I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2025

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Down Payment Assistance Kentucky 2025 Kentucky Housing Corporation KHC

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score For Mortgage Loan Approval

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky Mortgage Loan

- Testimonials

- Mortgage Calculator

- Kentucky USDA Rural Development Housing Loan

- Legal / Privacy Policy / Accessibility Statements

- About Me and this website

100% Financing Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers: Common Kentucky Mortgage Myths Busted!My credit sc...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

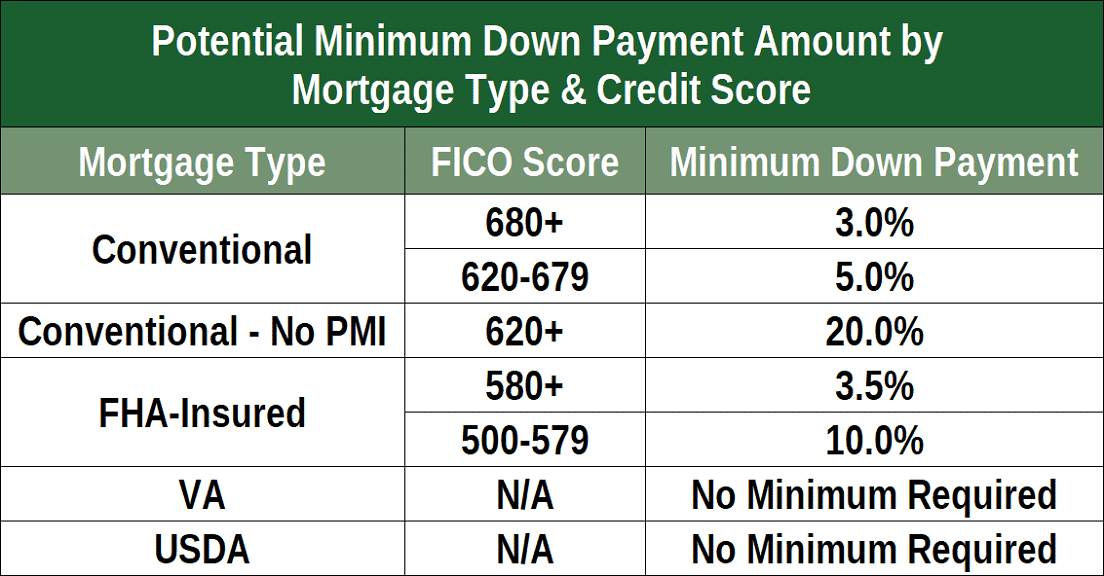

Homeownership doesn’t mean you need perfect credit. Some people can buy a home with a 620 credit score.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

About FICO® Scores

About FICO® Scores

What is a credit score?

What is a credit score?

A credit score is a number that summarizes your credit risk to lenders, or the likelihood that you’ll pay the lender back the amount you borrowed plus interest. The score is based on a snapshot of your credit report(s) at one of the three major credit bureaus—Equifax®, Experian®, and TransUnion®—at a particular point in time, and helps lenders evaluate your credit risk. Your credit score can influence the credit that’s available to you and the terms, such as interest rate, that lenders offer you.

What is a credit bureau?

What is a credit bureau?

A credit bureau, also known as a consumer reporting agency, collects and stores individual credit information and provides it to creditors so they can make decisions on granting loans and other credit activities. Typical clients include banks, mortgage lenders, and credit card issuers. The three largest credit bureaus in the U.S. are Equifax®, Experian®, and TransUnion®.

What are FICO® Scores?

What are FICO® Scores?

FICO® Scores are the most widely used credit scores and are used in over 90% of U.S. lending decisions. Your FICO® Scores (you have more than one) are based on the data generated from your credit reports at the three major credit bureaus, Experian®, TransUnion® and Equifax®. Each of your FICO® Scores is a three-digit number summarizing your credit risk, that predicts how likely you are to pay back your credit obligations as agreed.

What it the highest credit score?

What it the highest credit score?

Most credit scoring models follow a credit score range of 300 to 850 with that 850 being the highest score you can have. However, there can be other ranges for different models, some of which are customized for a particular industry (credit card, auto lending, or insurance for example). While the majority follow the 300 to 850 range, there are some scores (e.g., FICO® Bankcard Score) that range from 250 to 900 and others that may use other score ranges. For more information on the different scoring models, view Understanding the difference between credit scores.

Why do FICO® Scores fluctuate?

