I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2025

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Down Payment Assistance Kentucky Housing Corporation KHC up to $12,500

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score For Mortgage Loan Approval

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky Mortgage Loan

- Testimonials

- Mortgage Calculator

- Kentucky USDA Rural Development Housing Loan

- Legal / Privacy Policy / Accessibility Statements

- About Me and this website

Louisville Kentucky VA Home Loan Mortgage Lender: Louisville Kentucky Mortgage Lender VA Home Loans

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville Kentucky VA Income Guidelines

Louisville Kentucky VA Residual Income Guidelines

Residual Income

0

State Taxes

Proposed new monthly house payment (PITI: principle, interest, taxes and insurance)

Monthly Child Care Expense

Alimony or Child Support

Monthly consumer debt payments: installment and revolving credit cards

The balance remaining is "residual income" and will determine whether the borrower qualifies based on the table below.

Louisville Ky VA's minimum residual incomes (balance available for family support) are a guide. They should not automatically trigger approval or rejection of a loan. Instead consider residual income in conjunction with all other credit factors.

An obviously inadequate residual income alone can be a basis for disapproving a loan.

If residual income is marginal, look to other indicators such as the applicant's credit history, and in particular, whether and how the applicant has previously handled similar housing expense.

Consider whether the purchase price of the property may affect family expense levels. For example: A family purchasing in a higher priced neighborhood may feel a need to incur higher-than-average expenses to support a lifestyle comparable to that in their environment. Whereas a substantially lower priced home purchase may not compel such expenditures.

Also consider the ages of the applicant's dependents in determining the adequacy of residual income. Count all members of the household (without regard to the nature of the relationship) when determining "family size," including:

An applicant's spouse who is not joining in title or on the note, and

Any other individuals who depend on the applicant for support. For example, children from a spouse's prior marriage who are not the applicant's legal dependents.

Exception: The lender may omit any individuals from "family size" who are fully supported from a source of verified income which, for whatever reason, is not included in effective income in the loan analysis.

For example: A spouse not obligated on the note who has stable and reliable income sufficient to support his or her living expenses, or a child for whom sufficient foster care payments or child support is received regularly.

Reduce the residual income figure (from the following tables) by a minimum of 5% if the applicant or spouse is an active-duty or retired serviceperson, and there is a clear indication that he or she will continue to receive the benefits resulting from use of military-based facilities located near the property.

Use 5% unless the Louisville Ky VA office of jurisdiction has established a higher percentage, in which case, apply the specified percentage for that jurisdiction.

Louisville Kentucky VA Residual Income Guidelines

One of the most important — and often overlooked — requirements for a VA home loan in Louisville and across Kentucky is residual income. This rule ensures veterans and their families have enough money left over each month to cover daily living expenses after paying the mortgage, taxes, and other obligations.

What Is Residual Income?

Residual income is the amount of money you keep after paying:

- Federal, state, and Social Security taxes

- Your new house payment (PITI: principal, interest, taxes, insurance)

- Utilities and estimated home maintenance

- Child care, alimony, or child support

- Consumer debts like car loans and credit cards

The VA requires a minimum residual income based on family size and region. Louisville and all of Kentucky fall into the South Region.

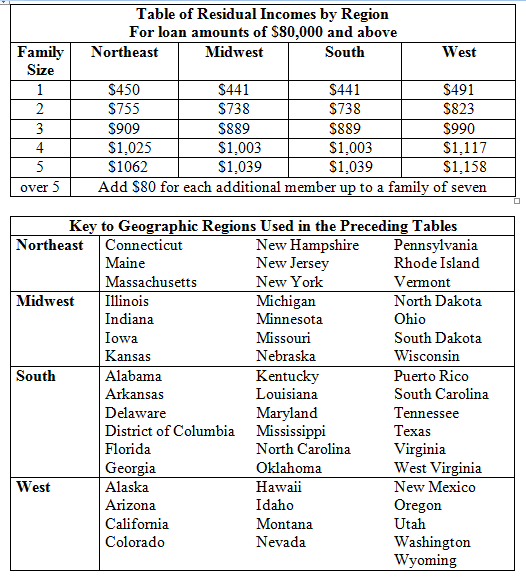

VA Residual Income Chart for Kentucky (Loans Over $80,000)

| Family Size | Minimum Residual Income |

|---|---|

| 1 | $441 |

| 2 | $738 |

| 3 | $889 |

| 4 | $1,003 |

| 5 | $1,039 |

Add $80 for each additional family member beyond five.

