Obtaining a mortgage pre-approval is a crucial initial step in the home buying journey for Kentucky first-time homebuyers.

Kentucky Conventional Loans: Offered by private lenders, these loans typically require a minimum credit score of 620.

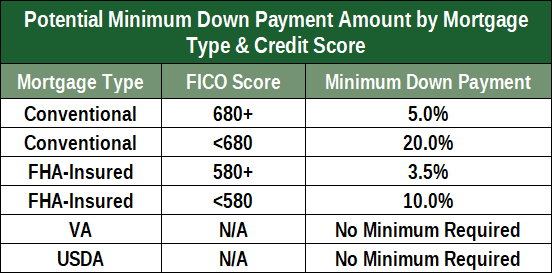

Kentucky FHA Loans: Insured by the Federal Housing Administration (FHA), FHA loans cater to borrowers with lower credit scores. A minimum credit score of 580 is required with a down payment of at least 3.5% and a 500 credit score and up to 580 will need a 10% down payment.

Kentucky VA Loans: Exclusive to veterans and active service members meeting eligibility criteria, VA loans don't have a minimum credit score requirement.

Kentucky USDA Loans: Backed by the U.S. Department of Agriculture (USDA) for rural properties, USDA loans often have a minimum credit score requirement around 620 with no down payment needed.

Kentucky Housing Corporation (KHC) Loans: Offered by the state housing authority, KHC loan programs may have varying minimum credit score requirements, but they're often around 620.

While these are the minimum credit score requirements, remember that a higher credit score typically translates to a more favorable interest rate. Consider consulting a mortgage professional to discuss strategies to improve your credit score and obtain the best possible mortgage terms for your Kentucky home purchase.

Detailed Analysis of Credit Score Requirements for First-Time Homebuyers in Kentucky

Overview of Kentucky’s Housing Market and First-Time Homebuyer Context

- FHA Loans:

- FHA loans, insured by the Federal Housing Administration, are popular for first-time homebuyers due to lower credit score and down payment requirements. a minimum credit score of 580 for a 3.5% down payment. For scores between 500 and 579, a 10% down payment is required, as noted in the Louisville source. This flexibility makes FHA loans accessible for those with less-than-perfect credit.

- Example: A buyer with a 575 credit score could qualify with a 10% down payment, significantly lowering the barrier to entry.

- VA Loans:

- Designed for qualifying active-duty military, veterans, and surviving spouses, VA loans typically come with lower interest rates and no down payment The Louisville source specifies no minimum credit score requirement set by the VA, but lenders may impose their own, often around 620, though this isn’t universally stated. This lack of a fixed minimum can be advantageous, but buyers should check with lenders for specific thresholds.

- USDA Loans:

- Backed by the U.S. Department of Agriculture, USDA loans require no down payment and are for designated rural areas. While Bankrate does not specify a credit score, Louisville Kentucky Mortgage Lender indicates a typical minimum of 620. This aligns with general industry standards, though some lenders might accept lower scores with additional conditions.

- Conventional Loans:

- Offered by private lenders, conventional loans generally require a minimum credit score of 620, as confirmed by [Equifax. These loans often have higher down payment requirements (typically 3%) and are less forgiving for

- Kentucky Housing Corporation (KHC) Loans:

- KHC, the state housing authority, offers programs like down payment assistance and tax credits, as noted in Ark7. The Louisville source specifies that KHC loans generally require a credit score of around 620, similar to conventional loans, but requirements can vary by program. KHC’s assistance can be combined with FHA, VA, and USDA loans, enhancing accessibility for first-time buyers.

Loan Type | Minimum Credit Score | Additional Notes |

|---|---|---|

FHA Loans | 580 (3.5% down) | 500-579 requires 10% down payment |

VA Loans | No minimum | Lenders may require around 620, varies by lender |

USDA Loans | 620 | No down payment, rural areas only |

Conventional Loans | 620 | Typically 3% down, stricter requirements |

KHC Loans | Around 620 | Varies by program, state assistance available |

Summary

-- Email - kentuckyloan@gmail.com

Email - kentuckyloan@gmail.com  Call/Text - 502-905-3708

Call/Text - 502-905-3708Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Kentucky Local Home Loan Lender Services

First-Time Home Buyers Welcome

First-Time Home Buyers Welcome FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans

FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans Conventional Loan Options Available

Conventional Loan Options Available Fast Local Decision-Making

Fast Local Decision-Making

Experienced Guidance Through the Home Buying Process of Credit Score Requirements

Experienced Guidance Through the Home Buying Process of Credit Score Requirements

| Loan Type | Minimum Credit Score | Notes |

|---|---|---|

| KHC FHA, VA, USDA | 620 | State-backed programs with down payment assistance options. |

| KHC Conventional | 660 | Requires higher credit score; offers competitive rates. |

| FHA (Federal) | 500–579 | Requires 10% down payment. |

| 580+ | Allows for 3.5% down payment. | |

| VA | Varies | No official minimum; lender-specific requirements apply. |

| USDA | 580–620 | No down payment; property must be in eligible rural area. |

Next Steps

Consulting with a mortgage professional can provide personalized guidance based on your financial situation. They can assist in identifying the most suitable loan programs and navigating the application process.

If you have further questions or need assistance in exploring these options, feel free to ask!