I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 900 Kentucky families buy their first home and refinance their current mortgage for a lower rate; Kentucky First time buyers $0 down still available with down payment assistance with KHC. Free Mortgage applications same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS ID 1364

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Down Payment Assistance Kentucky 2024 Kentucky Housing Corporation KHC

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2024

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score Booklet

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky

- Home

- Accessibility Statement

- Legal / Privacy Policy / Accessibility Statements

Louisville Kentucky VA Home Loan Mortgage Lender: COVID-19, Kentucky VA Home Loan Benefits

Louisville Kentucky VA Home Loan Mortgage Lender: COVID-19, Kentucky VA Home Loan Benefits: VA Announces Special Relief for those Potentially Impacted by COVID-19 VA issued Circular 26-20-7: Special Relief for those Potentiall...

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Mortgage Forbearance: Guidelines for Homeowners - NerdWallet

Mortgage Forbearance: Guidelines for Homeowners - NerdWallet

FORBEARANCES AGAIN

FORBEARANCES AGAIN

I am still getting a lot of questions in regard to forbearances so I am going to repeat and update some information.

- Who Qualifies for Forbearances? Anyone suffering financial hardship b/c of the COVID-19 crisis. Some servicers will take the borrower’s word but many will request “proof” of some sort. Borrowers who are not in financial peril should be careful about claiming they are, as they risk fraud charges.

- How Do I Obtain a Forbearance? Borrowers need to contact their servicer and apply for it. They should not simply stop making payments.

- Do I Have to Pay Back Missed Payments? Yes – without a doubt. Some servicers will want all of the missed payments repaid as soon as the forbearance ends; some will want to restructure entire loans; and some will want to set up repayment over a period of months. Servicers will most likely try to work out the repayment system when borrowers apply for forbearances.

- Does It Matter What Type of Mortgage I Have? Yes. Forbearances will be easier to obtain for conforming (Fannie/Freddie), FHA and VA loans. Jumbo and non-QM borrowers, however, will have a more difficult time obtaining forbearances b/c the government does not have as much influence over those channels.

- How Will a Forbearance Affect My Credit? If borrowers obtain a formal approval for a forbearance, it should not affect their credit. If borrowers just stop making payments, however, without getting an approval from their servicer, it will likely impact their credit – severely. There is a caveat here too: while credit reports will not show late payments when borrowers get their forbearances approved, future lenders will be able to see if a borrower obtained a forbearance in many cases, and that could affect credit decisions. This is something we saw with loan modifications after the 2008 crisis.

- Should I Go Through With My Purchase or Refinance If I Am Likely to Seek a Forbearance? Absolutely not. Not only will it be extremely difficult for borrowers to obtain a formal forbearance approval for a recently funded loan, missing payments on newly funded loans put the originating lender in extreme financial peril.

Here is a short article from Nerd Wallet with additional

info.https://www.bankrate.com/mortgages/everything-you-should-know-about-mortgage-forbearance/

info.https://www.bankrate.com/mortgages/everything-you-should-know-about-mortgage-forbearance/

Labels:

2020 Kentucky VA Mortgage info,

2020 USDA Kentucky Guidelines,

CARES Act Mortgage Forbearance,

covid-19,

FHA Kentucky Home Loans,

Forbearance,

foreclosure

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

CARES Act Mortgage Forbearance: What You Need to Know— consumerfinance.gov

Labels:

CARES Act Mortgage Forbearance,

Coronavirus Mortgage Impact,

covid-19,

First Time Home Buyer Louisville Kentucky Mortgage,

Forbearance

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky USDA, FHA, and VA Government Loans Due to Covid-19 Coronavirus

Updates to Kentucky USDA, FHA, and VA Government Loans Due to Covid-19 Coronavirus

VA Circular 26-20-11

Kentucky VA Mortgage And Coronavirus Impacted Changes Below:

Effective immediately, for all Kentucky VA Mortgage transactions requiring an appraisal. These flexibilities will remain in effect until the earlier of April 1, 2021 or when rescinded by VA.

