Kentucky Mortgage Underwriting Guidelines

Applying for a Kentucky Mortgage

Most Kentucky home buyers will need to gather and document the information upfront so you will have minimal problems once the underwriter issues your final mortgage loan approval . Let’s look at some common underwriting issues that arises on the final mortgage approval.

Most Kentucky home buyers will need to gather and document the information upfront so you will have minimal problems once the underwriter issues your final mortgage loan approval . Let’s look at some common underwriting issues that arises on the final mortgage approval.

Job Gap—The application will call for you to document your last two years of employment history. If you have had several jobs, or job gaps of more than 6 months, you will need to document why you were off work and why you made the changes in your job. The underwriter is looking for stability in your pay and job. If you were in school recently, then the underwrite may want to see transcripts to verify this.

Credit Inquiries- Are there credit inquiries producing a red flag? • Does the applicant have excessive verified assets that could cover the dollar amount of the large deposit to, in essence, negate the effect of the large deposit?

The asset documentation must present sufficient funds of an acceptable source for down payment, closing costs and reserves. If you have had a lot of recent inquiries on your credit report, the underwriter will want an explanation on why the inquiries were made and see if any new debts has opened since the credit report has been issued.

The asset documentation must present sufficient funds of an acceptable source for down payment, closing costs and reserves. If you have had a lot of recent inquiries on your credit report, the underwriter will want an explanation on why the inquiries were made and see if any new debts has opened since the credit report has been issued.

Large Deposits in Checking and Savings Accounts– this is a biggie for most people. what constitutes a large deposit requiring additional explanation and documentation. For Kentucky Mortgage Conforming loans: considers a large deposit to be any deposit greater than 25% of the borrower’s qualified monthly income. A letter of explanation and sufficient documentation to support the source of the funds will be required. For FHA/VA loans: will require a letter of explanation on any large deposit, as determined by the underwriter. Additionally, any deposit of an amount equivalent to 2% or greater of the loan sales price must have its source of funds documented and verified.

Most Kentucky Mortgage underwriters now days considers a large deposit to be any deposit greater than 25% of the borrower’s qualified monthly income. Any such deposit not consistent with the borrower’s employment, earnings and/or savings profile must be fully explained and sourced with acceptable documentation in order to be eligible for down payment, closing costs, earnest money deposit and reserves. All funds used for down payment, closing costs, earnest money deposit and reserves must be from an acceptable source and clearly not be a result of undisclosed borrowed funds or incentive from an interested party such as a seller, real estate agent or developer.

A large deposit could be a single deposit or multiple deposits over a period of time that in aggregate, result in a large deposit. A review of the borrower’s financial profile must be conducted in order to draw a conclusion that a deposit must be sourced. Items to take into consideration when identifying deposits to be sourced are as follows: • Are the deposits within the normal deposit pattern from an identifiable

income source?

A large deposit could be a single deposit or multiple deposits over a period of time that in aggregate, result in a large deposit. A review of the borrower’s financial profile must be conducted in order to draw a conclusion that a deposit must be sourced. Items to take into consideration when identifying deposits to be sourced are as follows: • Are the deposits within the normal deposit pattern from an identifiable

income source?

• Are total monthly deposits consistent with income?

• Is the ratio of deposits to income reasonable?

• Is the borrower’s income direct deposited?

• Are there multiple deposits over a period of time that in aggregate, result in a large deposit?

• Was the account recently opened?

All large deposits must be addressed. Regardless of how long ago the earnest money was deposited, it must be verified. A signed letter of explanation from the borrower is required in all circumstances. If the borrower is able to provide a reasonable explanation and sufficient documentation to support the deposit is of an acceptable source, the large deposit may be included in the funds to close.

