I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 900 Kentucky families buy their first home and refinance their current mortgage for a lower rate; Kentucky First time buyers $0 down still available with down payment assistance with KHC. Free Mortgage applications same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS ID 1364

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Down Payment Assistance Kentucky 2024 Kentucky Housing Corporation KHC

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2024

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score Booklet

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky

- Home

- Accessibility Statement

- Legal / Privacy Policy / Accessibility Statements

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Closing Costs Kentucky Mortgage

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky First Time Home Buyer Programs

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Legal Separation vs. Divorce Decree for a Kentucky Mortgage Loan.

- be a legal separation,

- include the same information that would be obtained from a divorce decree,

- be recorded, if required by law. (See Kentucky State Specific Requirements for Divorce and Legal Separation for Kentucky Mortgage Loans in Fairway guidelines)

Property in a Divorce

- What kinds of things are property?

- What happens to our property in a divorce?

- What is the difference between marital and non-marital property?

- Does the court divide marital property 50-50?

- What if I do not agree with what my spouse says is non-marital property?

- What about property from after the separation, but before the divorce is final?

- Will I get half of each asset?

- How do we know the value of our home?

- Will the court allow us to divide our property the way we want to?

- Real property, such as buildings and land, and

- Personal property, such as money in cash or in a financial institution, furniture, jewelry, automobiles, etc.

- Was obtained during your marriage (even if the title is in only one of your names),

- Was given to both of you as a gift, or

- You inherited together.

- You already had when you got married, or

- You inherited or received as a gift individually. (If your spouse says the property was given to both of you, you will have to prove that it was given only to you.)

- Each spouse's financial situation, including income, spousal maintenance, and non-marital property,

- Each spouse's contribution to their marital property,

- Which spouse will stay in the marital home, if there are children, and

- If a spouse improperly destroyed marital property after you separated.

Mortgage Loan Officer

email: kentuckyloan@gmail.com

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

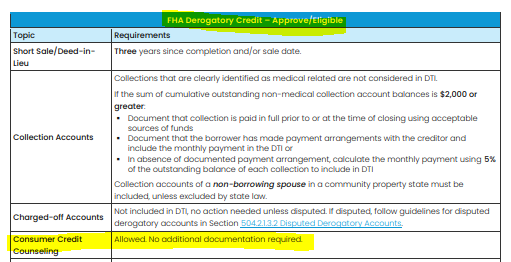

How does consumer credit counseling effects things on a Kentucky FHA or USDA loan in Kentucky ?

KENTUCKY FHA GUIDELINES FOR CONSUEMR CREDIT COUNSELING

(J) Credit Counseling/Payment Plan (APPROVE/ELIGIBLE)Participatin

(K) Credit Counseling/Payment Plan (MANUAL UW) Participating in a consumer credit counseling

- one year of the payout period has elapsed under the plan;

- the Borrower’s payment performance has been satisfactory and all required payments have been made on time; and

- the Borrower has received written permission from the counseling agency to enter into the mortgage transaction.

KENTUCKY RURAL HOUSING USDA GUIDELINES FOR CONSUMER CREDIT COUNSELING

CONSUMER CREDIT COUNSELING - DEBT MANAGEMENT PLANS |

Credit counseling provides guidance and support to consumers which may include assistance to negotiate with creditors on behalf of the borrower to reduce interest rates, late fees, and agree upon a repayment plan. The credit score will reflect the degradation of credit due to participation in this plan. Credit accounts that are included in the repayment plan may continue to report as delinquent or as late pays. This is typical and will not be considered as recent adverse credit. Lenders must retain documentation to support the accounts included in the debt management plan and the applicable monthly payment. Lenders must include the monthly payment amount due for the counseling plan in the monthly liabilities. GUS Accept/Accept with Full Documentation files: No credit exception is required. GUS Refer, Refer with Caution, and manually underwritten files: The following must be documented and retained in the lender’s permanent loan file: •One year of the payment period of the debt management plan has elapsed; •All payments have been made on time; and •Written permission from the counseling agency to recommend the applicant as acandidate for a new mortgage loan debt. •No credit exception is required |

Mortgage Loan Officer

email: kentuckyloan@gmail.com

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky USDA Rural Housing Mortgage Lender: Kentucky USDA Rural Housing Guidelines for Debt Ra...

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky VA Mortgage Loan Information

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

First Time Home Buyer Kentucky DOWN PAYMENT ASSISTANCE KENTUCKY Kentucky First Time Home Buyer Programs

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

FHA Mortgage Manual Underwriting Video Guidelines

We have the expertise to manually underwrite even the most difficult Kentucky FHA Mortgage loans. Whether it’s purchase or refi—we work hard to approve what other lenders won’t.