In areas where there are no mandatory quarantine or shelter in place orders, an exterior appraisal may be performed if any party does not wish to enter the subject property, or is showing flu-like symptoms. In areas where there are mandatory quarantine or shelter in place orders, a desktop appraisal may be performed.

Base loan amounts over the county loan limit will require a full appraisal.

Both exterior only and desktop appraisals must meet the additional requirements outlined in VA circular 26-20-11, including but not limited to any interview with the occupant or real estate agent, measuring the footprint of the home, and use of any MLS photos. Due to the extensive requirements, Correspondents are urged to read the circular for complete details.

VA Circular 26-20-10

Effective immediately, for all Kentucky VA Mortgage transactions, , including but not limited to the VVOE options. These flexibilities will remain in effect until the earlier of April 1, 2021 or rescinded by VA.

We may utilize employment and income verification third-party services, however fees for these services may not be charged to the veteran. If we are unable to use third party services, we may provide evidence of one of the following:

direct deposit from a bank statement and pay stubs covering a at least one full month of employment within 30 days of the closing date, or

cash reserves totaling at least 2 months mortgage payments (PITI+A) post-closing, in addition to any other required reserves and funds to close.

When using either the direct deposit and bank statements, or the additional cash reserves must indicate in box 47 of the remarks section of VA Form 26-6393 Loan Analysis.

Kentucky FHA Mortgage Changes due t Coronavirus and Covid-19

FHA ML 2020-05

Effective immediately Kentucky FHA Loans will follow ML 2020-05, including but not limited to flexibilities for appraisals and VVOEs. Appraisal flexibilities are effective through inspections on or before May 17, 2020. VVOE flexibilities are effective through loans closed on or before May 17, 2020.

FHA does not need to provide a re-verification of employment within 10 days of the note date provided that the correspondent is not aware of any loss of employment by the borrower and has obtained:

Evidence the Borrower has a minimum of 2 months of Principal, Interest, Taxes and Insurance (PITI) in reserves; and

Purchase and refinances require one of the following:

a year-to-date paystub or direct electronic verification of income for the pay period that immediately precedes the note date, or

a bank statement showing direct deposit from the borrower’s employment for the pay period that immediately precedes the note date.

FHA purchase transactions are eligible for either an exterior only or desktop appraisal. FHA rate and term refinances are eligible for an exterior only transaction. Exterior only and desktop appraisals must meet the additional requirements outlined in ML 2020-05. Construction-to-perm, new construction, cash-out, and 203(k) transactions continue to require a full appraisal.

Kentucky USDA Mortgage Changes with Coronavirus and Covid-19

USDA Temporary Exceptions for Appraisals, VVOEs, and transcripts

USDA’s temporary flexibilities for appraisals and VVOEs. This flexibilities are effective through conditional commitments issued on or before May 26, 2020.

For purchase and non-streamlined refinance transactions, when an appraiser is unable to complete an interior inspection of an existing dwelling due to concerns associated with the COVID-19 pandemic, an “Exterior-Only Inspection Residential Appraisal Report”, (FHLMC 2055/FNMA 2055) will be accepted. In such cases, appraisers are not required to certify that the property meets HUD HB 4000.1 standards. The appraisal must be completed in accordance with the Uniform Standards of Professional Practice (USPAP) and the Uniform Appraisal Dataset (UAD).

New construction and construction to perm transactions continue to require a full appraisal.

USDA will accept one of the following:

An email meeting the following requirements:

from the borrower’s direct supervisor/manager or the employer’s HR department, and

from the employer’s email address, such as name@company.com, and

contain all the standard information required on a verbal verification of employment, including the name, title, and phone number of the person providing the verification.

An additional two months of cash reserves (PITIA) in addition to any other required funds for reserves and closing.

USDA requires tax transcripts to ensure all income is considered for purposes of annual income calculation. USDA guidelines HB-1-3555 9.3 (E) 4 allows for loans to be closed without tax transcripts when the loan file contains evidence that transcripts were unable to be obtained. A response from the vendor may be acceptable to meet these requirements.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Louisville Kentucky VA Home Loan Mortgage Lender: Generally, mortgage borrowers in 2020 need to do t...

