We have the expertise to manually underwrite even the most difficult Kentucky FHA Mortgage loans. Whether it’s purchase or refi—we work hard to approve what other lenders won’t.

Did you know over 50% of our Kentucky FHA loans are manual underwrites?

Kentucky FHA will consider the borrower’s entire story, including extenuating circumstances and compensating factors, to justify loan approvals. If your borrower falls under any of these conditions, they may benefit from manual underwriting:

- Non-traditional credit / lack of credit

- True extenuating circumstances affecting credit or income history

- Lack of seasoning on a Chapter 13

- Disputed accounts over $1,000

- Frequent job changes in the last 12 months

If you think your borrower could benefit from manual underwriting call us to learn more about manual underwriting or submit your scenario today.

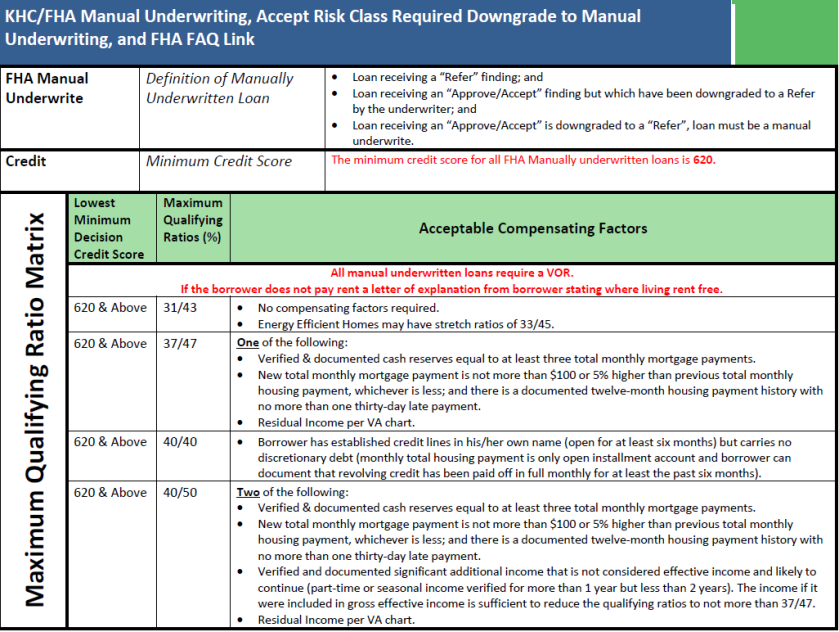

Lowest Minimum Decision Credit Score Maximum Qualifying Ratios (%) Acceptable Compensating Factors

All manual underwritten loans require a VOR.

If the borrower does not pay rent a letter of explanation from borrower stating where living rent free.

620 & Above

31/43

• No compensating factors required.

• Energy Efficient Homes may have stretch ratios of 33/45.

620 & Above

37/47

One of the following:

• Verified & documented cash reserves equal to at least three total monthly mortgage payments.

• New total monthly mortgage payment is not more than $100 or 5% higher than previous total monthly housing payment, whichever is less; and there is a documented twelve-month housing payment history with no more than one thirty-day late payment.

• Residual Income per VA chart.

620 & Above

40/40

• Borrower has established credit lines in his/her own name (open for at least six months) but carries no discretionary debt (monthly total housing payment is only open installment account and borrower can document that revolving credit has been paid off in full monthly for at least the past six months).

620 & Above

40/50

Two of the following:

• Verified & documented cash reserves equal to at least three total monthly mortgage payments.

• New total monthly mortgage payment is not more than $100 or 5% higher than previous total monthly housing payment, whichever is less; and there is a documented twelve-month housing payment history with no more than one thirty-day late payment.

• Verified and documented significant additional income that is not considered effective income and likely to continue (part-time or seasonal income verified for more than 1 year but less than 2 years). The income if it were included in gross effective income is sufficient to reduce the qualifying ratios to not more than 37/47.

• Residual Income per VA chart.

Residual Income

Calculating Residual Income

Residual income is calculated in accordance with the following:

• Calculate the total gross monthly income of all occupying borrowers

• Deduct from the gross monthly income the following items:

➢ State income taxes

➢ Federal income taxes

➢ Municipal or other income taxes

➢ Retirement or Social Security

➢ Proposed total monthly fixed mortgage payment

➢ All recurring monthly debt obligations

➢ Estimated maintenance and utilities ($0.14 x sq. ft.)

➢ Job related expenses (e.g., child care)

• The difference between the gross monthly income and the deductions above is the residual income

Compensating Factors

Using Residual Income as a Compensating Factor

Count all members of the household of the occupying borrowers without regard to the nature of their relationship and without regard to whether they are joining on title or the note.

Exception: As stated in the VA Guidelines, the mortgagee may omit any individuals from “family size” who are fully supported from a source of verified income which is not included in the effective income in the loan analysis. These Individuals must voluntarily provide sufficient documentation to verify their income to qualify for this exemption.

From the table below, select the applicable loan amount and household size. If residual income equals or exceeds the corresponding amount on the table, it may be cited as a compensating factor.

Accept Risk Class required downgrade to Manual Underwriting

The Mortgagee must downgrade and manually underwrite any mortgage that received an accept or approve/eligible recommendation if:

• The mortgage file contains information or documentation that cannot be evaluated by TOTAL.

• Additional information, not considered in the AUS recommendation affects the overall insurability of the mortgage.

• The borrower has $1,000 or more collectively in Disputed Derogatory Credit Accounts.

• The date of the borrower’s bankruptcy discharge as reflected on bankruptcy documents is within two years from the date of the case number assignment.

• The case number assignment date is within three years of the date of the transfer of title through a Pre-Foreclosure Sale (Short Sale).

• The case number assignment date is within three years of the date of the transfer of title through a foreclosure sale.

• The case number assignment date is within three years of the date of the transfer of title through a Deed-in-Lieu (DIL) of foreclosure.

• The Mortgage Payment history, for any mortgage trade line reported on the credit report used to score the application, requires a downgrade as defined in Housing Obligations/Mortgage Payment History.

• The Borrower has undisclosed mortgage debt that requires a downgrade.

• Business income shows a greater than 20 percent decline over the analysis period.

• Per AUS Findings.

FHA FAQ link

ML 2014 – 02 on Manual Underwriting was incorporated into the HUD Handbook 4000.1. Additional source for questions will be the FAQ’s. Use “manual underwriting and compensating factors” to searcH

.jpg)