Loan Inspection Checker

Select a loan type above to view inspection requirements.

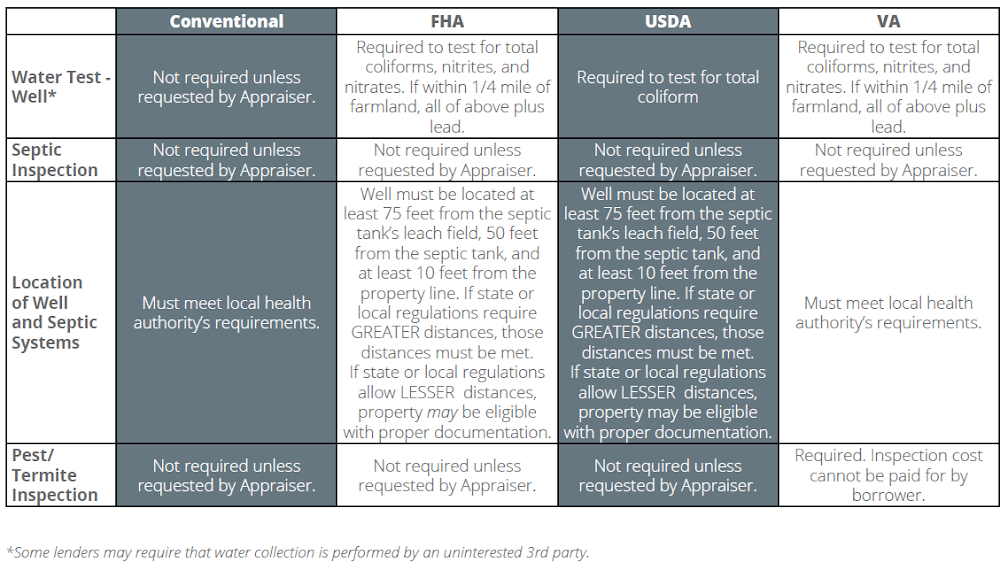

Kentucky Well, Septic, Water, and Termite Requirements for FHA, VA, USDA, and Conventional Loans

When you're buying a home in Kentucky with a well or septic system, the lending requirements can vary dramatically depending on whether you're using Conventional, FHA, USDA, or VA financing. As a result, borrowers and Realtors routinely get blindsided during underwriting – especially with water tests, well–septic distance rules, and VA termite requirements.

Below is a streamlined guide that tells you exactly what is required for each loan program so you can eliminate surprises, keep your file moving, and get to the closing table without delays.

Water Test Requirements

- Conventional: Only required if the appraiser calls for it.

- FHA: Coliform, nitrites, nitrates. Add lead test if within 1/4 mile of farmland.

- USDA: Total coliform test required.

- VA: Coliform, nitrites, nitrates. Add lead if within 1/4 mile of farmland.

Septic Inspection

- All loan types: Not required unless the appraiser specifically requests it.

Well & Septic Distance Requirements

For FHA and USDA, wells must meet these minimum distances:

- 75 ft from septic tank’s leach field

- 50 ft from septic tank

- 10 ft from property line

If state or local rules require greater distances, those take priority. Lower distances may be allowed with supporting documentation.

VA and Conventional: Must meet local health department requirements.

Pest / Termite Inspection

- Conventional, FHA, USDA: Only required if the appraiser notes a concern.

- VA: Required in most counties. Borrower cannot pay for the inspection.

Kentucky Takeaway

If a property uses well or septic and you're using FHA, USDA, or VA financing, expect additional scrutiny. These requirements aren’t difficult, but missing one can stop a loan cold. Align early with your lender, appraiser, and home inspector so nothing slips through the cracks.

Need help navigating a property with well or septic?

I specialize in FHA, VA, USDA, and KHC loans across the entire state of Kentucky. If you're buying a home with a private well or septic system and want the fastest path to a clear-to-close, reach out today.

Apply Now: https://www.mylouisvillekentuckymortgage.com/p/contact.html

Joel Lobb, Mortgage Broker FHA, VA, KHC, USDA

Joel Lobb, Mortgage Broker FHA, VA, KHC, USDA(NMLS #1738461) | Individual NMLS #57916

10602 Timberwood Cir. Suite 3, Louisville, KY 40223

Inspection & Testing Requirements for a Kentucky Mortgage

Each Kentucky Home loan program for Conventional, FHA, VA and USDA government mortgage loans has slightly different guidelines when it comes to water tests, septic inspections, and pest/termite inspections. Here's a quick comparison of the general guidelines for each program.