I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2026

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Down Payment Assistance Kentucky Housing Corporation KHC up to $12,500

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score For Mortgage Loan Approval

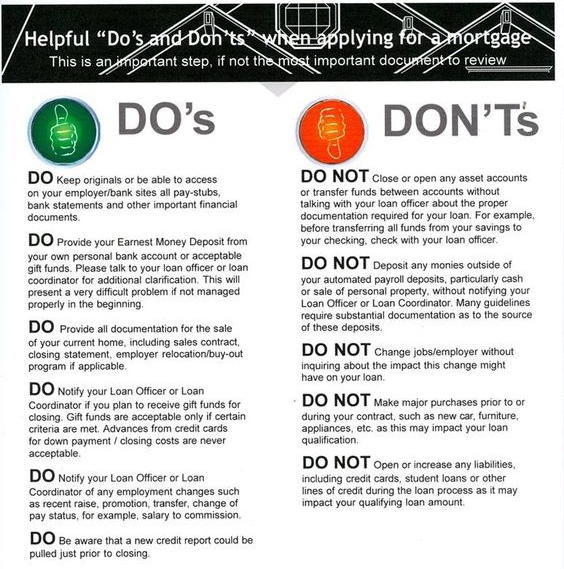

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky Mortgage Loan

- Testimonials

- Mortgage Calculator

- Kentucky USDA Rural Development Housing Loan

- Legal / Privacy Policy / Accessibility Statements

- About Me and this website

- Kentucky FHA/VA Approved Condos

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Down Payment Assistance Kentucky 2022 Kentucky Hou...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky USDA Rural Housing Mortgage Lender: Kentucky Housing Corporation $7,500 Down Payment A...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

A Beginner's Guide to Home Mortgage in Kentucky

- Conventional home loans - conventional mortgages are the ones that comply with the loan limits and terms set by government-backed mortgage companies Fannie Mae and Freddie Mac. They usually require a 3-5% down payment and allow you to borrow up to $647,200 (as of 2022). Typical credit score requirements are 620 and up. In reality, if scores are under 720, and with minimal down payment, it is hard to get approved for a conventional loan and best to look at doing a FHA loan.

- USDA Loans - these mortgages are designed for those buyers looking to invest in rural areas. They are backed by the USDA and don’t require a down payment, but only homes in certain areas might be eligible. No minimum score but 620 to 640 credit score requirement with household income limits for each county in Kentucky.

- VA Loans - these loans are catered to members of the US military and their families. They are backed by the Department of Veterans Affairs and don’t require a down payment or no monthly Private Mortgage Insurance (PMI). No minimum score but 580 and above with most lenders.

- FHA Loans - These are loans backed by the Federal Housing Administration and only require a minimum down payment of 3.5 and a score of 580 and 10% down with a 500 credit score.

- KHC loans with down payment assistance of $7,500 require minimum credit score of 620

A Good Credit Score

Some government-backed loans are accessible with a score no minimum score or 500 to 580, while conventional loans require a minimum credit score of 620.

Down Payment

Thanks to today’s availability of different loan types, you no longer need to build that infamous 20% down payment, and you can access a loan with a 0-3% down.

A Debt-To-Income Ratio Below 45%

The debt-to-income (DTI) ratio measures how much of your income is used to repay outstanding debt.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky First Time Home Buyer Programs For Home Mortgage Loans: Bankruptcy Guidelines for Kentucky FHA, VA, USDA, ...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky Bankruptcy Guidelines for Kentucky Conventional & Kentucky FHA Mortgage Loans

Can you buy a home while in bankruptcy in Kentucky?

Bankruptcy Chapter 7

Kentucky Fannie Mae Guidelines for a Previous Chapter & Bankruptcy:

4 years from discharge or dismissal date

2 years from discharge or dismissal date it borrower meets FNMA definition for Extenuating Circumstances

5 years if more than one bankruptcy was filed within the last 7 years

Kentucky FHA Guidelines for a Past Bankruptcy Chapter 7

2 years from the discharge date for DU approval. Case number assignment cannot be ordered until wait period has elapsed

Manual underwrites are allowed on a refer/eligible DU finding as long as 2 years has elapsed from the discharge date and the borrower has either re-established good credit or chosen not to incur any new credit obligations

Exception for 2 year wait period:

An elapsed period less than 2 years but no less than 12 months may be acceptable

The borrower must document the bankruptcy was caused by extenuating circumstances beyond their control such as a serious illness or death of a wage earner

The borrower must document an ability to manage their financial affairs in a responsible manner

Divorce, loss of a job, or inability to sell a home after relocation is not an acceptable extenuating circumstance

Bankruptcy Chapter 13

KY Fannie Mae Bk Guidelines for Chapter 13 Bk

2 years from discharge date

4 years from dismissal date

2 years from dismissal date it borrower meets FNMA definition for Extenuating Circumstances 5 years if more than one bankruptcy was filed within the last 7 years

Kentucky FHA Mortgage Guidelines for Chapter 13

2 years from the discharge date for DU approval. Case number assignment cannot be ordered until wait period has elapsed

Manual underwrites are allowed 1 day after discharge date or at least 12 months of the payout period under the bankruptcy has elapsed at the time of case number assignment

Must receive a refer/eligible DU finding

Must have documentation of 12 months satisfactory payment history

Must have written permission from trustee to enter into new mortgage transaction

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Credit Scores Required For A Kentucky Mortgage Loa...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

The Dos & Don’ts of Applying for a Mortgage in Kentucky

DO maintain up-to-date records The mortgage application process is paperwork-heavy, and lenders could ask you to pull up records at a moment’s notice. To make things easier for yourself, make sure you have the following records readily available:

- Income: Underwriters typically verify income and tax documents through your employer, so hold onto new paystubs as you receive them.