Why It Matters

Residual income helps prevent veterans from becoming “house poor.” Even if your debt-to-income ratio looks good, the VA double-checks that you’ll still have enough left over each month to take care of your family.

If you’re slightly below the guideline, other strengths like good credit history or savings may help, but falling far short of the requirement can be a deal breaker.

FAQ: Louisville VA Residual Income

Q: Who counts toward family size?

A: Everyone in the household — including a spouse not on the loan and dependents — unless they are fully supported by

outside verified income.

Q: Can I still be approved if my residual income is short?

A: NO

Q: How does this differ from debt-to-income ratio?

A: DTI looks only at income versus debt. Residual income measures the cash left over for everyday living after those debts are paid.

Kentucky VA Residual Income Guidelines Slides Graphs

A Kentucky Veteran's Guide to VA Residual Income

Introduction: What Kentucky Veterans Need to Know

Residual Income Requirements for Kentucky

Residual Income by Region for Loan Amounts of $80,000 and Above

| Family Size | Northeast | Midwest | South | West |

| 1 | $450 | $441 | $441 | $491 |

| 2 | $755 | $738 | $738 | $823 |

| 3 | $909 | $889 | $889 | $990 |

| 4 | $1,025 | $1,003 | $1,003 | $1,117 |

| 5 | $1,062 | $1,039 | $1,039 | $1,158 |

Local Resources for Kentucky Veterans

Want to See If You Qualify?

I’ll run your residual income numbers and give you a free VA loan pre-qualification for Louisville or anywhere in Kentucky.

📞 Call/Text Joel Lobb at (502) 905-3708

Apply Online NowEVO Mortgage | NMLS #1738461 | Joel Lobb NMLS #57916 | Equal Housing Lender

Call/Text - 502-905-3708

Call/Text - 502-905-3708

www.mylouisvillekentuckymortgage.com

911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

Kentucky Mortgage Loan Expert For Kentucky FHA, VA, USDA, Fannie Mae and KHC Down payment Assistance Loans

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

How to apply for a Kentucky VA Home Loan?

- Kentucky VA guaranteed home loans benefit veterans because they do not need to make a down payment and there is no upper limit or required cap on the income of the borrower. Without a down payment as security against foreclosure, lenders receive a certificate of guaranty from VA.

- In essence, as gratitude for honorable military service, the government is vouching for the veteran's trustworthiness to repay his/her debt.

- To determine eligibility, a military veteran, active duty person, or a member of the national guard or selected reserves, must submit a VA Form 26-1880 (2 pages) (Form is now in a FILLABLE format - but people with Adobe 5.0 seem to have trouble with it) along with proof of service (DD Form 214, a statement of active duty, or proof of participation in the national guard or reserves) to the VA Eligibility Center, P.O. Box 100034, Attn. COE (@^@), Decatur, GA 30331.

- Based on the applicant's length and type of service, VA issues a certificate for each person determined eligible to apply for a VA guaranteed home loan. Check the status after ten days by calling 1 (888) 768-2132, option 1, between 8:00 - 4:00 Eastern time.

- Viewing and Inspecting the Home

- Kentucky Home buyers usually use the services of state-licensed real estate agents to: determine an affordable price range, suggest certain home features suitable for the buyer, schedule home tours, negotiate sales contacts and hold earnest money deposits.

- State-licensed real estate professional can explain the legal requirements for buyers and sellers, and can refer buyers to local lenders and certified home inspectors. Buyers should accompany their preferred home inspector during the inspection of the property to ask questions about the home's systems.

- Requesting the Loan

- Kentucky Home buyers may want to contact a lender even before they sign a contract for a home, so that they can be pre-approved to determine their maximum mortgage amount. Home buyers who wish to obtain a VA guaranteed loan should make sure that the sales contract includes a phrase, sometimes called a financing contingency, making the contract subject to approval for a Kentucky VA guaranteed loan.

