Update for Kentucky homebuyers: KHC has permanently increased the Regular Down Payment Assistance Program (DAP) to up to $12,500. Purchase price limit shown below reflects KHC’s published $544,232 cap. Source links are included in this post.

Last updated:

Kentucky Down Payment Assistance (KHC DAP) Up to $12,500

If you’re trying to buy a home in Kentucky and cash for the down payment or closing costs is the main obstacle, the Kentucky Housing Corporation (KHC) Down Payment Assistance Program (DAP) is one of the most practical options available. It pairs with an approved first mortgage (FHA, VA, USDA, or select Conventional options) and provides additional funds to reduce your upfront out-of-pocket.

Louisville buyers: you may have both statewide KHC options and local Louisville/Metro programs available depending on income, location, and funding availability. Statewide buyers: KHC DAP is used across Kentucky, including Lexington, Northern Kentucky, Bowling Green, Elizabethtown, Owensboro, and many rural counties.

Want to know if you qualify for KHC DAP up to $12,500 and which loan (FHA, VA, USDA, or Conventional) makes the most sense?

Email: kentuckyloan@gmail.com | Call/Text: 502-905-3708

KHC Regular DAP quick facts

- Assistance amount: up to $12,500 (available in $100 increments).

- How it’s provided: a repayable second mortgage (not a free grant).

- Term and rate: amortized over 15 years at 4.75% fixed (program terms can change; confirm at time of application).

- Purchase price limit: up to $544,232 (subject to funding source requirements and published limits).

- Used with: KHC first mortgage options (FHA, VA, RHS/USDA, and select Conventional programs).

- Minimum credit score baseline: KHC publishes 620 minimum for general eligibility; some Conventional options require higher scores.

Official KHC program pages: KHC Down Payment Assistance, KHC Loan Programs, KHC Eligibility.

Purchase price and income limits are published by KHC and can update during the year. For MRB income limits (example PDF effective June 23, 2025): MRB Household Income Limits (PDF).

Louisville vs statewide Kentucky down payment assistance

Louisville homebuyers

If you’re buying in Louisville (Jefferson County) you should check two tracks:

- Statewide KHC DAP (up to $12,500) paired with FHA, VA, USDA, or select Conventional loans.

- Local Louisville/Metro down payment assistance programs, when funded and available. Reference: Louisville Metro Down Payment Assistance Program.

The right move is not guessing. It’s running your income, credit, and property details through the correct program rules and confirming funds are open.

Statewide Kentucky homebuyers

KHC DAP is used statewide and can be a strong fit for first-time buyers and repeat buyers, depending on the funding source (MRB vs Secondary Market), county rules, and income limits. If you’re buying outside Louisville, you can still use KHC DAP in most areas as long as the home and borrower meet current KHC requirements.

Which mortgage loans can be paired with KHC DAP?

KHC down payment assistance does not replace the mortgage. You must qualify for a primary first mortgage (the “main” loan). KHC DAP is then layered as a second loan under KHC rules.

FHA + KHC DAP

- Often a strong fit for buyers with limited down payment funds and average credit.

- FHA includes upfront and monthly mortgage insurance.

- KHC baseline eligibility shows 620 minimum credit score.

Internal resource: Kentucky FHA loans guide

VA + KHC DAP (eligible veterans)

- VA loans can allow 0% down financing for eligible borrowers.

- No monthly mortgage insurance on VA loans.

- KHC baseline eligibility shows 620 minimum credit score.

Internal resource: Kentucky VA loans guide

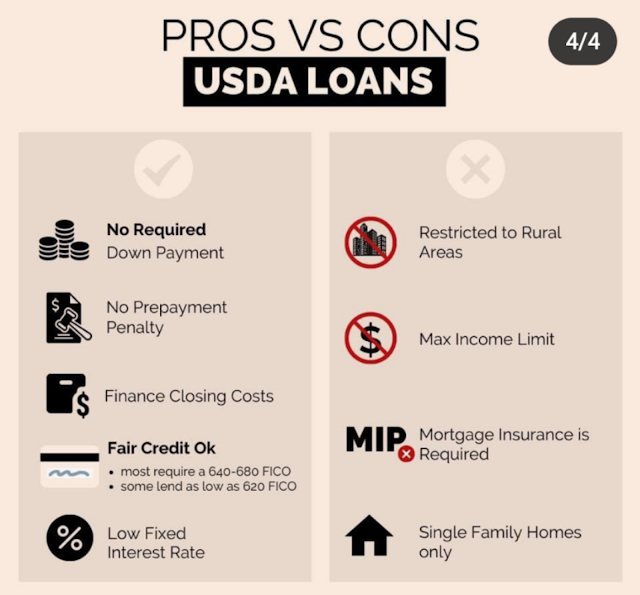

USDA/RHS + KHC DAP

- USDA can allow 0% down in eligible rural areas (property location matters).

- USDA includes upfront and monthly guarantee fees (often described as mortgage insurance).

- KHC baseline eligibility shows 620 minimum credit score.

Internal resources: Kentucky USDA loans guide | Check USDA eligibility map for Kentucky

Conventional options + KHC DAP

KHC’s Conventional programs can be a fit for buyers who meet higher score and underwriting requirements. Example: KHC’s Conventional Preferred program list shows a 660 minimum credit score and 3% down payment, with mortgage insurance required. Confirm current details with the loan setup you’re using at application time.

Internal resource: Kentucky conventional loans guide

How to apply for Kentucky down payment assistance (KHC DAP)

- Run a mortgage pre-approval first (income, credit, and debts).

- Confirm the correct KHC funding source (MRB vs Secondary Market) and county income limits.

- Identify the property type and location (especially for USDA eligibility).

- Lock the loan structure and confirm DAP availability and exact terms with your KHC-approved lender.

- Submit the full loan file and let underwriting confirm final approval.

If you want a clean yes/no on KHC DAP eligibility and a direct plan to get approved:

Email: kentuckyloan@gmail.com | Call/Text: 502-905-3708

Office: 911 Barret Ave., Louisville, KY 40204

FAQ: Kentucky down payment assistance (KHC DAP)

Is KHC DAP a grant?

No. KHC Regular DAP is typically structured as a repayable second mortgage. That means you must qualify with the added payment and repay it over the program term.

How much down payment assistance can I get in Kentucky?

KHC’s Regular DAP is published as up to $12,500. Actual eligibility and final terms depend on your KHC first mortgage type and current KHC program rules.

Do I have to be a first-time homebuyer in Kentucky?

Not always. KHC eligibility varies depending on whether you’re using MRB or Secondary Market and whether your county is considered targeted. A pre-approval review is the fastest way to confirm.

Can Louisville buyers use KHC and Louisville Metro assistance?

Sometimes, depending on local program funding and layering rules. Louisville buyers should check both tracks: statewide KHC and Louisville Metro housing resources.

What credit score do I need for KHC loans?

KHC publishes a 620 minimum credit score baseline for general eligibility. Some Conventional options require higher scores (commonly 660). Your full profile still matters: income stability, DTI, and documentation.

What should I do next if I want to use KHC DAP?

Get a mortgage pre-approval and confirm county income limits and the correct KHC funding source. If you want, contact me and I’ll map out the fastest path to approval.

Contact

Joel Lobb, Mortgage Loan Officer

EVO Mortgage

Company NMLS #1738461 | Individual NMLS #57916

911 Barret Ave., Louisville, KY 40204

Website: mylouisvillekentuckymortgage.com

Email: kentuckyloan@gmail.com

Call/Text: 502-905-3708