Kentucky Conventional mortgages

How to qualify for a Kentucky conforming loan

A conforming loan meets the borrowing limits set by the Federal Housing Finance Agency (FHFA). Here are the requirements:

- Credit score: 620-but to get an approval need a 720 or higher usually...

- DTI: 36% to 50%, depending on the lender and how strong other parts of your financial profile are-if you have mortgage insurance max debt to income ratio is 45% backend ratio

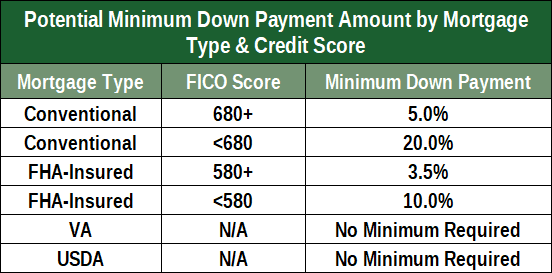

- Down payment: You may need up 5% minimum for standard Fannie Mae loans, but if your mortgage is backed by government-sponsored mortgage companies Freddie Mac or Fannie Mae, you'll only need 3% for their Homepath or Homepossible mortgage loans.

- Max loan limits of $548,000 in 2021

There are three main types of government mortgages: Kentucky FHA, VA, and USDA loans.

How to qualify for an Kentucky FHA loan

A loan from the Federal Housing Administration is for buyers who don't have the best credit scores or DTIs, but still want to buy a home. Here's what you'll need for an FHA loan:

- Credit score: 580

- DTI: 56% max approval usually with good scores and a AUS approval through Fannie Mae or Freddie Mac, and money down. DTI is lower on a manual underwrite loan.

- Down payment: 3.5%; or if your score is between 500 and 579, you can qualify with a 10% down payment

- Other requirements: The FHA restricts how much you can borrow, and your limit depends on where you live in the US and whether you're buying a single- or multi-family place. Your home must meet certain property standards. You can use an FHA loan to buy a home with normal wear and tear, but not one with major structural or safety issues.

- Max loan limits of $356,000 for 2021 in Kentucky

How to qualify for a Kentucky VA loan

A Veterans Affairs loan is for military families. Here are the requirements:

- Credit score: no minimum score but most lenders will want a 620 minimum credit score

- DTI: 41% for a manual underwrite, can be much higher on AUS approval through Fannie Mae or Freddie Max

- Down payment: No down payment is necessary

- Residual Income Requirements by state and household size.

- Other requirements: You must be an active-duty military member or a veteran who served for a certain amount of time. You'll also qualify if you're a spouse of someone who died in active duty or another military-related incident, or if your spouse is a prisoner of war or MIA. The home you're buying should meet safety standards and be used as your primary residence, but there are no strict borrowing limits set by the VA.

How to qualify for a USDA loan

A loan from the United States Department of Agriculture is for low-to-moderate income borrowers buying homes in rural or suburban areas. You'll need the following to be eligible:

- Credit score: 581 minimum score, but most lenders will want a 620 to 640 credit score

- DTI: 45% for a GUS USDA loan approval, on a manual underwriter 41%

- Down payment: No down payment is necessary

- Other requirements: Your home must be in a rural or suburban part of the US. If you already know the address of the home you want to buy, enter the information into the USDA Property Eligibility Site to see if it qualifies for a USDA loan. You also must earn a low-to-moderate income, and the limit varies based on where you live.

Knowing which mortgage types you qualify for can help you determine which one is the best fit. There may be some flexibility, though. For instance, a lender may approve you with a high DTI if you have an excellent credit score and sizeable down payment. If you're set on a certain type of mortgage but don't qualify, call a lender to ask about your options.

Mortgage Loan Officer

email: kentuckyloan@gmail.com