Louisville Kentucky VA Home Loan Mortgage Lender: Generally, mortgage borrowers in 2020 need to do t...: By Michele Lerner March 27, 2020 at 7:00 a.m. EDT No one wants to return to the days when anyone could get a mortgage e...

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

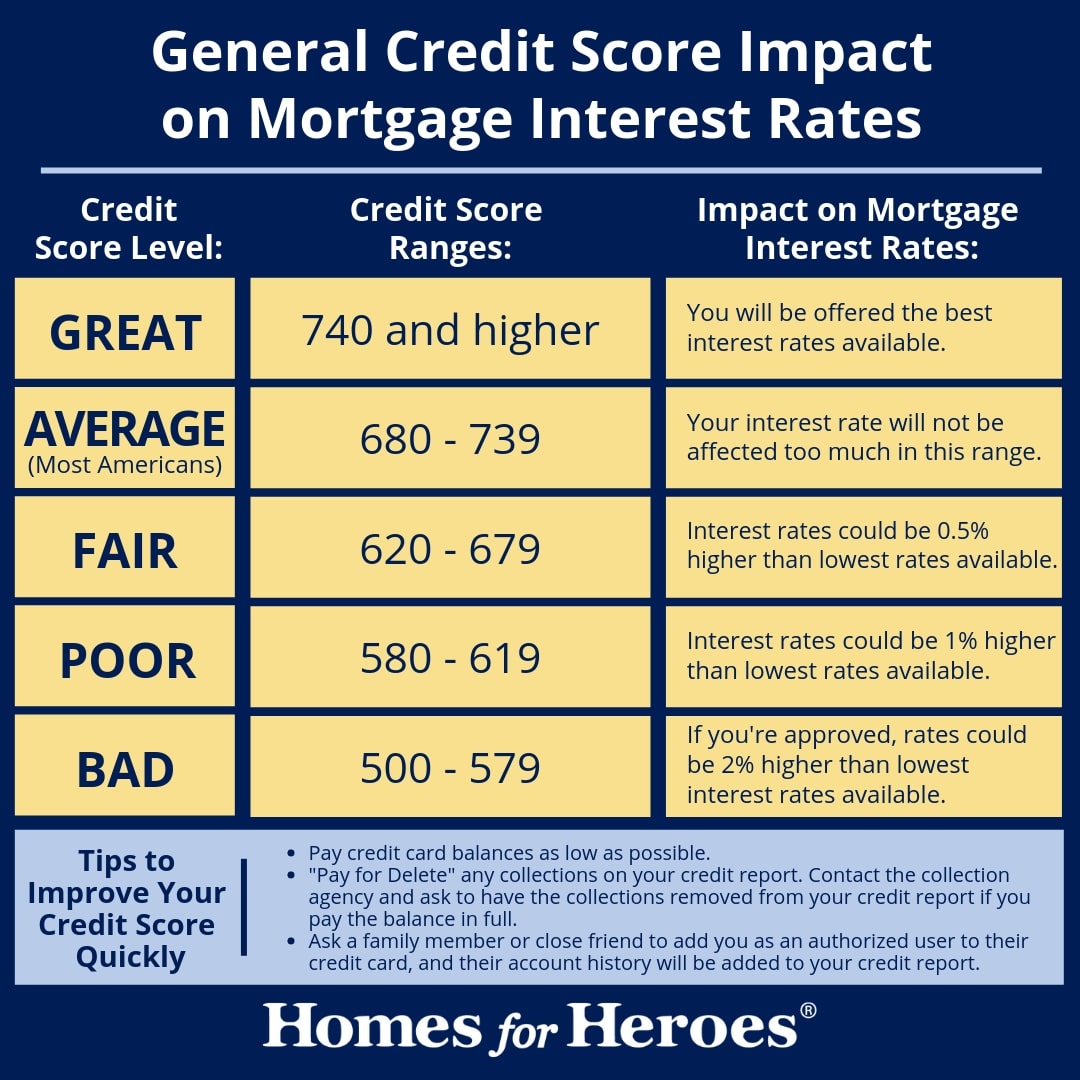

KENTUCKY FHA LOAN CREDIT SCORE REQUIREMENTS

What credit score do I need to qualify for Kentucky FHA loan is one of the most common questions lenders hear. The short answer is you must have a minimum credit score of 500 to be eligible for an Kentucky FHA loan. Higher scores will get you better terms and a smaller down payment requirement. Anything lower than 500 disqualifies you from consideration for an Kentucky FHA loan.