Why do FICO® Scores fluctuate?

There are many reasons why your score may change. The information on your credit report changes each time lenders report new activity to the credit bureau. So, as the information in your credit report at that bureau changes, your FICO® Scores may also change. Keep in mind that certain events such as late payments or bankruptcy can lower your FICO® Scores quickly.

FICO® Scores consider five main categories of information in your credit report.

- Your payment history

- The amount of money you currently owe

- The length of your credit history

- New credit accounts

- Types of credit in use

What are the minimum requirements to produce a FICO® Score?

What are the minimum requirements to produce a FICO® Score?

In order for a FICO® Score to be calculated, a credit report must contain these minimum requirements:

- At least one account that has been open for six months or more.

- At least one account that has been reported to the credit reporting agency within the past six months.

- No indication of deceased on the credit report (Please note: if you share an account with another person and the other account holder is reported deceased, it is important to check your credit report to make sure you are not impacted).

Does a FICO® Score alone determine whether I get credit?

Does a FICO® Score alone determine whether I get credit?

No. Most lenders use a number of factors to make credit decisions, including a FICO® Score. Lenders may look at information such as the amount of debt you are able to handle reasonably given your income, your employment history, and your credit history. Based on their review of this information, as well as their specific underwriting policies, lenders may extend credit to you even with a low FICO® Score, or decline your request for credit even with a high FICO® Score.

How long will negative information remain on my credit reports?

How long will negative information remain on my credit reports?

It depends on the type of negative information. Here’s the basic breakdown of how long different types of negative information will remain on your credit reports:

- Late payments: 7 years from the original delinquency date.

- Chapter 7 bankruptcies: 10 years from the filing date.

- Chapter 13 bankruptcies: 7 years from the filing date.

- Collection accounts: 7 years from the original delinquency date of the account

- Public Record: Generally 7 years

Keep in Mind: For all of these negative items, the older they are the less impact they will have on your FICO® Scores. For example, a collection that is 5 years old will hurt much less than a collection that is 5 months old.

Are FICO® Scores unfair to minorities?

Are FICO® Scores unfair to minorities?

No. FICO® Scores do not consider your gender, race, nationality or marital status. In fact, the Equal Credit Opportunity Act prohibits lenders from considering this type of information when issuing credit. Independent research has shown that FICO® Scores are not unfair to minorities or people with little credit history. FICO® Scores have proven to be an accurate and consistent measure of repayment for all people who have some credit history. In other words, at a given FICO® Score, non-minority and minority applicants are equally likely to pay as agreed.

How are FICO® Scores calculated for married couples?

How are FICO® Scores calculated for married couples?

Married couples don’t share joint FICO® Scores; each person has their own individual credit report, which is used to calculate FICO® Scores, and isn’t impacted by their spouse’s credit history. However, married couples should be mindful of the potential impact of opening joint credit accounts. For example, if you get a new credit card in both spouses’ names, and there is a late payment on that account, the late payment will impact both individuals’ FICO® Scores.

How can I access my credit report?

How can I access my credit report?

By federal law, you are entitled to one free credit report every 12 months from each credit reporting company, TransUnion®, Equifax®, and Experian®. Find them at annualcreditreport.com. Take advantage of this service annually to ensure the information on your credit report is current and accurate.

Impacts to FICO® Scores

Will closing a credit card account impact my FICO® Score?

Will closing a credit card account impact my FICO® Score?

It is possible that closing a credit account may have a negative impact depending on a few factors. FICO® Scores may consider your “credit utilization rate”, which looks at your total used credit in relation to your total available credit. Essentially, it measures how much of your available credit you are actually using. The more of your credit that you use, the higher your utilization rate and high credit utilization rates may negatively impact your FICO® Score. Before you close any credit card account, Wells Fargo recommends that you should first consider whether you really need to close the account or if your real intention is just to stop using that credit card. If you really just want to stop using that card, it may make sense if you stop using the card and put it somewhere for safe keeping in case of an emergency. It’s also important to note that length of your credit history accounts for 15% of your FICO® Score calculation. Therefore, having credit card accounts that are open and in good standing for a long time may affect your FICO® Score.

How does refinancing impact my FICO® Score?

How does refinancing impact my FICO® Score?

