I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 1300 Kentucky families buy their first home and refinance their current mortgage for a lower rate; Kentucky First time buyers $0 down still available with down payment assistance with KHC. Free Mortgage applications same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS ID1364

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Down Payment Assistance Kentucky 2024 Kentucky Housing Corporation KHC

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2024

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score Booklet

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky

- Home

- Accessibility Statement

- Legal / Privacy Policy / Accessibility Statements

KENTUCKY VA MORTGAGE LENDER APPROVAL REQUIREMENTS

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

KENTUCKY VA MORTGAGE QUALIFYING GUIDELINES

KENTUCKY VA MORTGAGE QUALIFYING GUIDELINES

What are Kentucky VA Home Loans?

VA Loans provide military veterans and current service members a distinct advantage when it comes time to purchase or refinance a home. Today's VA Loans have the most favorable terms available for most veterans. VA Loans can be used to purchase a new home with no down payment with no mortgage insurance or refinance up to 90% of homes current equity.

What are the eligibility requirements for a VA Loan in Kentucky?

Veterans Affairs loan guidelines use two methods of income qualification in Kentucky. The residual income method is the primary method, where it is determined that the borrower has sufficient income to cover daily living costs once housing, taxes, insurance and all other liabilities like credit card and auto payments have been made. Additionally, VA loans use a debt to income ratio (DTI).

How much can I borrow?

The maximum Kentucky VA Mortgage amount is determined by:

Maximum VA Loan in Kentucky: The largest loan allowed for VA mortgages with zero down is now based on your VA loan entitlement in KY. Please refer to the Kentucky VA Loan Limit chart at the bottom of this page to see your area's limit.

Maximum Finance: For purchase transactions, the Maximum VA Loan will be 100% of the lower of the selling price or the appraised value.

What will the down payment and closing costs be?

No down payment required and closing costs vary from lender to lender and usually is based upon the loan amount, credit score, time to close (lock period) and whether or not you get a par rate or a higher rate with a lender credit to pay some of your closing costs at closing.

What property types are allowed for VA Loans in Kentucky?

VA Loans may be used to purchase or refinance single-family residences and VA approved condo projects if the property is the veteran's primary residence.

Can I do a VA refinance in Kentucky?

Three kinds of VA Refinance programs are available for veterans in Kentucky.

Rate/Term VA Refinance

The Rate/Term VA Refinance can be used to refinance a conventional, FHA or subprime mortgage into a stable, fixed rate VA Loan.

VA Cash-Out Refinance

A Cash-Out VA Refinance is very beneficial for the veteran who wants to access the equity that they have built up in their home. VA Loans can be used to refinance up to 90% of a home's current value and take cash out for any reason.

Streamline Refinance

The VA Streamline Refinance is designed to lower the interest rate on a current VA mortgage or convert a current VA adjustable-rate mortgage into a fixed rate. A VA Streamline Refinance Loan can be performed quickly and easily. It requires much less hassle and paperwork than a normal refinance including no appraisal, no qualifying debt ratios and no income verification.

How much can I refinance in Kentucky?

The maximum amount for an KY VA loan is determined by:

Maximum VA Loan in Kentucky: The largest loan allowed for a VA Mortgage varies from county to county. To see what the limit is in the county in which you're interested, visit the following page

👇👇

https://www.benefits.va.gov/HOMELOANS/purchaseco_loan_limits.asp.

This site lists U.S. territories as well as states.

Maximum Finance: In Kentucky, the maximum VA refinance loan amount will be 100% of the appraised value of the home for a rate/term refinance or 100% of the appraised value for a VA cash out refinance.

What factors determine if I am eligible for a VA Refinance Loan?

VA refinance loans use two methods for income qualification purposes in Kentucky. The residual income method is the primary method, where it is determined that the borrower has sufficient income to cover daily living costs once housing, taxes, insurance and all other liabilities like credit card and auto payments have been made. Additionally, VA loans use a debt-to-income ratio (DTI). Using this ratio, the veteran's total debt should not exceed 41% of the veteran's total income. Most lenders will require at least a 580-credit score for a VA Loan approval.

Why choose a VA Home Loan?

Kentucky VA Mortgages require no down payment.

There are no prepayment penalties for VA Home Loans.

A Kentucky VA Loan is fully assumable, provided the person assuming is qualified.

