I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2025

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Down Payment Assistance Kentucky 2025 Kentucky Housing Corporation KHC

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score For Mortgage Loan Approval

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky Mortgage Loan

- Legal / Privacy Policy / Accessibility Statements

- Testimonials

- Mortgage Calculator

- About Me and this website

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky FHA Mortgage Information

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky FHA Mortgage Information: How to Qualify For a Kentucky FHA Mortgage Loan 1. Low Down Payment – FHA Mortgage Loans only require a 3.5% down payment. And what m...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky USDA Rural Housing Mortgage Lender: Kentucky USDA Mortgage Loan Requirements

Kentucky USDA Rural Housing Mortgage Lender: Kentucky USDA Mortgage Loan Requirements: Kentucky Rural Housing USDA loans require One of the biggest eligibility requirements is that the property be located in a designated rur...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

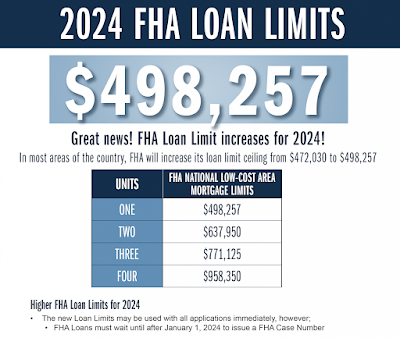

Kentucky FHA Mortgage Loans and Kentucky Fannie Mae Mortgage Loan Limits in 2024

| County | FHFA limit | FHA limit |

|---|---|---|

| Adair | $766,550 | $498,257 |

| Allen | $766,550 | $498,257 |

| Anderson | $766,550 | $498,257 |

| Ballard | $766,550 | $498,257 |

| Barren | $766,550 | $498,257 |

| Bath | $766,550 | $498,257 |

| Bell | $766,550 | $498,257 |

| Boone | $766,550 | $498,257 |

| Bourbon | $766,550 | $498,257 |

| Boyd | $766,550 | $498,257 |

| Boyle | $766,550 | $498,257 |

| Bracken | $766,550 | $498,257 |

| Breathitt | $766,550 | $498,257 |

| Breckinridge | $766,550 | $498,257 |

| Bullitt | $766,550 | $498,257 |

| Butler | $766,550 | $498,257 |

| Caldwell | $766,550 | $498,257 |

| Calloway | $766,550 | $498,257 |

| Campbell | $766,550 | $498,257 |

| Carlisle | $766,550 | $498,257 |

| Carroll | $766,550 | $498,257 |

| Carter | $766,550 | $498,257 |

| Casey | $766,550 | $498,257 |

| Christian | $766,550 | $498,257 |

| Clark | $766,550 | $498,257 |

| Clay | $766,550 | $498,257 |

| Clinton | $766,550 | $498,257 |

| Crittenden | $766,550 | $498,257 |

| Cumberland | $766,550 | $498,257 |

| Daviess | $766,550 | $498,257 |

| Edmonson | $766,550 | $498,257 |

| Elliott | $766,550 | $498,257 |

| Estill | $766,550 | $498,257 |

| Fayette | $766,550 | $498,257 |

| Fleming | $766,550 | $498,257 |

| Floyd | $766,550 | $498,257 |

| Franklin | $766,550 | $498,257 |

| Fulton | $766,550 | $498,257 |

| Gallatin | $766,550 | $498,257 |

| Garrard | $766,550 | $498,257 |

| Grant | $766,550 | $498,257 |

| Graves | $766,550 | $498,257 |

| Grayson | $766,550 | $498,257 |

| Green | $766,550 | $498,257 |

| Greenup | $766,550 | $498,257 |

| Hancock | $766,550 | $498,257 |

| Hardin | $766,550 | $498,257 |

| Harlan | $766,550 | $498,257 |