Refinancing and loan modifications may affect your FICO® Scores in a few areas. How much these affect the score depends on whether it’s reported to the consumer reporting agencies as the same loan with changes or as an entirely new loan. There are many reasons why a score may change. FICO® Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%) and credit mix (10%). If a refinanced loan or modified loan is reported as the same loan with changes, two pieces of information associated with the loan modification may affect your score: the new credit inquiry and changes to the amounts owed. If a refinanced loan or modified loan is reported as a “new” loan, your score could still be affected by the new credit inquiry and an increase in amounts owed,— along with the additional impact of a new “open date” which may affect the credit history category. In the end, a new or recent open date typically indicates that it is a new credit obligation and, as a result, may impact the score more than if the terms of the existing loan are simply changed.

How do FICO® Scores consider loan shopping?

How do FICO® Scores consider loan shopping?

In general, if you are “loan shopping” - meaning that you are applying for the same type of loan with similar amounts with multiple lenders in a short period of time - your FICO® Score will consider your “shopping” as a single credit inquiry on your score if the shopping occurs within a short time period (30 to 45 day) depending on which FICO® Score version is used by your lenders.

What are the different categories of late payments and do they impact FICO® Scores?

What are the different categories of late payments and do they impact FICO® Scores?

A history of payments is the largest factor in FICO® Scores. FICO® Scores consider late payments in these general areas; how recent the late payments are, how severe the late payments are, and how frequently the late payments occur. So this means that a recent late payment could be more damaging to a FICO® Score than a number of late payments that happened a long time ago. Late payments are listed on credit reports by how late the payments are. Typically, creditors report late payments in one of these categories: 30-days late, 60-days late, 90-days late, 120-days late, 150-days late, or charge off (written off as a loss because of severe delinquency). Of course a 90-day late is worse than a 30-day late, but the important thing to understand is that people who continually pay their bills on time tend to appear less risky to lenders. However, for people who continue not to pay debt, and their creditor either charges it off or sends it to a collection agency, it is considered a significant event with regard to a score and will likely have a severe negative impact.

How does a bankruptcy impact my FICO® Score?

How does a bankruptcy impact my FICO® Score?

A bankruptcy is considered a very negative event by FICO® Scores. As long as the bankruptcy is listed on your credit report, it will be factored into your scores. How much of an impact it will have on your score will depend on your entire credit profile. As the bankruptcy item ages, its impact on a FICO® Score gradually decreases. Typically, here is how long you can expect bankruptcies to remain on your credit reports (from the date filed):

- Chapter 11 and 7 bankruptcies up to 10 years.

- Completed Chapter 13 bankruptcies up to 7 years.

These dates and time periods refer to the public record item associated with filing for bankruptcy. All of the individual accounts included in the bankruptcy should be removed from your credit reports after 7 years.

How do public records and judgments impact FICO® Scores?

How do public records and judgments impact FICO® Scores?

Public records are legal documents created and maintained by Federal and local governments, which are usually accessible to the public. Some public records, such as divorces, are not considered by FICO® Scores, but adverse public records, which include bankruptcies, are considered by FICO® Scores. FICO® Scores may be affected by the mere presence of an adverse public record, whether paid or not. Adverse public records will have less effect on a FICO® Score as time passes, but they can remain in your credit reports for up to ten years based on what type of public record it is.

What are inquiries and how do they impact FICO® Scores?

What are inquiries and how do they impact FICO® Scores?

Inquiries may or may not affect FICO® Scores. Credit inquiries are classified as either “hard inquiries” or “soft inquiries”—only hard inquiries have an effect on FICO® Scores.

Soft inquiries are all credit inquiries where your credit is NOT being reviewed by a prospective lender. FICO® Scores do not take into account any involuntary (soft) inquiries made by businesses with which you did not apply for credit, inquiries from employers, or your own requests to see your credit report. Soft inquiries also include inquiries from businesses checking your credit to offer you goods or services (such as promotional offers by credit card companies) and credit checks from businesses with which you already have a credit account. If you are receiving FICO® Scores for free from a business with which you already have a credit account, there is no additional inquiry made on your credit report. FICO® Scores take into account only voluntary (hard) inquiries that result from your application for credit. Hard inquiries include credit checks when you’ve applied for an auto loan, mortgage, credit card or other types of loans. Each of these types of credit checks count as a single inquiry. Inquiries may have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk.

How does applying for new credit impact my FICO® Score?

How does applying for new credit impact my FICO® Score?

