Many debtors fear that a bankruptcy will close off any chance of getting a mortgage. But that’s simply not true, with a little time and proper planning you can get a mortgage with good interest rates.

Rebuild Your Credit

If you want to get a mortgage after bankruptcy, you’ll need to get busy rebuilding your credit right away. If you make sure your credit report accurately reflects your bankruptcy, all zero balance credit accounts are closed at the time of your discharge, and pay your credit bills on time you will begin to see some improvement in your credit score within 12 months of your discharge.

Here are some key tasks in rebuilding your credit:

- Get a secured credit card

While the items on your credit report matter, you’ll also need to watch your FICO score. There are many different types of credit scores out there. You have the individual credit bureaus scores (Experian, Trans Union, and Equifax), FICO scores, Vantage Scores, and industry specific scores. However when looking to purchase a home you will want to watch your FICO as it is used in an overwhelming majority of mortgage related credit evaluations.

Also it’s important to note that FICO changes the way they evaluate creditworthiness based on new information and changes in the market. They have recently release FICO version 9. Since the majority of mortgage lenders still use an older FICO scoring model, when evaluating and monitoring your score, FICO recommends you use one calculated from a scoring model previous to Version 8.

When evaluating your FICO score it’s good to know that a score above 760 is considered excellent while a score under 620 is considered poor AND IT WILL BE HARD TO GET PRE-APPROVED WITH A CREDIT SCORE BELOW 580 RIGHT NOW

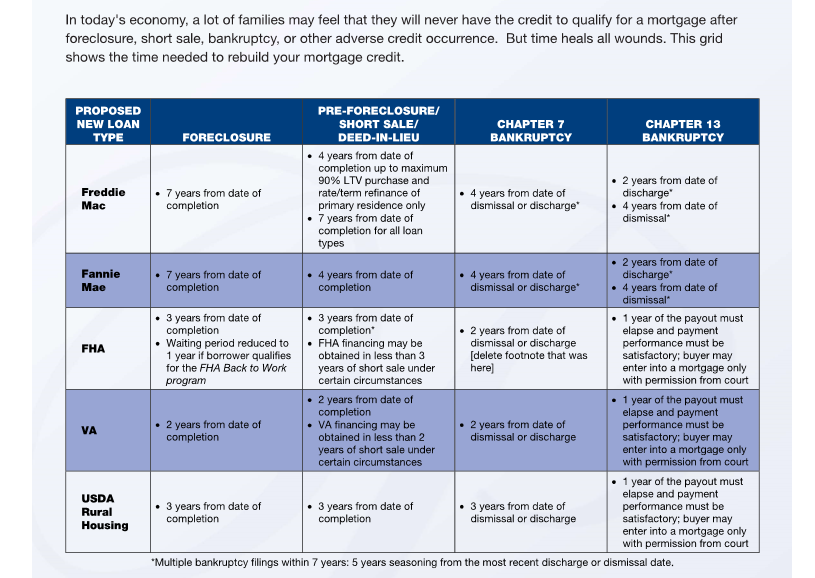

Timing

Typically speaking, if you want to get a mortgage after bankruptcy you’ll need to allow time to pass. For conventional mortgages you’ll need to wait four years after Chapter 7 bankruptcy or two years after Chapter 13 bankruptcy. But there are some other mortgage options that require a shorter waits.

FHA Mortgage

Two years after your Chapter 7 bankruptcy discharge you may apply for an FHA loan. If you filed Chapter 13 bankruptcy, then you’ll only need to wait until you’ve made twelve months of satisfactory payments, and you’ll need to get the approval of the bankruptcy trustee. But if you want to be given serious consideration, you’ll need to provide a clear explanation for why you filed bankruptcy. For example, maybe you filed Chapter 13 bankruptcy because you had a medical emergency and was unable to pay your medical bills.

VA Mortgage

If you’re a veteran, you can get a VA mortgage two years after your bankruptcy discharge. This VA application process can be challenging, but in some ways it’s more lenient since post-bankruptcy credit issues such as a foreclosure won’t restart the 2-year waiting period. However, credit issues after bankruptcy might affect your interest rate, so take care to keep your credit as clean as possible.

USDA Mortgage

If you live in a rural area, you may qualify for a USDA mortgage three years after your bankruptcy discharge. It’s important to note that while the USDA provides loans to rural residents it’s only for property that will serve as the borrower’s primary residence. The USDA will not finance the purchase of income property or a vacation home.

As you prepare to apply for a mortgage after bankruptcy, keep in mind that the mortgage lender will take into account the totality of your financial situation—your finances, credit history, credit score, and any extenuating circumstances.