VA Mortgage Loans have no PMI premiums.

A VA Mortgage Loan is eligible for non-credit qualifying, Streamline Refinance or "IRRRL".

A VA Home Mortgage is available all areas of the country, provided a market exists for the property and the home meets VA's property standards.

A VA Home Loan may be used to purchase or refinance a new or existing home.

Kentucky VA Loans are offered at terms of 15 or 30 years.

Senior Loan Officer

(NMLS#57916

text or call my phone: (502) 905-3708

email me at kentuckyloan@gmail.com

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people. NMLS ID# 57916,

All loans and lines are subject to credit approval, verification, and collateral evaluation and are originated by lender. Products and interest rates are subject to change without notice. Manufactured and mobile homes are not eligible as collateral.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Can you buy a house in Kentucky with Bad Credit?

Getting Approved for a Mortgage Loan in Kentucky with Bad Credit.

Mortgage late payments: One late payment in the last 12 months is permitted so long as it can be explained and fully documented if necessary.

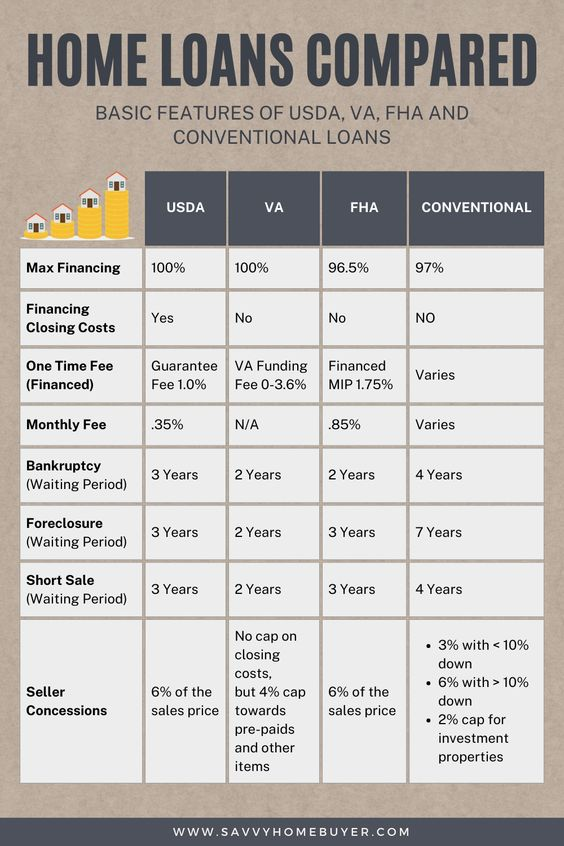

• Foreclosure: Thirty-six months from the date of the foreclosure until eligibility to repurchase using the 3.5 percent down payment FHA Loan, 48 months for VA Loans (no money down required), seven years no matter the down payment on a conventional type.

• Short sale: Thirty-six months from the date of the short sale until eligibility to repurchase using the 3.5 percent down payment FHA Loan, 24 months with the VA, 24 months on a conventional money loan with a minimum down payment of 20 percent.

Bankruptcy: Chapter 7 (Chapter 13 is less common), 24 months from the date of discharge until eligibility to repurchase using the 3.5 percent down FHA Loan, 48 months on VA Loans (still no money down required), 48 months on conventional no matter the down payment. All mortgage companies have different thresholds of risk appetite. For example, the FHA (Federal Housing Administration) has no credit score requirement. Why, then, do lenders have a minimum credit score requirement of 620 for an FHA Loan? Unbeknownst to the majority of home buyers, many mortgage companies have a secret ominous business strategy.

Enter “investor overlays.”

Investor overlays are adjustments to guidelines and/or pricing created in favor of the mortgage company. This is exactly why one lender can do the loan, and another lender cannot do the loan in some instances.

Tip: every mortgage lender has investor overlays, it’s the nature of how mortgage companies operate, key is work with the lender whose overlays are minimal.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky Mortgage Approval Checklist

Kentucky Mortgage Approval Guidelines

1. Mortgage Rates Change

Just like the stock market, mortgage rates change throughout the day. Mortgage rates you see today may not be available tomorrow. If you are in the market for a mortgage loan, be sure to check the current rates being offered by lenders. If you have already done your research and have found your dream home consider locking in your rate as soon as possible.

