I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2025

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Down Payment Assistance Kentucky 2025 Kentucky Housing Corporation KHC

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score For Mortgage Loan Approval

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky Mortgage Loan

- Testimonials

- Mortgage Calculator

- Kentucky USDA Rural Development Housing Loan

- Legal / Privacy Policy / Accessibility Statements

- About Me and this website

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: How to get a Kentucky mortgage loan with bad credi...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky Housing Corporation (KHC) Down Payment Assistance Program of $10,000 2025

Program Highlights

Regular DAP

- Maximum Purchase Price: Up to $510,939 with Secondary Market or Mortgage Revenue Bond (MRB) income limits.

- Loan Amount: Up to $10,000, provided in $100 increments.

- Repayment Terms:

- 10-year term.

- Fixed interest rate of 3.75%.

Eligibility:

- Available to all recipients of a KHC first-mortgage loan.

For more information or to apply, contact your KHC-approved lender. They can assist you with the application process and answer any questions about your eligibility.

Kentucky Housing Corporation (KHC) Down Payment Assistance Program (DAP)

The Kentucky Housing Corporation offers a program designed to help homebuyers overcome the financial challenges of down payments, closing costs, and prepaid expenses.

Program Details for 2025

Loan Amount:

- Up to $10,000 in assistance, provided in $100 increments.

Repayment Terms:

- 10-year term at a fixed interest rate of 3.75%.

Purchase Price Limit:

- Homes priced up to $510,939.

Eligibility:

- Assistance is available to all KHC first-mortgage loan recipients.

- Income limits apply based on the Secondary Market or Mortgage Revenue Bond (MRB) guidelines.

Email - kentuckyloan@gmail.com

Email - kentuckyloan@gmail.com  Call/Text - 502-905-3708

Call/Text - 502-905-3708Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky Homebuyers in 2025: Increased Loan Limits for Conventional and FHA Mortgages

New 2025 Loan Limits in Kentucky for Conventional and FHA Mortgage Loans

The Federal Housing Finance Agency (FHFA) has announced increased loan limits for 2025, providing more opportunities for homebuyers in Kentucky. These higher limits apply to both conventional loans acquired by Kentucky Fannie Mae and Freddie Mac,Fannie Mae and Freddie Mac, as well as Kentucky FHA loans, making homeownership more accessible—especially for first-time homebuyers.

Starting January 1, 2025, the FHFA maximum conforming loan limit for a single-unit property will increase to $806,500, reflecting a 5.21% increase from 2024. This adjustment allows Kentucky homebuyers to borrow more under the conforming loan limit without moving into jumbo loan territory.

Simultaneously, the Federal Housing Administration (FHA) has also raised its loan limits, providing even more options for those seeking low down payment mortgage solutions.

Property Type Conventional Loan Limit (FHFA) FHA Loan Limit

1-Unit $806,500 $524,225

2-Unit $1,032,650 $671,200

3-Unit $1,248,150 $811,275

4-Unit $1,551,250 $1,008,300

These increases give Kentucky buyers greater flexibility to purchase or refinance homes, whether using a conventional loan or an FHA loan.

Key Dates to Remember

The new loan limits go into effect January 1, 2025.

Borrowers applying for loans that close in 2024 may still take advantage of the new limits as long as the loan closes on or after January 1, 2025.

Take Advantage of the New Limits

With these increased loan limits, Kentucky homebuyers can explore more options for financing their dream homes in 2025. Whether you’re interested in a conventional loan backed by Fannie Mae or Freddie Mac or an FHA mortgage with its low down payment and credit score flexibility, now is the time to act.

-

Email - kentuckyloan@gmail.com

Email - kentuckyloan@gmail.com  Call/Text - 502-905-3708

Call/Text - 502-905-3708Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

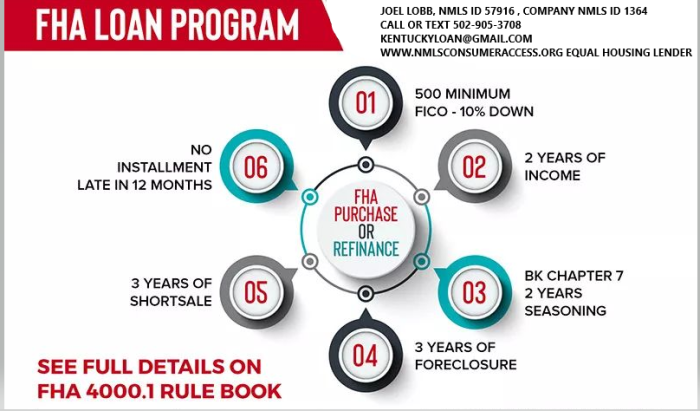

What is an FHA Loan and Is It Right for You?