There are two sets of credit score requirements.

One important thing to understand is that the Federal Housing Administration (FHA) does not lend money directly to home buyers. You will fill out an application with a regular lender just as you would if you were applying for any other type of mortgage. What the FHA does is ensure your loan to help protect the lender in case you default. You will be required not only to meet the FHA guidelines to qualify for a loan but also meet any additional qualifications required by the lender. This means there are two sets of requirements you have to meet with your credit score.

1. The first set of requirements comes from the Department of Housing and Urban Development (HUD). HUD oversees the FHA and determines what a borrower’s minimum eligibility requirements will be to obtain an FHA loan.

2. The second set of requirements comes from the mortgage lender. The mortgage lender has the right to add its requirements to those mandated by HUD.

What HUD requires of borrowers to be eligible for an FHA loan

The HUD Handbook 4000.1 includes the official guidelines when it comes to the FHA mortgage insurance program.

It states that in 2020 the borrowers with credit scores of 580 or higher are eligible for a 96.5% loan with 3.5% down.

Borrowers with credit scores from 500 to 579 are eligible for a 90% loan with 10% down.

Individuals with credit scores below 500 are not eligible for the FHA program.

What lenders may require of borrowers to be eligible for an FHA loan

Lenders have the right to add requirements over and above the minimum requirements of HUD. These additional requirements are called overlays. Your lender may or may not require them. This is not something that should come as a surprise to you, however. Requiring a credit score of 580 to 620 is not unusual. In addition to your credit score, you must have a manageable debt level that lenders are comfortable with and enough income to repay your loan.

What credit score do I need to qualify for FHA loan?

These percentages show that the majority of borrowers who successfully qualify for FHA loans fall into the 600 to 799 range. While it is true that some successfully qualify in the low range of 500 to 599, you have a much better chance of being approved for a loan with good terms and a low down payment if you fall into the higher range.

Labels:

580 credit fha ky,

Credit Scores and Kentucky Mortgage Loans,

FHA minimum credit score,

FHA Loan in Kentucky,

FHA Loans - Credit Qualifying for FHA Loans

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky First Time Home Buyer Programs For Home Mortgage Loans: First-Time Home Buyer Programs in Kentucky

Kentucky First Time Home Buyer Programs For Home Mortgage Loans: First-Time Home Buyer Programs in Kentucky: First-Time Home Buyer Programs in Kentucky As a home buyer in Kentucky, you should take a look at the Kentucky first-time home buyer prog...

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Credit Scores FHA Loans Louisville Kentucky KHC First Time Home Buyer Credit Score

What is the minimum Credit Score Needed to Buy a House and get a Kentucky Mortgage Loan?

