Mortgage credit history for any mortgage which the borrower is obligated as borrower, co-borrower, or co-signer may be

considered acceptable if it meets one of the following:

The borrower has made all payments due on time, prior to subject loan Note date, even though the loan was in

forbearance, or

The borrower has not made one or more payments due, and the late payments or forbearance has been resolved

per one of these acceptable resolution plans:

Resolution Plans* Eligibility Requirements

Reinstatement ▪ Any missed payments must be made

▪ Funds to reinstate after application must be documented from eligible source

▪ Funds from the current transaction may not be used to reinstate mortgage

Repayment Plan ▪ Must have made 3 timely** payments under the repayment plan, or

▪ Repayment plan has been completed

▪ Funds from the current transaction may satisfy the existing mortgage in full

Payment Deferral ▪ Must have made 3 timely** payments after executing the deferral agreement

▪ Funds from the current transaction may satisfy the existing mortgage in full

Modification ▪ Must have made 3 timely** payments under trial modification

▪ Funds from the current transaction may satisfy the existing mortgage in full

Any Other Loss Mitigation Option ▪ Must have completed successfully or made a minimum of 3 timely payments

▪ Funds from the current transaction may satisfy the existing mortgage in full

*If loan was in forbearance, provide documentation from servicer showing the exit from forbearance into one of the

acceptable resolution plans.

** Payments cannot be made in advance to meet the 3 required payments.

For purposes of determining acceptable mortgage payment history, missed payments under a COVID-19 forbearance

are not considered late payments.

The above guidance does not apply to Freddie Mac Enhanced Refinance or Fannie Mae High LTV Refinance

transactions.

VA ELIGIBILITY

Borrowers must provide a Letter of Explanation (LOE) stating the circumstances behind the forbearance.

Documentation will be required to verify the items listed in the LOE have been resolved.

If the forbearance was on a non-subject property, the forbearance must be resolved, and new payment (if

applicable) must be included in the DTI.

A Veteran who was granted a forbearance and continues to make payments as agreed under the terms of original

note is not considered delinquent or late and will be treated as if not in forbearance status, provided that the

forbearance plan is terminated prior to closing.

Cash-Out Refinances

Refinance of mortgages that are in a current forbearance status, where mortgage payments are not being made,

including mortgages under the CARES Act forbearance protection program, are not eligible. The forbearance plan

must be completed/terminated prior to closing.

Borrower in forbearance with missed payments- Borrower must have made 6 consecutive months’ timely payments

post-forbearance, regardless of method of resolution of the forbearance.

Missed payments due to COVID-19 forbearance cannot count toward seasoning. Borrower must have made six

consecutive monthly payments prior to the CARES Act forbearance or six consecutive payments will be required post

forbearance. In addition, loans that have been modified must meet seasoning requirements based on the modified

note first payment date. The new note date must be on or after the later of: The date that is 210 days after the date

on which the first modified monthly payment was due on the mortgage being refinanced, and the date on which 6

modified payments have been made on the mortgage being refinanced.

IRRRL Refinances

Borrowers must be current at time of application (any skipped payments under a COVID-19 forbearance have since

been made).

Borrower in forbearance with no missed payments- standard underwriting applies.

Borrower in forbearance with missed payments- Borrower must have made 6 consecutive months’ timely payments

post-forbearance.

Loans must still meet loan seasoning, fee recoupment, discount points, and net tangible benefit requirements.

Missed payments due to COVID-19 forbearance cannot count toward seasoning. Borrower must have made six

consecutive monthly payments prior to the CARES Act forbearance or will need to make six consecutive payments

post forbearance. In addition, loans that have been modified must meet seasoning requirements based on the

modified note first payment date. The new note date must be on or after the later of: The date that is 210 days after

the date on which the first modified monthly payment was due on the mortgage being refinanced, and the date on

which 6 modified payments have been made on the mortgage being refinanced.

