I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home or refinance their current mortgage for a lower payment; Kentucky First time buyers we still how available down payment assistance with KHC. Free Mortgage applications/ same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS 1738461

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2026

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Down Payment Assistance Kentucky Housing Corporation KHC up to $12,500

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score For Mortgage Loan Approval

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky Mortgage Loan

- Testimonials

- Mortgage Calculator

- Kentucky USDA Rural Development Housing Loan

- Legal / Privacy Policy / Accessibility Statements

- About Me and this website

- Kentucky FHA/VA Approved Condos

Kentucky USDA Rural Housing Mortgage Lender: CREDIT ALERT VERIFICATION REPORTING SYSTEM (CAIVRS...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky_First_Time_Home_Buyer_Programs

Kentucky Conventional mortgages

How to qualify for a Kentucky conforming loan

A conforming loan meets the borrowing limits set by the Federal Housing Finance Agency (FHFA). Here are the requirements:

- Credit score: 620-but to get an approval need a 720 or higher usually...

- DTI: 36% to 50%, depending on the lender and how strong other parts of your financial profile are-if you have mortgage insurance max debt to income ratio is 45% backend ratio

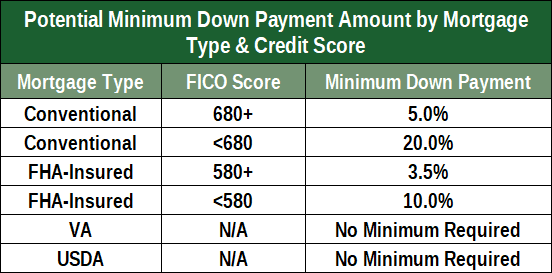

- Down payment: You may need up 5% minimum for standard Fannie Mae loans, but if your mortgage is backed by government-sponsored mortgage companies Freddie Mac or Fannie Mae, you'll only need 3% for their Homepath or Homepossible mortgage loans.

- Max loan limits of $548,000 in 2021

There are three main types of government mortgages: Kentucky FHA, VA, and USDA loans.

How to qualify for an Kentucky FHA loan

A loan from the Federal Housing Administration is for buyers who don't have the best credit scores or DTIs, but still want to buy a home. Here's what you'll need for an FHA loan:

- Credit score: 580

- DTI: 56% max approval usually with good scores and a AUS approval through Fannie Mae or Freddie Mac, and money down. DTI is lower on a manual underwrite loan.

- Down payment: 3.5%; or if your score is between 500 and 579, you can qualify with a 10% down payment

- Other requirements: The FHA restricts how much you can borrow, and your limit depends on where you live in the US and whether you're buying a single- or multi-family place. Your home must meet certain property standards. You can use an FHA loan to buy a home with normal wear and tear, but not one with major structural or safety issues.

- Max loan limits of $356,000 for 2021 in Kentucky

How to qualify for a Kentucky VA loan

A Veterans Affairs loan is for military families. Here are the requirements:

- Credit score: no minimum score but most lenders will want a 620 minimum credit score

- DTI: 41% for a manual underwrite, can be much higher on AUS approval through Fannie Mae or Freddie Max

- Down payment: No down payment is necessary

- Residual Income Requirements by state and household size.

- Other requirements: You must be an active-duty military member or a veteran who served for a certain amount of time. You'll also qualify if you're a spouse of someone who died in active duty or another military-related incident, or if your spouse is a prisoner of war or MIA. The home you're buying should meet safety standards and be used as your primary residence, but there are no strict borrowing limits set by the VA.

How to qualify for a USDA loan

A loan from the United States Department of Agriculture is for low-to-moderate income borrowers buying homes in rural or suburban areas. You'll need the following to be eligible:

- Credit score: 581 minimum score, but most lenders will want a 620 to 640 credit score

- DTI: 45% for a GUS USDA loan approval, on a manual underwriter 41%

- Down payment: No down payment is necessary

- Other requirements: Your home must be in a rural or suburban part of the US. If you already know the address of the home you want to buy, enter the information into the USDA Property Eligibility Site to see if it qualifies for a USDA loan. You also must earn a low-to-moderate income, and the limit varies based on where you live.

Knowing which mortgage types you qualify for can help you determine which one is the best fit. There may be some flexibility, though. For instance, a lender may approve you with a high DTI if you have an excellent credit score and sizeable down payment. If you're set on a certain type of mortgage but don't qualify, call a lender to ask about your options.

Mortgage Loan Officer

email: kentuckyloan@gmail.com

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville Kentucky VA Home Loan Mortgage Lender: How VA home loans Work

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville Kentucky VA Home Loan Mortgage Lender: How VA home loans Work

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

What effects your Kentucky Mortgage Rate for FHA, VA, USDA and Conventional Mortgage Loans?

What Affects Your Interest Rate for a home loan in Kentucky?

There are really four key factors that will influence rates on your mortgage loan in Kentucky:

The market, your financial situation, the type of Kentucky Mortgage loan (FHA, VA, USDA Conventional), and the loan structure.

