I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2025

- Kentucky First-time Home Buyer Programs

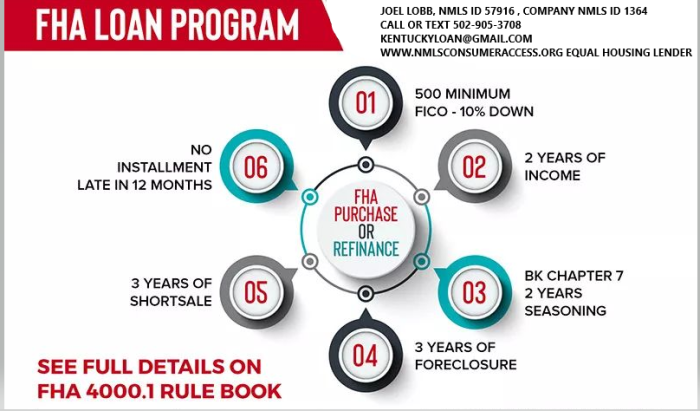

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Down Payment Assistance Kentucky Housing Corporation KHC up to $12,500

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score For Mortgage Loan Approval

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky Mortgage Loan

- Testimonials

- Mortgage Calculator

- Kentucky USDA Rural Development Housing Loan

- Legal / Privacy Policy / Accessibility Statements

- About Me and this website

- Kentucky FHA/VA Approved Condos

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky First-time Home Buyer Programs

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

2025 Kentucky VA Mortgage Guidelines

Things to know about getting a VA Mortgage Loan in Kentucky in 2025

Are you a veteran, active-duty service member, or surviving spouse looking to purchase a home in Kentucky?

Here’s everything you need to know about qualifying for a Kentucky VA mortgage loan in 2025:

1. No Loan Limits on VA Mortgages in Kentucky

For high-cost areas in Kentucky, the loan amount may vary based on county-specific limits. Be sure to check with your lender or the VA's official website for updated limits in 2025.

2. VA Loans Are for Primary Residences Only

A Kentucky VA mortgage loan must be used to purchase or refinance your primary residence. Vacation homes, second homes, and investment properties are not eligible. However, VA eligible properties include:Single-family homes

Multi-family homes (up to four units)

Condominiums approved by the VA

Manufactured or mobile homes on a permanent foundation that have only been moved once (from the factory or dealership to the land).

3. Surviving Spouses May Qualify

VA loans aren’t just for veterans and active-duty service members. Certain Kentucky VA surviving spouses may also be eligible. Here are some situations where eligibility applies:The veteran was killed in action or died from a service-connected disability.

The spouse has not remarried (or remarried on or after age 57 and after December 16, 2003).

The spouse of a veteran who is missing in action or a prisoner of war.

The spouse of a totally disabled veteran whose death was not related to their disability.

4. Certificate of Eligibility (COE) Is Required

To qualify for a Kentucky VA mortgage loan, borrowers must obtain a Certificate of Eligibility (COE) from the VA. This document proves you meet the eligibility criteria for a VA loan. Here’s what you’ll need to get your COE:Veterans: DD Form 214 (showing character of service and reason for separation).

Active-duty service members: A statement of service signed by your commander or personnel officer.

Surviving spouses: VA Form 26-1817 and the veteran’s DD Form 214, if available.

You can apply for your COE online, via mail, or through your lender.

5. Credit Score Requirements

To increase your chances of approval, it’s best to improve your credit score to 580 or higher. This will make the underwriting process smoother, especially if the automated underwriting system (AUS) is used.

6. VA Loans After Bankruptcy or Foreclosure

VA loans provide flexibility for borrowers who have faced financial difficulties. Here’s how you can qualify after a bankruptcy or foreclosure:Chapter 7 Bankruptcy: Eligible 2 years after discharge.

Chapter 13 Bankruptcy: Eligible 1 year after filing, with on-time payments.

Foreclosure: Eligible 2 years after the foreclosure is finalized.

Short Sale: Treated like a foreclosures and 2 years needed Some lenders may not require a waiting period.

