Louisville Kentucky VA Residual Income Guidelines

Residual Income

0

State Taxes

Proposed new monthly house payment (PITI: principle, interest, taxes and insurance)

Monthly Child Care Expense

Alimony or Child Support

Monthly consumer debt payments: installment and revolving credit cards

The balance remaining is "residual income" and will determine whether the borrower qualifies based on the table below.

Louisville Ky VA's minimum residual incomes (balance available for family support) are a guide. They should not automatically trigger approval or rejection of a loan. Instead consider residual income in conjunction with all other credit factors.

An obviously inadequate residual income alone can be a basis for disapproving a loan.

If residual income is marginal, look to other indicators such as the applicant's credit history, and in particular, whether and how the applicant has previously handled similar housing expense.

Consider whether the purchase price of the property may affect family expense levels. For example: A family purchasing in a higher priced neighborhood may feel a need to incur higher-than-average expenses to support a lifestyle comparable to that in their environment. Whereas a substantially lower priced home purchase may not compel such expenditures.

Also consider the ages of the applicant's dependents in determining the adequacy of residual income. Count all members of the household (without regard to the nature of the relationship) when determining "family size," including:

An applicant's spouse who is not joining in title or on the note, and

Any other individuals who depend on the applicant for support. For example, children from a spouse's prior marriage who are not the applicant's legal dependents.

Exception: The lender may omit any individuals from "family size" who are fully supported from a source of verified income which, for whatever reason, is not included in effective income in the loan analysis.

For example: A spouse not obligated on the note who has stable and reliable income sufficient to support his or her living expenses, or a child for whom sufficient foster care payments or child support is received regularly.

Reduce the residual income figure (from the following tables) by a minimum of 5% if the applicant or spouse is an active-duty or retired serviceperson, and there is a clear indication that he or she will continue to receive the benefits resulting from use of military-based facilities located near the property.

Use 5% unless the Louisville Ky VA office of jurisdiction has established a higher percentage, in which case, apply the specified percentage for that jurisdiction.

Louisville Kentucky VA Residual Income Guidelines

One of the most important — and often overlooked — requirements for a VA home loan in Louisville and across Kentucky is residual income. This rule ensures veterans and their families have enough money left over each month to cover daily living expenses after paying the mortgage, taxes, and other obligations.

What Is Residual Income?

Residual income is the amount of money you keep after paying:

- Federal, state, and Social Security taxes

- Your new house payment (PITI: principal, interest, taxes, insurance)

- Utilities and estimated home maintenance

- Child care, alimony, or child support

- Consumer debts like car loans and credit cards

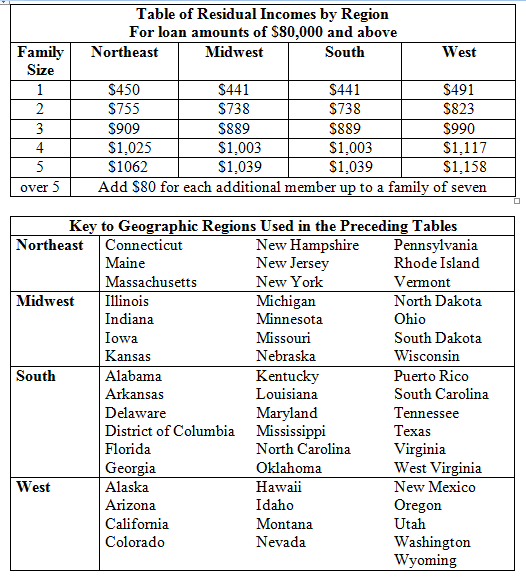

The VA requires a minimum residual income based on family size and region. Louisville and all of Kentucky fall into the South Region.

VA Residual Income Chart for Kentucky (Loans Over $80,000)

| Family Size | Minimum Residual Income |

|---|---|

| 1 | $441 |

| 2 | $738 |

| 3 | $889 |

| 4 | $1,003 |

| 5 | $1,039 |

Add $80 for each additional family member beyond five.

Why It Matters

Residual income helps prevent veterans from becoming “house poor.” Even if your debt-to-income ratio looks good, the VA double-checks that you’ll still have enough left over each month to take care of your family.

If you’re slightly below the guideline, other strengths like good credit history or savings may help, but falling far short of the requirement can be a deal breaker.

FAQ: Louisville VA Residual Income

Q: Who counts toward family size?

A: Everyone in the household — including a spouse not on the loan and dependents — unless they are fully supported by

outside verified income.

Q: Can I still be approved if my residual income is short?

A: NO

Q: How does this differ from debt-to-income ratio?

A: DTI looks only at income versus debt. Residual income measures the cash left over for everyday living after those debts are paid.

Kentucky VA Residual Income Guidelines Slides Graphs

A Kentucky Veteran's Guide to VA Residual Income

Introduction: What Kentucky Veterans Need to Know

Residual Income Requirements for Kentucky

Residual Income by Region for Loan Amounts of $80,000 and Above

| Family Size | Northeast | Midwest | South | West |

| 1 | $450 | $441 | $441 | $491 |

| 2 | $755 | $738 | $738 | $823 |

| 3 | $909 | $889 | $889 | $990 |

| 4 | $1,025 | $1,003 | $1,003 | $1,117 |

| 5 | $1,062 | $1,039 | $1,039 | $1,158 |

Local Resources for Kentucky Veterans

Want to See If You Qualify?

I’ll run your residual income numbers and give you a free VA loan pre-qualification for Louisville or anywhere in Kentucky.

📞 Call/Text Joel Lobb at (502) 905-3708

Apply Online NowEVO Mortgage | NMLS #1738461 | Joel Lobb NMLS #57916 | Equal Housing Lender

Call/Text - 502-905-3708

Call/Text - 502-905-3708

www.mylouisvillekentuckymortgage.com

911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

Kentucky Mortgage Loan Expert For Kentucky FHA, VA, USDA, Fannie Mae and KHC Down payment Assistance Loans