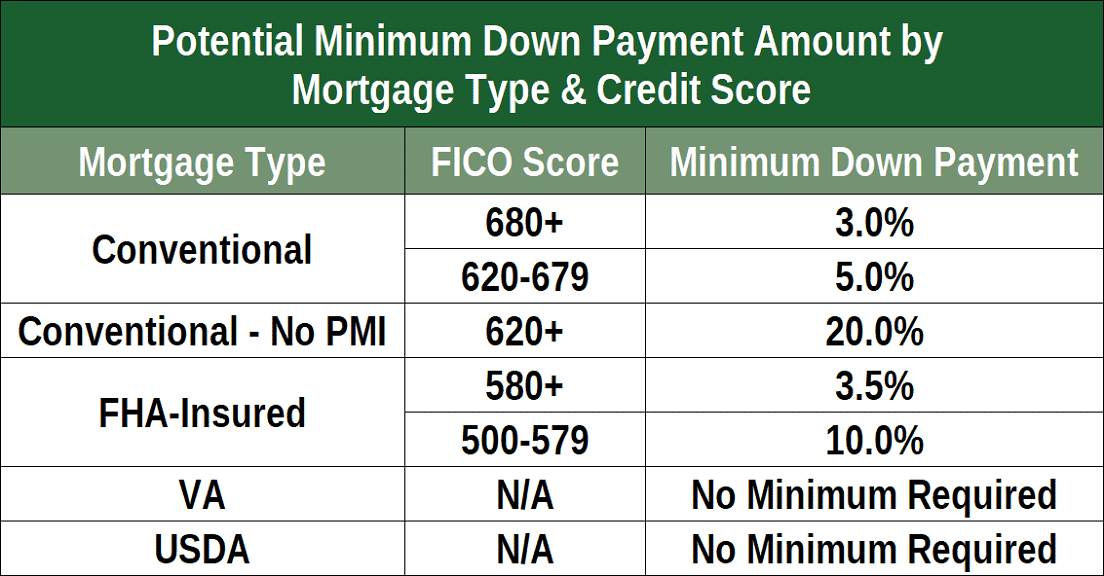

5 POPULAR PROGRAMS THAT KENTUCKY HOME BUYERS USE TO PURCHASE THEIR FIRST HOME.

• At least 3%-5% down• Closing costs will vary on which rate you choose and the lender. Typically the higher the rate, the lesser closing costs due to the lender giving you a lender credit back at closing for over par pricing. Also, called a no-closing costs option. You have to weigh the pros and cons to see if it makes sense to forgo the lower rate and lower monthly payment for the higher rate and less closing costs.

Fico scores needed start at 620, but most conventional lenders will want a higher score to qualify for the 3-5% minimum down payment requirements Most buyers using this loan have high credit scores (over 720) and at least 5% down.

The rates are a little higher compared to FHA, VA, or USDA loan but the mortgage insurance is not for life of loan and can be rolled off when you reach 80% equity position in home.Conventional loans require 4-7 years removed from Bankruptcy and foreclosure.Max Conventional loan limits are set at $510,400 for 2020 in Kentucky

If you meet income eligibility requirements and are looking to settle in a rural area, you might qualify for the KY USDA Rural Housing program. The program guarantees qualifying loans, reducing lenders’ risk and encouraging them to offer buyers 100% loans. That means Kentucky home buyers don’t have to put any money down, and even the “upfront fee” (a closing cost for this type of loan) can be rolled into the financing.

Fico scores usually wanted for this program center around 620 range, with most lenders wanting a 640 score so they can obtain an automated approval through GUS. GUS stands for the Guaranteed Underwriting system, and it will dictate your max loan pre-approval based on your income, credit scores, debt to income ratio and assets.

They also allow for a manual underwrite, which states that the max house payment ratios are set at 29% and 41% respectively of your income.

They loan requires no down payment, and the current mortgage insurance is 1% upfront, called a funding fee, and .35% annually for the monthly mi payment. Since they recently reduced their mi requirements, USDA is one of the best options out there for home buyers looking to buy in an rural area

A rural area typically will be any area outside the major cities of Louisville, Lexington, Paducah, Bowling Green, Richmond, Frankfort, and parts of Northern Kentucky .There is a map link below to see the qualifying areas.

Thee is also a max household income limits with most cutoff starting at $86,400 for a family of four, and up to $115,000 for a family of five or more.USDA requires 3 years removed from bankruptcy and foreclosureThere is no max USDA loan limit.

FHA loans are good for home buyers with lower credit scores and no much down, or with down payment assistance grants. FHA will allow for grants, gifts, for their 3.5% minimum investment and will go down to a 580 credit score.

The current mortgage insurance requirements are kinda steep when compared to USDA, VA , but the rates are usually good so it can counteracts the high mi premiums. As I tell borrowers, you will not have the loan for 30 years, so don’t worry too much about the mi premiums.

