Kentucky is known for its bluegrass pastures, thoroughbred horses, and bourbon heritage. But for many families, the biggest attraction is affordable housing and the chance to build wealth through homeownership. Whether you are buying your first home, moving up, or refinancing, understanding current Kentucky mortgage rates and loan options will help you make a smarter financial decision.

This guide explains the most common Kentucky mortgage programs, how rates are determined, and where to start if you are ready to apply for a home loan.

What Affects Kentucky Mortgage Rates?

Mortgage interest rates in Kentucky are driven by a mix of personal and market factors, including:

- Credit score and credit history

- Debt-to-income (DTI) ratio

- Loan program (FHA, VA, USDA, KHC, Conventional, Jumbo)

- Down payment amount

- Property type and occupancy (primary residence, second home, investment)

- Overall economic and rate environment

Lenders review your full profile and line you up with the program that best fits your goals. That is why it pays to work with a local Kentucky mortgage broker who understands all the options and overlays, not just one bank’s products.

FHA Mortgage Rates in Kentucky

FHA loans are one of the most popular options for Kentucky first-time homebuyers who need a flexible program with a low down payment. With FHA financing, you can:

- Put as little as 3.5 percent down

- Qualify with mid-range credit scores

- Use gift funds for part or all of the down payment

- Finance up to 96.5 percent of the home’s purchase price

Because FHA loans are insured by the Federal Housing Administration, interest rates are often very competitive compared to other low-down-payment options.

Learn more about Kentucky FHA loan requirements and how to qualify.

Conventional Mortgage Rates in Kentucky

Conventional loans can be a strong fit for Kentucky homebuyers with higher credit scores and stable income. Key advantages include:

- Down payments starting at 3 percent for qualified buyers

- Potentially lower interest rates for strong credit profiles

- Ability to remove private mortgage insurance (PMI) at 80 percent loan-to-value (LTV)

- More flexibility for second homes and investment properties

If your credit score is 720 or higher and you can make at least a small down payment, a conventional loan may provide the lowest long-term cost of ownership.

For more details, visit my page on Kentucky conventional mortgage loans.

Kentucky VA Loan Rates and Benefits

Eligible veterans, active-duty service members, and certain surviving spouses can take advantage of the VA home loan program. This is often the best overall deal available for qualified Kentucky borrowers. Benefits include:

- No down payment required if the property appraises for the purchase price or higher

- No monthly mortgage insurance

- Flexible underwriting guidelines and residual income standards

- Competitive interest rates backed by the Department of Veterans Affairs

The VA itself does not set a minimum credit score, but most lenders use a 620 overlay in today’s market. As a broker, I work with multiple VA lenders to find the most favorable fit.

Get more information on Kentucky VA home loan requirements.

USDA Rural Housing Loan Rates in Kentucky

USDA Rural Development loans offer 100 percent financing in eligible rural areas of Kentucky. These are powerful options for buyers who have stable income but limited savings for a down payment.

USDA benefits include:

- No down payment required

- Competitive fixed interest rates

- Income-based eligibility and geographic restrictions

- Lower monthly mortgage insurance than many other programs

To see if a property or area is eligible, and to understand income limits, review my guide to Kentucky USDA Rural Housing loans.

Kentucky Housing Corporation (KHC) Down Payment Assistance

Kentucky Housing Corporation (KHC) provides down payment assistance and affordable loan options through approved lenders. These programs can be combined with FHA, VA, USDA, and conventional loans to make homeownership more accessible.

Selected features of KHC down payment assistance include:

- Down payment assistance of $12,500 over 15 years at 4.75% percent

- Can be used for down payment and/or closing costs

- Paired with fixed-rate first mortgage products

For more information, start with my overview of Kentucky Housing Corporation (KHC) programs.

Jumbo Mortgage Rates in Kentucky

When the loan amount is above the conforming loan limit, a jumbo mortgage is required. Jumbo loans usually call for:

- Higher credit scores

- Strong, documentable income

- Lower debt-to-income ratios

- Larger reserves in savings or investments

Rates can still be very competitive, but jumbo loans usually price slightly higher than standard conforming loans because of the increased risk and loan size.

Which Kentucky Mortgage Program Is Right for You?

There is no one-size-fits-all mortgage. The right program depends on your goals, budget, credit profile, and how long you plan to stay in the home. Here is a quick way to think about it:

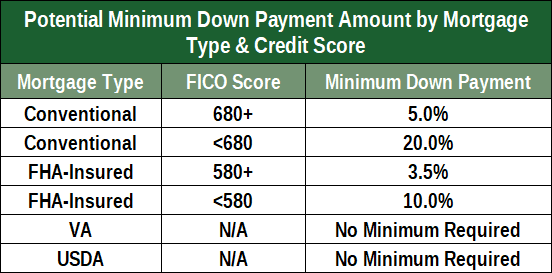

- FHA – Best for lower down payments and average credit

- VA – Best for eligible veterans and service members who want zero down and no monthly mortgage insurance

- USDA – Best for buyers in eligible rural areas who need 100 percent financing

- KHC – Best for buyers needing down payment or closing cost assistance

- Conventional – Best for strong credit and those who want to remove PMI at 80 percent LTV

- Jumbo – Best for higher-priced homes above conforming loan limits

If you are not sure where you fit, reach out and I will walk you through a side-by-side comparison based on your credit, income, and timeframe.

Start Your Kentucky Mortgage Preapproval

Getting preapproved is the first step to knowing your price range, estimated payment, and which loan programs you can qualify for. As a local Kentucky mortgage broker, I work with multiple lenders and investors to find the most competitive rate and program for your situation.

When you are ready, you can:

- Apply online through my secure application portal

- Upload income and asset documents electronically

- Receive a customized loan strategy and preapproval letter

Kentucky Mortgage Infographics

What Determines Your Kentucky Mortgage Rate?

Six key factors that impact your pricing

Higher scores = stronger pricing

Impacts underwriting risk

FHA, VA, USDA, KHC, Conventional, Jumbo

Larger down = lower rate

Primary vs. investment property

Fed policy, inflation, bond yields

Which Loan Is Right for You?

Choosing Your Perfect Mortgage Program

Visit my main site for more resources tailored to Kentucky homebuyers and homeowners:

https://www.mylouisvillekentuckymortgage.com/

About Joel Lobb, Kentucky Mortgage Broker

Joel Lobb (NMLS# 57916) Senior Loan Officer

Text or call: 502-905-3708

Email: kentuckyloan@gmail.com

If you are an individual with disabilities who needs accommodation, or you are having difficulty using this website to apply for a loan, please contact me at 502-905-3708.

Important Disclosures

No statement on this site is a commitment to make a loan. All loans are subject to borrower qualifications, including income, property evaluation, sufficient equity, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program requirements and are subject to change without notice based on applicant eligibility and market conditions.

Refinancing an existing loan may result in total finance charges being higher over the life of the new loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant.

Equal Opportunity Lender. NMLS# 57916 NMLS Consumer Access: http://www.nmlsconsumeraccess.org/