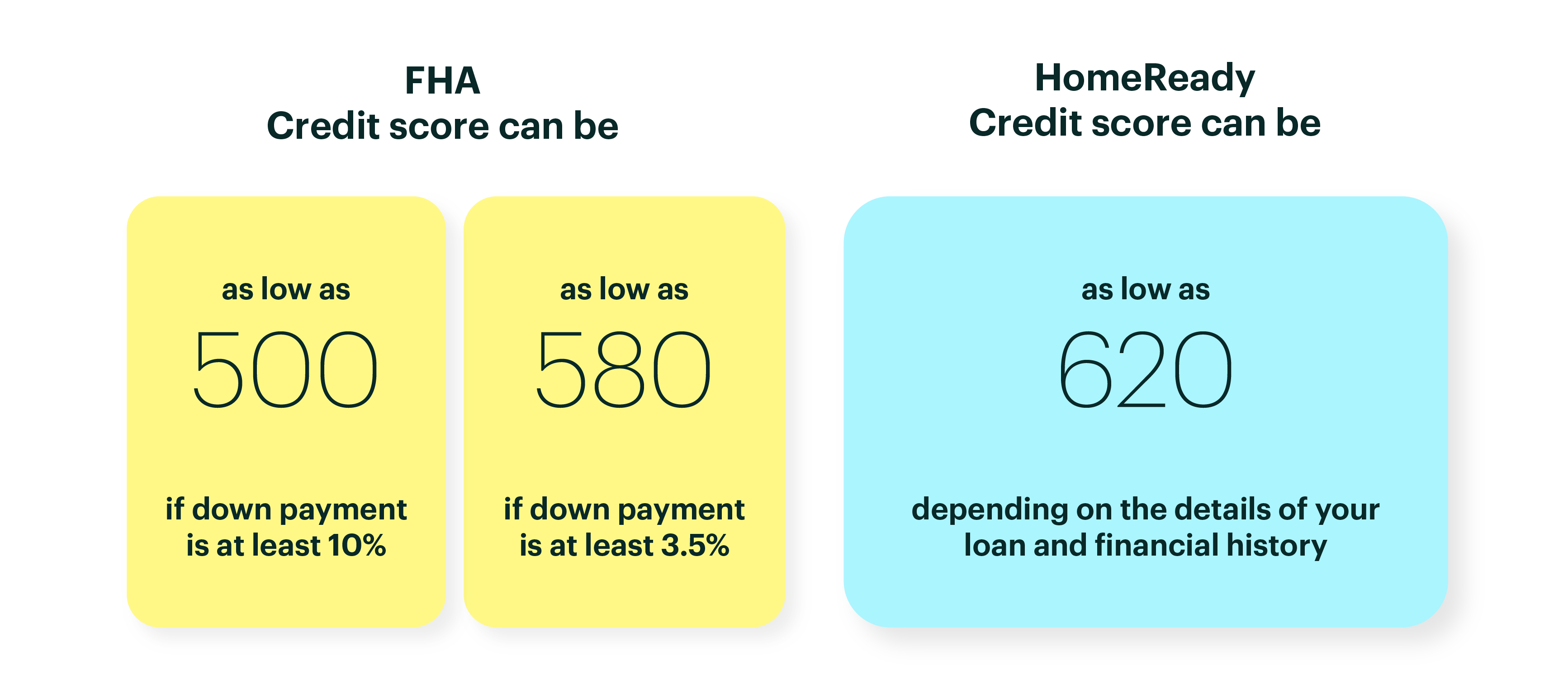

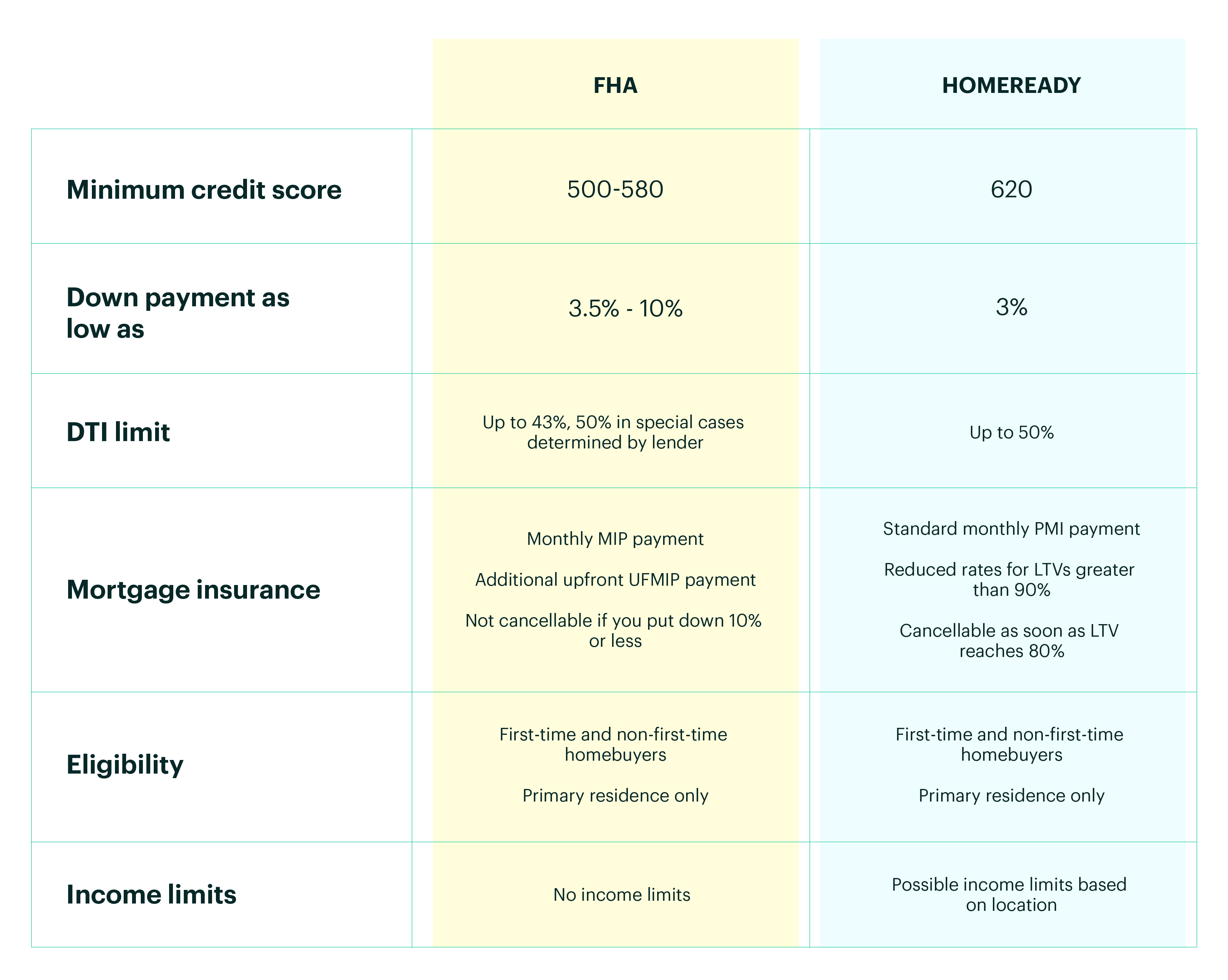

FHA ELIGIBILITY

*NOTE: FHA Guidance is permanent, not temporary, and applies where a Forbearance Plan was granted due to COVID-19, Presidentially Declared major

disaster or other hardship. This new guidance has been included in the updated 4000.1 Handbook.

Payment

History

Documentation

When any mortgage reflects payments under a Modification or Forbearance Plan within 12 months prior to case number

assignment, obtain:

Copy of Modification or Forbearance Plan* and

Evidence the payment amount and the date of payments during the agreement

* A copy of Forbearance Plan due to the COVID-19 National Emergency is not required. Must be able to determine the reason for

forbearance.

Borrowers that are or were in Forbearance

Maximum base loan amount for a Streamline of an owner-occupied primary residence and HUD-approved second home is

the lesser of:

The outstanding principal balance of the existing mortgage (including suspended payments from forbearance) as of

the month prior to mortgage disbursement; plus:

o Interest due on the existing mortgage

o Late charges and escrow shortages

o MIP due on existing mortgage; or

The original principal balance of the existing mortgage (including financed UFMIP)

Less any refund of UFMIP

New FHA Insured Mortgage Eligibility

Any active forbearance plan must be terminated.

