What is the minimum Credit Score Needed to Buy a House and get a Kentucky Mortgage Loan?

5 POPULAR PROGRAMS THAT KENTUCKY HOME BUYERS USE TO PURCHASE THEIR FIRST HOME.

• At least 3%-5% down• Closing costs will vary on which rate you choose and the lender. Typically the higher the rate, the lesser closing costs due to the lender giving you a lender credit back at closing for over par pricing. Also, called a no-closing costs option. You have to weigh the pros and cons to see if it makes sense to forgo the lower rate and lower monthly payment for the higher rate and less closing costs.

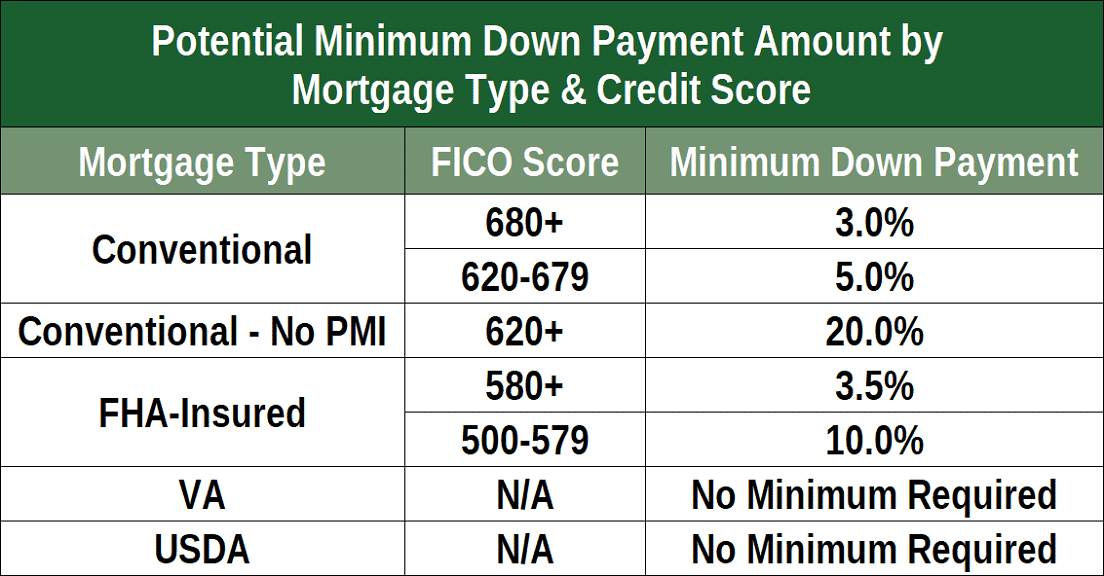

Fico scores needed start at 620, but most conventional lenders will want a higher score to qualify for the 3-5% minimum down payment requirements Most buyers using this loan have high credit scores (over 720) and at least 5% down.

The rates are a little higher compared to FHA, VA, or USDA loan but the mortgage insurance is not for life of loan and can be rolled off when you reach 80% equity position in home.Conventional loans require 4-7 years removed from Bankruptcy and foreclosure.Max Conventional loan limits are set at $510,400 for 2020 in Kentucky

If you meet income eligibility requirements and are looking to settle in a rural area, you might qualify for the KY USDA Rural Housing program. The program guarantees qualifying loans, reducing lenders’ risk and encouraging them to offer buyers 100% loans. That means Kentucky home buyers don’t have to put any money down, and even the “upfront fee” (a closing cost for this type of loan) can be rolled into the financing.

Fico scores usually wanted for this program center around 620 range, with most lenders wanting a 640 score so they can obtain an automated approval through GUS. GUS stands for the Guaranteed Underwriting system, and it will dictate your max loan pre-approval based on your income, credit scores, debt to income ratio and assets.

They also allow for a manual underwrite, which states that the max house payment ratios are set at 29% and 41% respectively of your income.

They loan requires no down payment, and the current mortgage insurance is 1% upfront, called a funding fee, and .35% annually for the monthly mi payment. Since they recently reduced their mi requirements, USDA is one of the best options out there for home buyers looking to buy in an rural area

A rural area typically will be any area outside the major cities of Louisville, Lexington, Paducah, Bowling Green, Richmond, Frankfort, and parts of Northern Kentucky .There is a map link below to see the qualifying areas.