Applying for new credit only accounts for about 10% of a FICO® Score. Exactly how much applying for new credit affects your score depends on your overall credit profile and what else is already in your credit reports. For example, applying for new credit may have a greater impact on your FICO® Scores if you only have a few accounts or a short credit history. That said, there are definitely a few things to be aware of depending on the type of credit you are applying for. When you apply for credit, a credit check or “inquiry” can be requested to check your credit standing.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Credit Scores FHA Loans Louisville Kentucky KHC First Time Home Buyer Credit Score

What is the minimum Credit Score Needed to Buy a House and get a Kentucky Mortgage Loan?

• At least 3%-5% down• Closing costs will vary on which rate you choose and the lender. Typically the higher the rate, the lesser closing costs due to the lender giving you a lender credit back at closing for over par pricing. Also, called a no-closing costs option. You have to weigh the pros and cons to see if it makes sense to forgo the lower rate and lower monthly payment for the higher rate and less closing costs.

Fico scores needed start at 620, but most conventional lenders will want a higher score to qualify for the 3-5% minimum down payment requirements Most buyers using this loan have high credit scores (over 720) and at least 5% down.

The rates are a little higher compared to FHA, VA, or USDA loan but the mortgage insurance is not for life of loan and can be rolled off when you reach 80% equity position in home.Conventional loans require 4-7 years removed from Bankruptcy and foreclosure.Max Conventional loan limits are set at $510,400 for 2020 in Kentucky

If you meet income eligibility requirements and are looking to settle in a rural area, you might qualify for the KY USDA Rural Housing program. The program guarantees qualifying loans, reducing lenders’ risk and encouraging them to offer buyers 100% loans. That means Kentucky home buyers don’t have to put any money down, and even the “upfront fee” (a closing cost for this type of loan) can be rolled into the financing.

They loan requires no down payment, and the current mortgage insurance is 1% upfront, called a funding fee, and .35% annually for the monthly mi payment. Since they recently reduced their mi requirements, USDA is one of the best options out there for home buyers looking to buy in an rural area

A rural area typically will be any area outside the major cities of Louisville, Lexington, Paducah, Bowling Green, Richmond, Frankfort, and parts of Northern Kentucky .There is a map link below to see the qualifying areas.

VA requires 2 years removed from bankruptcy or foreclosure

Senior Loan Officer

Text/call 502-905-3708

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant's eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant

Equal Opportunity Lender. NMLS#57916

http://www.

Estimated Sale Price: $110,000

• Rate - 3.75%

• APR - 4.854%

• Down payment - $3850.00

• Principal & Interest - $500.20

• Insurance (estimated) - $75

• Taxes - $47.92

• PMI - $74.56

TOTAL PAYMENT INCLUDING

TAXES + INSURANCE:

$697.68 a month!

*Rates effective 01/16/2020, based on 740 FICO score and subject to change. ARP may vary. Loan terms are fixed rate 30 year loans and payment will not rise over the life of the loan. Not all applicants will qualify for advertised terms and conditions, must meet underwriting guidelines and are subject to credit review and approval. This does not constitute a commitment to lend. The disclosed rates, payments, homeowners insurance and mortgage insurance are estimates and may vary according to lender guidelines. Property taxes based on current assessed value with homestead and mortgage exemptions in place. Equal Housing Lender.

Equal Opportunity Lender. NMLS#57916

• Rate - 3.75%

• APR - 4.854%

• Down payment - $3850.00

• Principal & Interest - $500.20

• Insurance (estimated) - $75

• Taxes - $47.92

• PMI - $74.56

TAXES + INSURANCE:

$697.68 a month!

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Credit Score Information for KY Home buyers

Credit Score Information for KY Home buyers

What Types of Credit Pulls Really Harm My Score?

- It is true that some inquiries can potentially harm your credit. Hard inquiries, like a lender pulling your credit report, could affect your score. But soft inquiries, like checking your own credit score, will not.For example: If you apply for numerous credit cards, then it will probably negatively impact your credit score. But if you have multiple credit pulls from mortgage companies, student loan providers, or auto lenders because you are rate shopping, then there might be a less substantial impact on your score because rate shopping doesn’t indicate an elevated credit risk — as long as multiple inquires occur within a small window of time (usually between 14 and 45 days).

Should I Close Paid-Off Credit Cards?

Is 30% the Magic Number for Credit Card Utilization?

