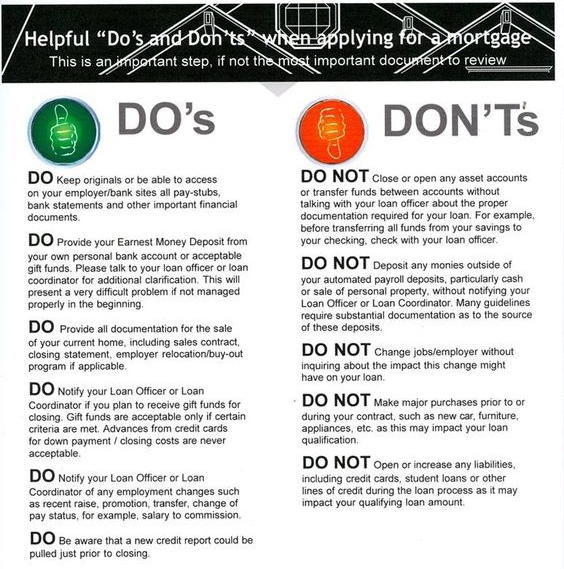

DO maintain up-to-date records The mortgage application process is paperwork-heavy, and lenders could ask you to pull up records at a moment’s notice. To make things easier for yourself, make sure you have the following records readily available:

- Income: Underwriters typically verify income and tax documents through your employer, so hold onto new paystubs as you receive them.

- Assets: It’s best practice to save all incoming account statements in the order in which you receive them; keep all numbered pages of each statement.

- Gifts: If you’re receiving any gift money from relatives, they’ll need to sign a gift letter (which your loan officer will provide) and an account statement evidencing the source, which must be “seasoned” funds.

- Current Residence: If you’re currently renting, continue to pay your rent on time and save proof of payment. If you intend to sell your current residence, be prepared to show your HUD-1 Settlement Statement. If you plan on renting out your home, you may need to show sufficient equity, a lease, and receipts for the security deposit and first month’s rent.

DO keep your credit score in mint condition. Continue to make payments on time. The lender might pull your credit report again, and any negative change to your score could jeopardize your approval.

DO understand that things change. The requirements to receive approval for a home loan are always changing, and underwriters require more documentation now than they have in the past. Even if requests seem silly, intrusive or unnecessary, keep in mind that if they didn’t need it, they wouldn’t ask for it.

DON’T apply for new credit. Changes in credit can cause delays, change the terms of your financing or even prevent you from closing on a home. If you must open a new account (or even borrow against retirement funds), be sure to consult your loan officer first.

DON’T change jobs midway through the process. Probationary periods and career or status changes — such as from a salaried to a commission-based position, leave of absence or new bonus structure — can be subject to strict rules.

DON’T make undocumented deposits. Large (and sometimes even small) deposits must be sourced unless they’re identified. Make copies of all checks and deposit slips, keep your deposits separate and small, and avoid depositing cash.

DON’T wait to liquidate funds from stock or retirement accounts. If you need to sell investments, do it now and document the transaction. Don’t take the risk of the market working against you, leaving you short on funds for closing.

Dos & Don’ts of Applying for a Mortgage in Kentucky