Kentucky VA Mortgage Qualifying Guidelines

Updated for 2025–2026. If you are a veteran, active-duty service member, or eligible surviving spouse looking to buy or refinance a home in Kentucky, the VA home loan program remains one of the most powerful mortgage options available.

This guide explains how Kentucky VA mortgage qualifying really works today, including credit scores, income, debt-to-income (DTI) ratios, residual income, loan limits and entitlement, plus real-world lender overlays that impact approvals in Kentucky.

My role as a local Kentucky mortgage broker is to translate the VA rules and lender overlays into a clear plan so you can see what it takes to qualify, where you stand now, and what steps to take next.

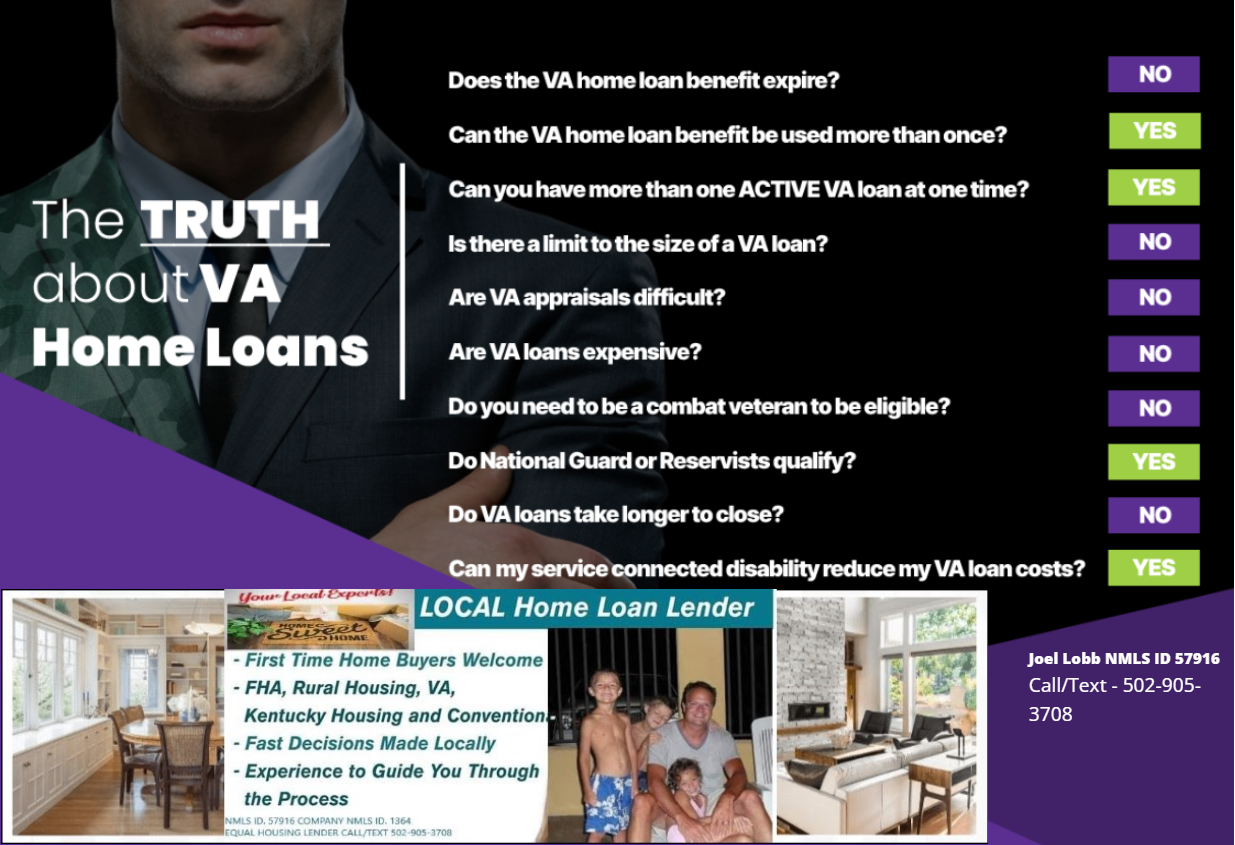

Why Kentucky VA Loans Are So Powerful

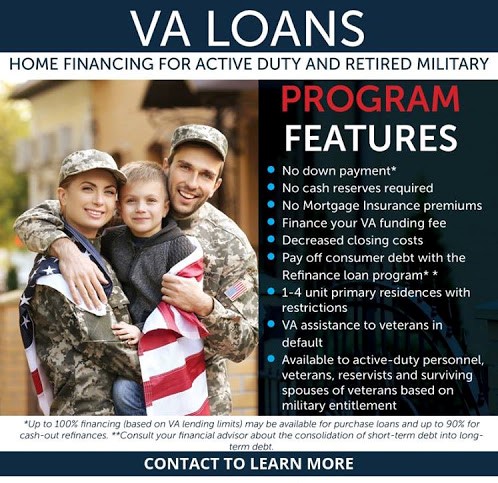

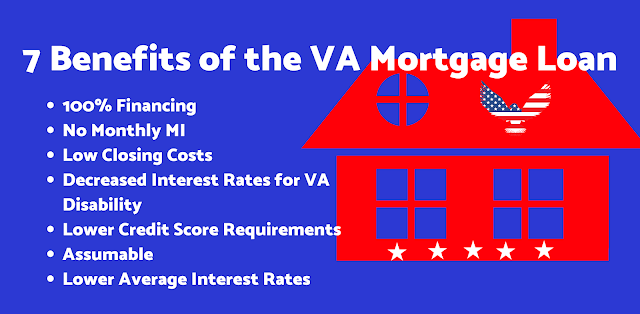

- Zero down payment in most cases when entitlement and income qualify.

- No monthly mortgage insurance (PMI), which can mean a much lower payment than FHA or low-down conventional loans.

- Flexible credit guidelines compared to many other loan types.

- Competitive interest rates.

- Reusable benefit – you can use your VA eligibility again, subject to entitlement rules.

- Assumable loans – in some situations a qualified buyer can assume your existing VA mortgage.

If you already know you want to explore Kentucky VA loans, you can review more details here: Kentucky VA Mortgage Loan Information.

Step 1: Basic VA Eligibility and COE

Before we look at credit and income, we confirm that you meet VA eligibility requirements and can obtain a Certificate of Eligibility (COE). Eligibility is based on your service history, discharge status, and other factors defined by the U.S. Department of Veterans Affairs.

Common groups who may qualify include:

- Veterans with sufficient active-duty service.

- Currently serving active-duty service members.

- Certain members of the National Guard and Reserves.

- Eligible surviving spouses of veterans who died in service or from service-connected causes.

If you are not sure whether you qualify, I can help pull your COE electronically and review your eligibility as part of a free pre-approval.

Step 2: Credit Scores and Lender Overlays in Kentucky

One of the most confusing parts of VA qualifying is credit scores, because what you see on the internet does not always match how lenders actually approve files.

What VA Itself Says

The VA Lenders Handbook states that VA does not have a minimum credit score requirement. VA focuses on the overall strength of the credit profile, payment history, and ability to repay.

What Lenders in Kentucky Usually Want

- Most lenders want to see at least the low-600s for a smooth automated approval.

- Some lenders may consider scores below 620 with stronger compensating factors (residual income, savings, strong payment history).

- Manual underwrites usually require a more conservative profile even when the score is acceptable.