7. Residual Income Requirement

VA loans are unique because they require borrowers to meet residual income requirements, ensuring you have enough money left over each month after paying your bills. This includes:Mortgage payment (including taxes and insurance)

Credit card and loan payments

Utilities and other fixed expenses

Federal, state, and local taxes

The amount of residual income required depends on your family size and location. For example, in Kentucky (Southern region), a family of five needs to have $1,039 in residual income to qualify for a VA loan.

8. Key Benefits of Kentucky VA Loans

No Private Mortgage Insurance (PMI): This can save you hundreds of dollars each month.

Competitive Interest Rates: VA loans typically have lower rates than conventional loans.

Flexible Credit Guidelines: More lenient than conventional and FHA loans.

No Loan Limits: Borrow as much as your lender approves based on your financial profile.

9. How to Apply for a Kentucky VA Mortgage Loan in 2025

Follow these steps to apply for your VA loan:Check Your Eligibility: Obtain your COE through the VA or your lender.

Improve Your Credit: Aim for a credit score of 580 or higher. '

Find a VA-Approved Lender: Work with an experienced lender familiar with VA loans in Kentucky.

Get Pre-Approved: Provide your lender with income, asset, and debt information to secure pre-approval.

Choose Your Home: Select a property that meets VA guidelines (primary residence, approved property type, permanent foundation, etc.).

Close on Your Loan: Finalize your loan with your lender and move into your new home!

As a veteran myself (19K Tanker) and a mortgage professional, I’ve helped over 100 veterans secure VA loans in Kentucky. Whether you’re buying your first home, upgrading, or refinancing, I’m here to make the process seamless.

Have questions about qualifying for a Kentucky VA mortgage loan in 2025? Call, text, or email me today!

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Mobile Home Loan Guidelines for Kentucky: FHA, VA, USDA, and Conventional Loans

Manufactured home properties are often more affordable than standard single-family homes, making them an attractive option for many prospective buyers. Whether you're a first-time homebuyer or looking to refinance, there are financing options for manufactured homes through FHA, VA, USDA, and Conventional loan programs.

Important Guidelines for Manufactured Home Mortgages in Kentucky

Before diving into specific loan programs, it's essential to understand two critical requirements that apply to almost all manufactured home loans in Kentucky:

Permanent Foundation: The manufactured or mobile home must be on a permanent foundation. This means the home must be permanently affixed to the land with proper structural supports, meeting local building codes. Read more here what constitutes a permanent foundation ➡️https://www.huduser.gov/portal/Publications/PDF/foundation_guide_complete.pdf

Single Relocation: The home must have only been moved once, from the factory or dealership to the permanent site. Homes that have been relocated more than once typically do not qualify for financing.

Keeping these two key factors in mind will significantly improve your chances of securing a mortgage loan for a manufactured home.

Here's a detailed look at the requirements and guidelines for each program:

FHA Manufactured Home Loans

Minimum Credit Score: 500 qualifying FICO score

Eligible Property Types: Singlewide, Doublewide, and Triplewide units

Loan-to-Value (LTV): Purchase or Rate-Term up to 96.5% LTV; Cash Out up to 80% LTV

Manual Underwrites: Allowed

Additional Requirements:

Real Property Conversion required at closing

Home must be your primary residence

Property cannot have been previously installed or occupied at another site

Age of Home: Home must have been constructed after June 15, 1976

USDA Manufactured Home Loans

Minimum Credit Score: 550 qualifying FICO score

Eligible Property Types: Singlewide, Doublewide, and Triplewide units

Loan-to-Value (LTV): Purchase up to 100% LTV

Manual Underwrites: Required; Maximum Debt-to-Income (DTI) ratio is 29/41

Additional Requirements:

Home must be located in a USDA-eligible rural area

Real Property Conversion required at closing

Home must be a 2006 model or newer

Property cannot have been previously installed or occupied at another site

Must be your primary residence

You cannot do not a mobile home loan on a USDA loan in Kentucky --Only available in select pilot States and Kentucky is not in that program

VA Manufactured Home Loans

Minimum Credit Score: 500 qualifying FICO score

Eligible Property Types: Singlewide, Doublewide, and Triplewide units

Loan-to-Value (LTV): Purchase or Rate-Term up to 100% LTV; Cash Out up to 80% LTV

