I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2026

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Down Payment Assistance Kentucky Housing Corporation KHC up to $12,500

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score For Mortgage Loan Approval

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky Mortgage Loan

- Testimonials

- Mortgage Calculator

- Kentucky USDA Rural Development Housing Loan

- Legal / Privacy Policy / Accessibility Statements

- About Me and this website

- Kentucky FHA/VA Approved Condos

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Closing Costs Kentucky Mortgage

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky First Time Home Buyer Programs

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

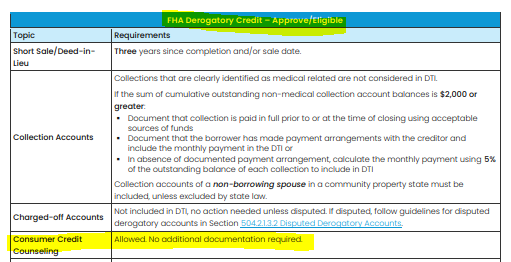

How does consumer credit counseling effects things on a Kentucky FHA or USDA loan in Kentucky ?

KENTUCKY FHA GUIDELINES FOR CONSUEMR CREDIT COUNSELING

(J) Credit Counseling/Payment Plan (APPROVE/ELIGIBLE)Participatin

(K) Credit Counseling/Payment Plan (MANUAL UW) Participating in a consumer credit counseling

- one year of the payout period has elapsed under the plan;

- the Borrower’s payment performance has been satisfactory and all required payments have been made on time; and

- the Borrower has received written permission from the counseling agency to enter into the mortgage transaction.

KENTUCKY RURAL HOUSING USDA GUIDELINES FOR CONSUMER CREDIT COUNSELING

CONSUMER CREDIT COUNSELING - DEBT MANAGEMENT PLANS |

Credit counseling provides guidance and support to consumers which may include assistance to negotiate with creditors on behalf of the borrower to reduce interest rates, late fees, and agree upon a repayment plan. The credit score will reflect the degradation of credit due to participation in this plan. Credit accounts that are included in the repayment plan may continue to report as delinquent or as late pays. This is typical and will not be considered as recent adverse credit. Lenders must retain documentation to support the accounts included in the debt management plan and the applicable monthly payment. Lenders must include the monthly payment amount due for the counseling plan in the monthly liabilities. GUS Accept/Accept with Full Documentation files: No credit exception is required. GUS Refer, Refer with Caution, and manually underwritten files: The following must be documented and retained in the lender’s permanent loan file: •One year of the payment period of the debt management plan has elapsed; •All payments have been made on time; and •Written permission from the counseling agency to recommend the applicant as acandidate for a new mortgage loan debt. •No credit exception is required |

Mortgage Loan Officer

email: kentuckyloan@gmail.com

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky USDA Rural Housing Mortgage Lender: Kentucky USDA Rural Housing Guidelines for Debt Ra...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky VA Mortgage Loan Information

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

First Time Home Buyer Kentucky DOWN PAYMENT ASSISTANCE KENTUCKY Kentucky First Time Home Buyer Programs

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: USDA Rural Housing Kentucky Loan Information