A borderline credit score does not automatically kill a VA loan, but it does change how tight we need to be on your DTI, residual income, reserves, payment shock, and overall risk layering.

Important: Guidelines vs. Lender Reality

The credit-score ranges you see online (for example, 580–620) are lender overlays, not VA policy. The VA does not publish a minimum score. Each lender sets its own credit floor to manage risk and investor requirements.

That means you can be fully VA-eligible and still not qualify with a particular lender because of their internal overlays. In those cases, a different lender or a brief time spent improving your credit profile can make a material difference.

Step 3: Income, DTI and Residual Income

VA underwriting looks at both your debt-to-income (DTI) ratio and your residual income. Residual income is the amount of money left over each month after paying your mortgage, taxes, insurance, and all other monthly debts.

Debt-to-Income Ratio (DTI)

- The VA “guide” DTI ratio is 41% of your gross monthly income.

- Many Kentucky VA approvals close with DTIs above 41% when the rest of the file is strong.

- Higher DTI cases often require more residual income and stronger overall credit.

In practice, automated underwriting systems commonly approve VA loans in the 45–55% DTI range when the borrower shows strong residual income and stable credit. Manual underwrite files are usually held closer to the 41% guideline.

Residual Income

Residual income is a core part of VA’s ability-to-repay test. The VA publishes residual income tables by region, family size, and loan amount. Kentucky falls in the South region. The larger your family and the higher your loan amount, the more residual income is required.

Underwriters typically want to see:

- At least the minimum VA residual income for your region and family size.

- A cushion above the minimum if your DTI is higher than 41% or your credit is borderline.

This is why two borrowers with the same DTI can get different results: one has more residual income left over after all bills and therefore represents less risk.

Step 4: VA Loan Limits, Entitlement and Purchase Price

With full VA entitlement, many Kentucky buyers are no longer limited by a traditional county loan limit for no-down-payment purchases. Instead, the main question becomes: what is the maximum loan amount a lender is comfortable approving based on your income, credit, and obligations.

For veterans with partial entitlement, or who still have a VA loan on another property, county-based loan limits can still apply and may influence whether a down payment is required. These limits are adjusted periodically and follow conforming-loan benchmarks.

If you are not sure whether you have full or partial entitlement, that is something we confirm when we review your COE and run numbers for your specific scenario.

Step 5: Property Eligibility and VA Appraisal

The property must meet VA guidelines and Minimum Property Requirements (MPRs). At a high level, the home must be safe, sound, and sanitary for you to live in as your primary residence.

