Here are the important points about Kentucky USDA Rural Housing Loans:

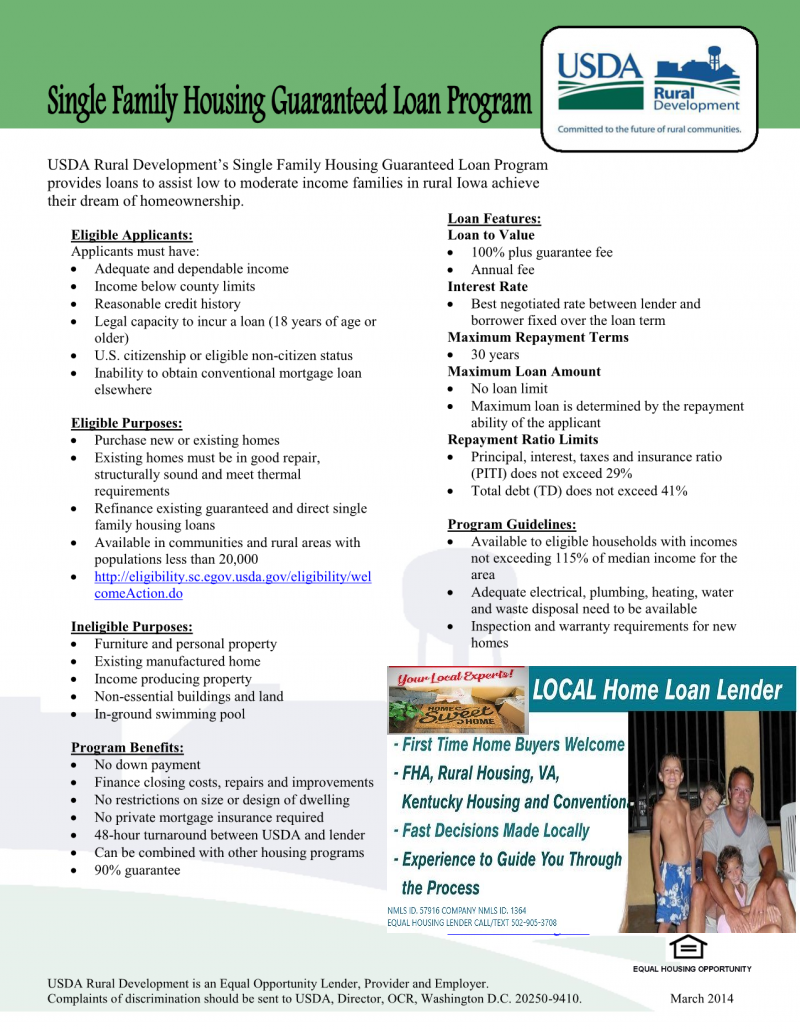

- USDA loan are only available in certain counties of Kentucky.

- There are two types of USDA loans available: Direct and Guaranteed.

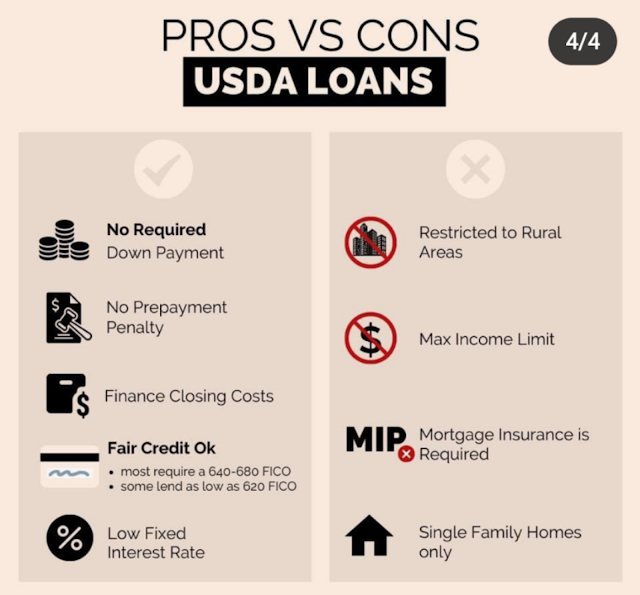

- 100% financing. No down payment

- USDA will go down to a no score and uses and automated underwriting pre-approval system called GUS-Guarantee Underwriting System. The GUS findings will dictate your loan pre-approval.