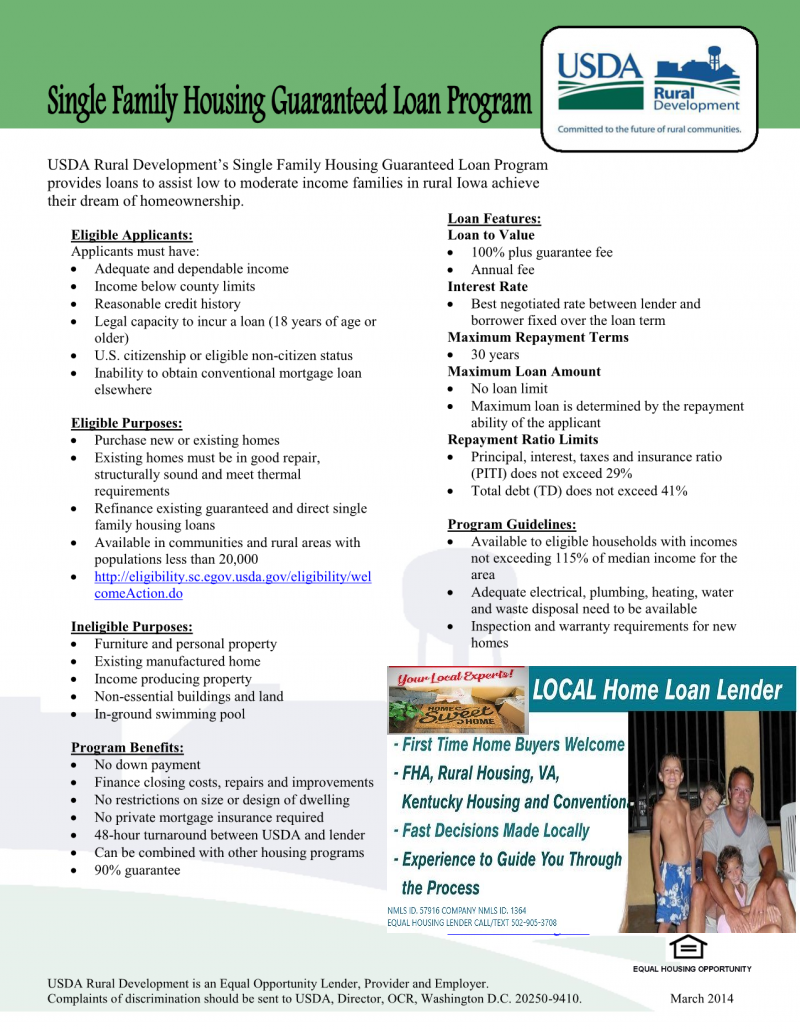

Kentucky USDA Rural Development Loans Program Guidelines

Loan Purpose of Kentucky Rural Housing Loans

- Purchase

- One-time Close Construction Loan (very few lenders do this)

- Rate-term refinance for existing USDA Loans Only. Cannot refinance a Conventional loan, FHA, VA, or other loans into an USDA loan.

Credit Profile for a Kentucky Rural Housing Buyer

- 581 minimum middle credit score for all borrowers on the loan – purchase

- No score allowed with alternative trade lines

- Most Kentucky USDA lenders will want a 620 or 640 score or higher. A 640 middle score is required for a USDA loan through GUS, the automated underwriting system used by rural development to determine the max lending limits for a loan.

- No foreclosure, short sale, or Chapter 7 bankruptcy discharge within three years of contract ratification date on credit report not permitted

- Minimum of two tradelines on credit, with a positive pay history within the most recent 12-month period. Accounts can be open or closed

- If two tradelines aren’t on credit, alternative tradelines can be

- No mortgage delinquency in the last 12 months for a USDA-to-USDA Refinance

Loan Amount limits for USDA loans in Kentucky.

- No maximum loan amounts. A lot of borrowers think they're max limits on this because there is max limits on total household income by county in Kentucky, but there actually is no limit as long as the borrower gets approved on the ability to repay the loan.

Mortgage Insurance Requirements and Premiums for USDA Loans:

- USDA charges a 1% Commitment Fee that is financed into the loan. Not paid out of pocket but can be

- Commitment Fee can be financed into the loan

Example:

Purchase price - $100,000

Base Loan amount - $100,000

Commitment Fee - $1,010 ($100,000 [purchase price] /.99 - 100,000)

Maximum financed loan amount = $101,010 - USDA requires a monthly Annual Fee (i.e. mortgage insurance premium) with an annual factorial of .35%

- This is much lower than FHA's upfront 1.75% and the monthly mi of .85% so keep that in mind.

Ratios for USDA Loan Approval in Kentucky

- 33.99/45.99% (DTI) with GUS Accept/Eligible underwriting findings

- 29/41% debt-to-income (DTI) with GUS Accept/Refer underwriting findings and credit score less than 679

- 31.99/42.99 with GUS Accept/Refer underwriting findings and credit score greater than 680 and with compensating factors such as:

- 680 or higher credit score

- No or low "payment shock" - less than a 100% increase in proposed mortgage payment Vs. current rental housing expenses

- Fiscally sound use of credit

- Ability to accumulate savings

- Stable employment history with 2 or more in current position or continuous employment history with no job gaps

- Cash reserves available for use after settlement

- Career advancement as indicated by job training or additional education in the applicants profession

- Trailing spouse income - as a result of a job transfer, the house is being purchased, prior to the secondary wage-earner obtaining employment. If the secondary wage-earner has an established history of employment and has a reasonable chance to obtain new employment in the area

- Low total debt load

Property Type for USDA Loan Approval in Kentucky

- Must be located in an eligible USDA Rural Development Location

- Owner-occupied properties---no rental properties or second homes

- Existing attached and detached single-family residences

- New construction with permanent financing only

- PUD's (i.e. Townhomes)

- Condo-units. HUD, VA, FNMA or FHLMC approved project

- Log cabin homes, provided Appraisal Report lists other comparable log cabin homes that have recently sold in the area

- No used or old mobile homes allowed. Only allows new mobile homes from dealer setup on land with mobile home land package deal...Kentucky only. ..

Documentation for loan approval on income/job history for a Kentucky Rural Housing Loan:

- All loans must be fully documented per Agency Guidelines. USDA likes to see a 2 year job history with stable employment. Does not have to be same employer, just a contiguous 2 year work history with no gaps over 30 days.

- If recently graduated form college, sometimes they will waive the 2 year job history rule if show transcripts and be on your job for 6-12 months. Case by case here.

- For Self Employed borrowers, in addition to Agency Guidelines, two years of the tax returns (personal and business) along with a year-to-date profit and loss (unaudited)

- If overtime or bonus income or second job is used to qualify, you can take a 2 year avg and as long as stable and not decreasing, you can usually this income to qualify.

