|

|

| |

|

| |

|

| |

|

|

|

|

|

|

I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

|

|

| |

|

| |

|

| |

|

|

|

|

|

|

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky VA Home loan Program Highlights |

|

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

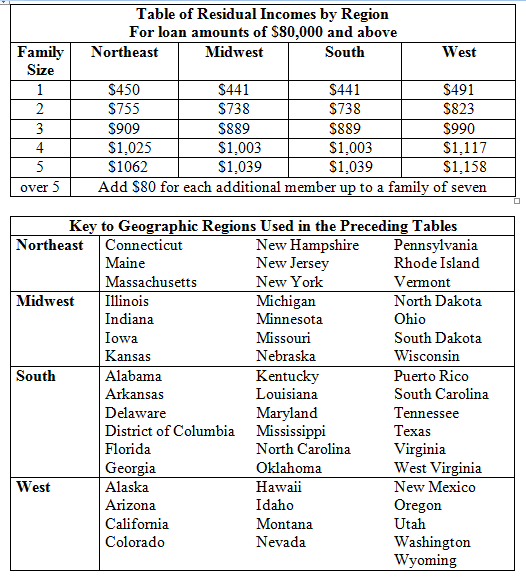

One of the most important — and often overlooked — requirements for a VA home loan in Louisville and across Kentucky is residual income. This rule ensures veterans and their families have enough money left over each month to cover daily living expenses after paying the mortgage, taxes, and other obligations.

Residual income is the amount of money you keep after paying:

The VA requires a minimum residual income based on family size and region. Louisville and all of Kentucky fall into the South Region.

| Family Size | Minimum Residual Income |

|---|---|

| 1 | $441 |

| 2 | $738 |

| 3 | $889 |

| 4 | $1,003 |

| 5 | $1,039 |

Add $80 for each additional family member beyond five.

Residual income helps prevent veterans from becoming “house poor.” Even if your debt-to-income ratio looks good, the VA double-checks that you’ll still have enough left over each month to take care of your family.

If you’re slightly below the guideline, other strengths like good credit history or savings may help, but falling far short of the requirement can be a deal breaker.

Q: Who counts toward family size?

A: Everyone in the household — including a spouse not on the loan and dependents — unless they are fully supported by

outside verified income.

Q: Can I still be approved if my residual income is short?

A: NO

Q: How does this differ from debt-to-income ratio?

A: DTI looks only at income versus debt. Residual income measures the cash left over for everyday living after those debts are paid.

Kentucky VA Residual Income Guidelines Slides Graphs

| Family Size | Northeast | Midwest | South | West |

| 1 | $450 | $441 | $441 | $491 |

| 2 | $755 | $738 | $738 | $823 |

| 3 | $909 | $889 | $889 | $990 |

| 4 | $1,025 | $1,003 | $1,003 | $1,117 |

| 5 | $1,062 | $1,039 | $1,039 | $1,158 |

I’ll run your residual income numbers and give you a free VA loan pre-qualification for Louisville or anywhere in Kentucky.

📞 Call/Text Joel Lobb at (502) 905-3708

Apply Online NowEVO Mortgage | NMLS #1738461 | Joel Lobb NMLS #57916 | Equal Housing Lender

Call/Text - 502-905-3708

Call/Text - 502-905-3708

www.mylouisvillekentuckymortgage.com

911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

Kentucky Mortgage Loan Expert For Kentucky FHA, VA, USDA, Fannie Mae and KHC Down payment Assistance Loans

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.