Kentucky FHA Mortgage Credit Score Requirements

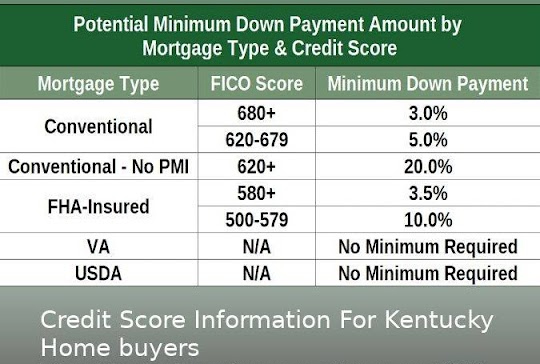

To be eligible for maximum financing, borrowers will need a minimum credit score of 500 or higher.

Kentucky FHA Borrowers with a credit score between 500 and 579 will be limited to a loan to value of 90%. A sub 580 FICO credit score borrower will henceforth need to make a 10% minimum down payment on a purchase transaction.

All Kentucky FHA borrowers with a credit score below 500 will not be eligible for FHA-insured mortgage financing in Kentucky.

The new credit requirements are not expected to dramatically change the number of Kentucky FHA mortgage approvals.

minimum credit score requirement of 580 to 620 or higher for Kentucky FHA borrowers.

In limited cases, borrowers with scores between 580 and 639 could still obtain mortgage approval with compensating factors such as large down payment (more than 3.5% minimum), low debt to income ratios, and substantial reserves in the bank with a verifiable pay history of no late payments in the last 12 months of rent and on credit report. A late is considered 30 days late in the credit rating world.

Ultimately, there is no singular credit score that can guarantee you a mortgage approval. Each lender is free to set their own credit score requirements.

But many loan types are insured by government organizations. And lenders cannot accept borrowers with credit scores below the minimum these organizations set. The four most popular home loan types are:

Conventional: Not backed by any government agency, but must meet the Fannie Mae and Freddie Mac underwriting guidelines

VA: Loans backed by the US Department of Veterans Affairs (for military members)USDA: Loans backed by the US Department of Agriculture (for low- to moderate-income families who buy homes in rural areas)

The minimum credit score requirements for each of these loan types:

Conventional:

620 SCORE NEEDED. BUT TO GET APPROVED FOR A FANNIE MAE LOAN MOSTLY LIKE YOU WILL NEED A 720 SCORE OR HIGHER IF YOU HAVE LESS THAN 20% EQUITY POSITION OR LESS THAN 20% DOWN PAYMENT DUE TO PRIVATE MORTGAGE INSURANCE

FHA:

580 for a 3.5% down payment500 for down payments of at least 10%

**MOST FHA LENDERS WILL WANT A 580 to 620 CREDIT SCORE NOWADAYS

VA:

No minimum BUT MOST VA LENDERS WILL WANT A 580 to 620 CREDIT SCOREUSDA:

No minimum, but with a credit score of at least 620 to 640 you could qualify for streamlined credit analysis and chances of approval goes way down if score is below 640...Which credit score is used to qualify for a Mortgage loan in Kentucky?

If you’re planning to apply for a mortgage, be aware that the credit score you see on your application might differ slightly from the one you’re used to.It might even be different than what comes up when you monitor your credit, or even when you apply for a car loan.

Banks use a slightly different credit score model when evaluating mortgage applicants. Below, we go over what you need to know about credit scores you’re looking to buy a home.

The scoring model used in mortgage applications

While the FICO® 8 model is the most widely used scoring model for general lending decisions, banks use the following FICO scores when you apply for a mortgage:

FICO® Score 2 (Experian)

FICO® Score 5 (Equifax)

FICO® Score 4 (TransUnion)

As you can see, each of the three main credit bureaus (Equifax, Experian and TransUnion) use a slightly different version of the industry-specific FICO Score. That’s because FICO tweaks and tailors its scoring model to best predict the creditworthiness for different industries and bureaus. You’re still evaluated on the same core factors (payment history, credit use, credit mix and age of your accounts), but the categories are weighed a little bit differently.

The FICO 8 model is known for being more critical of high balances on revolving credit lines. Since revolving credit is less of a factor when it comes to mortgages, the FICO 2, 4 and 5 models, which put less emphasis on credit utilization, have proven to be reliable when evaluating good candidates for a mortgage.

Mortgage lenders pull all three reports,from all three bureaus, but they only use one when making their final decision.

“A bank will use all three bureaus,”--- “It’s called a tri-merge.”

If all three of your scores are the same, then their choice is simple. But what if your scores are different?

If two of the three scores are the same, lenders use that one, regardless of whether it’s higher or lower than the other one.

And if you are applying for a mortgage with another person, such as your spouse or partner, each applicant’s FICO 2, 4 and 5 scores are pulled. The bank identifies the median score for both parties, then uses the lowest of the final two.

Joel Lobb Mortgage Loan Officer NMLS 57916

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

.png)

Email -

Email - Call/Text -

Call/Text -  Website:

Website:  Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204 First-Time Home Buyers Welcome

First-Time Home Buyers Welcome