The Market for Kentucky Mortgage Rates

Mortgage Backed Security prices directly impact interest rates. Mortgage backed securities or mortgage

bonds are a market just like the stock market. So, when economic news affects these mortgage bond

prices, home loan rates are directly influenced. One of the biggest influencers of this market is

inflation. Inflation or even expectations of inflation will negatively impact mortgage bond prices and

ultimately increase rates on your home loan in Kentucky

Financial Situation For Your Kentucky Mortgage Rate

Income –

Your income gives you the ability to make

your monthly mortgage payments. Generally,

lenders require applicants to have a two-year stable

employment history. Applicants who have been at

their job for a shorter period of time should be in the

same field.

Savings –

Your savings enable you to pay for the

upfront costs associated with purchasing a home.

These include the down payment, closing costs and

cash reserves.

Debts –

The amount of debt you have will impact your

debt to income ratio. Debt payments consist of car

payments, student loans, alimony, required payments

on installment loans and required payments on credit

cards. They do not include rent, utility bills, mortgage

payments for loans being paid off, or payments on

credit card balances that you pay in full at the end of

the month. Lenders look at debt to income ratios to

determine how much home you can buy.

Credit and Credit Score

– If you want to be eligible for

the best mortgage rates, you will need to maintain a

credit score of 760 and above middle score of the

Mortgage Fico Scores lenders pull through Equifax, Experian and Transunion

Not only will this excellent

score motivate the lender to lower your rates to get

you as a customer, you will have more choices about

which mortgages are available to you. Your overall

payment history on the debts you have can also impact

your ability to qualify for certain types of loans, which

can affect your interest rate.

Type of Kentucky Mortgage Loan & Loan Structure

Loan Type

– The type of loan will impact the rate

you can expect. There are many types of loans Kentucky Mortgage Loans.

Conventional, FHA, VA, USDA, and Jumbo loans

can all have different rates.

Occupancy

– The best mortgage rates are

typically offered if you are purchasing a property

that is intended to be occupied as your primary

residence. Rates for second homes and investment

properties are typically higher.

Duration

– The duration of the loan can affect

mortgage rates. A shorter loan period will usually

equate to a lower mortgage rate and a longer loan

will typically have higher rates.

Down Payment –

A larger down payment can

impact interest rates. Putting more down will

decrease the risk for a lender and can improve

your interest rate. If you put less than twenty

percent down, certain types of loans require

mortgage insurance and this can also impact the

interest rates available.

Discount Points –

In order to get a lower rate

some clients choose to pay discount points.

Basically, discount points are percentages of the

loan amount paid in cash at closing in order to

lower a rate.

Lock Term –

The length of time you need to lock

in your rate can impact your rate. Typically, longer

term rates are more expensive.

Mortgage Loan Officer

email: kentuckyloan@gmail.com

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Kentucky USDA Rural Housing Mortgage Lender: Kentucky USDA Rural Housing Updated Guidelines for...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Down payment assistance to buy a home in Kentucky!

There are various types of down payment assistance to buy a home in Kentucky with little or no money down!

Here are a few:

- Kentucky FHA loans - federal loan through the Federal Housing Authority-Credit scores low as 620 and gifts can be used or down payment assistance from government agency to meet the 3.5% down payment investment. No income limits but max loan currently is $356,000 in Kentucky for 2021

- Kentucky USDA loans - zero down mortgages for rural and suburban homeowners-640 credit score needed currently for most loans and has income limits and property location restrictions

- Kentucky VA loans - if military service or active duty, can buy a home with zero down with a 620 minimum credit score. No income restrictions and can buy a house anywhere as long as VA appraisal supports the purchase price. No max loan limits but must meet residual income requirements and Eligibility based off Certification of Eligibly Entitlement. Amount.

- Kentucky Housing Down Payment Assistance of $6000 can be used for FHA, VA, USDA or Conventional mortgage loans for their down payment requirements or to help with closing costs. Max income limits and loan limits for this program.

KHC recognizes that down payments, closing costs, and prepaids are stumbling blocks for many potential home buyers. Here are several loan programs to help. Your KHC-approved lender can help you apply for the program that meets your need.

KHC recognizes that down payments, closing costs, and prepaids are stumbling blocks for many potential home buyers. Here are several loan programs to help. Your KHC-approved lender can help you apply for the program that meets your need.

Regular DAP

- Purchase price up to $346,644 with Secondary Market.

- Assistance in the form of a loan up to $6,000 in $100 increments.

- Repayable over a ten-year term at 5.50 percent.

- Available to all KHC first-mortgage loan recipients.

Affordable DAP

- Purchase price up to $346,644 with Secondary Market.

- Assistance up to $6,000.

- Repayable over a ten-year term at 1.00 percent.

- Borrowers must meet Affordable DAP income limits.

MORE ABOUT DOWN PAYMENT AND CLOSING COSTS

- No liquid asset review and no limit on borrower reserves.

