Down Payment Assistance Programs in Kentucky

Kentucky Housing Regular Down Payment Assistance of $10,000

- Purchase price up to $510,939 with Secondary Market or Mortgage Revenue Bond (MRB) income limits.

- Assistance in the form of a loan up to $10,000 in $100 increments.

- Repayable over a 10-year term at 3.75 percent.

- Available to all KHC first-mortgage loan recipients.

More About Down Payment and Closing Costs

- No liquid asset review and no limit on borrower reserves.

- Specific credit underwriting standards may apply to down payment programs.

Kentucky Housing Mortgage Revenue Bonds (MRB)

- Informational Flyer

- First-time homebuyers statewide in non-targeted areas

- First-time and repeat homebuyers statewide in targeted areas

- 30-year fixed interest rate

- Principal residence ONLY

- Purchase Price Limit: $510,939

- Borrower must meet KHC's MRB Income Limits

Secondary Market Funding Source

- First-time and repeat homebuyers statewide

- 30-year fixed interest rate

- Principal residence ONLY

- Purchase Price Limit: $510,939

- Borrower must meet KHC's Secondary Market Income Limits

Email - kentuckyloan@gmail.com

Email - kentuckyloan@gmail.com  Call/Text - 502-905-3708

Call/Text - 502-905-3708Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

Website: www.

Website: www. Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Kentucky Local Home Loan Lender Services

First-Time Home Buyers Welcome

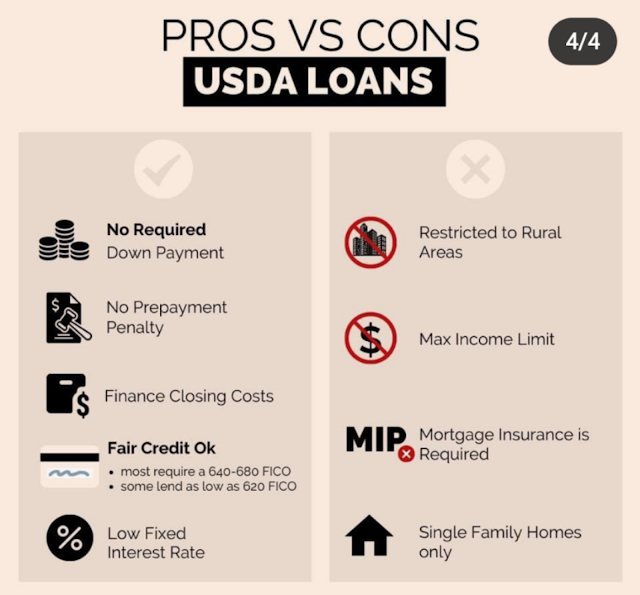

First-Time Home Buyers Welcome FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans

FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans Conventional Loan Options Available

Conventional Loan Options Available Fast Local Decision-Making

Fast Local Decision-Making Experienced Guidance Through the Home Buying Process

Experienced Guidance Through the Home Buying Process

ReplyForward |