Borrowers granted forbearance but who continued to make all payments as agreed under the terms of original Note

are not considered delinquent. No additional payment seasoning post forbearance required.

Borrowers granted forbearance but who did not continue to make payments require additional mortgage payment

seasoning post-forbearance that document satisfactory, consecutive monthly payments. See chart below for details:

Transaction Additional Requirements

Purchase Must make three consecutive payments* post-forbearance or

▪ If home sold prior to making three payments, must be manually underwritten

Cash-Out Refinance Must make 12 consecutive payments* post-forbearance

GNMA Seasoning: Loans that have been modified must meet seasoning

requirements based on the modified note first payment date.

No Cash Out Refinance Must make three consecutive payments* post-forbearance (six payments if

mortgage was modified after forbearance)

Simple Refinance Must make three consecutive payments* post-forbearance

*NOTE: The consecutive payments must be documented on the credit report and read by AUS to follow AUS approval.

Streamline Refinance Missed payments under forbearance do not count toward mortgage

seasoning requirements

If mortgage modified after forbearance, six payments under

modification required.

Non-Credit Qualifying

At time of case number assignment, borrower has made three post

forbearance payments.

Credit Qualifying

At time of case number assignment, borrower is still in mortgage

payment forbearance or has made less than three monthly payments,

and

Has made all mortgage payments due within the month due for the six

months prior to forbearance

***ALL Streamlines: GNMA Seasoning: Loans that have been modified must

meet seasoning requirements based on the modified note first payment date.

References FHA Mortgagee Letter 2020-30:

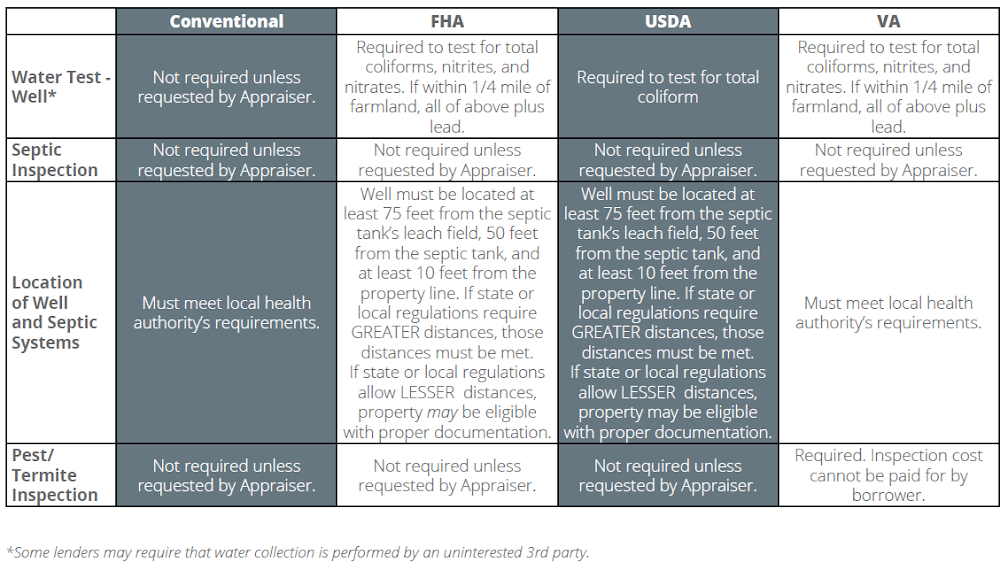

USDA ELIGIBILITY

For each open mortgage, confirm the forbearance status and payment history.

Borrowers who have a current mortgage that was placed in COVID-19 forbearance, but continued to make all

payments as scheduled, are not subject to additional seasoning.

Purchases: Borrowers who missed any payments as allowed under the forbearance plan must have resumed

repayment of their mortgage loan for a period of at least 3 months prior to applying for a new loan.

Refinances: the loan must have closed at least 12 months prior to the request to refinance, borrower must have

resumed making payments for a period of at least 3 months and have a total 180-day period of satisfactory

payments, excluding the time the loan was in forbearance.