2. Different Lenders Charge Different Fees

Don’t expect every lender to charge the same fees for a mortgage loan. Every lender structures their fees differently, which is why it is important to shop with at least 3 lenders to compare. Next time you apply for a mortgage loan pay attention to the rates, points being charged and closing costs.

3. Lenders Can Sell Your Loan to Another Bank

Many borrowers have experience getting a mortgage loan with a certain lender only to find out that the loan has been sold to another bank. This occurs because lenders need to free up their liabilities in order to make room to give out more loans. This does not affect your mortgage whatsoever, but it’s important to pay close attention to your mortgage statement and any correspondence you receive in the mail to make sure you do not make payments to the wrong bank.

4. Your Middle Credit Score Matters

When you apply for a mortgage loan, the lender will pull your credit scores from three credit bureaus (Transunion, Equifax and Experian) to help them determined if you are credit worthy. Your middle score of the three is what lenders will use for loan qualification. However, the underwriter will review all three scores as part of the loan underwriting process. If you pull your own credit score through a website online, the credit scores displayed to you may be different than what lenders use because they use different reporting systems.

5. You Can Refinance Your Home Loan Anytime

You can refinance your mortgage anytime, but it doesn’t necessarily mean you should. Think about why you want to refinance. Is because you want to lower your monthly payments, to change the type of loan you are in or to take cash out from your equity? Whatever the reason is, make sure that it makes financial sense.

6. You Can Get a Mortgage Loan After a Foreclosure

Many homeowners have experienced a foreclosure after the recent mortgage crisis. There is good news for these borrowers because they can get a mortgage loan after foreclosure. There are waiting periods involved, for example, to apply for an FHA loan you must wait three years after foreclosure to apply. If you want to get a conventional loan the waiting period is seven years from foreclosure. For those seeking a VA loan, the waiting period is two-years.

There are exceptions to the waiting periods, but you have to show the lender that your foreclosure was caused by an event outside your control, such as losing your job or being seriously ill.

8. Good Credit Allows you to Get Better Mortgage Rates

Good credit scores mean a better rate in any type of loan, especially a mortgage loan. Your credit heavily impacts the type mortgage loan you will qualify for. To maintain a good credit report, make sure you monitored it closely. One of the advantages to good credit is that more banks will want to compete for your business, therefore giving you leverage to negotiate the closing costs.

9. Know Your Annual Percentage Rate (APR)

Knowing your APR will allow you see the true cost of your loan. While the interest rate shows the annual cost of your loan, the APR includes other fees such as origination points, admin fees, loan processing fees, underwriting fees, documentation fees, private mortgage insurance and escrow fees.

There may be more or less fees included in the ARP from what we mentioned. To be sure what fees are included in the APR, ask your lender to give you a breakdown of the closing costs included.

10. You Can Always Reduce Closing Costs

One way to reduce closing costs is to have the sellers contribute towards the closing costs when purchasing your home. This can be negotiated between the buyer and the sellers in the purchase contract. The amount the seller can contribute will depend on the type of loan. Another way to save on closing costs is to have the lender give you a credit to cover out of pocket loan costs.

Senior Loan Officer

(NMLS#57916

text or call my phone: (502) 905-3708

email me at kentuckyloan@gmail.com

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Here are action steps you can take right now to buy a home in Kentucky in 2024

Here are action steps you can take right now to buy a home in Kentucky in 2023

1. Focus on your credit score

FICO credit scores are among the most frequently used credit scores, and range from 350-800 (the higher, the better). A consumer with a credit score of 750 or higher is considered to have excellent credit, while a consumer with a credit score below 620 is considered to have poor credit.

To qualify for a mortgage and get a low mortgage rate, your credit score matters.

Each credit bureau collects information on your credit history and develops a credit score that lenders use to assess your riskiness as a borrower. If you find an error, you should report it to the credit bureau immediately so that it can be corrected.

2. Manage your debt-to-income ratio

Many lenders evaluate your debt-to-income ratio when making credit decisions, which could impact the interest rate you receive.

A debt-to-income ratio is your monthly debt payments as a percentage of your monthly income. Lenders focus on this ratio to determine whether you have enough excess cash to cover your living expenses plus your debt obligations.

Since a debt-to-income ratio has two components (debt and income), the best way to lower your debt-to-income ratio is to:

- repay existing debt;

- earn more income; or

- do both

3. Pay attention to your payments

Simply put, lenders want to lend to financially responsible borrowers.