There may be an occasion, when the borrower is able to provide a reasonable explanation, but unable or unwilling to sufficiently document the source of a large deposit and has assets exclusive of the large deposit that are sufficient for closing and reserves. An underwriter, after exercising due diligence to ensure funds are not from an unacceptable source, may deduct the large deposit from the balance of the account, and allow the remaining balance in the account to be used as funds to qualify. In the course of due diligence, the underwriter must be confident the deposit was not as a result of an undisclosed debt or as a result of incentives from a seller, real estate agent or developer. In the event that an asset balance is reduced by the amount of a deposit, the system must be corrected, the reason for the change in the asset amount documented and the AUS decision must be updated.

Any deposit that cannot be adequately explained could potentially raise a red flag and result in a declination. Items for consideration when excluding a deposit from the asset balance:

• Do the overall assets seem reasonable given the borrower’s financial profile?

• Is there other documentation in the file (such as tax returns) that may support additional income or asset sources?

• Is the deposit possibly a loan?

GIFT FUNDS —- Gift funds are acceptable from a close relative, a close friend with a clearly defined interest in the borrower, the borrower’s employer or a non-profit organization. Entire cash investment can be gifted by relative, church municipality, non-profit agency. Transfer of funds must be documented (no exceptions). Underwriters will require the donor’s account statement and proof of withdrawal. Provide copy of fully executed gift letter (FHA applicant must also sign). Provide copy of cancelled check from donor or copy of donor’s withdrawal slip and matching deposit into applicant’s bank account or deposit slip; or Provide copy of cashier/treasurer/certified check to be given to closing agent. Amount must be denoted on HUD-1. If funds wired at closing, provide copy of wire transfer or copy of the check. This will need to take place prior to the funding of the loan. Only family members may provide a gift of equity.

CASH ON HAND—Money must be deposited and verified either through VOD or title company escrow letter AND the applicant must provide satisfactory evidence of the ability to have saved this money. If a VOD is used, a 1 month bank statement supporting the VOD is required. (The applicant must also provide a letter explaining how the money was saved and the length of time it took to save it.) May not be used as a source of assets for gift transactions.

Note: All other factors being equal, those individuals with checking and/or savings accounts are less likely to save money at home than an individual with no history of such accounts.

Note: All other factors being equal, those individuals with checking and/or savings accounts are less likely to save money at home than an individual with no history of such accounts.

If you would like more information or just have questions about qualifying for a Kentucky Mortgage in 2013, be it FHA, VA, Fannie Mae, USDA, just contact me below for your mortgage needs.

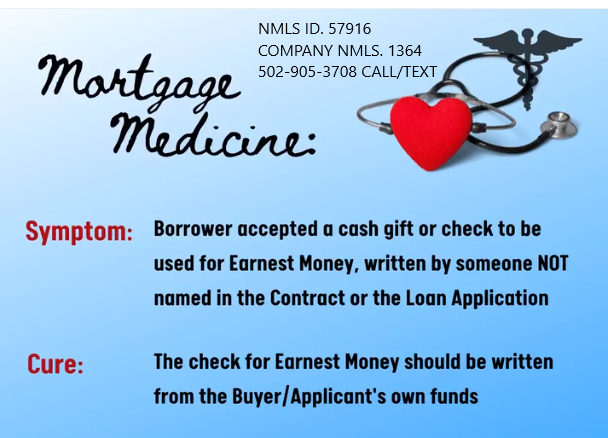

Earnest Money Deposit (EMD)

A deposit made by the buyer when the purchase offer is accepted. The funds are held by the escrow company and credited towards the cost of down payment and closing costs.

A deposit made by the buyer when the purchase offer is accepted. The funds are held by the escrow company and credited towards the cost of down payment and closing costs.

Earnest Money Deposit– If you put down a deposit on the home you are buying, you will need to get a copy of the bank statement or cancelled check to show the check has cleared your bank account and it will need to show your updated balance after the cancelled check has cleared.

Joel Lobb

Mortgage Loan Officer

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

fax: 502-327-9119

email: kentuckyloan@gmail.com

email: kentuckyloan@gmail.com