Credit Score Needed to Buy a House and get a Kentucky Mortgage?

Conventional Loan

• At least 3%-5% down• Closing costs will vary on which rate you choose and the lender. Typically, the higher the rate, the lesser closing costs due to the lender giving you a lender credit back at closing for over par pricing. Also, called a no-closing costs option. You have to weigh the pros and cons to see if it makes sense to forgo the lower rate and lower monthly payment for the higher rate and less closing costs.

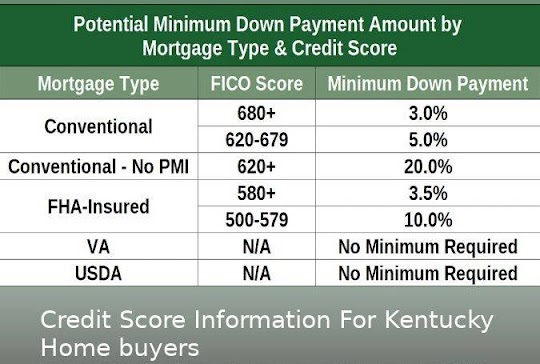

Fico scores needed start at 620, but most conventional lenders will want a higher score to qualify for the 3-5% minimum down payment requirements Most buyers using this loan have high credit scores (over 720) and at least 5% down.

The rates are a little higher compared to FHA, VA, or USDA loan but the mortgage insurance is not for life of loan and can be rolled off when you reach 80% equity position in home. Conventional loans require 4-7 years removed from Bankruptcy and foreclosure.

Kentucky USDA Rural Housing Program

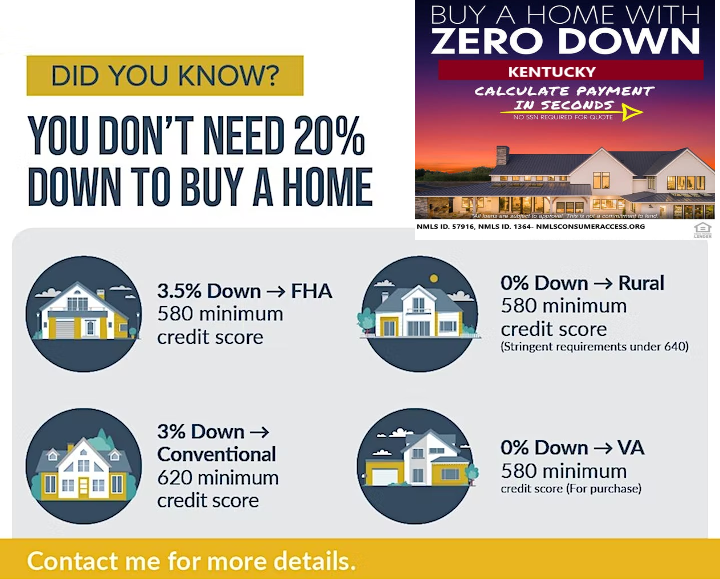

If you meet income eligibility requirements and are looking to settle in a rural area, you might qualify for the KY USDA Rural Housing program. The program guarantees qualifying loans, reducing lenders’ risk and encouraging them to offer buyers 100% loans. That means Kentucky home buyers don’t have to put any money down, and even the “upfront fee” (a closing cost for this type of loan) can be rolled into the financing.

Fico scores usually wanted for this program center around 620 range, with most lenders wanting a 640 score so they can obtain an automated approval through GUS. GUS stands for the Guaranteed Underwriting system, and it will dictate your max loan pre-approval based on your income, credit scores, debt to income ratio and assets.

They also allow for a manual underwrite, which states that the max house payment ratios are set at 29% and 41% respectively of your income.

They loan requires no down payment, and the current mortgage insurance is 1% upfront, called a funding fee, and .35% annually for the monthly mi payment. Since they recently reduced their mi requirements, USDA is one of the best options out there for home buyers looking to buy in a rural area

A rural area typically will be any area outside the major cities of Louisville, Lexington, Paducah, Bowling Green, Richmond, Frankfort, and parts of Northern Kentucky. There is a map link below to see the qualifying areas.

There is also a max household income limits with most cutoff starting at 109,500 for a family of four, and up to $136,000 for a family of five or more.

The income limits change every spring, so make sure and check to see what updated income limits are.

USDA requires 3 years removed from bankruptcy and foreclosure

There is no max USDA loan limit.

Kentucky FHA Loan

FHA loans are good for home buyers with lower credit scores and no much down, or with down payment assistance grants. FHA will allow for grants, gifts, for their 3.5% minimum investment and will go down to a 580-credit score.

The current mortgage insurance requirements are kind of steep when compared to USDA, VA, but the rates are usually good so it can counteract the high mi premiums. As I tell borrowers, you will not have the loan for 30 years, so don’t worry too much about the mi premiums.

The mi premiums are for life of loan like USDA.

FHA requires 2 years removed from bankruptcy and 3 years removed from foreclosure.

Kentucky VA Loan

VA loans are for veterans and active-duty military personnel. The loan requires no down payment and no monthly mi premiums, saving you on the monthly payment. It does have an funding fee like USDA, but it is higher starting at 2% for first time use, and 3% for second time use. The funding fee is financed into the loan, so it is not something you have to pay upfront out of pocket.

VA loans can be made anywhere, unlike the USDA restrictions, and there is no income household limit and no max loan limits in Kentucky

Most VA lenders I work with will want a 580-credit score, even though VA says in their guidelines there is no minimum score, good luck finding a lender

VA requires 2 years removed from bankruptcy or foreclosure

Clear Caviars needed to for a VA loan.

Kentucky Down Payment Assistance

This type of loan is administered by KHC in the state of Kentucky. They typically have $10,000 down payment assistance year around, that is in the form of a second mortgage that you pay back over 10 years.

Sometimes they will come to market with other down payment assistance and lower market rates to benefit lower income households with not a lot of money for down payment.

KHC offers FHA, VA, USDA, and Conventional loans with their minimum credit scores being set at 620 for all programs. The conventional loan requirements at KHC requires 660 credit score.

The max debt to income ratios is set at 40% and 50% respectively.

Joel Lobb (NMLS#57916)

Senior Loan Officer

Text/call 502-905-3708

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

kentuckyloan@gmail.com

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant's eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant

Equal Opportunity Lender. NMLS#57916

http://www.nmlsconsumeraccess.org/