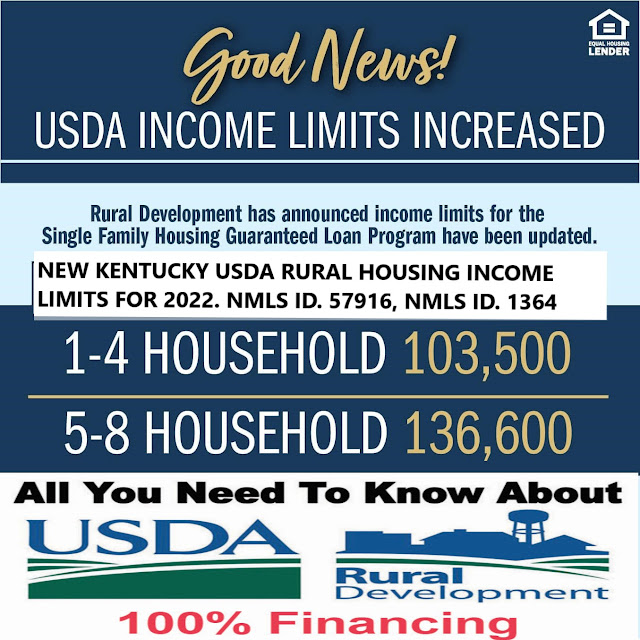

- Kentucky USDA Rural Housing Income limits based on county and number of people in household.

- Must be 3 years removed from bankruptcy and foreclosure

- No purchase price limit

- Upfront funding fee of 1% of loan amount paid to RD at closing

- Annual mi fee of .35% paid each month for life of loan.

- Takes on average 30-45 days to close.

- 30 year fixed rate is the only term available and rates are usually comparable to FHA and VA government mortgage insured rates.

- Do not have to be a first time home buyer and can currently own another home if USDA deems the current living situation not suitable.

- Appraisal has to meet FHA minimum standards

- You can buy a home with land on USDA Loans as long as the property does not have any agricultural characteristics or income producing capabilities.

- There is no set max acreage but the appraisal will dictate approval of property by USDA.

- You can only use USDA loans to purchase property or refinance an existing USDA loan

- Pools are okay and homes in a flood zone are okay. This is a recent change

Here are some important facts about Kentucky FHA Loans:

- FHA loans can be made in any county of Kentucky.

- FHA loans require 3.5% down payment

- FHA Mortgage terms are available in 30, 20, 15, 10 year terms.

- Credit score down to 500 are acceptable but subject to investor approval. will need 10% down payment

- Most lenders will want a 620 score, with some going down to 580 with conditions will need 3.5% down payment

- FHA loans are pre-approved using DU, an online automated underwriting system that will dictate your loan approval conditions.

- FHA has max income limits in Kentucky with the maximum being $498,257 for most Kentucky Counties

- There are no income limits on the household for FHA loans

- There is a upfront mi premium of 1.75% and a monthly fee of .85% payable each month.

- If you finance over 90% of the homes value, the monthly mi factor of .85% is for life of loan. If less than 90%, 11 year term for annual mi fee.

- FHA, USDA rates are really comparable on paper, no big difference except for the mi

- FHA requires 3 years out on a short-sale or foreclosure

- FHA requires 2 years out on Chapter 7 and 1 year out on a Chapter 13 with good clean history for the last 12 months with no lates.

- Not required to be a first time home buyer

- Can refinance an existing FHA loan to another without appraisal, income, a processed call FHA streamline refinance

- Can go no money down potentially with a 620 credit score with a grant. We offer these.

Senior Loan Officer