Key points:

- VA loans are for primary residences only, not second homes or investment properties.

- Single-family homes, some approved condos, and certain multi-unit properties can qualify if you live in one of the units.

- The VA appraiser will call out repairs that are health, safety, or structural in nature, and those items typically must be resolved before closing.

Cosmetic issues are usually less of a concern. Major safety or structural issues can delay or prevent closing until repaired.

VA Refinance Options in Kentucky

VA loans also offer strong refinance options for eligible Kentucky homeowners.

VA Interest Rate Reduction Refinance Loan (IRRRL)

- Streamlines an existing VA loan into a new VA loan with a lower rate or better terms.

- Often requires no appraisal, no full income documentation, and less paperwork than a standard refinance, subject to lender guidelines.

- Cannot be used to take out cash; its focus is on rate/term improvement and payment stability.

VA Cash-Out Refinance

- Allows you to refinance into a new VA loan and access equity for home improvements, debt consolidation, or other large expenses.

- VA historically permits high loan-to-value (LTV) options, but most lenders now cap cash-out closer to about 90% of your home’s value, sometimes less depending on credit and risk.

- Loan purpose, seasoning, and net tangible benefit requirements apply.

This is an area where lender overlays matter a lot. The same borrower might qualify for different maximum LTVs at different lenders.

What To Treat as Guidelines, Not Guarantees

There are three common areas where borrowers can be misled by oversimplified rules they find online.

Credit-score ranges like “580–620” are lender overlays, not VA rules. The VA does not publish a minimum credit score, but most lenders do, and those cutoffs change over time. A score that was acceptable two years ago may not be acceptable today with the same lender.

The 41% DTI number is a guideline, not a hard stop. Many VA loans close above 41% DTI when residual income, credit strength, and reserves support it. Files with DTI above 41% often face closer scrutiny and may require stronger residual income.

Cash-out refinance limits you see, such as “up to 90% of your home’s value,” are not universal. Actual LTV caps depend on lender overlays, current market conditions, and the risk profile of your file.

Because of this, any online rule of thumb should be treated as a starting point, not a guarantee of approval.

What You Should Always Double-Check

Before you lean on any online guideline, it is smart to verify a few key items for your specific situation:

- Confirm your accurate mortgage credit scores and recent credit history, not just a consumer score from a phone app.

- Run full DTI and residual income numbers that include all debts, taxes, insurance, HOA dues, and any support obligations.

- Verify that the property you want meets VA occupancy and property-condition rules.

- For refinance scenarios, confirm current value, desired loan amount, purpose (rate/term versus cash-out), seasoning, and lender LTV overlays.

This is exactly what a complete pre-approval is designed to do: translate general guidelines into a clear yes/no answer and a realistic price range for your specific file.

Related Kentucky Loan Programs

If you are comparing VA with other options, you may also want to review:

- Kentucky FHA Mortgage Loans

- Kentucky First-Time Home Buyer Programs and KHC

- Additional Kentucky first-time buyer resources

Frequently Asked Kentucky VA Loan Questions

Do I need a 620 credit score for a Kentucky VA loan?

No. VA itself does not set a minimum score, but many lenders in Kentucky prefer at least the low-600s for smoother approvals. Some lenders may consider lower scores if the rest of the file is strong.

Can I get a Kentucky VA loan with a DTI above 41%?

Yes, it is possible. Many VA approvals close above 41% DTI when residual income is strong and the rest of the file is solid. Higher DTIs often require more careful underwriting and compensating factors.

Can I use a VA loan to buy a home with zero down in Kentucky?

In many cases yes, provided you have sufficient entitlement and qualify based on income, credit, and property guidelines. With full entitlement, many buyers can purchase with no down payment.

Can I refinance my current loan into a Kentucky VA loan?

Yes, if you are eligible and the new VA loan provides a documented benefit. That could be a rate reduction using an IRRRL or a cash-out refinance if you want to access equity, subject to current lender LTV limits and guidelines.

How do I get started with a Kentucky VA pre-approval?

The first step is a conversation and a basic application. I will pull your COE, review your credit, income and obligations, and then walk you through your approval range and next steps.

Next Step: Talk Through Your Kentucky VA Options

If you are a veteran or active-duty service member looking to buy or refinance in Kentucky, I can walk you through your numbers, explain your options in plain language, and help you build a game plan that fits your budget and timeline.

Call or text, email, or use the contact form on the site to get started.

Joel Lobb, Mortgage Broker FHA, VA, KHC, USDA

Phone/Text: 502-905-3708

Email: kentuckyloan@gmail.com

Office: 10602 Timberwood Cir, Suite 3, Louisville, KY 40223

NMLS #57916 | Company NMLS #1738461

Mortgage loans only offered in Kentucky.

This information is for educational purposes only and does not constitute a commitment to lend. All loans are subject to credit approval, acceptable appraisal, and underwriting terms. Not affiliated with or endorsed by any government agency, including the VA.