I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 900 Kentucky families buy their first home and refinance their current mortgage for a lower rate; Kentucky First time buyers $0 down still available with down payment assistance with KHC. Free Mortgage applications same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS ID 1364

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Down Payment Assistance Kentucky 2024 Kentucky Housing Corporation KHC

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2024

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score Booklet

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky

- Home

- Accessibility Statement

- Legal / Privacy Policy / Accessibility Statements

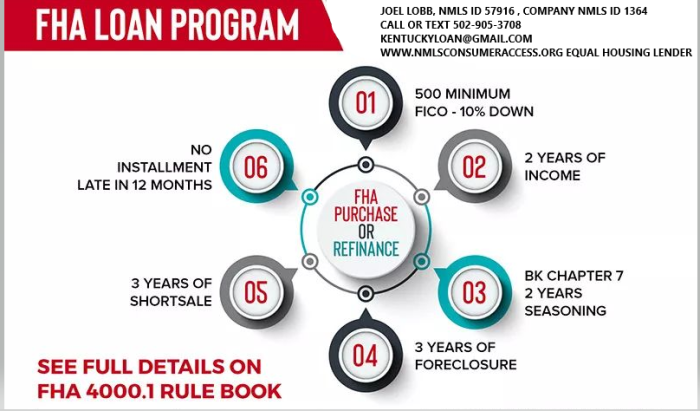

Bankruptcy, Foreclosure, Short-sale for Kentucky Conventional, FHA, VA, Mortgage Loan Guidelines

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

What is an FHA Loan and Is It Right for You?

The Federal Housing Administration insures what are called FHA loans. These mortgage loans provide opportunities for buyers with less-than-perfect credit or limited down payments to purchase homes, but they aren’t without potential pitfalls.

FHA loans are available to borrowers with a credit score of at least 580, and you have to make a minimum 3.5% down payment. They’re a popular option for first-time home buyers.

Lenders such as banks and credit unions issue the mortgages, which are insured by the FHA. That protects the lender if the borrower defaults, which is why the terms are more favorable than a traditional mortgage.

Around eight million single-family homes have loans insured by the FHA.

What Can an FHA Loan be Used For?

You can use an FHA loan to refinance single-family houses, to buy a single-family home, to buy some multifamily homes and condos and certain mobile and manufactured homes. There are particular types of FHA loans that can be used to renovate an existing property or for new construction.

How is an FHA Loan Different from a Conventional Mortgage Loan?

The biggest differentiator between an FHA loan and a conventional mortgage is that it’s easier to qualify for an FHA loan. You may get a loan with a lower credit score than you would otherwise, and your mortgage insurance payments may be lower too.

There are also fewer restrictions as far as using gifts from family or donations for your down payment.

If you have a FICO score of at least 580, you have to make a 3.5% down payment. With a FICO score between 500 and 579, you’re required to make a 10% down payment, and mortgage insurance is required. Your debt-to-income ratio needs to be less than 43% whereas with a conventional loan it’s usually 36%. You do need to have proof of income and steady employment, as you would need with a conventional loan.

Are There FHA Loan Limits?

There are limits on the mortgage amount you can get with an FHA-guaranteed loan. The limits vary based on your county, and in 2020 these ranged from $331,760 to $765,600. The limit amounts are updated by the FHA each year based on fluctuations in home prices.

The Benefits of the FHA Loan

The primary benefits of an FHA loan are that buyers who wouldn’t otherwise qualify may be able to own a home and for a lower down payment. Sometimes the FHA will help facilitate coverage of closing costs. If you have problems making payments on an FHA loan you may be eligible for a forbearance period if you qualify.

What Are the Downsides of an FHA Loan?

You will have to pay an upfront mortgage insurance premium with an FHA loan to protect the lender. The fee is due when you close and it’s 1.75% of your loan. You will also have to pay an annual mortgage insurance premium for the life of your loan. The amount can range between 0.45% and 1.05%.

When you buy a home with an FHA loan, it has to meet strict standards in terms of health and safety.

Also, while there are set standards from the FHA, approved lenders can create their own requirements.

Applying for an FHA Loan

You’ll have to first find an FHA-approved lender to get one of these home loans. You’ll need some documents, including proof of U.S. citizenship, legal permanent residency, or eligibility to work in America. You’ll need bank statements for at least the past 30 days, and you’ll probably need to show pay stubs.

Some of the information your lender may be able to obtain on your behalf, such as your credit reports, tax returns and employment records.

There are advantages to an FHA loan because it expands homeownership to more people than conventional loans. It’s just important that if you’re considering this loan you understand the costs and that you’re not taking on more than you’re financially prepared for because of the less stringent approval requirements.

Written by Ashley Sutphin for www.RealtyTimes.com Copyright © 2020 Realty Times All Rights Reserved.

|

| Add caption |

Mortgage Loan Officer Individual NMLS ID #57916

American Mortgage Solutions, Inc.

Text/call: 502-905-3708 fax: 502-327-9119

|

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky USDA Rural Housing Mortgage Lender: USDA Rural Housing Loan helps elderly woman become...

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Current Credit Score Requirements for Kentucky FHA, VA, USDA and Conventional Mortgages Loans in Kentucky!

KENTUCKY FHA MORTGAGE LOANS 👈👈👈 Read more at link

· Minimum credit score: 620 AUS approved, 640 manuals

· Non-Credit Qualifying Streamline refinances allowed

· Gift funds allowed for down payment and closing costs

· Cash out 80% LTV

KENTUCKY VA MORTGAGE LOANS 👈👈👈 Read more at link

· Minimum credit score: 620 AUS approved, 640 manuals

· Cash-out up to 90% LTV

· Foreclosure/Short Sale/Bankruptcy <2 years allowed with AUS Approval

KENTUCKY USDA MORTGAGE LOANS 👈👈👈 Read more at link

· Minimum credit score: 640

· 100% maximum LTV

· No maximum loan amount

· Rate/Term refinances allowed

KENTUCKY CONVENTIONAL MORTGAGE LOANS 👈👈👈 Read more at link

· 620 min score

· Fannie Mae

· Freddie Mac

· Standard and High Balance

· HomeReady

· HomePossible

***KEEP IN MIND..ALL MORTGAGE LENDERS HAVE DIFFERENT CREDIT SCORE REQUIREMENTS SO CHECK WITH YOUR LENDER FIRST.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

100% Financing Zero Down Payment Kentucky Mortgage Home Loans for Kentucky First time Home Buyers: Louisville Kentucky Mortgage Lender for FHA, VA, ...

Kentucky First-time Home Buyer Programs

Conventional Mortgage Loan in Kentucky.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky First Time Home Buyer Programs For Home Mortgage Loans: Kentucky Home Loan Programs available to buy a hom...

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgage: Credit Scores Kentucky Mortgage Loan

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky USDA Rural Housing Mortgage Lender: USDA has announced an upfront guarantee fee of 1%

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.