Kentucky Mortgage Rates and Home Loan Strategies for 2026

Kentucky mortgage rates in today’s market

Kentucky mortgage rates remain within long-term historical norms, but affordability continues to challenge many buyers due to higher home prices, insurance costs, and post-pandemic economic pressures. In 2026, the most successful borrowers focus on preparation and loan structure rather than attempting to time the market.

Interest rates matter, but credit strength, debt-to-income ratios, and loan program selection often have a greater impact on approval and long-term affordability.

How to secure the best mortgage rate on a Kentucky home loan

- Improve credit scores by paying down revolving debt and maintaining on-time payment history

- Evaluate fixed-rate versus adjustable-rate options based on long-term plans

- Compare lenders for pricing, fees, and underwriting flexibility

- Choose the right loan program rather than defaulting to conventional financing

Small differences in rate or fees can result in thousands of dollars over the life of a mortgage. There is no universal best rate—only the best structure for your specific financial profile.

::contentReference[oaicite:0]{index=0}Best loan options for Kentucky homebuyers in 2026

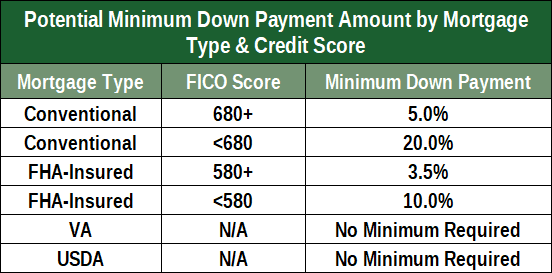

Selecting the right loan program is just as important as the interest rate. Kentucky borrowers commonly qualify under the following options:

- Conventional loans for borrowers with strong credit and stable income

- FHA loans for buyers needing more flexible credit guidelines and lower down payment options

- VA loans offering zero-down financing for eligible veterans, active-duty service members, and surviving spouses

- USDA rural housing loans providing zero-down options for moderate-income buyers in eligible Kentucky areas

- Bank statement loans designed for self-employed borrowers who do not qualify using traditional tax returns

- Kentucky Housing Corporation loan programs paired with down payment assistance to reduce upfront cash to close

Borrowers should also discuss 2-1 temporary buydowns and adjustable-rate mortgages when appropriate.

How much home can you afford in Kentucky?

Affordability is based on more than interest rates alone. Lenders evaluate income stability, employment history, credit profile, and total monthly obligations.

- The 28/36 guideline suggests housing costs should not exceed 28 percent of gross income, with total debt under 36 percent

In practice, many Kentucky borrowers qualify with debt-to-income ratios closer to 40–50 percent depending on loan program and compensating factors.

Ways to lower your monthly mortgage payment

- Improve credit scores before applying

- Leverage down payment assistance or grant programs

- Select a home price aligned with underwriting comfort levels

- Compare lender fees and overlays carefully

- Use temporary rate buydowns when available

- Explore Kentucky Housing Corporation Mortgage Revenue Bond programs

- Shared Appreciation Mortgage (SAM) options when applicable

Explore Kentucky mortgage programs

- Kentucky FHA loans

- Kentucky VA home loans

- Kentucky USDA rural housing loans

- Kentucky down payment assistance programs

Learn more about mortgage rate locks and timing strategies

Joel Lobb

Mortgage Loan Officer

NMLS ID #57916

Text or call: 502-905-3708

Call/Text -

Call/Text -