Your payment history is one of the largest components of your credit score. To ensure on-time payments, set up autopay for all your accounts so the funds are directly debited each month.

FICO scores are weighted more heavily by recent payments so your future matters more than your past.

In particular, make sure to:

- Pay off the balance if you have a delinquent payment

- Don't skip any payments

- Make all payments on time

4. Get pre-approved for a mortgage before you start shopping for a home loan.

Too many people find their home and then get a mortgage.

Switch it.

Get pre-approved with a lender first. Then, you'll know how much home you can afford.

To get pre-approved, lenders will look at your income, assets, credit profile and employment, among other documents.

5. Keep credit utilization low on your credit cards

Lenders also evaluate your credit card utilization, or your monthly credit card spending as a percentage of your credit limit.

Ideally, your credit utilization should be less than 30%. If you can keep it less than 10%, even better.

For example, if you have a $10,000 credit limit on your credit card and spent $3,000 this month, your credit utilization is 30%.

Here are some ways to manage your credit card utilization:

- set up automatic balance alerts to monitor credit utilization

- ask your lender to raise your credit limit (this may involve a hard credit pull so check with your lender first)

- pay off your balance multiple times a month to reduce your credit utilization

6. Look for down payment assistance in Kentucky

There are various types of down payment assistance, even if you have student loans.

Here are a few:

- FHA loans - federal loan through the Federal Housing Authority

- USDA loans - zero down mortgages for rural and suburban homeowners

- VA loans - if military service

- Kentucky Housing Down Payment Assistance of $10,000

There are federal, state and local assistance programs as well so be on the look out.

If you want a personalized answer for your unique situation call, text, or email me or visit my website below:

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

https://kentuckyloan.blogspot.com/

Mortgage Loan Officer

email: kentuckyloan@gmail.com

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Different Types of Kentucky Home Loans

Different Loan Programs to Consider below:

1. KHC Loan (Kentucky Housing Loan with Down Payment Assistance)

The first no money-down home loan program offered by Kentucky Housing currently offers $10,000 in down payment assistance (DAP) along with a 30 year fixed rate loan of 6.0%. The maximum income limits are $157,000 for a household with a max loan of 481,000.00 It requires a 620 minimum credit score and can be done anywhere in Kentucky.

-Need to be 2 years removed from a Chapter 7 Bankruptcy and 3 years removed from a foreclosure.

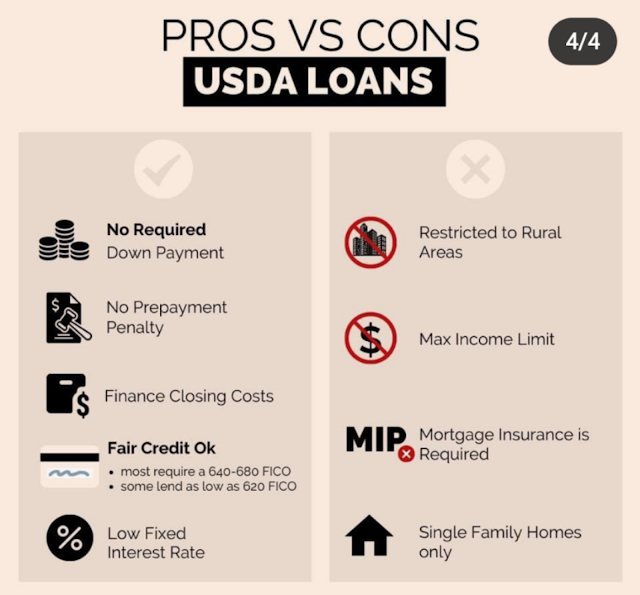

2. USDA Loan (Rural Housing Loan)

The second no money down home loan option is the USDA program for properties located outside urban areas of Kentucky areas where you can secure a no money down loan at a current low fixed rate of 6.75% on 30 years. The max household income limits usually are between $110,500 to $146,000 for most rural area counties depending on household family size. as long as you meet the income and credit restrictions

A 620-640 middle credit score is needed for loan approval on this program. They're no max loan limits on USDA loans. You just need to qualify based on your debt to income ratio (see below under income section)

Need to be 3 years removed from a Chapter 7 Bankruptcy and 3 years from a foreclosure

3. FHA Loan

If you have access to putting a small down payment down on the sales price of the house , ( at least a 3.5% down payment of the sales price for FHA), we can always look at doing a FHA loan down to a lower credit score of 580-

The current 30 year fixed rate loan with someone having at least 3.5% down payment is averaging around 6.75% on a 30 year fixed rate loan.

