I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 900 Kentucky families buy their first home and refinance their current mortgage for a lower rate; Kentucky First time buyers $0 down still available with down payment assistance with KHC. Free Mortgage applications same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS ID 1364

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Down Payment Assistance Kentucky 2024 Kentucky Housing Corporation KHC

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2024

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score Booklet

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky

- Home

- Accessibility Statement

- Legal / Privacy Policy / Accessibility Statements

100% Financing Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers: AFR announces homebuyer program to grant 2% of pur...

100% Financing Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers: AFR announces homebuyer program to grant 2% of pur...: AFR announces homebuyer program to grant 2% of purchase price, 6% of closing costs : American Financial Resources announced its new down pay...

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Louisville Kentucky VA Mortgage Requirements for i...

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Louisville Kentucky VA Mortgage Requirements for i...: Fill out my form! Louisville Kentucky VA Mortgage Requirements for income and debt to income ratios: Kentucky VA lenders use debt ...

Fill out my form!

Fill out my form!

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: 4 Things Every Borrower Needs to Get Approved for ...

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: 4 Things Every Borrower Needs to Get Approved for ...: There are 4 basic things that a borrower needs to show a lender in order to get approved for a mortgage. Each category has so many what ...

Fill out my form!

Fill out my form!

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky USDA Rural Housing Loans : Kentucky USDA Rural Development For 2019 Mortgage ...

Kentucky USDA Rural Housing Loans : Kentucky USDA Rural Development For 2019 Mortgage ...: 2019 Kentucky Rural Development Mortgage Guide 30 year fixed rate only for Purchases and Existing USDA l...

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

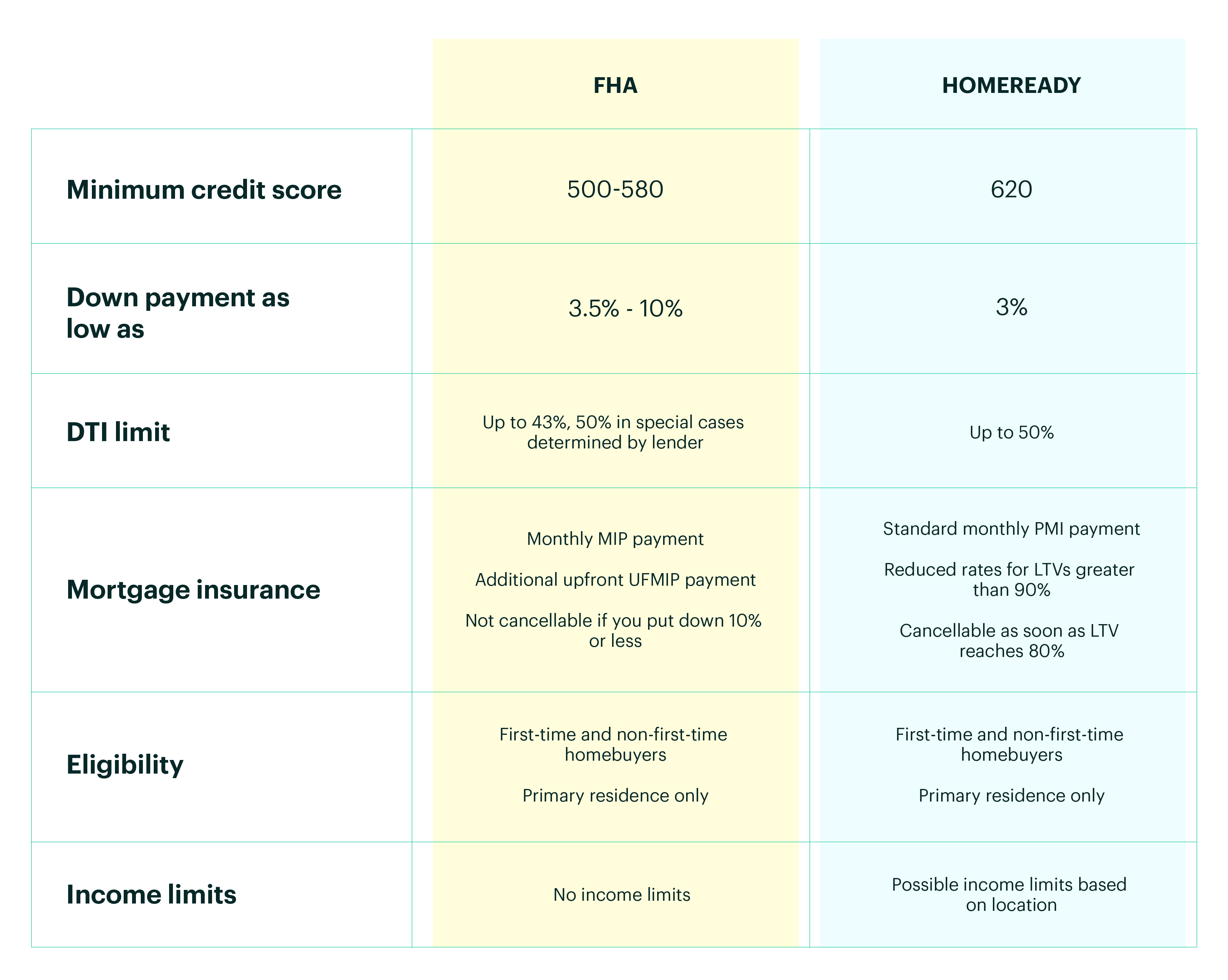

Kentucky Fannie Mae Loans versus Kentucky FHA Loans

|

|

Labels:

2019 Kentucky First Time Home Buyer Programs,

Fannie Mae,

FHA,

fha vs fannie mae,

gift of equity,

identity of interest FHA,

non arms length,

non-occupant co-borrower

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Subscribe to:

Posts (Atom)