Manual Underwrites: Allowed

Additional Requirements:

Real Property Conversion required at closing

Property can be previously installed or occupied at another site

Must be your primary residence

Age of Home: Home must have been constructed after June 15, 1976

Conventional Manufactured Home Loans

Minimum Credit Score: 620 qualifying FICO score

Eligible Property Types: Singlewide, Doublewide, and Triplewide units

Loan-to-Value (LTV): Purchase or Rate-Term up to 95% LTV; Cash Out up to 65% LTV

Additional Requirements:

Real Property Conversion required at closing

Home must have been constructed after June 15, 1976

Property cannot have been previously installed or occupied at another site

Primary and second homes allowed

Why Choose a Manufactured Home Loan?

Manufactured homes offer a cost-effective alternative to traditional housing, with modern designs and layouts that meet the needs of today's homeowners. With these flexible loan options, Kentucky homebuyers have access to financing programs tailored to manufactured housing.

Whether you’re looking for a low credit score option, zero money down, or a loan for a primary or secondary residence, these programs cater to a variety of financial situations.

Email - kentuckyloan@gmail.com

Email - kentuckyloan@gmail.com  Call/Text - 502-905-3708

Call/Text - 502-905-3708Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Credit Scores Required For A Kentucky Mortgage Loan Approval

Email - kentuckyloan@gmail.com

Email - kentuckyloan@gmail.com  Call/Text - 502-905-3708

Call/Text - 502-905-3708Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: How to get a Kentucky mortgage loan with bad credi...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky Housing Corporation (KHC) Down Payment Assistance Program of $10,000 2025

Program Highlights

Regular DAP

- Maximum Purchase Price: Up to $510,939 with Secondary Market or Mortgage Revenue Bond (MRB) income limits.

- Loan Amount: Up to $10,000, provided in $100 increments.

- Repayment Terms:

- 10-year term.

- Fixed interest rate of 3.75%.

Eligibility:

- Available to all recipients of a KHC first-mortgage loan.

For more information or to apply, contact your KHC-approved lender. They can assist you with the application process and answer any questions about your eligibility.

Kentucky Housing Corporation (KHC) Down Payment Assistance Program (DAP)

The Kentucky Housing Corporation offers a program designed to help homebuyers overcome the financial challenges of down payments, closing costs, and prepaid expenses.

Program Details for 2025

Loan Amount:

- Up to $10,000 in assistance, provided in $100 increments.

Repayment Terms:

- 10-year term at a fixed interest rate of 3.75%.

Purchase Price Limit:

- Homes priced up to $510,939.

Eligibility:

- Assistance is available to all KHC first-mortgage loan recipients.

- Income limits apply based on the Secondary Market or Mortgage Revenue Bond (MRB) guidelines.

Email - kentuckyloan@gmail.com

Email - kentuckyloan@gmail.com  Call/Text - 502-905-3708

Call/Text - 502-905-3708Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky Homebuyers in 2025: Increased Loan Limits for Conventional and FHA Mortgages

New 2025 Loan Limits in Kentucky for Conventional and FHA Mortgage Loans

The Federal Housing Finance Agency (FHFA) has announced increased loan limits for 2025, providing more opportunities for homebuyers in Kentucky. These higher limits apply to both conventional loans acquired by Kentucky Fannie Mae and Freddie Mac,Fannie Mae and Freddie Mac, as well as Kentucky FHA loans, making homeownership more accessible—especially for first-time homebuyers.

Starting January 1, 2025, the FHFA maximum conforming loan limit for a single-unit property will increase to $806,500, reflecting a 5.21% increase from 2024. This adjustment allows Kentucky homebuyers to borrow more under the conforming loan limit without moving into jumbo loan territory.

Simultaneously, the Federal Housing Administration (FHA) has also raised its loan limits, providing even more options for those seeking low down payment mortgage solutions.

Property Type Conventional Loan Limit (FHFA) FHA Loan Limit

1-Unit $806,500 $524,225

2-Unit $1,032,650 $671,200

3-Unit $1,248,150 $811,275

4-Unit $1,551,250 $1,008,300

These increases give Kentucky buyers greater flexibility to purchase or refinance homes, whether using a conventional loan or an FHA loan.