The Federal Housing Administration insures what are called FHA loans. These mortgage loans provide opportunities for buyers with less-than-perfect credit or limited down payments to purchase homes, but they aren’t without potential pitfalls.

FHA loans are available to borrowers with a credit score of at least 580, and you have to make a minimum 3.5% down payment. They’re a popular option for first-time home buyers.

Lenders such as banks and credit unions issue the mortgages, which are insured by the FHA. That protects the lender if the borrower defaults, which is why the terms are more favorable than a traditional mortgage.

Around eight million single-family homes have loans insured by the FHA.

What Can an FHA Loan be Used For?

You can use an FHA loan to refinance single-family houses, to buy a single-family home, to buy some multifamily homes and condos and certain mobile and manufactured homes. There are particular types of FHA loans that can be used to renovate an existing property or for new construction.

How is an FHA Loan Different from a Conventional Mortgage Loan?

The biggest differentiator between an FHA loan and a conventional mortgage is that it’s easier to qualify for an FHA loan. You may get a loan with a lower credit score than you would otherwise, and your mortgage insurance payments may be lower too.

There are also fewer restrictions as far as using gifts from family or donations for your down payment.

If you have a FICO score of at least 580, you have to make a 3.5% down payment. With a FICO score between 500 and 579, you’re required to make a 10% down payment, and mortgage insurance is required. Your debt-to-income ratio needs to be less than 56.99% whereas with a conventional loan it’s usually 45%. You do need to have proof of income and steady employment, as you would need with a conventional loan.

Are There FHA Loan Limits?

There are limits on the mortgage amount you can get with an FHA-guaranteed loan. The limits vary based on your county, Yes, FHA loans have limits based on your county's median home prices.

The limit amounts are updated by the FHA each year based on fluctuations in home prices.

The Benefits of the FHA Loan

The primary benefits of an FHA loan are that buyers who wouldn’t otherwise qualify may be able to own a home and for a lower down payment. Sometimes the FHA will help facilitate coverage of closing costs. If you have problems making payments on an FHA loan you may be eligible for a forbearance period if you qualify.

What Are the Downsides of an FHA Loan?

You will have to pay an upfront mortgage insurance premium with an FHA loan to protect the lender. The fee is due when you close and it’s 1.75% of your loan. You will also have to pay an annual mortgage insurance premium for the life of your loan. The amount can range between 0.45% and 1.05%.

When you buy a home with an FHA loan, it has to meet strict standards in terms of health and safety.

Also, while there are set standards from the FHA, approved lenders can create their own requirements.

Applying for an FHA Loan

You’ll have to first find an FHA-approved lender to get one of these home loans. You’ll need some documents, including proof of U.S. citizenship, legal permanent residency, or eligibility to work in America. You’ll need bank statements for at least the past 30 days, and you’ll probably need to show pay stubs.

Some of the information your lender may be able to obtain on your behalf, such as your credit reports, tax returns and employment records.

There are advantages to an FHA loan because it expands homeownership to more people than conventional loans. It’s just important that if you’re considering this loan you understand the costs and that you’re not taking on more than you’re financially prepared for because of the less stringent approval requirements.

Written by Ashley Sutphin for www.RealtyTimes.com Copyright © 2020 Realty Times All Rights Reserved.

Mortgage Loan Officer Individual NMLS ID #57916

Text/call: 502-905-3708 fax: 502-327-9119

|

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Can You Buy A House After Bankruptcy in Kentucky?

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

New USDA Loan Guidelines for Kentucky Home Buyers

I wanted to share an important update regarding the USDA Single Family Housing Guaranteed Loan Program (SFHGLP) for Kentucky home buyers.

The USDA has recently proposed revisions to several chapters of their technical Handbook 1-3555, which may impact various aspects of the loan process. These proposed changes are currently open for comment until December 8, 2024, with final publication expected soon. Here’s an overview of the proposed revisions:

Key Proposed Updates to Kentucky Rural Housing USDA Guidelines:

Seller Concessions: Clarifies that funds provided by the seller to pay the buyer’s real estate commission fees are excluded from the 6% seller concession cap.