| Harrison | $766,550 | $498,257 |

| Hart | $766,550 | $498,257 |

| Henderson | $766,550 | $498,257 |

| Henry | $766,550 | $498,257 |

| Hickman | $766,550 | $498,257 |

| Hopkins | $766,550 | $498,257 |

| Jackson | $766,550 | $498,257 |

| Jefferson | $766,550 | $498,257 |

| Jessamine | $766,550 | $498,257 |

| Johnson | $766,550 | $498,257 |

| Kenton | $766,550 | $498,257 |

| Knott | $766,550 | $498,257 |

| Knox | $766,550 | $498,257 |

| Larue | $766,550 | $498,257 |

| Laurel | $766,550 | $498,257 |

| Lawrence | $766,550 | $498,257 |

| Lee | $766,550 | $498,257 |

| Leslie | $766,550 | $498,257 |

| Letcher | $766,550 | $498,257 |

| Lewis | $766,550 | $498,257 |

| Lincoln | $766,550 | $498,257 |

| Livingston | $766,550 | $498,257 |

| Logan | $766,550 | $498,257 |

| Lyon | $766,550 | $498,257 |

| Mccracken | $766,550 | $498,257 |

| Mccreary | $766,550 | $498,257 |

| Mclean | $766,550 | $498,257 |

| Madison | $766,550 | $498,257 |

| Magoffin | $766,550 | $498,257 |

| Marion | $766,550 | $498,257 |

| Marshall | $766,550 | $498,257 |

| Martin | $766,550 | $498,257 |

| Mason | $766,550 | $498,257 |

| Meade | $766,550 | $498,257 |

| Menifee | $766,550 | $498,257 |

| Mercer | $766,550 | $498,257 |

| Metcalfe | $766,550 | $498,257 |

| Monroe | $766,550 | $498,257 |

| Montgomery | $766,550 | $498,257 |

| Morgan | $766,550 | $498,257 |

| Muhlenberg | $766,550 | $498,257 |

| Nelson | $766,550 | $498,257 |

| Nicholas | $766,550 | $498,257 |

| Ohio | $766,550 | $498,257 |

| Oldham | $766,550 | $498,257 |

| Owen | $766,550 | $498,257 |

| Owsley | $766,550 | $498,257 |

| Pendleton | $766,550 | $498,257 |

| Perry | $766,550 | $498,257 |

| Pike | $766,550 | $498,257 |

| Powell | $766,550 | $498,257 |

| Pulaski | $766,550 | $498,257 |

| Robertson | $766,550 | $498,257 |

| Rockcastle | $766,550 | $498,257 |

| Rowan | $766,550 | $498,257 |

| Russell | $766,550 | $498,257 |

| Scott | $766,550 | $498,257 |

| Shelby | $766,550 | $498,257 |

| Simpson | $766,550 | $498,257 |

| Spencer | $766,550 | $498,257 |

| Taylor | $766,550 | $498,257 |

| Todd | $766,550 | $498,257 |

| Trigg | $766,550 | $498,257 |

| Trimble | $766,550 | $498,257 |

| Union | $766,550 | $498,257 |

| Warren | $766,550 | $498,257 |

| Washington | $766,550 | $498,257 |

| Wayne | $766,550 | $498,257 |

| Webster | $766,550 | $498,257 |

| Whitley | $766,550 | $498,257 |

| Wolfe | $766,550 | $498,257 |

| Woodford | $766,550 | $498,257 |

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

Labels:

2024 Kentucky FHA and Fannie Mae Loan Limits,

2024 Loan Limits for Kentucky VA and Kentucky FHA Loans,

FHA

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: USDA Rural Housing Kentucky Loan Information

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: USDA Rural Housing Kentucky Loan Information: A Kentucky USDA home loan is a zero-dollar-down mortgage option provided by USDA’s Department of Rural Development. This government-...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