Thee is also a max household income limits with most cutoff starting at $86,400 for a family of four, and up to $115,000 for a family of five or more.USDA requires 3 years removed from bankruptcy and foreclosureThere is no max USDA loan limit.

FHA loans are good for home buyers with lower credit scores and no much down, or with down payment assistance grants. FHA will allow for grants, gifts, for their 3.5% minimum investment and will go down to a 580 credit score.

The current mortgage insurance requirements are kinda steep when compared to USDA, VA , but the rates are usually good so it can counteracts the high mi premiums. As I tell borrowers, you will not have the loan for 30 years, so don’t worry too much about the mi premiums.

THe mi premiums are for life of loan like USDA.

FHA requires 2 years removed from bankruptcy and 3 years removed from foreclosure.Maximum FHA loan limits in Kentucky are set around $331,600 and below.

VA loans are for veterans and active duty military personnel. The loan requires no down payment and no monthly mi premiums, saving you on the monthly payment. It does have an funding fee like USDA, but it is higher starting at 2% for first time use, and 3% for second time use. The funding fee is financed into the loan, so it is not something you have to pay upfront out of pocket.

VA loans can be made anywhere, unlike the USDA restrictions, and there is no income household limit and no max loan limits in Kentucky

Most VA lenders I work with will want a 580 credit score, even though VA says in their guidelines there is no minimum score, good luck finding a lender

VA requires 2 years removed from bankruptcy or foreclosure

VA requires 2 years removed from bankruptcy or foreclosure

This type of loan is administered by KHC in the state of Kentucky. They typically have $4500 to $6000 down payment assistance year around, that is in the form of a second mortgage that you pay back over 10 years.

Sometimes they will come to market with other down payment assistance and lower market rates to benefit lower income households with not a lot of money for down payment.KHC offers FHA, VA, USDA, and Conventional loans with their minimum credit scores being set at 620 for all programs. The conventional loan requirements at KHC requires 660 credit score.

The max debt to income ratios are set at 40% and 50% respectively.

Joel Lobb (NMLS#57916)

Senior Loan Officer

Text/call 502-905-3708

Senior Loan Officer

Text/call 502-905-3708

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant's eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant

Equal Opportunity Lender. NMLS#57916

http://www.

Estimated Sale Price: $110,000

• Rate - 3.75%

• APR - 4.854%

• Down payment - $3850.00

• Principal & Interest - $500.20

• Insurance (estimated) - $75

• Taxes - $47.92

• PMI - $74.56

TOTAL PAYMENT INCLUDING

TAXES + INSURANCE:

$697.68 a month!

*Rates effective 01/16/2020, based on 740 FICO score and subject to change. ARP may vary. Loan terms are fixed rate 30 year loans and payment will not rise over the life of the loan. Not all applicants will qualify for advertised terms and conditions, must meet underwriting guidelines and are subject to credit review and approval. This does not constitute a commitment to lend. The disclosed rates, payments, homeowners insurance and mortgage insurance are estimates and may vary according to lender guidelines. Property taxes based on current assessed value with homestead and mortgage exemptions in place. Equal Housing Lender.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant's eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant

Equal Opportunity Lender. NMLS#57916

http://www.

Estimated Sale Price: $110,000

• Rate - 3.75%

• APR - 4.854%

• Down payment - $3850.00

• Principal & Interest - $500.20

• Insurance (estimated) - $75

• Taxes - $47.92

• PMI - $74.56

• Rate - 3.75%

• APR - 4.854%

• Down payment - $3850.00

• Principal & Interest - $500.20

• Insurance (estimated) - $75

• Taxes - $47.92

• PMI - $74.56

TOTAL PAYMENT INCLUDING

TAXES + INSURANCE:

$697.68 a month!

TAXES + INSURANCE:

$697.68 a month!

*Rates effective 01/16/2020, based on 740 FICO score and subject to change. ARP may vary. Loan terms are fixed rate 30 year loans and payment will not rise over the life of the loan. Not all applicants will qualify for advertised terms and conditions, must meet underwriting guidelines and are subject to credit review and approval. This does not constitute a commitment to lend. The disclosed rates, payments, homeowners insurance and mortgage insurance are estimates and may vary according to lender guidelines. Property taxes based on current assessed value with homestead and mortgage exemptions in place. Equal Housing Lender.