Using Gift Funds for a Down Payment in Kentucky (Updated 2025)

Many Kentucky homebuyers rely on financial help from family or close friends when buying a home. Gift funds can make the upfront investment far more manageable and can strengthen a buyer’s overall approval profile. Here is a clear breakdown of how gift money works across today’s loan programs and what documentation lenders require to use it.

Who Can Give a Down Payment Gift?

Eligible donors usually include parents, grandparents, children, siblings, fiancés, domestic partners, or other close family members. FHA and VA also allow gifts from close friends with a documented long-standing relationship. Gifts from sellers, builders, real estate agents, or anyone with a financial interest in the sale are not allowed unless structured as an approved credit through the contract.

How Gift Funds Help

Gift funds can reduce the cash needed to close and may help the loan qualify more easily. Lower borrower-funded contributions can improve reserves, reduce debt-to-income stress, and in some cases improve pricing. For first-time homebuyers in Kentucky using programs such as FHA, VA, USDA, or KHC, gift funds remain one of the most common tools to get to the closing table with minimal cash.

FHA Gift Fund Rules (2025)

- 100% of the down payment may be gifted.

- No minimum borrower contribution required.

- Gift letter must state no repayment expected.

- Documented transfer required.

Learn more about FHA loans here: Kentucky FHA Loans

VA Gift Fund Rules (2025)

- VA allows gifts for closing costs or earnest money.

- No down payment required for most VA buyers.

- Gift letter and proof of transfer required.

Learn more about VA loans here: Kentucky VA Loans

USDA Rural Housing Gift Rules (2025)

- USDA allows gifts toward closing costs.

- No down payment required for USDA purchases.

- Documented transfer required.

Learn more about USDA loans here: Kentucky USDA Rural Housing Loans

Conventional Loan Gift Rules (Fannie Mae vs. Freddie Mac)

Fannie Mae

- 100% of the down payment can be gifted on one-unit homes.

- No minimum borrower funds required unless the property is a multi-unit or second home.

Freddie Mac

- Often requires at least 5% of the purchase price from the borrower’s own funds if the down payment is under 20%.

- Some lenders still follow this rule even when overlays vary.

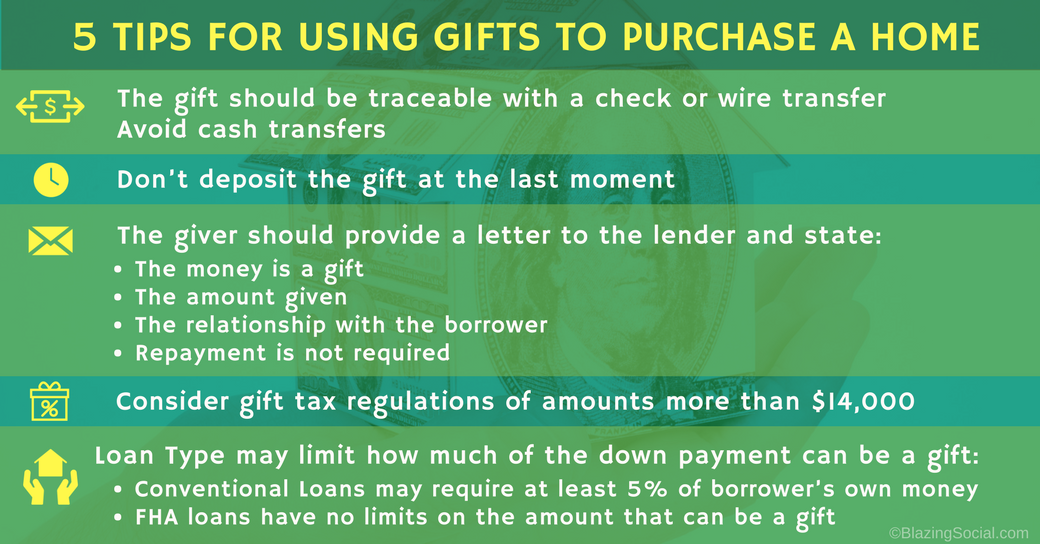

Gift Documentation Requirements

- Signed gift letter stating no repayment is expected.

- Donor’s name, relationship, and contact information.

- Proof of donor’s ability to give (bank statement or screenshot).

- Proof the gift was transferred into the borrower’s account.

Gift Tax Considerations

Gift tax rules apply to the donor, not the buyer. The IRS allows an annual exclusion per donor, per recipient. Larger gifts may require a simple tax form from the donor, but this rarely affects the mortgage process. Underwriting only cares that the funds are a legitimate gift and are fully documented.

Using Gift Funds with Kentucky Housing Corporation (KHC)

Kentucky Housing Corporation allows gift funds with Regular DPA and SmartBuy DPA programs. These can be applied to minimum investment, closing costs, or prepaid expenses. For buyers aiming to bring little to no money to closing, combining gift funds with KHC assistance and seller credits can be a strong structure.

Learn more about KHC here: Kentucky First-Time Home Buyer and KHC Programs

Practical Tips for a Smooth Approval

- Avoid cash deposits; always use traceable transfers.

- Have donors coordinate with your loan officer before sending funds.

- Keep all statements, screenshots, and receipts.

- Notify your lender early so the gift is structured properly.

Final Thoughts

Gift funds are a powerful way to reduce or eliminate upfront cash requirements. FHA, VA, USDA, and most Conventional programs allow them with proper documentation. Combined with Kentucky Housing Corporation assistance, many borrowers can reach the closing table with minimal or even zero out-of-pocket cost.

For help structuring your loan with gift funds or Kentucky first-time buyer programs, contact:

Joel Lobb, Mortgage Loan Officer Joel Lobb, Mortgage Broker FHA, VA, KHC, USDA NMLS 57916 | Company NMLS 1738461 Call or Text: 502-905-3708 kentuckyloan@gmail.com www.mylouisvillekentuckymortgage.com

Using Gift Funds for a Down Payment in Kentucky (Updated 2025)

Many Kentucky homebuyers rely on financial help from family or close friends when buying a home. Gift funds can make the upfront investment far more manageable and can strengthen a buyer’s overall approval profile. Here is a clear breakdown of how gift money works across today’s loan programs and what documentation lenders require to use it.