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Credit Score Information for Kentucky Mortgage Loan Approvals

Credit Score Knowledge Quiz Information for Kentucky Mortgage Loans

Question 01

A credit score is:

- a. A three-digit number summarizing the state of your credit

- b. An alphabetical score grading your creditworthiness

- c. A numerical score reporting how much money you owe

CORRECTThe major credit reporting bureaus might report slightly different scores, but all three use a three-digit number to summarize the state of your credit. A credit score is a number that summarizes the historical credit information on a credit report. The number reflects the likelihood that you will become delinquent on a loan or a credit obligation in the future.Question 02

What is the number-one contributing factor to a good credit score?

- a. Length of credit history

- b. Amounts you owe

- c. Payment history

CORRECTPaying bills on time is generally the single most important contributor to a good credit score. Being late on any bill, for any length of time, is a possible indication of future nonpayment of debt and is almost always viewed negatively by lenders. Any late payments will remain on your credit report for up to seven years.Question 03

Does each consumer have just ONE generic credit score?

- a. Yes

- b. No

- c. Don't Know

CORRECTThe answer is "no." Most Americans have many generic scores reflecting the use of the scoring system and the source of the credit report—Experian, Equifax, or TransUnion. One of the most common myths about credit scores is that there is only one credit score. Web sites or financial advisers who claim there is only one "real" credit score either are misinformed or are being misleading. In fact, there are many different credit scores used by lenders (according to some estimates, more than 1,000), although some scores are used more than others. While there are many credit scores on the market, VantageScore® is the first credit score developed jointly by Experian and the other national credit reporting companies, TransUnion and Equifax.Question 04

Your credit score affects?

- a. Whether you can get a loan

- b. Your interest rate

- c. Both A and B

CORRECTIn addition to using your credit score to help decide whether it's a good idea to give you money, lenders use the score to determine your rate. In general, the better the score, the lower the rate – and the lower your payments.Question 05

Who collects the information on which credit scores are most frequently based?

- a. FICO and VantageScore

- b. Three main credit bureaus – Experian, Equifax, and TransUnion

- c. Individual lenders

- d. Federal government

CORRECTThe answer is the "three main credit bureaus," which collect information on the credit use of more than 200 million Americans and make it available in credit reports. FICO and VantageScore have developed the most popular scoring systems for using credit reports to compute credit scores.Question 06

Lenders look at credit scores when deciding whether to extend which type of credit?

- a. Credit cards

- b. Mortgages

- c. Loans

- d. All of the above

CORRECTBanks, credit card companies, auto dealers, retail stores and other lenders decide if you get your loan. Most businesses that issue credit or loans use credit scores to quickly summarize a consumer's credit history, saving the need to manually review an applicant's credit report and providing a better, faster decision. Although many additional factors are used in determining whether or not you receive the credit you applied for — such as an applicant's income versus the size of the loan — a credit score is a leading indicator of one's basic creditworthiness. Credit reporting agencies do not make lending decisions.Question 07

How important is it to check the accuracy of your credit reports at the three main credit bureaus?

- a. Very Important

- b. Somewhat Important

- c. Not Very Important

- d. No Big Deal

CORRECTThe correct answer is "very important." Lenders may have provided inaccurate information, or failed to add accurate information, about your payment history to your credit reports. And, since many consumers have similar names, even accurate information may have been added to the wrong file. Fortunately, a federal law requires the three main credit bureaus—Experian, Equifax, and TransUnion—to provide on request a free copy of your credit report once a year. An easy way to get these reports is to visit www.annualcreditreport.com or call 877-322-8228.Question 08

Which of the following actions helps a consumer raise a low score or maintain a high one?

- a. Make all loan payments on time

- b. Avoid opening several credit card accounts at the same time

- c. Use a credit card keeping the balance under 25% of the credit limit

- d. All of the above

CORRECTThe correct answer is "all of the above," though it takes much longer to raise a low score than lower a high one. For example, someone with a good score may lose 100 points if they miss payments on two credit cards. But they may gain only 50 of these points back by making all mortgage, car, and credit card payments on time for six months.Question 09

After paying off a high-interest credit card, you should:

- a. Continue using it occasionally

- b. Close the account

- c. Use the full amount of available credit every month

INCORRECTYou may be tempted to close old accounts you're not using, but that won't help your credit scores and may actually hurt them. It reduces the amount of your available credit, which can lead to lower scores.Question 10

Which of the following does a credit score MAINLY indicate?