- They usually will take your base gross income to qualify you on the mortgage loan. They don't qualify you off your net income.

Down Payment/Closing Costs for a USDA loan in KY

- 0% down payment required, but if you have available 20% down payment in checking or savings, they will make you use that..If the money is in a tax-deferred or 401k plan, retirement plan, they will not hold this against you.

- Seller contribution toward buyers closing costs up to 6% of the purchase price

- Closing cost help can come from flexible sources including family member gifts and loans against a 401k retirement account

- If the appraised value of the property exceeds the purchase price, the difference can be used to cover closing costs---This is a key benefit of Kentucky USDA loans. This is the only type of loan that will allow this.

Terms

- Amortization period: 30-year fixed rate-They do not offer any other terms. Just a 30 year fixed rate loan with no prepay penalty.

Existing Properties Owned

- USDA primarily often won't allow applicants to own other properties

- Exceptions include when the other property owned is:

- Not owned in the local commuting area as the new property; or

- Not structurally sound and/or functionally adequate

- Manufactured home not on a permanent foundation

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky USDA Rural Development Loans for 2023 Upfront Mortgage Insurance and Annual Fee Changes for Conditional Commitments

KENTUCKY USDA RURAL HOUSING CONDITIONAL COMMITMENT FOR 2023

With the start of Fiscal Year 2023 (FY) soon approaching, please take a few minutes to review the Single-Family Housing Guaranteed Loan Program (SFHGLP) Conditional Commitment process. We hope you find this information helpful.

FY 2023 will begin October 1, 2022 and ends at the close of business September 30, 2023.

Fee Structures:

An upfront guarantee fee of 1.00 percent and an annual fee of .35 percent will apply to both purchase and refinance transactions for Kentucky USDA Rural Development Loans for 2023

Issuance of :

At the beginning of each fiscal year, funding for the guaranteed loan program is not available for a short period of time – approximately two weeks. USDA anticipates this brief lapse in funding to continue for FY 2023. During the temporary lapse in funding, Rural Development - Rural Housing Service (RHS) will issue Conditional Commitments (Form RD 3555-18/18E) “subject to the availability of commitment authority” for purchase and refinance transactions. The issued Conditional Commitment will include the following:

"Funds are not presently available for this Conditional Commitment. The Rural Development-Rural Housing Service (RHS) obligation under this Conditional Commitment is contingent upon the availability of an appropriation from which payment for contract purposes can be made. No legal liability on the part of RHS for any payment on this Conditional Commitment may arise until funds are made available to RHS for this Conditional Commitment and until the Lender receives notice of such availability, to be confirmed in writing by RHS. More specifically, this Conditional Commitment is subject to RHS receiving sufficient funds (in the Program Funds Control System for the Single Family Housing Guaranteed Loan Program for the Type of Assistance and State of application submission) to fund this and all prior eligible outstanding applications in their entirety in the time and date order received. When such funds become available, RHS will notify the lender, and the guarantee process will continue subject to all applicable Agency regulations and conditions set forth in this Conditional Commitment. RHS will not reserve loan funds for applications in process during this timeframe. Lenders may close the loan as scheduled. The lender will assume all risk of loss for the loan until RHS obligates funds and the Loan Note Guarantee is subsequently issued. When the lender requests the Loan Note Guarantee, the lender must certify to the Agency, using the process provided in this commitment, that there have been no adverse changes to the borrower's financial condition since the date the Conditional Commitment was issued by the Agency. The lender will submit the appropriate guarantee fee at the time they request the Loan Note Guarantee. The loan will be subject to an annual fee of 0.35 percent over the average scheduled unpaid principal balance of the loan. The Agency will not be able to issue the Loan Note Guarantee until these conditions are met and funding is obligated."

The application processing workflow is as follows:

Rural Development will continue to accept complete guaranteed loan applications for purchase and refinance loan transactions from approved lenders;

Rural Development will process, approve, and issue Conditional Commitments for those applications that are eligible “subject to the availability of commitment authority”;

Lenders may close loans as scheduled;

When funds become available, Rural Development will utilize the Electronic Customer File (ECF) system to advance the file to “Obligate Application” for Conditional Commitments that were issued for loans subject to the availability of commitment authority;

Once loans are obligated, Rural Development may process lender’s Loan Note Guarantee requests when the loan closing is verified, and all conditions of the Conditional Commitment are satisfied;

Lenders assume all loss default risk for the loan until Rural Development is able to obligate the loan and issue the Loan Note Guarantee.

Thank you for your participation in the USDA Single Family Housing Guaranteed Program. We look forward to serving you in FY 2023!

Questions regarding this announcement may be directed to sfhgld.program@usda.gov or (833) 314-0168.

Thank you for your support of the Single-Family Housing Guaranteed Loan Program!

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.