Did you know over 50% of our Kentucky FHA loans are manual underwrites?

Kentucky FHA will consider the borrower’s entire story, including extenuating circumstances and compensating factors, to justify loan approvals. If your borrower falls under any of these conditions, they may benefit from manual underwriting:

- Non-traditional credit / lack of credit

- True extenuating circumstances affecting credit or income history

- Lack of seasoning on a Chapter 13

- Disputed accounts over $1,000

- Frequent job changes in the last 12 months

If you think your borrower could benefit from manual underwriting call us to learn more about manual underwriting or submit your scenario today.

Lowest Minimum Decision Credit Score Maximum Qualifying Ratios (%) Acceptable Compensating Factors

All manual underwritten loans require a VOR.

If the borrower does not pay rent a letter of explanation from borrower stating where living rent free.

620 & Above

31/43

• No compensating factors required.

• Energy Efficient Homes may have stretch ratios of 33/45.

620 & Above

37/47

One of the following:

• Verified & documented cash reserves equal to at least three total monthly mortgage payments.

• New total monthly mortgage payment is not more than $100 or 5% higher than previous total monthly housing payment, whichever is less; and there is a documented twelve-month housing payment history with no more than one thirty-day late payment.

• Residual Income per VA chart.

620 & Above

40/40

• Borrower has established credit lines in his/her own name (open for at least six months) but carries no discretionary debt (monthly total housing payment is only open installment account and borrower can document that revolving credit has been paid off in full monthly for at least the past six months).

620 & Above

40/50

Two of the following:

• Verified & documented cash reserves equal to at least three total monthly mortgage payments.

• New total monthly mortgage payment is not more than $100 or 5% higher than previous total monthly housing payment, whichever is less; and there is a documented twelve-month housing payment history with no more than one thirty-day late payment.

• Verified and documented significant additional income that is not considered effective income and likely to continue (part-time or seasonal income verified for more than 1 year but less than 2 years). The income if it were included in gross effective income is sufficient to reduce the qualifying ratios to not more than 37/47.

• Residual Income per VA chart.

Residual Income

Calculating Residual Income

Residual income is calculated in accordance with the following:

• Calculate the total gross monthly income of all occupying borrowers

• Deduct from the gross monthly income the following items:

➢ State income taxes

➢ Federal income taxes

➢ Municipal or other income taxes

➢ Retirement or Social Security

➢ Proposed total monthly fixed mortgage payment

➢ All recurring monthly debt obligations

➢ Estimated maintenance and utilities ($0.14 x sq. ft.)

➢ Job related expenses (e.g., child care)

• The difference between the gross monthly income and the deductions above is the residual income

Compensating Factors

Using Residual Income as a Compensating Factor

Count all members of the household of the occupying borrowers without regard to the nature of their relationship and without regard to whether they are joining on title or the note.

Exception: As stated in the VA Guidelines, the mortgagee may omit any individuals from “family size” who are fully supported from a source of verified income which is not included in the effective income in the loan analysis. These Individuals must voluntarily provide sufficient documentation to verify their income to qualify for this exemption.

From the table below, select the applicable loan amount and household size. If residual income equals or exceeds the corresponding amount on the table, it may be cited as a compensating factor.

Accept Risk Class required downgrade to Manual Underwriting

The Mortgagee must downgrade and manually underwrite any mortgage that received an accept or approve/eligible recommendation if:

• The mortgage file contains information or documentation that cannot be evaluated by TOTAL.

• Additional information, not considered in the AUS recommendation affects the overall insurability of the mortgage.

• The borrower has $1,000 or more collectively in Disputed Derogatory Credit Accounts.

• The date of the borrower’s bankruptcy discharge as reflected on bankruptcy documents is within two years from the date of the case number assignment.

• The case number assignment date is within three years of the date of the transfer of title through a Pre-Foreclosure Sale (Short Sale).

• The case number assignment date is within three years of the date of the transfer of title through a foreclosure sale.

• The case number assignment date is within three years of the date of the transfer of title through a Deed-in-Lieu (DIL) of foreclosure.

• The Mortgage Payment history, for any mortgage trade line reported on the credit report used to score the application, requires a downgrade as defined in Housing Obligations/Mortgage Payment History.

• The Borrower has undisclosed mortgage debt that requires a downgrade.

• Business income shows a greater than 20 percent decline over the analysis period.

• Per AUS Findings.

FHA FAQ link

ML 2014 – 02 on Manual Underwriting was incorporated into the HUD Handbook 4000.1. Additional source for questions will be the FAQ’s. Use “manual underwriting and compensating factors” to searcH

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.