- a. Knowledge of consumer credit

- b. Amount of consumer debt

- c. Risk of not repaying a loan

- d. Financial resources to pay back loans

CORRECTThe answer is "risk of not repaying a loan." The other factors may influence this risk, but it is the risk itself that a credit score tries to measure.Question 11

How long can negative items on your credit history impact your score?

- a. 1 year

- b. 3 years

- c. 5 years

- d. 7 years

CORRECTNegative items generally affect your score for up to seven years, but, as time goes by, their impact lessens. If you pay your bills, keep account balances low and don't open a lot of new accounts, your score can rebound surprisingly quickly.Question 12

Are missed payments a factor used to calculate a credit score?

- a. Yes

- b. No

- c. Maybe

CORRECTPaying bills on time is generally the single most important contributor to a good credit score. Being late on any bill, for any length of time, is a possible indication of future nonpayment of debt and is almost always viewed negatively by lenders. Any late payments will remain on your credit report for up to seven years.Question 13

Which of the following is NOT considered when calculating your FICO score?

- a. Your payment history

- b. The types of credit you are using

- c. The amount of debt you owe

- d. Your income

CORRECTYour FICO score consists of 35% Payment History, 30% Amounts Owed, 15% Length of Credit History, 10% New Credit, 10% Types of Credit used. Credit scores use information from three key areas of your credit report: account information (such as credit cards, auto loans, student loans, mortgages and rent), public records (such as tax liens or bankruptcies) and inquiries (requests by lenders to view your credit). Information such as race, gender, where you live and marital status are not used in credit scores.Question 14

Applying for credit cards in order to just receive a free sign-up gift (t-shirt, mugs, etc.) has no impact on my credit profile?

- a. True

- b. False

INCORRECTOpening an account to get freebies such as filling out a credit card application just to get a free t-shirt, goofy hat, or official university credit card isn't worth the risk. Most students don't realize that applying for multiple credit cards in a short period of time may cause the credit bureaus to regard this as very risky behavior, which in turn drives their credit scores down.Question 15

Is marital status a factor used to calculate a credit score?

- a. Yes

- b. No

- c. Maybe

CORRECTMarital status is not one of the factors used to calculate a credit score. If you hold a joint credit account, have cosigned a loan or have authorized use of another person's credit, these items could affect a score if they appear on your credit report. It's important that joint account holders or authorized users understand that their credit behavior does affect the other joint account holder or main account holder.Question 16

Does a cell phone company use a credit score to decide whether a person can buy a service and/or what price they'll pay?

- a. Yes

- b. No

- c. Maybe

CORRECTCell phone companies may use credit scores to decide whether you can buy a service or if a deposit will be required.Question 17

Does a mortgage lender use a credit score to decide whether a person can get credit and what interest rate they'll pay?

- a. Yes

- b. No

- c. Maybe

CORRECTMortgage lenders use credit scores to help them decide if you can get credit and what interest rate you'll pay.Question 18

Does a landlord use a credit score to decide whether a person can rent a property and/or what price they'll pay?

- a. Yes

- b. No

- c. Maybe

CORRECTLandlords use credit scores to decide whether you can rent a property and/or what price you'll pay.Question 19

Does an electric utility use a credit score when establishing service for a consumer?

- a. Yes

- b. No

- c. Maybe

CORRECTElectric utilities may use credit scores as they evaluate whether or not to require a deposit.Question 20

Your credit card company just increased the spending limit on your card. Will this help or hurt your credit score?

- a. Help

- b. Hurt

CORRECTAs long as you don't borrow more money, the higher limit improves your credit utilization ratio, which is the percentage of your available credit that you've used. Lenders like you to use only a small percentage of your available credit so you don't appear to be maxing out your cards. Charging $3,000 when you have a $10,000 limit, for example, looks a lot better than charging $3,000 when your limit is only $5,000.Question 21

In regards to a married couple purchasing a home, the mortgage lender uses which credit score when more than one borrower is applying together?

- a. The highest score between both people

- b. The lowest middle score between both people

- c. The average of all scores

- d. The median score between both people

CORRECTBoth you and your spouse have individual FICO scores. When you apply for credit stating your joint income, lenders will usually look at both of your FICO scores when evaluating your loan application. For example if your FICO scores are 750, 730, 700, your middle score is 730. If your spouse has FICO scores of 640, 600, 650, your spouse's middle score is 640. The lender will then take the lower of the two middle scores. So in this example your score is 640 which may lead to higher rates.

Mortgage Loan Officer

email: kentuckyloan@gmail.com

Fill out my form!

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.