Refinancing Eligibility: The seasoning period for an existing loan to be eligible for refinancing has been updated to 180 days.

Payment History Requirement: To qualify for a refinance, the existing loan must not have any delinquencies greater than 30 days within the previous 180-day period.

Manufactured Homes: Removed existing manufactured homes from the list of prohibited loan purposes.

Builder’s Warranty: The one-year builder’s warranty must include the date, warrantor, buyer, location, and signatures.

Rehabilitation and Repair: The maximum for non-structural repairs with a home purchase is updated to $75,000. Structural repairs now have a reserve period extended to 10 months if exceeding $75,000.

Manufactured Homes Repairs: Repairs to manufactured homes (both new and existing) are no longer listed as prohibited purposes.

Title Insurance: Community land trust, leasehold interest properties, and manufactured homes now require title insurance.

New Manufactured Homes: Must be built within 12 months of loan closing. The certification label should remain visible after installation is complete.

Existing Manufactured Homes: New guidelines for financing existing manufactured homes align with the requirements in the upcoming Existing Manufactured Home Final Rule.

These revisions enhance flexibility for Kentucky USDA home buyers, especially with updates related to manufactured homes, property types, and refinancing eligibility. If you’re interested in discussing how these changes may affect your eligibility or if you have any questions about Kentucky Rural Housing USDA loan options, please feel free to reach out. I’m here to help you navigate these updates and find the best financing solution for your new home.

Email - kentuckyloan@gmail.com

Email - kentuckyloan@gmail.com  Call/Text - 502-905-3708

Call/Text - 502-905-3708Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Key ways to get your best rate possible on your Kentucky Home loan

Kentucky Mortgage Rates

Key ways to get your best rate possible on your Kentucky Home loan

Historically speaking, current mortgage rates are pretty average.

But considering all the other factors involved in our post-pandemic housing market, many people are struggling to afford a home.

Here are the top ways you can get your best mortgage rate, even in a tough market:

- Improve your credit score by paying down your debt and making all payments on time

- Consider all your loan options, including your term length and fixed rate vs. adjustable-rate mortgages

- Shop around for a lender and compare rates and terms

These key factors can mean the difference in paying thousands of dollars extra over the life of your loan.

It all depends on your unique situation.

Best loan options for Kentucky Mortgage borrowers in today’s market

- Conventional purchase — best for borrowers with a high credit score and at least 5% down payment

- FHA loan — best for first-time borrowers with more flexible credit requirements with lower credtit scores 500 to 580-

- VA loan — potential for zero down for active-duty military personnel, veterans, and eligible surviving spouses

- USDA loan — potential for zero down for for borrowers in rural areas who have moderate to low incomes

- Bank statement loan — for self-employed individuals

- KHC Loan --Down payment Assistance Grant for Zero Down Home Loans

Ask your lender about 2-1 buydowns and adjustable-rate mortgages for methods to get a lower initial rate.

How much home can you afford?

Let’s demystify the mortgage process.

Here are three common models lenders use to calculate how much of your income should go toward your monthly mortgage payment:

- 28/36 rule: Your max monthly mortgage payment can’t exceed 28% of your gross monthly income, and your mortgage plus other monthly debts cannot exceed 36%

Beyond your debts, lenders will evaluate your income, employment history, and credit score.

That's how to get the lowest mortgage rate possible for your borrower scenario.

What about getting the lowest monthly mortgage payment possible?

- Boost your credit score

- Make a larger down payment

- Choose a more affordable home

- Shop around for the best mortgage rate

- 2-1 mortgage buy down with points pay to lower rate

- Mortgage Revenue Bonds Programs Kentucky Housing Corp.

- Shared Appreciated Mortgage (SAM) in Kentucky

Discounted Mortgage Rate 5.5% 30 year fixed rate loan. ***

Eligibility requirements for the programs do apply, so reach out to us today for more information. Call or Message us now and seize the moment!

***Subject to Credit Qualifying Criteria and subject to change.

(1) The above rate quote has the following assumptions: $200,000 purchase; $194,000 loan amount; 0% down payment; 620 FICO credit score; property is SFR; borrower has sufficient income and assets to qualify; Tax and insurance impounds required; Estimated closing costs affecting the 6.375% APR include all standard fees. Monthly payment without taxes and insurance is $1,481.00. Rate and Annual Percentage Rate shown as of 11/01/2024, subject to change.

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

Text/call: 502-905-3708

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

How to Qualify For A Kentucky Mortgage Loan

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

.jpg)