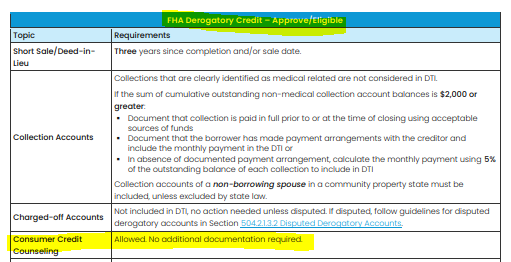

KENTUCKY FHA GUIDELINES FOR CONSUEMR CREDIT COUNSELING

(J) Credit Counseling/Payment Plan (APPROVE/ELIGIBLE)Participatin

(K) Credit Counseling/Payment Plan (MANUAL UW) Participating in a consumer credit counseling

- one year of the payout period has elapsed under the plan;

- the Borrower’s payment performance has been satisfactory and all required payments have been made on time; and

- the Borrower has received written permission from the counseling agency to enter into the mortgage transaction.

KENTUCKY RURAL HOUSING USDA GUIDELINES FOR CONSUMER CREDIT COUNSELING

CONSUMER CREDIT COUNSELING - DEBT MANAGEMENT PLANS |

Credit counseling provides guidance and support to consumers which may include assistance to negotiate with creditors on behalf of the borrower to reduce interest rates, late fees, and agree upon a repayment plan. The credit score will reflect the degradation of credit due to participation in this plan. Credit accounts that are included in the repayment plan may continue to report as delinquent or as late pays. This is typical and will not be considered as recent adverse credit. Lenders must retain documentation to support the accounts included in the debt management plan and the applicable monthly payment. Lenders must include the monthly payment amount due for the counseling plan in the monthly liabilities. GUS Accept/Accept with Full Documentation files: No credit exception is required. GUS Refer, Refer with Caution, and manually underwritten files: The following must be documented and retained in the lender’s permanent loan file: •One year of the payment period of the debt management plan has elapsed; •All payments have been made on time; and •Written permission from the counseling agency to recommend the applicant as acandidate for a new mortgage loan debt. •No credit exception is required |

Mortgage Loan Officer

email: kentuckyloan@gmail.com