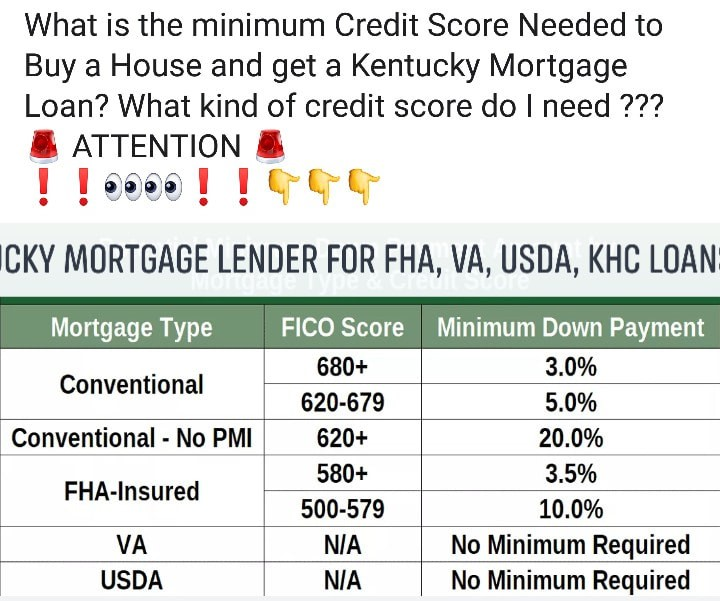

Credit Scores Required for Kentucky Mortgage Loan Approvals for FHA, VA, USDA and Kentucky

Credit Scores Required for Kentucky Mortgage Loan Approvals for FHA, VA, USDA and Kentucky

Can you get a Kentucky mortgage loan with bad credit in 2023?

Bad Credit and Getting Approved for A Mortgage Loan in Kentucky

First of all, when we consider what is bad credit, we must look at two things:

1. Credit Score

Credit scores go from 300 to 800 on the FICO scale. The higher the score, the better the chances of getting approved. Most borrowers fall in the 500 to 700 range on most credit pulls.

A good rule of thumb, to get the very best rates, you will need a 760 Fico score or higher. Now that doesn't mean you have to have that high of score to get approved, just to get the best rates and pricing.

In order to get approved for most homes loans nowadays that are sold to FHA, VA, USDA, Fannie Mae and Kentucky Housing, you will need to have a 620 credit score for most programs, with FHA, USDA, and VA going below that threshold.

You have three credit scores from Experian, Transunion and Equifax. Lenders will throw out the high and low score to get your qualifying score.

For example, if you have a 598 Experian score, a 609 Equifax score, and a 603 Transunion score, then your qualifying scour would be 603.

If your scores are in the lower range, say below 680, they're still numerous home loan programs in Kentucky where you can get approved for a mortgage loan and get a very good fixed rate for 30 years.

On FHA loans in Kentucky, FHA will go down to a 500 minimum credit score with at least 10% down payment or 10% equity on a refinance.

If your scores is over 580, then you could use a FHA loan in Kentucky to with just 3.5% down payment or refinance with that much equity.

If it turns out that you have a 620 credit score or higher, you can look at doing an Conventional loan with just 3 to 5% down payment. Typically on conventional loans if your score is below 660, you would need 5% down payment.

If you happen to be a Veteran and qualify for a Kentucky VA loan, you could possibly get approved for a VA loan with no minimum credit score.

In reality, it is very difficult to get for a VA loan with a score below 560 to 580 range, with most VA lenders requiring a 620 credit score.

If you are looking to purchase a home in a rural area, you can look at doing a Kentucky USDA loan because they have no minimum credit score but most lenders will want a 620 to 640 credit score.

Popular Kentucky Home Loan Programs below:

Conventional Loan

• At least 3%-5% down

• Closing costs will vary on which rate you choose and the lender. Typically the higher the rate, the lesser closing costs due to the lender giving you a lender credit back at closing for over par pricing. Also, called a no-closing costs option. You have to weigh the pros and cons to see if it makes sense to forgo the lower rate and lower monthly payment for the higher rate and less closing costs.

Fico scores needed start at 620, but most conventional lenders will want a higher score to qualify for the 3-5% minimum down payment requirements Most buyers using this loan have high credit scores (over 720) and at least 5% down.

The rates are a little higher compared to FHA, VA, or USDA loan but the mortgage insurance is not for life of loan and can be rolled off when you reach 80% equity position in home.

Conventional loans require 4-7 years removed from Bankruptcy and foreclosure.

• Closing costs will vary on which rate you choose and the lender. Typically the higher the rate, the lesser closing costs due to the lender giving you a lender credit back at closing for over par pricing. Also, called a no-closing costs option. You have to weigh the pros and cons to see if it makes sense to forgo the lower rate and lower monthly payment for the higher rate and less closing costs.