THe mi premiums are for life of loan like USDA.

FHA requires 2 years removed from bankruptcy and 3 years removed from foreclosure.Maximum FHA loan limits in Kentucky are set around $331,600 and below.

VA loans are for veterans and active duty military personnel. The loan requires no down payment and no monthly mi premiums, saving you on the monthly payment. It does have an funding fee like USDA, but it is higher starting at 2% for first time use, and 3% for second time use. The funding fee is financed into the loan, so it is not something you have to pay upfront out of pocket.

VA loans can be made anywhere, unlike the USDA restrictions, and there is no income household limit and no max loan limits in Kentucky

Most VA lenders I work with will want a 580 credit score, even though VA says in their guidelines there is no minimum score, good luck finding a lender

VA requires 2 years removed from bankruptcy or foreclosure

VA requires 2 years removed from bankruptcy or foreclosure

This type of loan is administered by KHC in the state of Kentucky. They typically have $4500 to $6000 down payment assistance year around, that is in the form of a second mortgage that you pay back over 10 years.

Sometimes they will come to market with other down payment assistance and lower market rates to benefit lower income households with not a lot of money for down payment.KHC offers FHA, VA, USDA, and Conventional loans with their minimum credit scores being set at 620 for all programs. The conventional loan requirements at KHC requires 660 credit score.

The max debt to income ratios are set at 40% and 50% respectively.

Joel Lobb (NMLS#57916)

Senior Loan Officer

Text/call 502-905-3708

Senior Loan Officer

Text/call 502-905-3708

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant's eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant

Equal Opportunity Lender. NMLS#57916

http://www.

Estimated Sale Price: $110,000

• Rate - 3.75%

• APR - 4.854%

• Down payment - $3850.00

• Principal & Interest - $500.20

• Insurance (estimated) - $75

• Taxes - $47.92

• PMI - $74.56

TOTAL PAYMENT INCLUDING

TAXES + INSURANCE:

$697.68 a month!

*Rates effective 01/16/2020, based on 740 FICO score and subject to change. ARP may vary. Loan terms are fixed rate 30 year loans and payment will not rise over the life of the loan. Not all applicants will qualify for advertised terms and conditions, must meet underwriting guidelines and are subject to credit review and approval. This does not constitute a commitment to lend. The disclosed rates, payments, homeowners insurance and mortgage insurance are estimates and may vary according to lender guidelines. Property taxes based on current assessed value with homestead and mortgage exemptions in place. Equal Housing Lender.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant's eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant

Equal Opportunity Lender. NMLS#57916

http://www.

Estimated Sale Price: $110,000

• Rate - 3.75%

• APR - 4.854%

• Down payment - $3850.00

• Principal & Interest - $500.20

• Insurance (estimated) - $75

• Taxes - $47.92

• PMI - $74.56

• Rate - 3.75%

• APR - 4.854%

• Down payment - $3850.00

• Principal & Interest - $500.20

• Insurance (estimated) - $75

• Taxes - $47.92

• PMI - $74.56

TOTAL PAYMENT INCLUDING

TAXES + INSURANCE:

$697.68 a month!

TAXES + INSURANCE:

$697.68 a month!

*Rates effective 01/16/2020, based on 740 FICO score and subject to change. ARP may vary. Loan terms are fixed rate 30 year loans and payment will not rise over the life of the loan. Not all applicants will qualify for advertised terms and conditions, must meet underwriting guidelines and are subject to credit review and approval. This does not constitute a commitment to lend. The disclosed rates, payments, homeowners insurance and mortgage insurance are estimates and may vary according to lender guidelines. Property taxes based on current assessed value with homestead and mortgage exemptions in place. Equal Housing Lender.

Labels:

580 credit fha ky,

Credit Score First Time Home Buyer Louisville Kentucky KHC,

Credit Scores and Kentucky Mortgage Loans,

FHA Loans,

Fico Score,

Louisville Kentucky

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Subscribe to:

Posts (Atom)