchase business with our new

temporary buydown programs. Connect with your builder and real estate agent partners to see how this incentive

could give your borrowers access to temporary lower rates, monthly payments and increases their motivation to

buy. They could also potentially save thousands of dollars in the first few years of their loan!

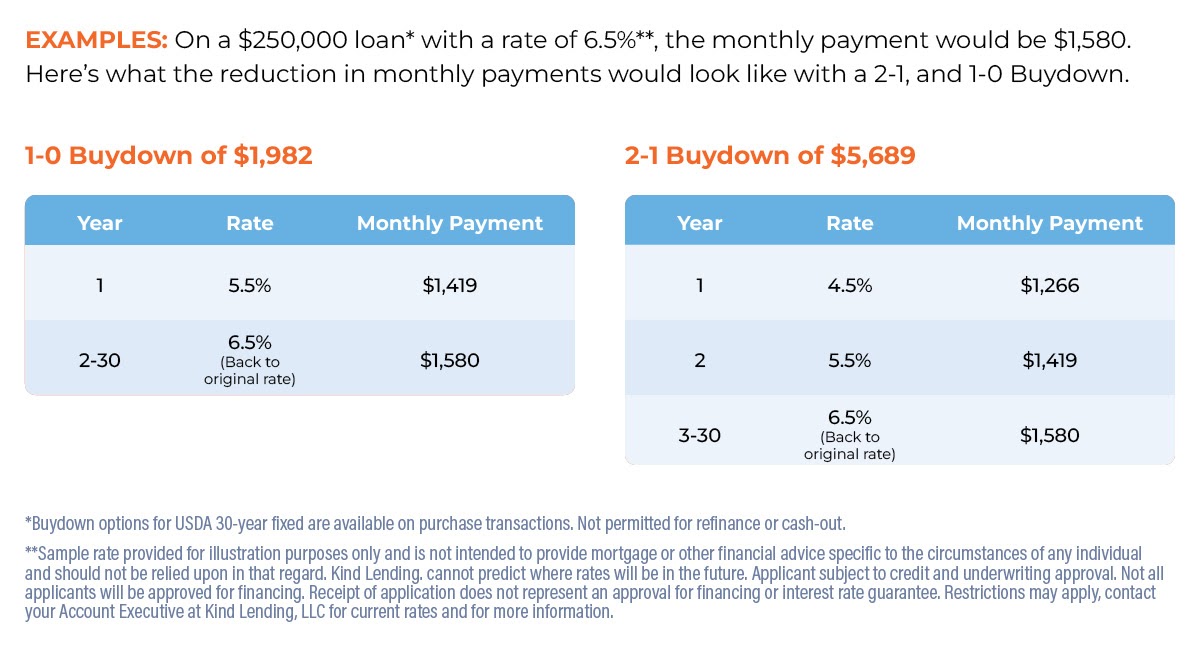

See the rate benefits below and the attached Buydown Calculator for your use.

2% lower interest rate in the first year

1% lower interest rate in the second year

1-0 Temporary Buydown

1% lower interest rate in the first year

A few important things to keep in mind:

Our buydown program is for the following fixed rate purchase loan types: Conventional, FHA, VA

and USDA. It’s funded by an escrow account carrying a credit balance, which can only be

contributed to by the seller or builder seller, and it is subject to maximum seller contribution.

The borrowers must also qualify at the Note Rate, not the Buydown Rate.

|

|---|

|

|---|

Have Questions or Need Expert Advice? Text, email, or call me below:

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS ID# 57916, (www.nmlsconsumeraccess.org).