Fico scores needed start at 620, but most conventional lenders will want a higher score to qualify for the 3-5% minimum down payment requirements Most buyers using this loan have high credit scores (over 720) and at least 5% down.

The rates are a little higher compared to FHA, VA, or USDA loan but the mortgage insurance is not for life of loan and can be rolled off when you reach 80% equity position in home.

Conventional loans require 4-7 years removed from Bankruptcy and foreclosure.

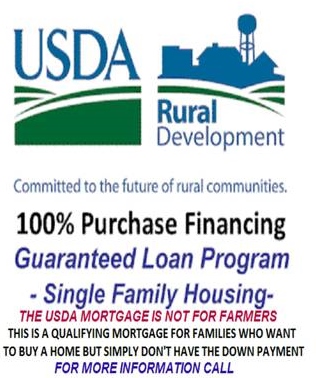

Kentucky USDA Rural Housing Program

If you meet income eligibility requirements and are looking to settle in a rural area, you might qualify for the KY USDA Rural Housing program. The program guarantees qualifying loans, reducing lenders’ risk and encouraging them to offer buyers 100% loans. That means Kentucky home buyers don’t have to put any money down, and even the “upfront fee” (a closing cost for this type of loan) can be rolled into the financing.

Fico scores usually wanted for this program center around 620 range, with most lenders wanting a 640 score so they can obtain an automated approval through GUS. GUS stands for the Guaranteed Underwriting system, and it will dictate your max loan pre-approval based on your income, credit scores, debt to income ratio and assets.

They also allow for a manual underwrite, which states that the max house payment ratios are set at 29% and 41% respectively of your income.

They loan requires no down payment, and the current mortgage insurance is 1% upfront, called a funding fee, and .35% annually for the monthly mi payment. Since they recently reduced their mi requirements, USDA is one of the best options out there for home buyers looking to buy in an rural area.

A rural area typically will be any area outside the major cities of Louisville, Lexington, Paducah, Bowling Green, Richmond, Frankfort, and parts of Northern Kentucky .

There is a map link below to see the qualifying areas.

USDA requires 3 years removed from bankruptcy and foreclosure.

There is no max USDA loan limit.

Kentucky FHA Loan

FHA loans are good for home buyers with lower credit scores and no much down, or with down payment assistance grants. FHA will allow for grants, gifts, for their 3.5% minimum investment and will go down to a 580 credit score.

The current mortgage insurance requirements are kind of steep when compared to USDA, VA , but the rates are usually good so it can counteracts the high mi premiums.

As I tell borrowers, you will not have the loan for 30 years, so don’t worry too much about the mi premiums.

The mi premiums are for life of loan like USDA.

FHA requires 2 years removed from bankruptcy and 3 years removed from foreclosure.

Kentucky VA Loan

VA loans are for veterans and active duty military personnel. The loan requires no down payment and no monthly mi premiums, saving you on the monthly payment. It does have an funding fee like USDA, but it is higher starting at 2.3% for first time use, and 3.6% for second time use. The funding fee is financed into the loan, so it is not something you have to pay upfront out of pocket.

VA loans can be made anywhere, unlike the USDA restrictions, and there is no income household limit.

VA loans can be made anywhere, unlike the USDA restrictions, and there is no income household limit.

Most VA lenders I work with will want a 580 credit score even though on paper, VA says they don't have a minimum credit score.

VA requires 2 years removed from bankruptcy or foreclosure.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: What is the minimum Credit Score Needed to Buy a H...

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: What is the minimum Credit Score Needed to Buy a H...: Credit Score Needed to Buy a House and get a Kentucky Mortgage? Conventional Loan • At least 3%-5% down• Closing costs will vary on which r...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky USDA Rural Housing Mortgage Lender: USDA APPRAISAL REQUIREMENTS FOR KENTUCKY MORTGAGE ...

Kentucky USDA Rural Housing Mortgage Lender: USDA APPRAISAL REQUIREMENTS FOR KENTUCKY MORTGAGE ...: -- Kentucky USDA appraisals can take home buyers by surprise. That’s why we've put together some good-to-know info about the process...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Subscribe to:

Posts (Atom)