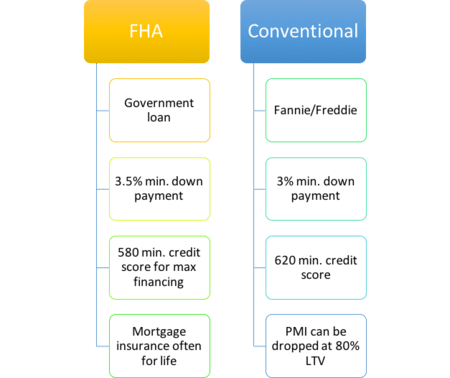

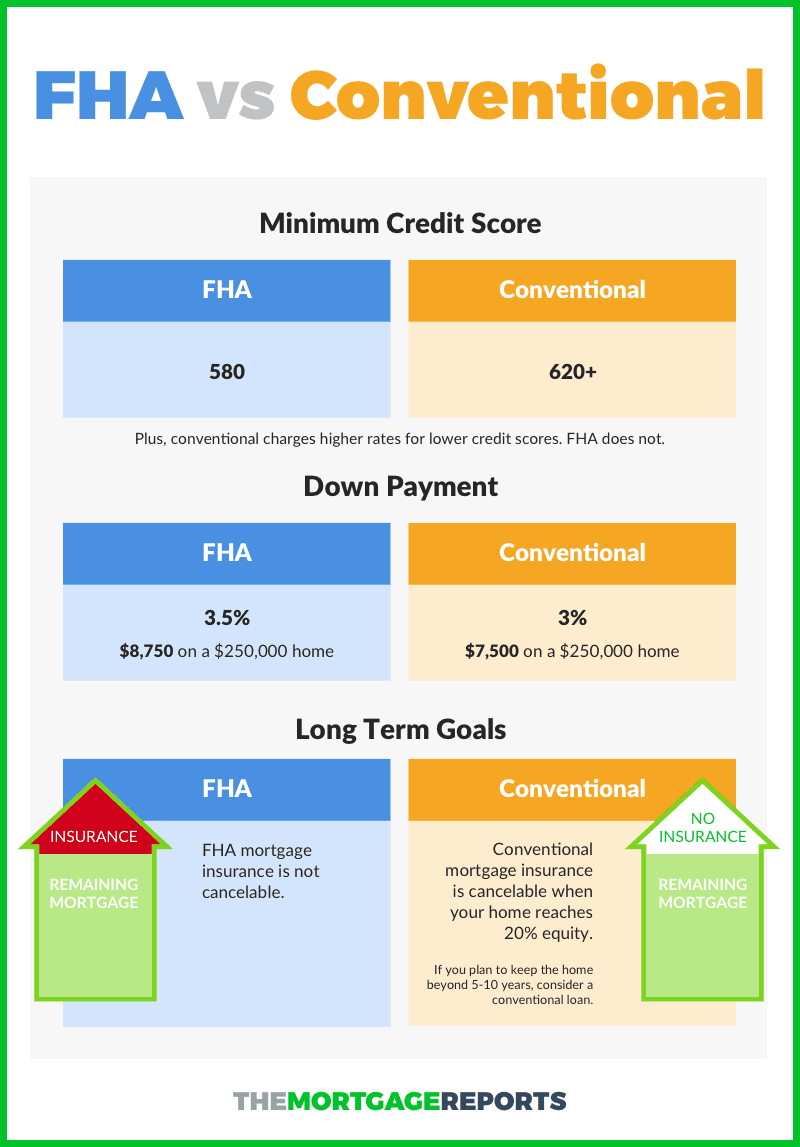

Down payments as low as 3%

Down payments as low as 3% No upfront mortgage insurance premium

No upfront mortgage insurance premium Monthly mortgage insurance that automatically falls off once the home has been paid down to 78% of the home’s value

Monthly mortgage insurance that automatically falls off once the home has been paid down to 78% of the home’s value The ability to choose between an adjustable-rate or fixed-rate mortgage with different term lengths

The ability to choose between an adjustable-rate or fixed-rate mortgage with different term lengths Use on different property types, including primary residences, second homes, and investment properties

Use on different property types, including primary residences, second homes, and investment properties