Key Dates to Remember

The new loan limits go into effect January 1, 2025.

Borrowers applying for loans that close in 2024 may still take advantage of the new limits as long as the loan closes on or after January 1, 2025.

Take Advantage of the New Limits

With these increased loan limits, Kentucky homebuyers can explore more options for financing their dream homes in 2025. Whether you’re interested in a conventional loan backed by Fannie Mae or Freddie Mac or an FHA mortgage with its low down payment and credit score flexibility, now is the time to act.

-

Email - kentuckyloan@gmail.com

Email - kentuckyloan@gmail.com  Call/Text - 502-905-3708

Call/Text - 502-905-3708Joel Lobb

Mortgage Loan Officer - Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

What is an FHA Loan and Is It Right for You?

The Federal Housing Administration insures what are called FHA loans. These mortgage loans provide opportunities for buyers with less-than-perfect credit or limited down payments to purchase homes, but they aren’t without potential pitfalls.

FHA loans are available to borrowers with a credit score of at least 580, and you have to make a minimum 3.5% down payment. They’re a popular option for first-time home buyers.

Lenders such as banks and credit unions issue the mortgages, which are insured by the FHA. That protects the lender if the borrower defaults, which is why the terms are more favorable than a traditional mortgage.

Around eight million single-family homes have loans insured by the FHA.

What Can an FHA Loan be Used For?

You can use an FHA loan to refinance single-family houses, to buy a single-family home, to buy some multifamily homes and condos and certain mobile and manufactured homes. There are particular types of FHA loans that can be used to renovate an existing property or for new construction.

How is an FHA Loan Different from a Conventional Mortgage Loan?

The biggest differentiator between an FHA loan and a conventional mortgage is that it’s easier to qualify for an FHA loan. You may get a loan with a lower credit score than you would otherwise, and your mortgage insurance payments may be lower too.

There are also fewer restrictions as far as using gifts from family or donations for your down payment.

If you have a FICO score of at least 580, you have to make a 3.5% down payment. With a FICO score between 500 and 579, you’re required to make a 10% down payment, and mortgage insurance is required. Your debt-to-income ratio needs to be less than 56.99% whereas with a conventional loan it’s usually 45%. You do need to have proof of income and steady employment, as you would need with a conventional loan.

Are There FHA Loan Limits?

There are limits on the mortgage amount you can get with an FHA-guaranteed loan. The limits vary based on your county, Yes, FHA loans have limits based on your county's median home prices.

The limit amounts are updated by the FHA each year based on fluctuations in home prices.

The Benefits of the FHA Loan

The primary benefits of an FHA loan are that buyers who wouldn’t otherwise qualify may be able to own a home and for a lower down payment. Sometimes the FHA will help facilitate coverage of closing costs. If you have problems making payments on an FHA loan you may be eligible for a forbearance period if you qualify.

What Are the Downsides of an FHA Loan?

You will have to pay an upfront mortgage insurance premium with an FHA loan to protect the lender. The fee is due when you close and it’s 1.75% of your loan. You will also have to pay an annual mortgage insurance premium for the life of your loan. The amount can range between 0.45% and 1.05%.

When you buy a home with an FHA loan, it has to meet strict standards in terms of health and safety.

Also, while there are set standards from the FHA, approved lenders can create their own requirements.

Applying for an FHA Loan

You’ll have to first find an FHA-approved lender to get one of these home loans. You’ll need some documents, including proof of U.S. citizenship, legal permanent residency, or eligibility to work in America. You’ll need bank statements for at least the past 30 days, and you’ll probably need to show pay stubs.

Some of the information your lender may be able to obtain on your behalf, such as your credit reports, tax returns and employment records.

There are advantages to an FHA loan because it expands homeownership to more people than conventional loans. It’s just important that if you’re considering this loan you understand the costs and that you’re not taking on more than you’re financially prepared for because of the less stringent approval requirements.

Written by Ashley Sutphin for www.RealtyTimes.com Copyright © 2020 Realty Times All Rights Reserved.

Mortgage Loan Officer Individual NMLS ID #57916

Text/call: 502-905-3708 fax: 502-327-9119

|

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.