𝗧𝗵𝗲 𝗶𝗺𝗽𝗼𝗿𝘁𝗮𝗻𝘁 𝘁𝗵𝗶𝗻𝗴 for you to know is that conventional loans have many benefits, including:

Down payments as low as 3%

No upfront mortgage insurance premium

Monthly mortgage insurance that automatically falls off once the home has been paid down to 78% of the home’s value

The ability to choose between an adjustable-rate or fixed-rate mortgage with different term lengths

Use on different property types, including primary residences, second homes, and investment properties

✔ Maximum Loan Limits set each year.

✔ PMI based on credit score and equity position

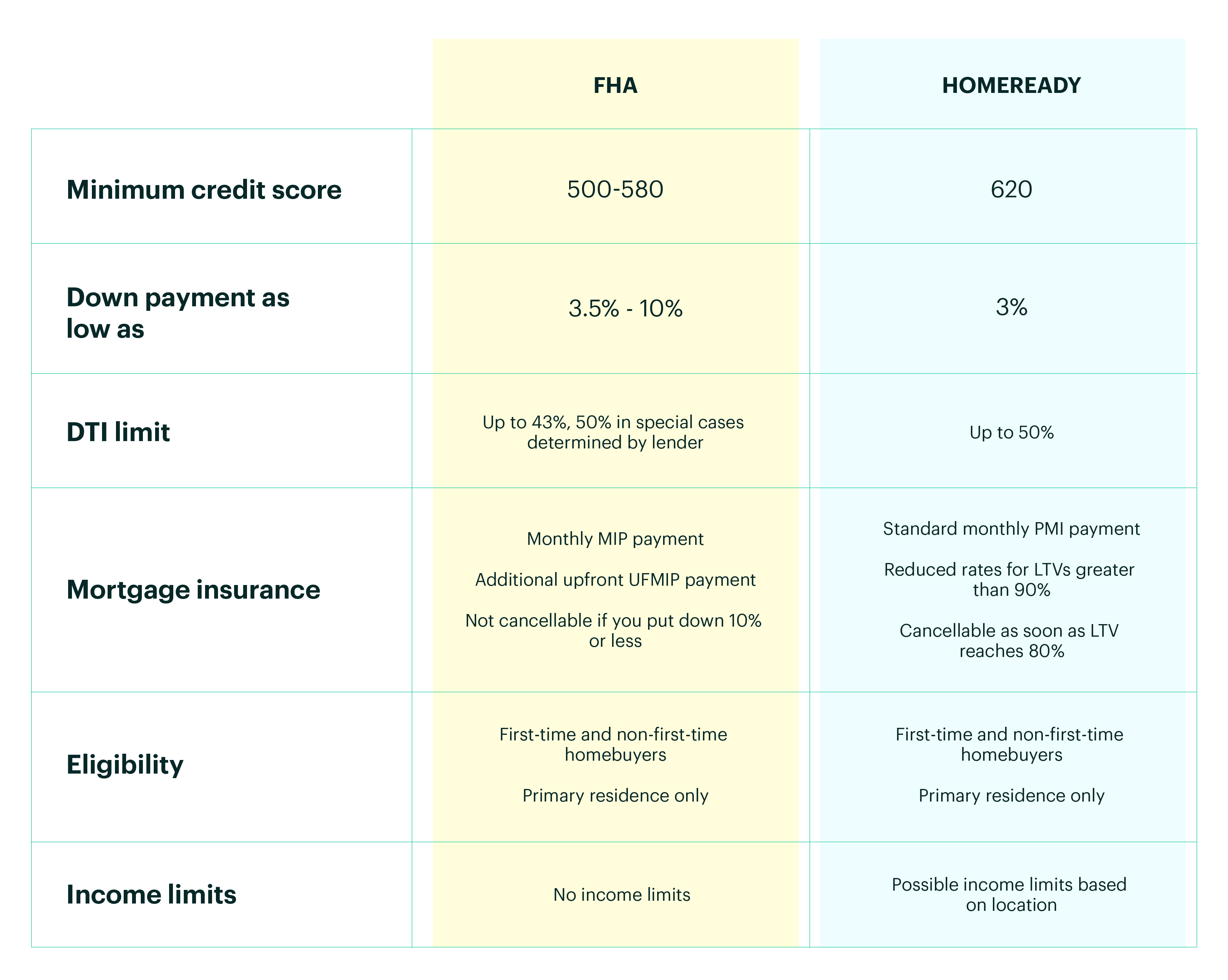

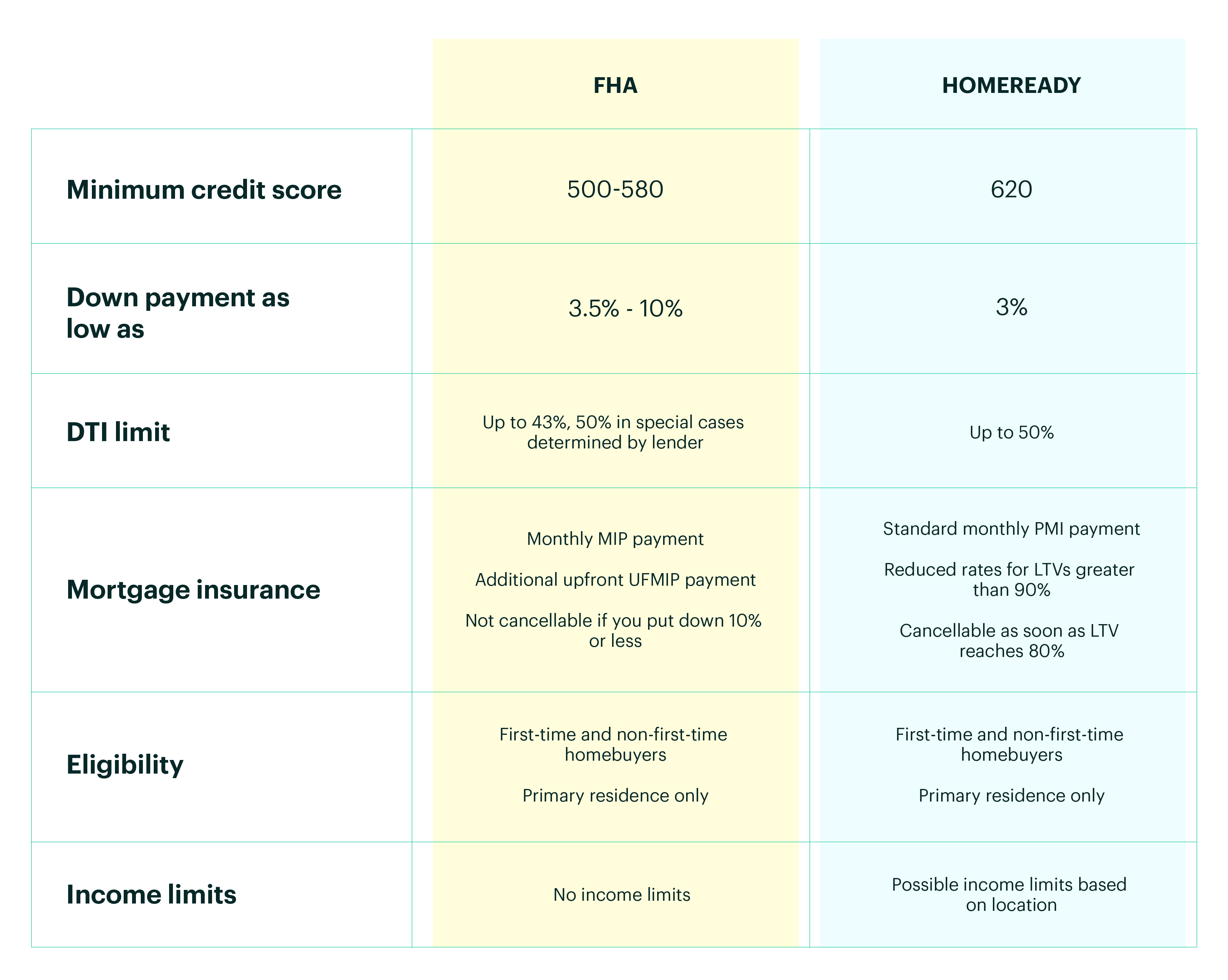

Kentucky Fannie Mae Loans versus Kentucky FHA Loans

|

|

Non Occupant Co-Borrower for Fannie Mae and FHA Loans.

The differences below: |

Kentucky Fannie Mae Loans - Allowed on all Purchases up to 95% LTV

- Allowed on all Refinances including Cash out

- Does not have to be a Family Member

Kentucky FHA Loans - Limited to 75% LTV. LTV can be increased to max 96.5% LTV provided:

- Non occupying borrower is not the seller in the transaction

- Property is not a 2-4 unit property

- Has to be a family member

- Not allowed on Cash out Refinances

- Non Occupant Co Borrowers must either be United State Citizens or have a Principal Residence in the United States.

|

|

Non arms Length / Identity of Interest for FHA and Fannie Mae Loans In KY |

Fannie Mae Loans(non arms length) - Underwriter must confirm transaction is not a bail out

- Gift of Equity is allowed

- No additional restrictions apply

FHA loans (Identity of Interest) - Gift of Equity is allowed

- LTV limited to 85% unless

- Purchase is the principle residence of another Family Member

- Borrower has been a tenant in property for 6 months predating the sales contract. A lease or other written evidence is needed to verify occupancy

- Borrower is an employee of the Builder of the property

- If a Family Member is providing secondary financing for the transaction, additional guidelines apply. See HUD 4000.1 II.A.4.(3) for additional guidelines.

Joel Lobb

Mortgage Loan OfficerIndividual NMLS ID #57916

American Mortgage Solutions, Inc.

Text/call: 502-905-3708

|

|

Down payments as low as 3%

Down payments as low as 3% No upfront mortgage insurance premium

No upfront mortgage insurance premium Monthly mortgage insurance that automatically falls off once the home has been paid down to 78% of the home’s value

Monthly mortgage insurance that automatically falls off once the home has been paid down to 78% of the home’s value The ability to choose between an adjustable-rate or fixed-rate mortgage with different term lengths

The ability to choose between an adjustable-rate or fixed-rate mortgage with different term lengths Use on different property types, including primary residences, second homes, and investment properties

Use on different property types, including primary residences, second homes, and investment properties