I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2025

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Down Payment Assistance Kentucky 2025 Kentucky Housing Corporation KHC

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score For Mortgage Loan Approval

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky Mortgage Loan

- Testimonials

- Mortgage Calculator

- Kentucky USDA Rural Development Housing Loan

- Legal / Privacy Policy / Accessibility Statements

- About Me and this website

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Louisville Kentucky First Time Home Buyer Programs...

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Louisville Kentucky First Time Home Buyer Programs...: Kentucky First Time Home Buyer Programs and Resources If you are a potential Louisville Kentucky First Time home buyer first time home ...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

100% Financing Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers: Common Kentucky Mortgage Myths Busted!My credit sc...

100% Financing Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers: Common Kentucky Mortgage Myths Busted!My credit sc...: Common Kentucky Mortgage Myths Busted! My credit score or fico score is too low: Most people’s credit scores are better than they think. A...

Labels:

Credit Score First Time Home Buyer Louisville Kentucky KHC,

FHA Loans Kentucky Housing First time home buyer,

fha. va,

First Time Home Buyer in Kentucky Zero Down,

USDA

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

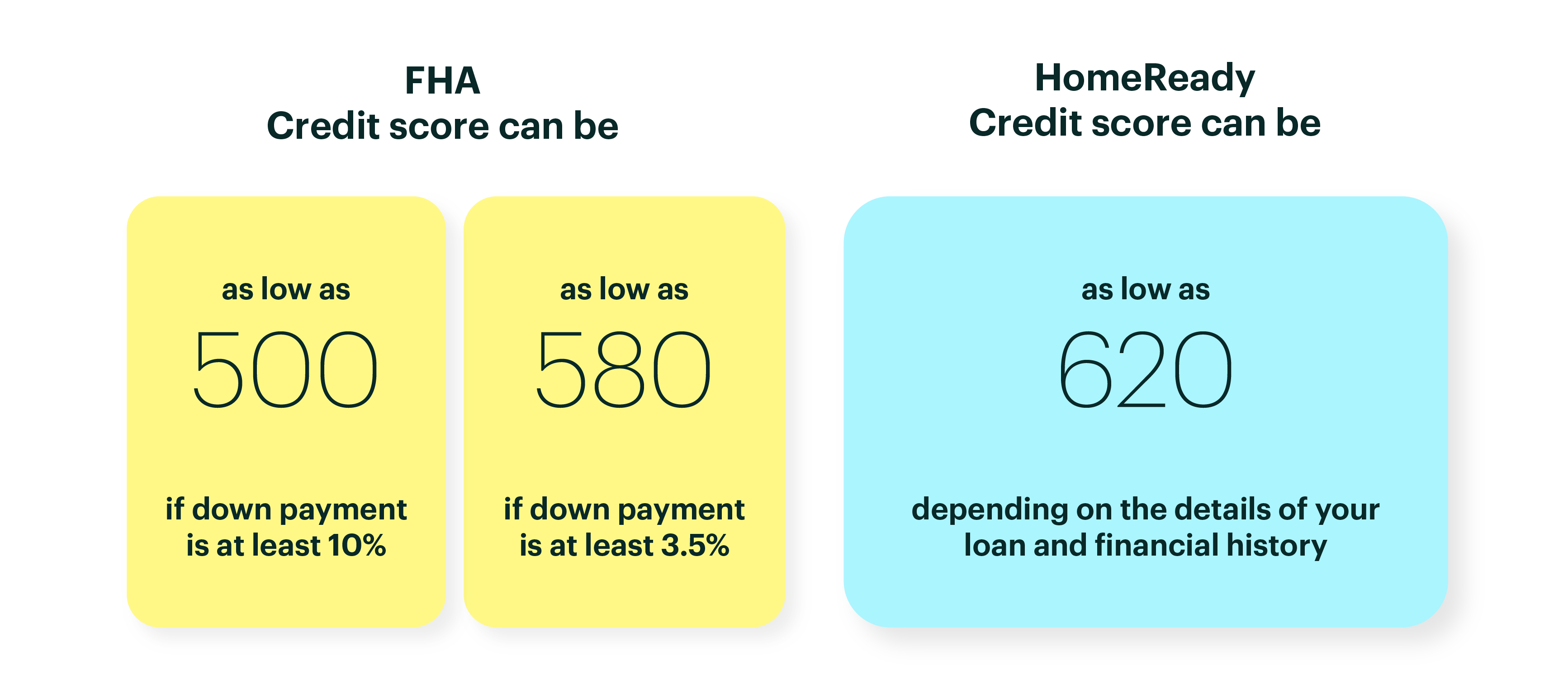

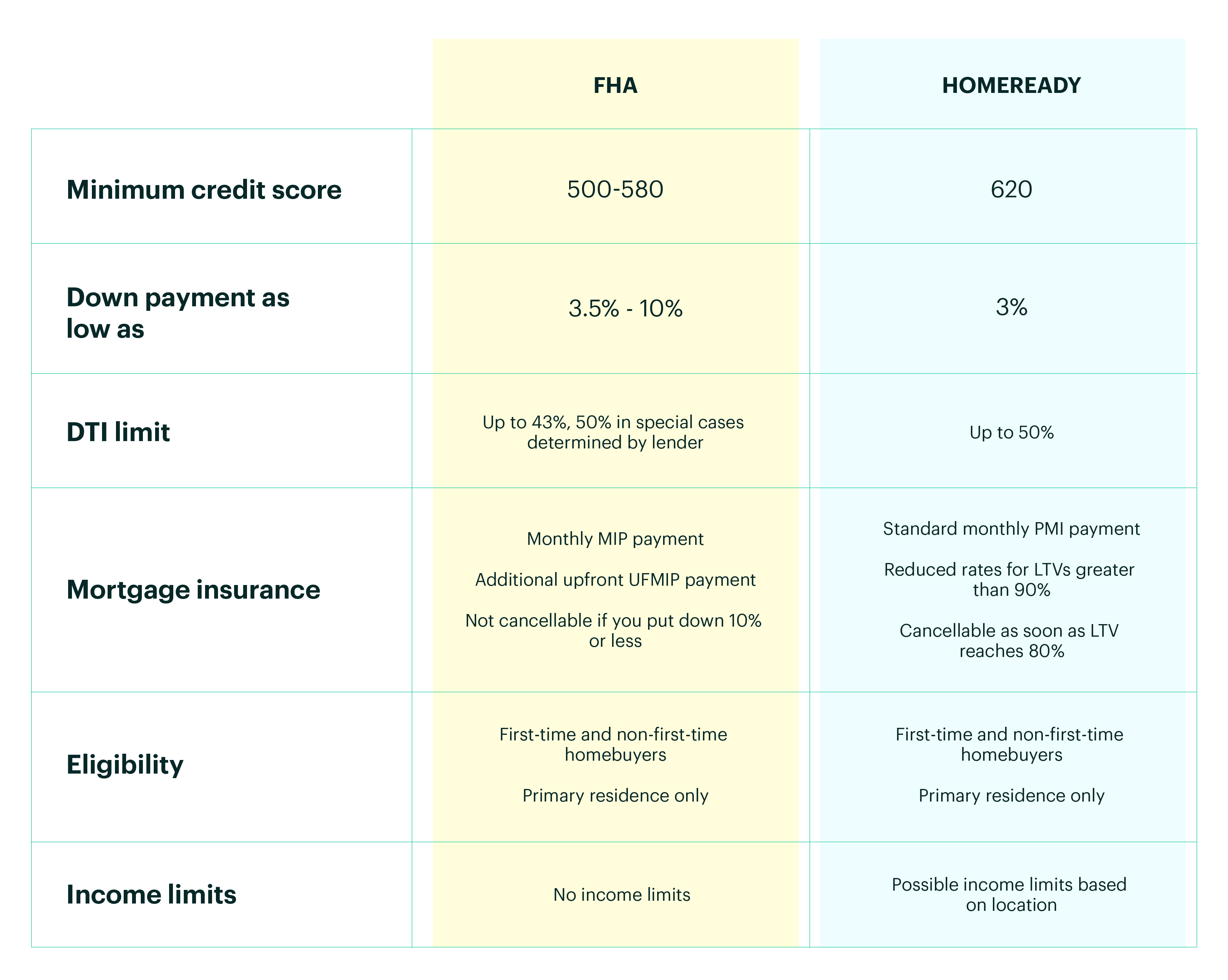

𝗪𝗵𝗮𝘁 𝗶𝘀 𝗮 Kentucky 𝗰𝗼𝗻𝘃𝗲𝗻𝘁𝗶𝗼𝗻𝗮𝗹 𝗹𝗼𝗮𝗻, 𝗮𝗻𝗱 𝗵𝗼𝘄 𝗶𝘀 𝗶𝘁 𝗱𝗶𝗳𝗳𝗲𝗿𝗲𝗻𝘁 𝗳𝗿𝗼𝗺 𝗮𝗻 Kentucky 𝗙𝗛𝗔 𝗹𝗼𝗮𝗻?

Unlike Kentucky FHA loans, conventional loans are 𝙉𝙊𝙏 backed by a government agency, but they do follow specific guidelines set by Conventional Mortgage Kentucky Fannie Mae and Freddie Mac, federally backed companies that buy and guarantee mortgages.