It is possible to get a FHA loan with a score below 580, but you would need 10% down payment and it is much tougher to qualify honestly with most FHA lenders we deal with.

The max loan for a FHA loan in Kentucky is $472,000 and there are no maximum household income limits nor geographical restrictions on FHA loans so you can buy a home in any location with no check to your maximum income limits.

Need to be 2 years removed from a Chapter 7 Bankruptcy and 3 years from a foreclosure

4. Conventional Loan

Requires 5% down payment and good for buyers that have a 660-720 credit score or higher . The max loan is $726,200 and has no income restrictions and the loan can be done anywhere. Current rate is around 7.25% with someone with high credit scores over 720

Need to be removed from a Chapter 7 or 13 Bankruptcy from 4 years of discharge date.

Best suited for borrowers will have high credit scores, say over 700, and at least 3 to 5% down payment.

5. VA loan

If you happen to be a Veteran, you can also buy a house, going no money down with a current 30 year fixed rate of 6.75%.

-Need to be 2 years removed from a Chapter 7 Bankruptcy and 2 years removed from a foreclosure.

Must be a veteran and no minimum score required but most VA lenders will want a 580 or higher. some may want a 620

-No max income limits or purchase price limits or restrictions on where home is located.

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Can You Buy A House After Bankruptcy

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky FHA Mortgage Loans vs Kentucky USDA Rural Housing Loans Compared

Here are the important points about Kentucky USDA Rural Housing Loans:

- USDA loan are only available in certain counties of Kentucky.

- There are two types of USDA loans available: Direct and Guaranteed.

- 100% financing. No down payment

- USDA will go down to a no score and uses and automated underwriting pre-approval system called GUS-Guarantee Underwriting System. The GUS findings will dictate your loan pre-approval.

- Kentucky USDA Rural Housing Income limits based on county and number of people in household.

- Must be 3 years removed from bankruptcy and foreclosure

- No purchase price limit

- Upfront funding fee of 1% of loan amount paid to RD at closing

- Annual mi fee of .35% paid each month for life of loan.

- Takes on average 30-45 days to close.

- 30 year fixed rate is the only term available and rates are usually comparable to FHA and VA government mortgage insured rates.

- Do not have to be a first time home buyer and can currently own another home if USDA deems the current living situation not suitable.

- Appraisal has to meet FHA minimum standards

- You can buy a home with land on USDA Loans as long as the property does not have any agricultural characteristics or income producing capabilities.

- There is no set max acreage but the appraisal will dictate approval of property by USDA.

- You can only use USDA loans to purchase property or refinance an existing USDA loan

- Pools are okay and homes in a flood zone are okay. This is a recent change

Here are some important facts about Kentucky FHA Loans:

- FHA loans can be made in any county of Kentucky.

- FHA loans require 3.5% down payment

- FHA Mortgage terms are available in 30, 20, 15, 10 year terms.

- Credit score down to 500 are acceptable but subject to investor approval. will need 10% down payment

- Most lenders will want a 620 score, with some going down to 580 with conditions will need 3.5% down payment

- FHA loans are pre-approved using DU, an online automated underwriting system that will dictate your loan approval conditions.

- FHA has max income limits in Kentucky with the maximum being $498,257 for most Kentucky Counties

- There are no income limits on the household for FHA loans

- There is a upfront mi premium of 1.75% and a monthly fee of .85% payable each month.

- If you finance over 90% of the homes value, the monthly mi factor of .85% is for life of loan. If less than 90%, 11 year term for annual mi fee.

- FHA, USDA rates are really comparable on paper, no big difference except for the mi

- FHA requires 3 years out on a short-sale or foreclosure

- FHA requires 2 years out on Chapter 7 and 1 year out on a Chapter 13 with good clean history for the last 12 months with no lates.

- Not required to be a first time home buyer

- Can refinance an existing FHA loan to another without appraisal, income, a processed call FHA streamline refinance

- Can go no money down potentially with a 620 credit score with a grant. We offer these.

Senior Loan Officer

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant's eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.