- Lenders verify and review past and present job and credit history of home applicants and compare it with VA loan approval guidelines. If the documents with the loan request cannot be approved, then additional written information must be presented to the lender or the Kentucky VA for further consideration.

- Kentucky VA Lender Appraisal Processing Program (LAPP) lenders can process loans faster than other lenders. Kentucky VA LAPP lenders do not need to send any paperwork to VA until after the home sale is closed. VA's long-standing policy is not to recommend any specific lender.

- VA recommends that buyers compare lending terms among several lenders in order to find the best combination of interest rates, discount points, and other negotiable costs for a Kentucky VA guaranteed loan.

- Appraising the Property

- When an eligible veteran contacts a lender to request a Kentucky VA guaranteed loan, the lender obtains a VA number for the request via the Internet. The lender uses the VA number to monitor progress of the appraisal and loan application. The lender also sends a VA form to a state-licensed real estate appraiser who will visit the home to give the lender and VA an opinion of the market value of the property.

- The appraisal tells the lender and VA whether the property is expected to be adequate collateral for the requested loan. Neither the appraisal of the home nor the VA guaranty is a warranty from constructional defects and their resulting repair costs. Builders and brokers can issue warranties for the condition of the home's structure and systems.

- Closing the Sale

- If the loan and home are approved, the buyer needs to contact a state-licensed insurance agent who will provide homeowner coverage to protect the owner and lender from property damage and loss.

- Title to the home is usually examined and insured by a title insurance company that may also prepare closing documents and enter them into public records after the closing. After the home is purchased and the loan is originated, the lender usually sells the active loan to another company which will receive the loan payments and pay the real estate taxes and insurance premiums.

- Closing Costs for Kentucky VA Home Loans

- VA regulates the closing costs that a veteran can be charged when obtaining a VA home loan. The closing cost regulation is designed to keep lenders from charging veterans those closing costs that VA has determined as being beneficial to the lender and not necessarily beneficial to the veteran. For a list of allowable and unallowable closing costs, please follow the link below.

- Prequalifying Worksheet

- The Prequalifying Worksheet will give you a general idea of what you can afford, and whether you are within VA underwriting guidelines for approval. This Prequalifying Worksheet is not a commitment to lend, nor can it be used to determine whether a lender will approve the Kentucky VA loan. Please note, the Prequalifying Worksheet is in Excel format. Prequalifying Worksheet

Mortgage Application Checklist of Documents Needed

below 👇

Paycheck stubs (last 30 days - most current)

Employer name and address (2 year history including any gaps)

Bank accounts statement (recent 2 months – all pages

Statements for 401(k)s, stocks and other investments (most recent)

federal tax returns (previous 2 years)

Residency history (2 year history)

Photo identification for applicant and co-applicant (valid Driver’s License

Joel Lobb (NMLS#57916)

Senior Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

Text/call 502-905-3708

kentuckyloan@gmail.com

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant's eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

NMLS Consumer Access for Joel Lobb

Accessibility for Website

Privacy Policy

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

What are the residual income requirements for a Kentucky VA Home Loan Approval?

| Residual Income for a Kentucky VA Loan Approval |

Residual income is the amount of income remaining after housing expenses, income taxes, long-term obligations and other expenses have been deducted from the borrower’s total gross pay. VA requires a specific amount of monthly residual income be available for the borrower’s use. This amount is based on the family size, location of the property and loan amount.

|

Mortgage Application Checklist of Documents Needed below 👇

Paycheck stubs (last 30 days - most current)

Employer name and address (2 year history including any gaps)

Bank accounts statement (recent 2 months – all pages

Statements for 401(k)s, stocks and other investments (most recent)

federal tax returns (previous 2 years)

Residency history (2 year history)

Photo identification for applicant and co-applicant (valid Driver’s License

Joel Lobb (NMLS#57916)

Senior Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

Text/call 502-905-3708

kentuckyloan@gmail.com

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant's eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

NMLS Consumer Access for Joel Lobb

Accessibility for Website

Privacy Policy

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.