- Assets: It’s best practice to save all incoming account statements in the order in which you receive them; keep all numbered pages of each statement.

- Gifts: If you’re receiving any gift money from relatives, they’ll need to sign a gift letter (which your loan officer will provide) and an account statement evidencing the source, which must be “seasoned” funds.

- Current Residence: If you’re currently renting, continue to pay your rent on time and save proof of payment. If you intend to sell your current residence, be prepared to show your HUD-1 Settlement Statement. If you plan on renting out your home, you may need to show sufficient equity, a lease, and receipts for the security deposit and first month’s rent.

DO keep your credit score in mint condition. Continue to make payments on time. The lender might pull your credit report again, and any negative change to your score could jeopardize your approval.

DO understand that things change. The requirements to receive approval for a home loan are always changing, and underwriters require more documentation now than they have in the past. Even if requests seem silly, intrusive or unnecessary, keep in mind that if they didn’t need it, they wouldn’t ask for it.

DON’T apply for new credit. Changes in credit can cause delays, change the terms of your financing or even prevent you from closing on a home. If you must open a new account (or even borrow against retirement funds), be sure to consult your loan officer first.

DON’T change jobs midway through the process. Probationary periods and career or status changes — such as from a salaried to a commission-based position, leave of absence or new bonus structure — can be subject to strict rules.

DON’T make undocumented deposits. Large (and sometimes even small) deposits must be sourced unless they’re identified. Make copies of all checks and deposit slips, keep your deposits separate and small, and avoid depositing cash.

DON’T wait to liquidate funds from stock or retirement accounts. If you need to sell investments, do it now and document the transaction. Don’t take the risk of the market working against you, leaving you short on funds for closing.

Dos & Don’ts of Applying for a Mortgage in Kentucky

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

What NOT To Do After You Apply for a Kentucky Mortgage Loan Approval

Congratulations! You applied for your loan and maybe you finally found the house of your dreams. You made a bid, had it accepted by the seller, and went through the mortgage application process. It looks like you'll qualify. The closing is only weeks away, and you are feeling pretty good.

It's smooth sailing from here, right? Probably. However, more than one buyer has had the wind taken out of his sails at this point in a real estate transaction. If at all possible, steer clear of the following "NO-NOs" until AFTER you have gone to settlement.

· Do not take on new debt or apply for new credit cards. The temptation is strong. There are so many big purchases people potentially want to make in connection with a move: appliances, window treatments, furniture, etc.. When you add to this the fact that, today, everyone offers easy terms and no money down - well, why not just do it? Answer: because you will change what the industry calls your "back-end ratios" ( the relationship of your income to your debt). It could also lower your credit score.

· Do not be difficult to reach. The loan officer or processor may need to reach you for additional information or documents. Check your voice mails and emails often. Check your junk email file also. Communication is the key to a smooth closing.

· Do not quit your job, change jobs or take a leave of absence. If at all possible, try not to make a career move during the time between your mortgage application and the closing on the home you are purchasing. But, you ask, "What if it is a BETTER job, for MORE money, in a DIFFERENT field?" Still, try and wait until AFTER closing. One of the factors mortgage companies consider is length of present employment; they are partial to stability. At the very least, changing jobs initiates the need for more paperwork, and maybe a delay in closing.

· Do not stop paying your bills. Pay all your bills on time including rent or mortgages.

· Do not pack too soon. Well, go ahead and pack your clothes and pictures. But, do not pack away your bank statements, tax returns, or other important paperwork. Most especially, do not pack away your checkbook! More than one buyer has had closing delayed while a friend or relative hurried over with additional funds because the checkbook was in the moving van.

· Do not lease a new car. This should go under the general heading of "no new debt". It is highlighted here because, for some strange reason, many buyers do run right out and lease a new car during the intervening time between mortgage application and closing! As with any debt, this will change your "back-end ratios", and may cause you not to qualify for your mortgage.

· Do not throw away pay stubs, bank statements, or other financial documents.

· Do not spend your money needed for closing.

· In short, do nothing that negatively impacts your ability to qualify for your mortgage loan, or initiates a new round of paperwork.

| ||||||||||

| | ||||||||||

|

These suggestions are merely that - suggestions. No one is saying, flat out, that bad things will necessarily follow if you do any of the above. They are offered as cautions. Many buyers seem to view the mortgage application procedure as an static entity, a snap shot of their financial lives at a given moment in time. It is not. It is an on-going process that can take into account everything you do right up until the day of closing.

What NOT To Do After You Apply for a Kentucky Mortgage Loan Approval

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.