- Specific credit underwriting standards may apply to down payment programs

- .

SECONDARY MARKET FUNDING SOURCE

- First-time and repeat homebuyers statewide

- 30-year fixed interest rate

- Principal residence ONLY

- Purchase Price Limit: $346,644

- Borrower must meet KHC’s Secondary Market Income Limits

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (charter coverage)

- All KHC DAPs applicable

- No minimum borrower contribution

- No reserves required

- 80 percent AMI income

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (standard coverage)

- All KHC DAPs applicable

- No minimum borrower contribution

- No reserves required

- Secondary Market Income limits apply

- Insured by the Federal Housing Administration

- 3.5 percent down payment

- All KHC DAPs applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- Credit qualifying Streamline Refinance and Rate/Term Refinance

- Insured by the Federal Housing Administration

- Cash back to borrower not to exceed $500

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

- Guaranteed by the Veterans Administration for qualified military veterans

- No down payment if the property appraises for the sales price or greater

- All KHC DAPs applicable

- Minimum credit score of 620

- No monthly mortgage insurance payments

Refinance Options (Available only through Secondary Market)

- VA IRRRL

- 620 minimum credit score

- No appraisal required

- 30-year term

- VA existing loan

- Guaranteed by Rural Housing Services (RHS)

- Home must be located in a rural area as defined by RHS

- No down payment if the property appraises for the sales price or greater

- All KHC DAPs applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- RHS Streamlined-Assist Refinance Program

- 620 minimum credit score

- No appraisal required

- Must have made timely mortgage payments for the last 12 months

- 30-year term

- RHS existing 502 guaranteed loan

KENTUCKY HOUSING CORPORATION

2021 SECONDARY MARKET

GROSS ANNUAL APPLICANT’S INCOME LIMITATIONS

Effective May 1, 2021

Secondary Market Purchase Price Limit — $346,644

KENTUCKY HOUSING CORPORATION 2021 SECONDARY MARKET GROSS ANNUAL APPLICANT’S INCOME LIMITATIONS

- First-time and repeat homebuyers statewide

- 30-year fixed interest rate

- Principal residence ONLY

- Purchase Price Limit: $346,644

- Borrower must meet KHC’s Secondary Market Income Limits

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (charter coverage)

- All KHC DAPs applicable

- No minimum borrower contribution

- No reserves required

- 80 percent AMI income

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (standard coverage)

- All KHC DAPs applicable

- No minimum borrower contribution

- No reserves required

- Secondary Market Income limits apply

- Insured by the Federal Housing Administration

- 3.5 percent down payment

- All KHC DAPs applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- Credit qualifying Streamline Refinance and Rate/Term Refinance

- Insured by the Federal Housing Administration

- Cash back to borrower not to exceed $500

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

- Guaranteed by the Veterans Administration for qualified military veterans

- No down payment if the property appraises for the sales price or greater

- All KHC DAPs applicable

- Minimum credit score of 620

- No monthly mortgage insurance payments

Refinance Options (Available only through Secondary Market)

- VA IRRRL

- 620 minimum credit score

- No appraisal required

- 30-year term

- VA existing loan

- Guaranteed by Rural Housing Services (RHS)

- Home must be located in a rural area as defined by RHS

- No down payment if the property appraises for the sales price or greater

- All KHC DAPs applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- RHS Streamlined-Assist Refinance Program

- 620 minimum credit score

- No appraisal required

- Must have made timely mortgage payments for the last 12 months

- 30-year term

- RHS existing 502 guaranteed loan

KENTUCKY HOUSING CORPORATION

2021 SECONDARY MARKET

GROSS ANNUAL APPLICANT’S INCOME LIMITATIONS

Effective May 1, 2021

Secondary Market Purchase Price Limit — $346,644

There are federal, state and local assistance programs as well so be on the look out.

If you want a personalized answer for your unique situation call, text, or email me or visit my website below:

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

https://kentuckyloan.blogspot.com/

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Down Payment Assistance Kentucky 2021 Kentucky Hou...

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.

Why Work With Me?

Local Expertise: I know the ins and outs of Kentucky’s housing market and loan programs.

Fast Approvals: I offer free mortgage applications with same-day approvals to keep the process moving quickly.

Customized Loan Solutions: Whether you’re buying a home or refinancing, I’ll find the right loan program to fit your needs.

Personalized Service: I treat every client like family, ensuring you’re supported and informed throughout the process.

About My Website

Visit my website for a wealth of resources tailored to Kentucky homebuyers. You’ll find:

Step-by-step guides for first-time homebuyers.

Information on loan programs like FHA, VA, USDA, and KHC.

Tools to help you calculate potential payments and affordability.

Blog posts with tips and updates on the Kentucky housing market.

A secure portal to start your loan application and upload documents.

Please Note: My website is not endorsed by the FHA, VA, USDA, or any government agency. It is an independent platform created to educate and assist homebuyers with expert advice and accessible tools.