𝗧𝗵𝗲 𝗶𝗺𝗽𝗼𝗿𝘁𝗮𝗻𝘁 𝘁𝗵𝗶𝗻𝗴 for you to know is that conventional loans have many benefits, including:

Down payments as low as 3%

Down payments as low as 3% No upfront mortgage insurance premium

No upfront mortgage insurance premium Monthly mortgage insurance that automatically falls off once the home has been paid down to 78% of the home’s value

Monthly mortgage insurance that automatically falls off once the home has been paid down to 78% of the home’s value The ability to choose between an adjustable-rate or fixed-rate mortgage with different term lengths

The ability to choose between an adjustable-rate or fixed-rate mortgage with different term lengths Use on different property types, including primary residences, second homes, and investment properties

Use on different property types, including primary residences, second homes, and investment properties✔ Maximum Loan Limits set each year.

✔ PMI based on credit score and equity position

|

|

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky USDA Rural Housing Mortgage Lender: Kentucky USDA Mortgage Loan Requirements

Kentucky USDA Rural Housing Mortgage Lender: Kentucky USDA Mortgage Loan Requirements: Kentucky Rural Housing USDA loans require One of the biggest eligibility requirements is that the property be located in a designated rur...

Labels:

502 USDA,

Kentucky Rural Development Frequently Asked Questions (Real Estate Professionals),

Kentucky Rural Development Loans,

Kentucky USDA,

maps for eligible USDA Loans in Kentucky,

USDA loans

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Student Loan Guidelines For Qualifying for a Mortgage Loan in Kentucky.

Loan type

|

Student Loan Payment Requirement

|

FHA

|

Must be included in the borrower’s liabilities regardless of the payment type or

status. The payment amount must be either:

▪ The greater of:

· ..5% of the outstanding balance on the loan or

· Monthly payment reported on the borrower’s credit report, or

▪ The servicer’s documented payment provided the payment will fully amortize

the loan over the repayment term period

|

VA

|

Deferred

A payment does not need to be included if written evidence supports that the

student loan debt will be deferred beyond 12 months of closing.

In Repayment

Include loans with payments starting within 12 months. Calculate threshold

payment as a rate of 5% of outstanding balance divided by 12 months. If credit

report payment is higher, use credit report payment. If current documentation

from student loan servicer reflects actual terms and payment for each loan,

the verified payments may be used even if less than the threshold payment

calculation.

|

USDA

|

Fixed Payment

A permanent amortized, fixed payment is used when documentation supports fixed payment, interest and term.

Non-Fixed payment

Use .5% of the loan balance reflected on the credit report. Payment arrangements

that are deferred or non-fixed (Income Based Repayment (IBR), graduated, adjustable, interest only, etc.) may not be used.

|

Fannie

|

Loans in Repayment Period

▪ If provided, use the credit report payment

▪ If credit report is incorrect, obtain student loan documentation from the servicer

to verify the payment used for qualification

Income Driven

Repayment Plan

Use the student loan documentation to verify the actual monthly payment. Borrower

may be qualified with a $0 payment if the documentation supports it.

Loans in Deferment or

Forbearance

▪ A payment equal to 1% of the outstanding student loan balance (even if this

amount is lower than the actual fully amortizing payment) or

▪ A fully amortizing payment using the documented loan repayment terms

|

Freddie

|

Loans in Repayment

Period

Use the greater of payment reported on credit report or .5% of the higher of original

or outstanding loan balance as shown on credit report.

Loans in Deferment or

Forbearance

Use greater of payment reported on credit report or .5% of the higher of original or

current outstanding loan balance as shown on the credit report.

Loan Forgiveness

Cancelation

Discharge

Employment Contingent

Repayment

Programs

Payment may be excluded if file contains documentation that indicates:

▪ Monthly payment is deferred and/or in forbearance and full balance of the loan will be forgiven, canceled, discharged or will be paid if qualified for an employment-contingent repayment program and

▪ Borrower currently meets requirements for the student loan forgiveness/cancelation program

Obtain documentation from the student loan servicer to show the loan will be forgiven, canceled, discharged or that the borrower qualifies and is approved under an employment contingent repayment program that will extinguish the debt.

|

Joel Lobb

Mortgage Loan Officer

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

fax: 502-327-9119

email: kentuckyloan@gmail.com

email: kentuckyloan@gmail.com

Fill out my form!

Labels:

deferred student loans,

Fannie Mae's policy on student loans and retirement accounts,

fha student loans,

IBR Student loans,

student loans,

Student Loans USDA Loan/RHS

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Subscribe to:

Posts (Atom)